Static Random-Access Memory Market Outlook:

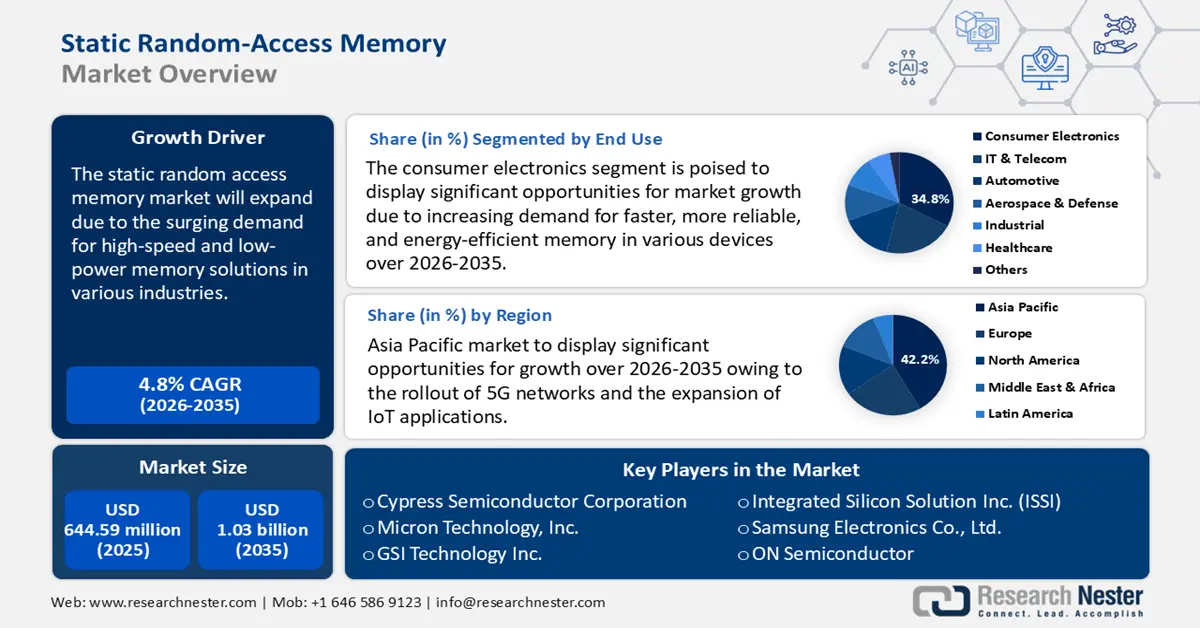

Static Random-Access Memory Market size was valued at USD 644.59 million in 2025 and is likely to cross USD 1.03 billion by 2035, expanding at more than 4.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of static random-access memory is assessed at USD 672.44 million.

The SRAM market is driven by the increasing demand for high-speed, low-power memory solutions in industries such as consumer electronics, automotive, and telecommunications. This demand is fueled by the need for faster data processing and efficient energy consumption in devices like smartphones, IoT devices, and advanced computing systems.

SRAM lowers latency and speeds up data access by eliminating the need for time-consuming refresh cycles. These features can be especially important for crucial components such as speed-sensitive central processor unit caches. In general, SRAM is better able to boost computer system speed and performance since it allows processors to retrieve information quickly. SRAM can be used as a RAM digital-to-analog converter on a computer's video or graphics card. It can also be utilized as a buffer cache on a disk drive, in a peripheral like a printer or a liquid crystal display, or in a network device like a router or switch. SRAM is commonly used in computer cache memory, such as a processor's L2 or L3 cache, as well as high-speed registers.

Key Static Random-Access Memory Market Insights Summary:

Regional Highlights:

