Stationary Fuel Cell Market Outlook:

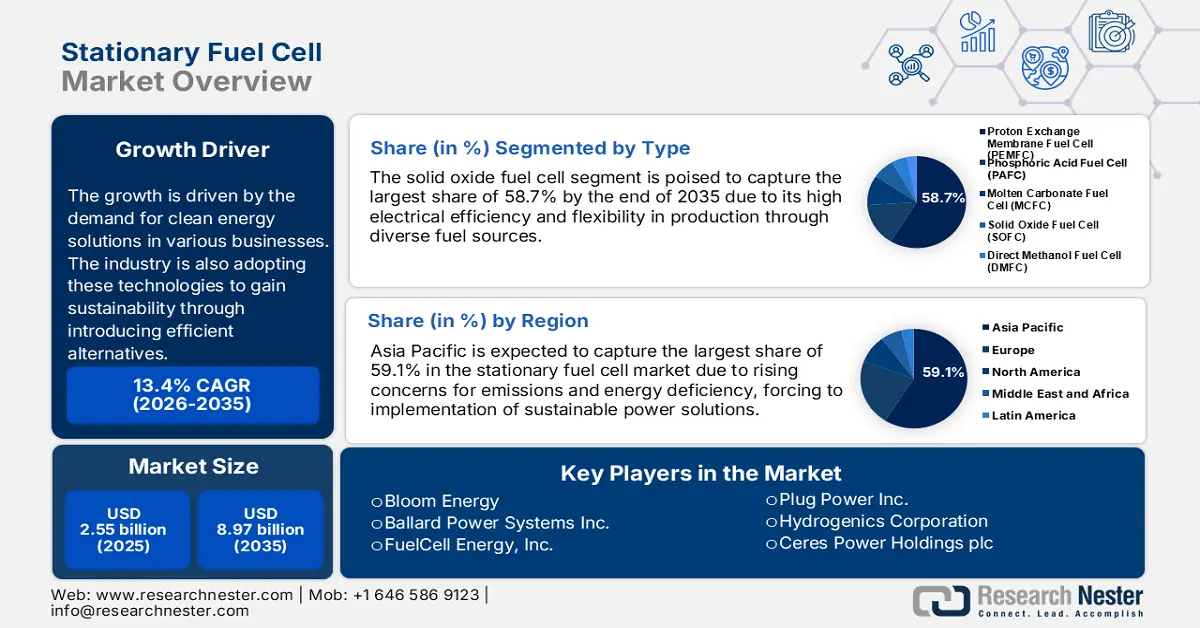

Stationary Fuel Cell Market size was valued at USD 2.55 billion in 2025 and is set to exceed USD 8.97 billion by 2035, expanding at over 13.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of stationary fuel cell is estimated at USD 2.86 billion.

The growth is driven by the demand for clean energy solutions in various businesses. The industry is also adopting these technologies to gain sustainability by introducing efficient alternatives. For instance, in May 2023, BASF and Advent Technologies partnered to establish a reliable supply chain for hydrogen fuel cells in Europe. According to the agreement, BASF will accelerate the production of Celtec MEA technology to support the planned Advent fuel cell manufacturing facility in Greece.

The growing demand for electricity due to emerging private organizations is inflating the demand in the stationary fuel cell market for sustainable and cost-effective solutions. According to an EIA report published in June 2023, the energy consumption by commercial buildings accounted to be 32% of the total U.S. power usage. Thus, with the increase in the number of businesses and electricity prices, the demand for affordable energy alternatives is rising. Fuel cells can act as a decentralized power generation tool, reducing the pressure upon conventional power grids. The push for achieving neutrality goals is also forcing corporate organizations to implement less-emission power generators. This is further influencing the adoption rate of energy-efficient solutions to grow higher.

