Stationary Battery Storage Market Outlook:

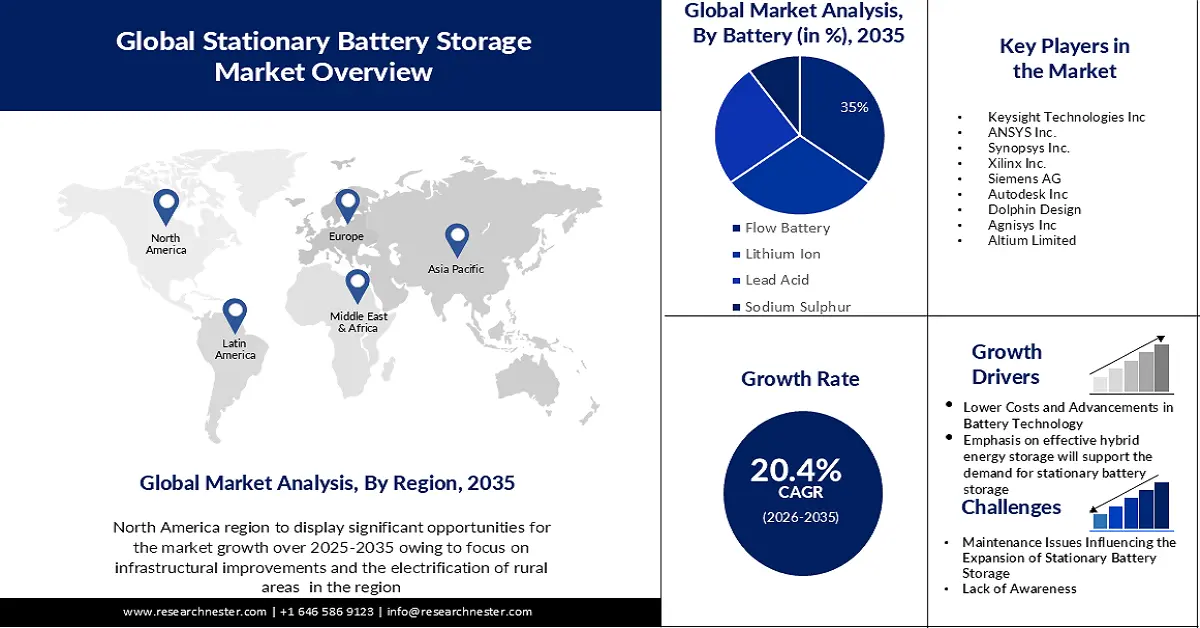

Stationary Battery Storage Market size was over USD 58.16 billion in 2025 and is anticipated to cross USD 372.3 billion by 2035, witnessing more than 20.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of stationary battery storage is assessed at USD 68.84 billion.

The market is expanding at a very quick pace owing to numerous causes contribute to this expansion, one of which is the expanding usage of renewable energy sources as a result of growing environmental concerns. By 2028, electricity generated worldwide will come from renewable sources at a rate of over 42%, with solar and wind power producing 25% of the total.

In addition to these, the market is expected to expand as a result of advantageous laws and regulations. As an example, the Spanish government issued its Energy Storage Strategy in February 2021, outlining its goal of installing 20 GW of grid-scale and behind-the-meter storage throughout the nation by 2030.In a similar vein, the Chinese government declared in July 2021 that it intended to install over 30 GW of energy storage throughout the nation by 2025. In comparison to 2021, this is predicted to enhance the nation's capacity by an eight-fold margin.

Key Stationary Battery Storage Market Insights Summary:

Regional Highlights:

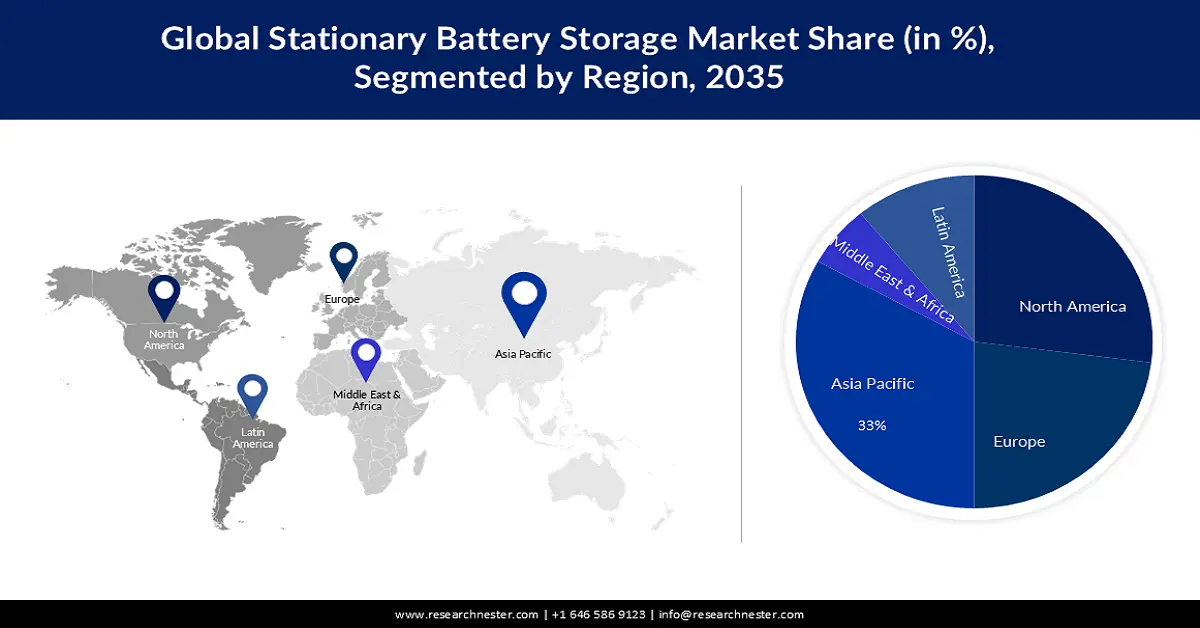

- Asia Pacific stationary battery storage market is expected to capture 33% share by 2035, fueled by infrastructural improvements and electrification of rural areas, along with renewable energy projects like the Asian Development Bank's initiatives.

- North America market will achieve a 27% share by 2035, driven by the increasing demand for energy storage systems and growing investments in renewable energy infrastructure.

Segment Insights:

- The behind the meter segment in the stationary battery storage market is anticipated to achieve a 55% share by 2035, driven by the integration of EV charging and minimized grid impact.

- The flow battery segment in the stationary battery storage market is expected to capture a 35% share by 2035, influenced by the growing focus on developing redox flow batteries for energy storage.

Key Growth Trends:

- Emphasis on effective hybrid energy storage will support the demand for stationary battery storage

- Lower Costs and Advancements in Battery Technology Are Driving the Stationary Battery Storage Market's Expansion

Major Challenges:

- Emphasis on effective hybrid energy storage will support the demand for stationary battery storage

- Lower Costs and Advancements in Battery Technology Are Driving the Stationary Battery Storage Market's Expansion

Key Players: Exide Technologies, Durapower Group, Duracell, INC, Siemens AG, Samsung SDI Co., Ltd, A123 Systems, LLC, LG Chem Ltd., BYD Company Ltd., Lockheed Martin Corporation.

Global Stationary Battery Storage Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 58.16 billion

- 2026 Market Size: USD 68.84 billion

- Projected Market Size: USD 372.3 billion by 2035

- Growth Forecasts: 20.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 16 September, 2025

Stationary Battery Storage Market Growth Drivers and Challenges:

Growth Drivers

-

Emphasis on effective hybrid energy storage will support the demand for stationary battery storage- The increasing need for electricity will present growth prospects for companies that create battery storage systems. According to IEA data, electricity will make up 50% of all energy consumed by 2050, up from 20% in 2018. This will encourage the adoption of stationary battery storage devices to maintain grid resilience. The main market driver for stationary energy storage is the quick adoption of renewable energy sources combined with supportive government initiatives to lower carbon emissions. Additionally, the market for stationary energy storage is expected to grow as a result of the ongoing integration of renewable energy sources like solar and wind, which call for affordable network synchronization solutions. Moreover, during the projection period, growing electricity demand and grid stability are driving the stationary energy storage market's expansion. It is anticipated that a lack of standardization and unstable investment prospects across many industrial sectors will hinder the growth of the stationary energy storage market.

-

Lower Costs and Advancements in Battery Technology Are Driving the Stationary Battery Storage Market's Expansion- Because renewable energy sources are non-flexible, they cannot be deployed as needed to meet the constantly shifting demands of energy users. Energy storage solutions are anticipated to emerge as a leading contender in tackling their flexibility issue, even if conventional power plants and interconnections will remain crucial tools in addressing this challenge. Improvements in battery technology and decreasing costs are driving the advent of stationary energy storage devices. Energy storage devices need to be charged in order to deliver electricity when needed, unlike fuel cells, which produce power on demand. Batteries and an electronic control system are the foundation of stationary energy storage systems. The most popular element used in batteries to store chemical energy is lithium.

- Advancements in Digital Technologies- The SES market is anticipated to follow trends set by the introduction of new technologies like blockchain, artificial intelligence (AI), and predictive analytics. Among solution providers, the most exciting advances may be the emergence of new business models that integrate customer-sited storage to offer a range of services to utilities, grid operators, and electrical consumers like residential or commercial and industrial (C&I).