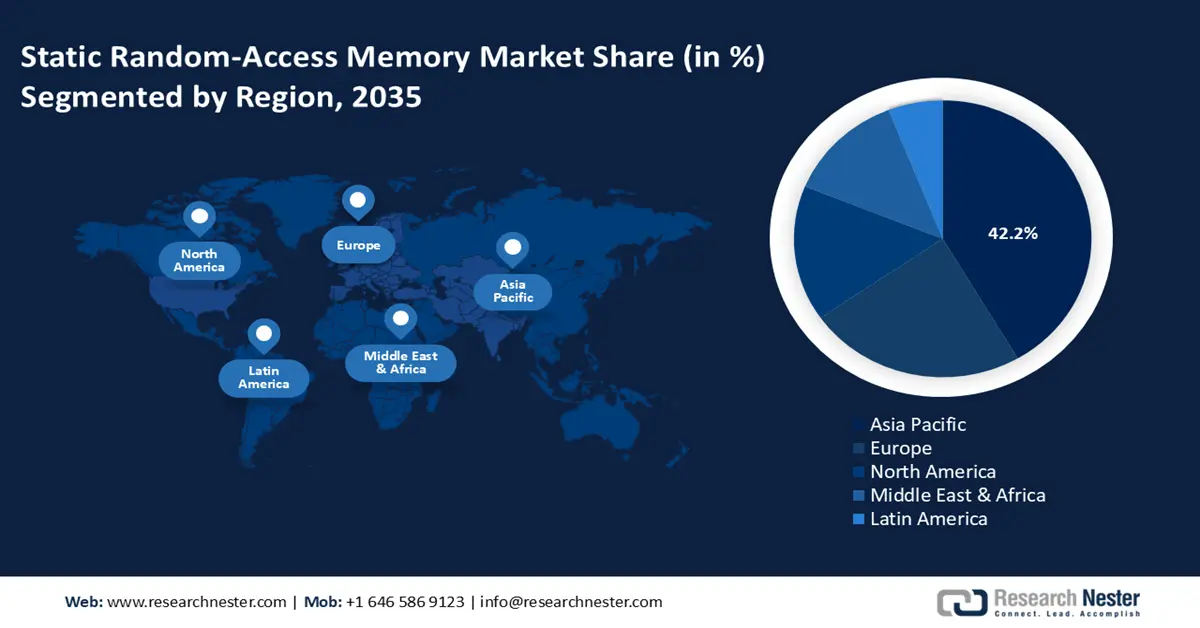

- Asia Pacific leads the Static Random-Access Memory Market with a 42.2% share, propelled by strong electronics manufacturing, technological advancements, and increasing demand across industries, fostering significant growth by 2035.

Segment Insights:

- Synchronous SRAM segment is projected to hold the highest share by 2035, driven by its synchronization with system clocks for high-speed data transfer.

- Consumer Electronics segment is projected to capture around a 34.8% share by 2035, driven by demand for faster, reliable, and energy-efficient memory in electronic devices.

Key Growth Trends:

- Proliferation of consumer electronics

- Technological advancements and innovations

Major Challenges:

- High cost of production

- Limited density of scalability

- Key Players: Micron Technology, Inc., GSI Technology Inc., Integrated Silicon Solution Inc. (ISSI), Samsung Electronics Co., Ltd., ON Semiconductor, Hanwha Group.

Global Static Random-Access Memory Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 644.59 million

- 2026 Market Size: USD 672.44 million

- Projected Market Size: USD 1.03 billion by 2035

- Growth Forecasts: 4.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, South Korea, Germany

- Emerging Countries: China, Japan, South Korea, India, Singapore

Last updated on : 13 August, 2025

Static Random-Access Memory Market Growth Drivers and Challenges:

Growth Drivers

-

Proliferation of consumer electronics: Modern consumer devices, such as smartphones, laptops, and tablets, require high-speed memory for fast data processing and seamless user experiences. SRAM, known for its low latency and high-speed operation, is ideal for applications like cache memory in processors and CPUs. Smart home appliances, wearables, and other IoT-enabled devices often use SRAM for its reliability and ability to handle intermittent power cycles. Consumer devices such as wearables and cell phones frequently use SRAM chips. They may also be included in medical equipment, which can range from hearing aids to body area networks, which comprise several devices that are incorporated inside the body. All of these devices require quick data access; hence SRAM is preferable to DRAM or non-volatile flash memory.

Moreover, SRAM is extensively used in gaming consoles and VR/AR devices for fast rendering and smooth graphics performance. As gaming and multimedia content consumption increase, so does the demand for SRAM in these applications. According to the International Trade Administration of the U.S. Department of Commerce, the video gaming industry's global worth in 2023 was USD 184 billion, with more than 3.2 billion gamers worldwide. - Technological advancements and innovations: The development of advanced SRAM architectures such as multi-port SRAM enables simultaneous read and write operations, enhancing performance in high-speed applications like processors and networking equipment. FinFET-based SRAM offers lower power consumption and reduced leakage currents, making it ideal for advanced computing and mobile devices. For instance, TSMC’s 5nm FinFET technology integrates SRAM for high-performance System-on-Chip (SoC) designs. Used in Apple’s A14 Bionic chip for iPhones and iPads, features high-speed SRAM caches. The A14 is the fastest smartphone chip ever, 40% faster than the previous version. The chip has 11.8 billion transistors and was built by TSMC using a 5nm technology. This manufacturing procedure is also used on the Apple M1.

