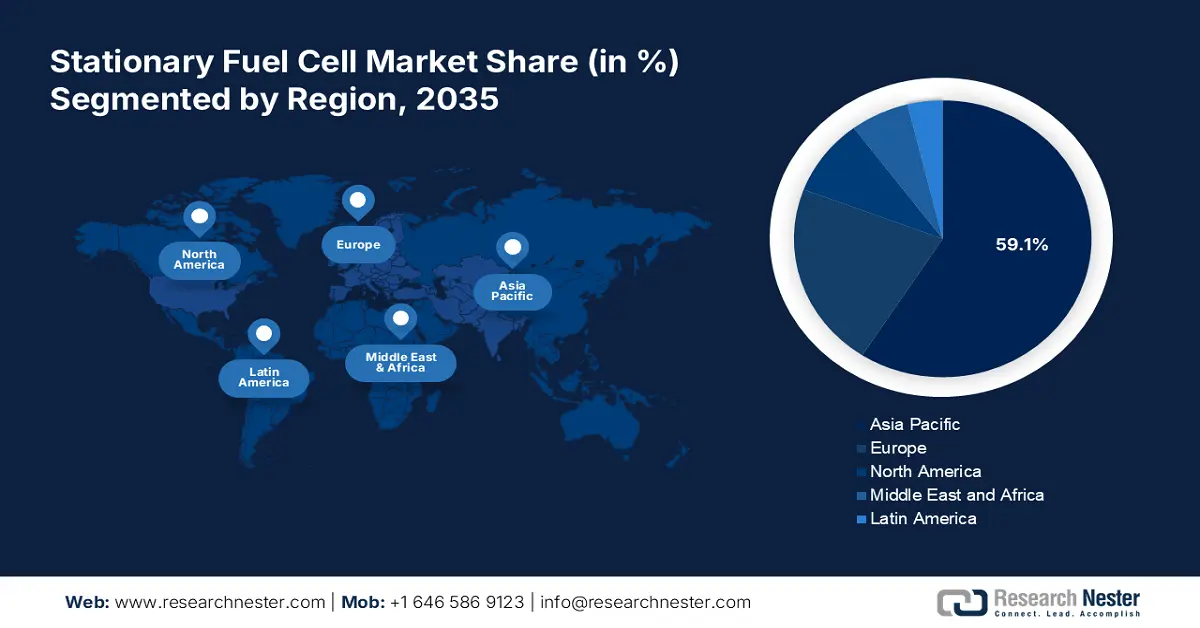

Stationary Fuel Cell Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is expected to hold largest revenue share of 59.1% by 2035,due to rising concerns for emissions and energy deficiency. The sustainability goal further influences companies to bring innovation to this industry. Governing authorities are also supporting this R&D culture through financial and infrastructural backups. For instance, in September 2024, Siltrax secured funding of USD 7 million to introduce a revolutionary silicon-based fuel stack, improving the energy efficiency of fuel cells. Such technological advancements not only broaden this region’s neutrality roadmap but also accelerate stationary power generation. Developing countries such as China, Japan, India, and South Korea are taking action to control the high intensity of GHG gases by installing maximum fuel cells.

Highly influential governmental initiatives are propelling the market in India. It is emerging to be one of the largest consumer bases of alternative power sources in the world, creating opportunities for both domestic and international leaders. The authorities of this country are also implementing these on-premises solutions for high-end purposes. For instance, in May 2023, SFC Energy received an order for 900 stationary methanol fuel cells from the Ministry of Defense in India. The supply is worth USD 18.8 million which will be assembled by SFC India in FCT’s production facility at Gurgaon. Such large-scale orders are evidence of increasing demand for these power generators.

China is showing significant progress in the stationary fuel cell market through supportive government subsidies and demand for sustainable power generation. The country’s ambitious renewable energy goals highly promote hydrogen to be used as a reliable power source. This is further encouraged by favorable policies and incentives, subsequently funding for future research and development in production. Global leaders are now expanding their production facilities in China to grab the marketplace. For instance, in May 2024, EKPO inaugurated its hydrogen fuel cell plant in Suzhou district. The expansion is expected to generate profitable revenue from the emerging dynamics of this country through delivering cutting-edge power-generating solutions.

Europe Market Insights

The Europe stationary fuel cell market has become the home to the leading global suppliers of renewable power generating systems. The region’s commitment to complete decarbonization by 2050 is inspiring residential, commercial, and industrial sectors to adopt stationary applications of these solutions. The government is also proactively fostering innovative technologies to upscale production through programs such as Horizon 2020 and the Green Deal. The implementation of fuel cells is now surpassing residential use and being utilized for large-scale industries such as telecommunications, data centers, and other commercial facilities. Such diversity in application is encouraging companies to invest in this sector, expanding market reach.

The U.K. is presenting lucrative opportunities for the market, propelled by the strategic activities of global leaders. The country is paving the path of technological development in producing more efficient power-generating cells that can supply personalized energy demand. The leading companies are now targeting new green hydrogen sources to produce generous amounts of energy through installed fuel cells. For instance, in July 2024, Intelligent Energy invested USD 7.6 million to build a new testing facility at Chelveston Renewable Energy Park in Northamptonshire. Through utilizing its Enapter AEM electrolyzer, the company aims to generate 1.3MW to support the net-zero target of the UK.

Germany is also becoming one of the leading countries in Europe to supply for the global stationary fuel cell market. The country’s strategy to ensure sufficient energy storage and grid stability is resulting in the increment of stationary projects. Domestic companies are leveraging their production to become efficient and reliable suppliers of fuel cells. The focus on quality and quantity has dragged the focus of consumers to rely on such companies. For instance, in June 2024, SFC Energy gained a follow-up order worth USD 4.3 million for EFOY methanol fuel cells and accessories over the success of HANNOVER MESSE 2024. The increment in order value represents the growing demand for such low-emission or emission-free energy solutions.