Key Stationary Fuel Cell Market Insights Summary:

Regional Highlights:

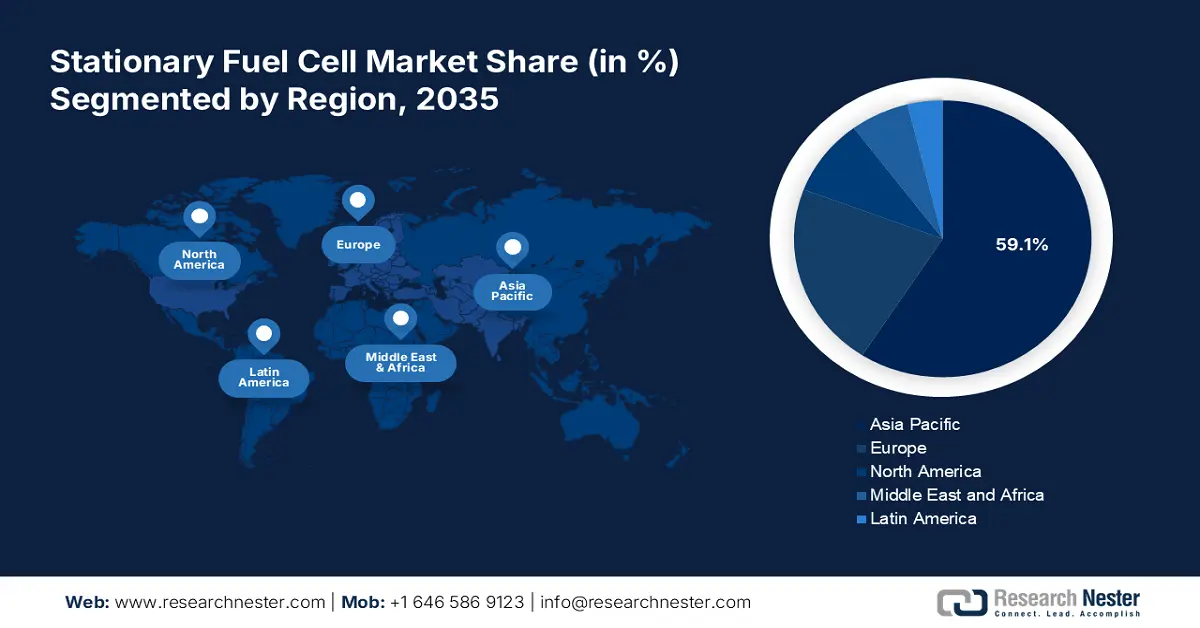

- Asia Pacific stationary fuel cell market will account for 59.10% share by 2035, driven by rising concerns for emissions and energy deficiency, supported by governmental R&D initiatives.

Segment Insights:

- Solid oxide fuel cell segment in the stationary fuel cell market is expected to achieve 58.70% growth by the forecast year 2035, driven by high electrical efficiencies, fuel flexibility, and regulatory compliance.

Key Growth Trends:

- Government support for sustainability

- Technological advancements

Major Challenges:

- Lack of sufficient infrastructure

- High initial cost of production

Key Players: Bloom Energy, Ballard Power Systems Inc., FuelCell Energy, Inc., Plug Power Inc., Hydrogenics Corporation, Ceres Power Holdings plc, Doosan Corporation Intelligent Energy Limited, SerEnergy A/S, Sainergy Tech, Inc., FC TecNrgy Pvt Ltd., K- Pas Instronic Engineers India Private Limited, Power & Energy, Inc..

Global Stationary Fuel Cell Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.55 billion

- 2026 Market Size: USD 2.86 billion

- Projected Market Size: USD 8.97 billion by 2035

- Growth Forecasts: 13.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (59.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Japan, South Korea, Germany, China

- Emerging Countries: China, Japan, South Korea, India, Singapore

Last updated on : 18 September, 2025

Stationary Fuel Cell Market Growth Drivers and Challenges:

Growth Drivers

- Government support for sustainability: The environmental impact of emissions due to excessive power demand is raising concern among regional governing bodies. Thus, they are promoting investment in the stationary fuel cell market. Several regional governments are enacting favorable policies and subsidies including tax incentives, grants, and mandating rules, pushing the adoption of these clean energy sources. For instance, in 2022, the U.S. government issued a tax credit system by passing the Inflation Reduction Act. The U.S. Department of IRS supervised the process of IRA crediting implementation to ensure optimum financial support to the fuel cell projects.