Innovations such as voltage scaling and low-power SRAM configurations address the demand for energy-efficient devices, especially in IoT and portable electronics. SRAM solutions with adaptive power management are being developed to optimize energy consumption. - Advancements in networking and telecommunications: Increased bandwidth requirements such as 5G networks require SRAM for high-speed data processing in base stations, routers, and switches. SRAM’s fast access times make it ideal for enabling real-time communication in 5G applications. SRAM supports real-time data processing in IoT gateways, ensuring smooth data transfer across connected devices.

SRAM is used in AI accelerators for networking applications, ensuring fast data analysis and intelligent routing. SRAM enables high-speed processing for machine learning algorithms in network optimization.

Additionally, SRAM is widely used as cache memory in data centers to improve processor performance and manage high data traffic efficiently. As more businesses adopt cloud services, SRAM demand increases for servers handling vast amounts of concurrent data.

Challenges

-

High cost of production: SRAM requires complex manufacturing techniques, especially when integrated into advanced semiconductor processes like FinFET or 3D stacking. This makes SRAM more expensive compared to other memory types like DRAM or Flash memory. The design and fabrication of SRAM cells with low power and high density can be costly, especially as demand for smaller nodes increases.

-

Limited density of scalability: SRAM cells are larger compared to other memory types, limiting how much data can be stored in the same chip area. As demand for higher memory capacities grows, SRAM becomes less scalable for high-density applications. Although SRAM is energy-efficient during use, increasing the density to meet memory demand can increase power consumption, particularly in large-scale systems.

Static Random-Access Memory Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.8% |

|

Base Year Market Size (2025) |

USD 644.59 million |

|

Forecast Year Market Size (2035) |

USD 1.03 billion |

|

Regional Scope |

|

Static Random-Access Memory Market Segmentation:

End use (IT & Telecom, Consumer Electronics, Automotive, Aerospace & Defense, Industrial, and Healthcare)

By end use, the consumer electronics segment is projected to account for static random-access memory market share of around 34.8% by 2035. The market growth is due to increasing demand for faster, more reliable, and energy-efficient memory in various devices. SRAM is widely used as a cache memory in mobile processors, enabling faster app execution and seamless multitasking. Advanced cameras in smartphones rely on SRAM for rapid image processing and buffering.

SRAM is used in GPUs to enable real-time rendering of high-resolution graphics, essential for gaming consoles like PlayStations and Xbox. For instance, the Xbox Series X uses 16GB of GDDR6 memory for main storage but incorporates SRAM in its custom AMD Zen 2 processor for caching and high-speed operations. SRAM supports 4K gaming and advanced features like hardware-accelerated ray tracing.

Consumer electronics drive the demand for FinFET-based SRAM for higher performance and reduced power consumption. The global consumer electronics sector’s scale significantly contributes to the growth of SRAM as an essential component.

Type (Asynchronous SRAM and Synchronous SRAM)

The synchronous SRAM segment of the static random-access memory market is poised to register the highest share during the forecast period. Synchronous SRAM operates in synchronization with the system clock, enabling faster and more reliable data transfer compared to asynchronous SRAM. Its high-speed capabilities make it ideal for applications in networking, computing, and telecommunications. The growth of 5G networks requires fast and efficient memory, and synchronous SRAM is a preferred choice for base stations and other telecommunications infrastructure.

Also, the clock-synchronized operation makes synchronous SRAM suitable for a wide range of applications in semiconductors. Synchronous SRAM is integrated into testing platforms for validating semiconductor designs and performance. Synchronous SRAM is used in semiconductor prototyping for evaluating high-speed operations and error-free data transfer. Infineon's synchronous SRAMs with ECC are the only high-density standard sync and NoBL SRAMs on the static random-access memory (SRAM) market that feature on-chip error detection and correction. The primary features include <0.01 FIT/Mb dependability, pin-to-pin compatibility, RTR of 250 MT/s, 1.05 W, and high-density ECC SRAMs.

Synchronous SRAM is essential in real-time data processing systems in ADAS and autonomous vehicles. Automotive infotainment platforms rely on synchronous SRAM for high-speed data handling. Moreover, industrial automation and aerospace systems require synchronous SRAM for its predictable and reliable performance in time-sensitive operations. The robust performance of synchronous SRAM in extreme environments makes it suitable for aerospace and defense applications.