Challenges

-

Maintenance Issues Influencing the Expansion of Stationary Battery Storage- Correct cleaning and maintenance of the batteries are essential components. The safety measures that must be followed when cleaning batteries are challenging and even dangerous if done carelessly. Thus, the market for stationary battery storage is being impacted by each of these issues.

-

Energy storage systems with stationary batteries are linked to kidney and brain damage, even with their expanding range of applications. The public's awareness of these health concerns could, in part, put up barriers to the industry's advancement.

- The market's expansion is being impeded by the high cost of storage systems.

Stationary Battery Storage Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

20.4% |

|

Base Year Market Size (2025) |

USD 58.16 billion |

|

Forecast Year Market Size (2035) |

USD 372.3 billion |

|

Regional Scope |

|

Stationary Battery Storage Market Segmentation:

Battery Segment Analysis

Based on battery, the flow battery segment in the stationary battery storage market is expected to hold largest revenue share of about 35% during the forecast period. The growth of the segment is because there is a growing focus on the development of redox flow batteries. These energy-storage systems can reduce storage costs and have great power density, energy, longevity, and efficiency without harming the environment. Consequently, a growing number of end-user sectors are using flow batteries as a result of these characteristics. Since flow batteries have a long service life and are increasingly being used in long-duration energy storage applications like renewable power systems, the market for these batteries is expected to expand throughout the course of the study period. Global installed renewable energy generation and capacity have been increasing steadily during the past ten years. Global installed renewable energy capacity increased by over 9.1% in 2021 to reach 3063.93 GW. Since renewable energy sources like solar and wind produce power at different times and in different amounts, it is essential to store this energy for times when demand is high.

Application Segment Analysis

Based on application, the behind the meter segment is projected to hold 55% share of the global stationary battery storage market during the forecast period. In addition to providing homes and buildings with a direct electricity supply, behind-the-meter storage (BTMS) systems also minimize grid impact and integrate EV charging. Research groups like the BTMS Consortium of the NREL have also been working with US labs to develop energy storage technologies for stationary uses that don't require more than 10MWh. The installation of behind-the-meter stationary battery storage systems is probably going to happen more quickly as a result of these measures, along with improvements in operational safety and efficiency.

Our in-depth analysis of the global stationary battery storage market includes the following segments:

|

Battery |

|

|

Type of Energy Storage |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Stationary Battery Storage Market Regional Analysis:

APAC Market Insights

Stationary battery storage market in Asia Pacific region is anticipated to hold largest revenue share of about 33% during the forecast period. The growth of the market in this region is because of the focus on infrastructural improvements and the electrification of rural areas. For instance, TP Renewable Microgrid introduced the biggest sustainability initiative for India's rural areas in December 2021. The demand for storage battery systems will be increased by initiatives like this. A number of establishments have also aimed to promote sustainability by augmenting their dependence on sustainable energy resources. For example, the Asian Development Bank authorized a USD 3 million credit in November 2022 to help with project preparations for renewable energy projects around the area. The purpose of this facility was to increase the energy sector's dependability and sustainability while encouraging private sector investment in renewable energy. Such initiatives will increase the region's adoption of stationary battery storage systems based on clean energy.

North American Market Insights

Stationary battery storage market in North America is attributed to hold second largest market share of about 27% during the forecast period. The end-user markets, battery energy storage manufacturers, and equipment suppliers comprise the US market value chain. The process of creating a battery energy storage system requires the usage of bus bars, connections, cables, module packs, and batteries. The batteries are a big and crucial component of the battery energy storage system.

Stationary Battery Storage Market Players:

- Tesla

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Exide Technologies

- Durapower Group

- Duracell, INC

- Siemens AG

- BYD Company Ltd.

- Samsung SDI Co., Ltd

- A123 Systems, LLC

- LG Chem Ltd.

- Lockheed Martin Corporation

Recent Developments

- March 2022: Tesla announced that it is establishing new energy storage system production plants in Queensland. In order to provide Queenslanders with more reliable, affordable, and clean electricity, publicly owned generator CS Energy would therefore build a grid-scale battery near Chinchilla. The Tesla Megapack-based battery, which will serve as part of CS Energy's energy center at Kogan Creek, will have a capacity of 100 megawatts and 200 megawatt hours.

- November 2021: The Duracell Power Center product line will consist of 5 kW and 10 kW inverter outputs with batteries expandable from 14 kWh to 84 kWh. The Power Center's unique bi-directional inverter technology allows new and existing residential solar owners to store excess solar power for use in the evening, maximizing their solar investment, while increasing energy security and independence, all without additional hardware. In addition, Power Center offers the flexibility of remote software upgrades to meet ever changing power regulatory standards.

- Report ID: 5566

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Stationary Battery Storage Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.