- Technological advancements: Advanced technologies are increasing the efficiency of on-premises energy production, encouraging more innovations in the market. The improved longevity and performance have created new application potentials in both residential and commercial sectors. Hybrid integrating technologies are also diversifying the usage of these cells. More innovative models are being introduced to elevate the energy production capacity of the fuel cells. According to a LANL article published in June 2023, the new grooved electrode design can leverage the performance of hydrogen fuel cells by 50%. This can further be used to supply power for emission-less transportation.

Challenges

- Lack of sufficient infrastructure: Limitations in manufacturing or distributing infrastructure to produce efficient solutions may hinder the progress in the market. Integrating such technologies into old power-generating systems can be challenging, which further hinders production. As hydrogen is still not the mainstream energy source, maintaining the supply chain can become complex for companies. Thus, it limits the feasibility and accessibility for widespread use.

- High initial cost of production: Expensive raw materials such as platinum can increase the cost of production, which may further deter the participation from companies with limited capital. Cost-effectively producing clean hydrogen is still a major challenge, which causes additional expenses. Developing new technology to offer sufficient supply can also exacerbate cost concerns. Uncertain fuel supply and cost volatility can also affect long-term profit margins, reducing economic benefits

Stationary Fuel Cell Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.4% |

|

Base Year Market Size (2025) |

USD 2.55 billion |

|

Forecast Year Market Size (2035) |

USD 8.97 billion |

|

Regional Scope |

|

Stationary Fuel Cell Market Segmentation:

Type Segment Analysis

The solid oxide fuel cell segment is expected to dominate stationary fuel cell market share of around 58.7% by the end of 2035. The high electrical efficiencies of SOFC make them an attractive option for designing fully utilized power generation systems. These cells can be produced by using a diverse range of fuels including natural gas, biogas, hydrogen, and ethanol or methanol. Such flexibility helps these to be adaptive to different infrastructures and regional availability. SOFCs are also preferred due to the less environmental impact with less emissions. This further solidifies its positioning for its sophistical regulatory compliance and encourages companies to increase their production. For instance, in December 2020, Bosch aimed to increase the SOFC systems capacity to 200MW by the end of 2024.

Stacking Segment Analysis

Based on stacking, the stationary fuel cell market is expected to be dominated by planar bipolar stacking. The growth in this segment is driven by the effective operation and scalability of these systems. The bipolar plates are used to serve with dual functionality of gas distribution and water removal for electricity conduction. Alongside, the planar design is dedicated to maximizing the surface area while minimizing the weight and volume of the system. Together, this contributes to the manufacturing of a compact yet effective solution for on-premises power generation. This further makes this segment preferable for businesses seeking fuel cells to deliver optimum performance and capture less space.

Our in-depth analysis of the market includes the following segments

|

Type |

|

|

Stacking |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Stationary Fuel Cell Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is expected to hold largest revenue share of 59.1% by 2035,due to rising concerns for emissions and energy deficiency. The sustainability goal further influences companies to bring innovation to this industry. Governing authorities are also supporting this R&D culture through financial and infrastructural backups. For instance, in September 2024, Siltrax secured funding of USD 7 million to introduce a revolutionary silicon-based fuel stack, improving the energy efficiency of fuel cells. Such technological advancements not only broaden this region’s neutrality roadmap but also accelerate stationary power generation. Developing countries such as China, Japan, India, and South Korea are taking action to control the high intensity of GHG gases by installing maximum fuel cells.

Highly influential governmental initiatives are propelling the market in India. It is emerging to be one of the largest consumer bases of alternative power sources in the world, creating opportunities for both domestic and international leaders. The authorities of this country are also implementing these on-premises solutions for high-end purposes. For instance, in May 2023, SFC Energy received an order for 900 stationary methanol fuel cells from the Ministry of Defense in India. The supply is worth USD 18.8 million which will be assembled by SFC India in FCT’s production facility at Gurgaon. Such large-scale orders are evidence of increasing demand for these power generators.