Our in-depth analysis of the static random-access memory market includes the following segments:

|

Type |

|

|

Memory Size |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Static Random-Access Memory Market Regional Analysis:

APAC Market Forecast

Asia Pacific static random-access memory market is set to hold revenue share of more than 42.2% by 2035. The growth is supported by the region’s strong electronics manufacturing sector, technological advancements, and increasing demand across various industries. The rollout of 5G networks and the expansion of IoT applications in Asia Pacific demand faster data processing and low power consumption, areas where SRAM excels.

The automotive industry in APAC is integrating advanced electronics and infotainment systems, requiring efficient memory solutions. SRAM’s high-speed data processing capabilities are essential for ADAS and in-vehicle networking applications. Countries like China, Japan, and South Korea are at the forefront due to their robust automotive manufacturing sectors.

China’s rapid expansion in consumer electronics, including smartphones, tablets, and smart appliances, has significantly boosted the demand for SRAM. These devices require efficient memory solutions to ensure optimal performance and responsiveness. China hosts a range of SRAM manufacturers and suppliers, contributing to the global supply chain. The static random-access memory market features both domestic companies and international players operating within the country.

Moreover, the ongoing investments in technology and infrastructure and the growing digital economy are expected to further strengthen China’s position in the global SRAM market in the coming years. The China-Britain Business Council states that China is the world's fastest-expanding and most dynamic market for new digital technology. With over 900 million internet users and a thriving consumer economy, China is seeing quick and widespread adoption of emerging technologies such as 5G, sophisticated AI, IoT, and blockchain-based technologies. Its digital economy contributes 30% of its GDP. China accounts for nearly half of global e-commerce transactions, is home to nine of the 23 privately held FinTech unicorns, and owns 29% of the world's renewable energy patents. In 2019, China's total import and export of high-tech products surpassed USD 1.5 trillion, and international collaboration has become the most essential aspect of China's technological development. In 2020, revenue from software products, information technology services, information security products, and embedded system software climbed by 12.5%, 18.4%, 12.4%, and 7.8%, respectively.

In India, the static random-access memory market is set for substantial growth, supported by the expanding electronics manufacturing industry, data center proliferation, and increasing applications in computing, IoT, and AI sectors. Ongoing investments and technological advancements are also driving the static random-access memory (SRAM) market. According to a 2024 published report on Digital Economy by the International Trade Administration, India's digital ecosystem is growing, owing to its young, tech-savvy population. As of mid-2024, there are more than 650 million smartphone users, and internet customers exceeded 950 million. This widespread acceptance is fueling expansion in e-commerce, digital payments, and finance, as well as considerable investments in AI and blockchain technology.

Europe Market Analysis

Europe will encounter huge growth in the static random-access memory market during the forecast period. Europe’s strong automotive sector, particularly in countries like Germany is increasingly incorporating advanced electronics and memory solutions, including SRAM, to support modern vehicle functionalities.

Germany’s renowned automotive sector increasingly incorporates advanced electronics, necessitating high-speed memory solutions like SRAM for applications in autonomous driving, infotainment systems, and ADAS. Additionally, the rise of Industry 4.0 and automation in manufacturing processes across France requires reliable and fast memory solutions, further driving the SRAM market.

Key Static Random-Access Memory Market Players:

- Cypress Semiconductor Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Micron Technology, Inc.

- GSI Technology Inc.

- Integrated Silicon Solution Inc. (ISSI)

- Samsung Electronics Co., Ltd.

- ON Semiconductor

- Hanwha Group

- GCL System

Key players are focusing on developing SRAM with faster speeds, lower power consumption, and enhanced reliability to meet the needs of applications such as AI, 5G, and autonomous vehicles. Companies are innovating in reducing SRAM chip sizes while increasing storage capacity, aligning with the trends in consumer electronics and IoT devices.

Here are some of the key players:

Recent Developments

- In September 2024, Micron Technology, Inc. announced the Crucial P310 2280 Gen4 NVMe solid-state drive (SSD), which boasts twice the performance of Gen3 SSDs and is 40% faster than Crucial's P3 Plus. This provides a significant speed boost for gamers, students, and creatives when using data-intensive applications.

- In April 2024, GSI Technology, Inc., announced the availability of two high-capacity, low-power server products. The Gemini-I APU powers the Leda-E and Leda-S boards, which can deliver 1.2 POPs at 80W and 800 TOPs at 40W, respectively. The new server choices include a single 2U server with eight Leda-E boards and 10 POPs and a 1U server with sixteen Leda-S boards and 13 POPs.

- Report ID: 6912

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Static Random-Access Memory Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.