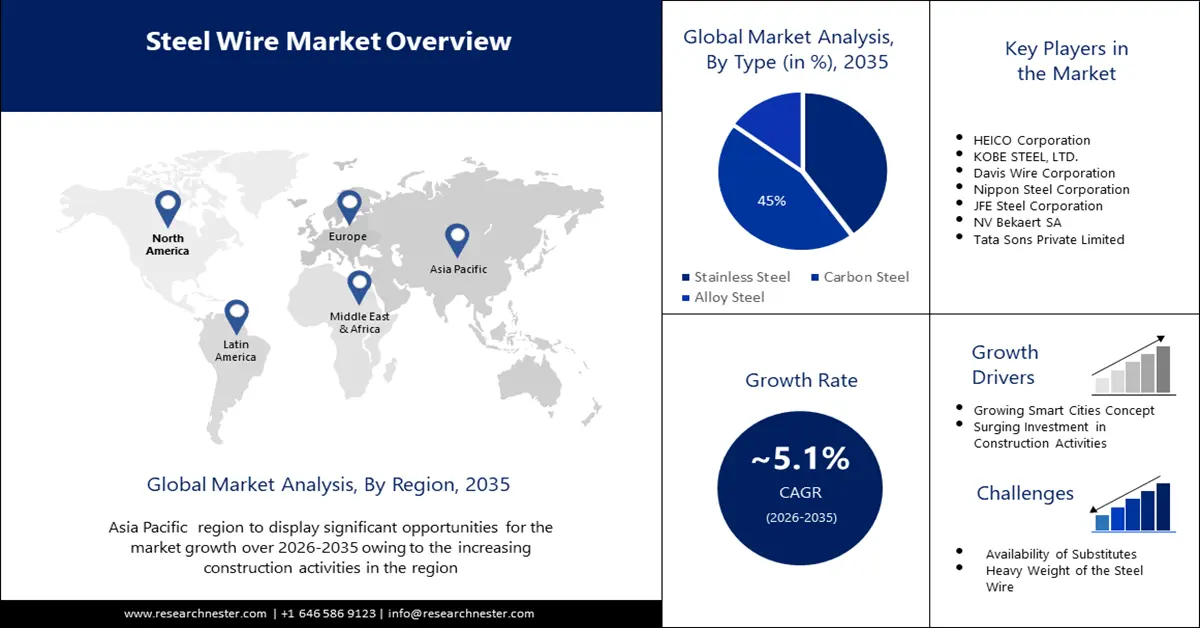

Stainless Steel Market Outlook:

Stainless Steel Market size was valued at USD 156.12 billion in 2025 and is set to exceed USD 256.74 billion by 2035, registering over 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of stainless steel is estimated at USD 163.29 billion.

The primary growth driver for the global stainless steel market is its widespread use across various key industries, globally. Stainless steel is widely employed in the infrastructure and construction sectors. It is also used in the production of vehicles for applications such as exhaust systems, body panels, and fuel tanks. It is estimated that the world finished steel production grew from 1 .76 Billion tons in 2020 to 1.84 Billion tons in 2021. Furthermore, the transition from conventional uses in industries like consumer products, construction, architecture, etc. to extensive uses in industries like the railroad, car, and transportation sectors is another factor driving the industry. Owing to the cost reductions in the steel-making process and the adoption of more energy-efficient production methods, there is likely to be a rising transition from older to newer technologies, which is expected to support market growth.

The components of stainless-steel combine to create a potent alloy. Nitrogen, molybdenum, and chromium are all components of this alloy. The item is additionally corrosion-resistant, durable, robust, neutral alloy, and eternally recyclable. Steel is an ideal material for a variety of industries, including the automotive, building, and electronics sectors, along with use in the medical and healthcare sector for applications such as surgical instruments, implants, and medical equipment. Additionally, the product's capacity to resist corrosion together with expanding recycling production will further support the market expansion during the anticipated timeframe. Additionally, the renewable energy sector has only been increasing its steel consumption, for applications such as wind turbine towers and blades, wave energy converters, and solar thermal systems. Manufacturers have been creating consistent sources of income in the steel business over the past few years since steel is a necessary raw material for most sectors. The total global crude steel production has seen a small but steady increase to 1.94 Billion tons in 2021 from 1.88 Billion in 2020.