China is showing significant progress in the stationary fuel cell market through supportive government subsidies and demand for sustainable power generation. The country’s ambitious renewable energy goals highly promote hydrogen to be used as a reliable power source. This is further encouraged by favorable policies and incentives, subsequently funding for future research and development in production. Global leaders are now expanding their production facilities in China to grab the marketplace. For instance, in May 2024, EKPO inaugurated its hydrogen fuel cell plant in Suzhou district. The expansion is expected to generate profitable revenue from the emerging dynamics of this country through delivering cutting-edge power-generating solutions.

Europe Market Insights

The Europe stationary fuel cell market has become the home to the leading global suppliers of renewable power generating systems. The region’s commitment to complete decarbonization by 2050 is inspiring residential, commercial, and industrial sectors to adopt stationary applications of these solutions. The government is also proactively fostering innovative technologies to upscale production through programs such as Horizon 2020 and the Green Deal. The implementation of fuel cells is now surpassing residential use and being utilized for large-scale industries such as telecommunications, data centers, and other commercial facilities. Such diversity in application is encouraging companies to invest in this sector, expanding market reach.

The U.K. is presenting lucrative opportunities for the market, propelled by the strategic activities of global leaders. The country is paving the path of technological development in producing more efficient power-generating cells that can supply personalized energy demand. The leading companies are now targeting new green hydrogen sources to produce generous amounts of energy through installed fuel cells. For instance, in July 2024, Intelligent Energy invested USD 7.6 million to build a new testing facility at Chelveston Renewable Energy Park in Northamptonshire. Through utilizing its Enapter AEM electrolyzer, the company aims to generate 1.3MW to support the net-zero target of the UK.

Germany is also becoming one of the leading countries in Europe to supply for the global stationary fuel cell market. The country’s strategy to ensure sufficient energy storage and grid stability is resulting in the increment of stationary projects. Domestic companies are leveraging their production to become efficient and reliable suppliers of fuel cells. The focus on quality and quantity has dragged the focus of consumers to rely on such companies. For instance, in June 2024, SFC Energy gained a follow-up order worth USD 4.3 million for EFOY methanol fuel cells and accessories over the success of HANNOVER MESSE 2024. The increment in order value represents the growing demand for such low-emission or emission-free energy solutions.

Stationary Fuel Cell Market Players:

- Bloom Energy

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ballard Power Systems Inc.

- FuelCell Energy, Inc.

- Plug Power Inc.

- Hydrogenics Corporation

- Ceres Power Holdings plc

- Doosan Corporation Intelligent Energy Limited

- SerEnergy A/S

- Sainergy Tech, Inc.

- FC TecNrgy Pvt Ltd.

- K- Pas Instronic Engineers India Private Limited

- Power & Energy, Inc.

- Nuvera

- SFC Energy

The current stationary fuel cell market is focusing on manufacturing complete zero-emission energy production through developing their technology and production capability. They are introducing hybrid systems that can be integrated for multiple applications, including on-premises power generation. For instance, in January 2023, Nuvera launched G-Series Power Generators, which can deliver 360 kW and 470 kW by using hydrogen. The containerized package can further produce three-phase VAC power for commercial and industrial applications including data centers, electric vehicles, backup power, and microgrids. Such product utility is attracting more companies to invest in this market. Such key players include:

Recent Developments

- In October 2024, SFC Energy acquired a small stationary hydrogen fuel cell business of Ballard in Scandinavia. This acquisition will help its Danish subsidiary, SFC Denmark to expand its reach in Europe through accessing selected assets of BPSE.

- In March 2024, Ballard received an order for 15MW fuel cell systems from an off-grid renewable power generating company in the UK. The order is expected to encompass 150 x FCmove-HD+ 100 kW systems throughout late 2024 to 2025.

- Report ID: 6677

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Stationary Fuel Cell Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.