Key Stainless Steel Market Insights Summary:

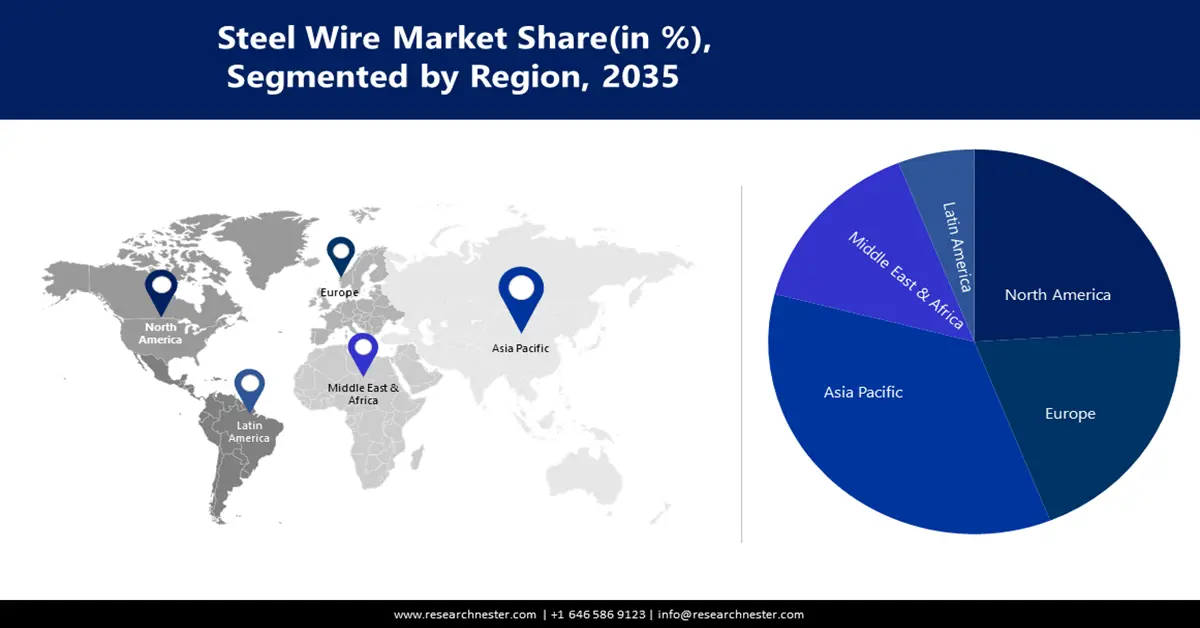

Regional Highlights:

- North America stainless steel market commands the largest share by 2035, driven by rising manufacturing of cardiovascular devices, increasing healthcare expenditure, and adoption of advanced devices.

- Asia Pacific market sees significant growth during the forecast timeline, driven by demand from construction and automotive sectors, led by China and India, and increasing EV adoption.

Segment Insights:

- The austenitic (type) segment in the stainless steel market is projected to secure the largest share by 2035, driven by its excellent resistance to corrosion, heat treatments, and ability to harden with cold pressing.

- The construction (end-user) segment in the stainless steel market is expected to maintain the largest share by 2035, fueled by the housing industry's high demand.

Key Growth Trends:

- Global Inelastic Demand for Steel

- Demand in Automobile Industry

Major Challenges:

- Availability of Substitute Materials

- Supply Chain Delays and Issues

Key Players: China BaoWu Steel Group Corporation Limited, ArcelorMittal, Ansteel Group Corporation Limited, NIPPON STEEL CORPORATION, Shagang Group Corporation, POSCO, HBIS Group, China Jianlong Steel Industrial Co Ltd., Shougang Group Co., Ltd., Tata Steel Limited Company.

Global Stainless Steel Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 156.12 billion

- 2026 Market Size: USD 163.29 billion

- Projected Market Size: USD 256.74 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, India, Japan, United States, Germany

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 10 September, 2025

Stainless Steel Market Growth Drivers and Challenges:

Growth Drivers

-

Global Inelastic Demand for Steel – One of the determinants of the price elasticity of steel is the nature of the commodity. Steel is categorized as a necessity good because it is necessary for manufacturing and development in almost all sectors of the modern economy. Hence, when the price of steel fluctuates, the demand for the material does not alter considerably. This happens wherever steel is essential to the end product's operation or if it is employed in goods or sectors where there are few alternatives. From 1950, the total crude steel production has grown from 190 million tons to over 1800 tons in 2020 around the globe.

-

Demand in Automobile Industry – In a regular modern car, steel accounts for more than 50% of the total material used. Steel consumption and production will rise in direct proportion to the use of steel as a raw material in the automotive sector. Global auto sales increased from 62 million in 2020 to more than 67 million in 2021. This is largely attributable to the - emergence automobile industry, which lost a significant portion of its revenue as a result of the epidemic.

-

Quality of Being 100% Recyclable – Since steel is 100 percent recyclable, it may be repeatedly recycled into the same type of material. A refrigerator, a car door, or a roof panel can all be made from a single steel beam. In North America, between 62 and 85 million tons of steel scrap are recycled each year into new steel products. The North American steel industry has recycled more than 1000 million tons of steel scrap into new steel during the last three decades.

-

Demand for Stainless-steel in Energy and other Industries – The steel demand is significantly influenced by the energy sector. Numerous energy-related processes rely on steel, including the construction of nuclear power plants, pipelines for oil and gas, and wind turbines. The energy industry continues to expand globally as a country's energy infrastructure is improved. A high-voltage transmission tower typically weighs between 18000 to 28000 kilograms of steel. Apart from that, applications in packaging, medical instruments, and cookware all require steel to create quality products.

Challenges

-

Availability of Substitute Materials - Materials that can be utilized in some applications in place of steel are known as substitute materials. They include aluminum and wood, as well as composites like carbon fiber-reinforced plastic and fiberglass-reinforced plastic. In some cases, for instance, in the automobile industry, aluminum or carbon fiber can be used for lightweight body panels. Another instance is the use of wood or fiberglass sheets in construction applications.

-

Decarbonization Issues - The average amount of carbon dioxide released per ton of steel produced was over 1.7 tons or roughly a tenth of the world's total emissions. As a result, steel producers all around the world, are dealing with decarbonization issues, while finding more efficient and eco-friendly ways to produce.

-

Supply Chain Delays and Issues

Stainless Steel Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 156.12 billion |

|

Forecast Year Market Size (2035) |

USD 256.74 billion |

|

Regional Scope |

|

Stainless Steel Market Segmentation:

Type

The global stainless-steel market is segmented and analyzed for demand and supply by type into austenitic, ferritic, martensitic, duplex, and precipitation. Out of these segments, the austenitic segment holds the largest market share and is expected to keep its bigger share till 2035. This is because austenitic stainless steel makes up for more than 2/3rd of steel’s commercial production. This is because of qualities such as excellent resistance against corrosion, hardening with cold pressing, and resistance to heat treatments.

End-user

The global stainless steel devices market is also segmented and analyzed for demand and supply by end-user into automotive, construction, energy, and defense. Out of these segments, the construction segment is projected to hold the largest market share and is expected to generate the highest revenue by 2035. The construction and housing industry uses more than half of the total steel produced across the world. With buildings becoming taller and the ever-growing need for housing as the world population hits 8 billion, the segment is a key market driver.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Series |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Stainless Steel Market Regional Analysis:

North American Market Insights

The North American stainless-steel market, amongst the market in all the other regions, is projected to hold the largest market share by the end of 2035 on the back of the rising surge in manufacturing of cardiovascular devices, increasing healthcare expenditure, and growing adoption of advanced devices. As per the U.S. Centers for Medicare & Medicaid Services, the national health expenditure rose by 9.7% and reached USD 4.1 trillion in 2020 accounting for USD 12,350 per person. Furthermore, it is anticipated that the expansion of cold-rolled facilities will continue to play a crucial role in the market's evolution.

APAC Market Insights

The stainless-steel business has grown significantly in the Asia-Pacific region owing to major shares accounted for by nations like China and India. The demand for the construction of new offices and buildings has also increased with the presence of international businesses in the Asia-Pacific area. As consumer preference for battery-powered electric vehicles increases, the automotive sector in China is seeing shifting trends. The demand for stainless steel is anticipated to increase with the development of China's car industry. For instance, the International Organization of Motor Vehicle Manufacturers (OICA) estimates that China produces nearly 32.5% of the world's automobiles, making it the biggest producer in the world. 2021 saw a 3% rise in vehicle production from 25,225,242 units in 2020 to 2,60,82,220 units in 2021. The fourth stage of the Forward-looking Infrastructure Development Program, which would be used from 2023 to 2024, is suggested to have a budget of NTD 180 billion (USD 6.47 billion), according to the National Development Council (NDC).

Stainless Steel Market Players:

- China BaoWu Steel Group Corporation Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ArcelorMittal

- Ansteel Group Corporation Limited

- NIPPON STEEL CORPORATION

- Shagang Group Corporation

- POSCO

- HBIS Group

- China Jianlong Steel Industrial Co Ltd.

- Shougang Group Co., Ltd.

- Tata Steel Limited Company

Recent Developments

-

Tata Steel Limited - Tata Steel Group and Hardt Hyperloop formally signed an agreement for the delivery of Zeremis Carbon Lite, a steel with an allotted carbon footprint reduction of up to 100%, during a festive ceremony at this year's InnoTrans in Berlin.

-

ArcelorMittal - Following a successful audit conducted by DNV Poland, which determined that the company satisfies the requirements to acquire certification against the ResponsibleSteelTM Standard, ArcelorMittal Poland has been granted ResponsibleSteelTM accreditation.

- Report ID: 4628

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Stainless Steel Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.