Stainless Steel Kirschner Wires Market Outlook:

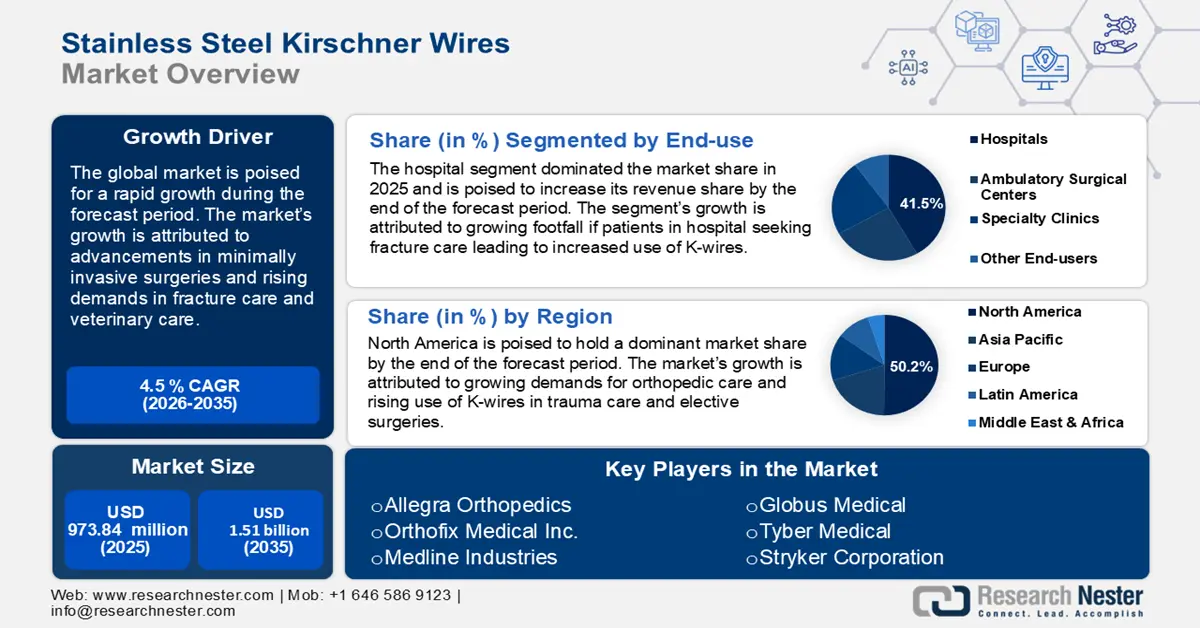

Stainless Steel Kirschner Wires Market size was over USD 973.84 million in 2025 and is anticipated to cross USD 1.51 billion by 2035, witnessing more than 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of stainless steel kirschner wires is assessed at USD 1.01 billion.

The robust stainless steel kirschner wires market growth is attributed to rising prevalence of bone-related disorders and growing demand for orthopedic surgeries. The increase in aging population globally is projected to exponentially increase the demand for fracture care in the next decade. For instance, the United Nations reported 1 in 10 people were aged 65 or above in 2021 and due to decreasing fertility levels, the share of older people has eventually risen up.

In September 2024, the World Health Organization (WHO) released figures of fracture rate comparisons from 1990 to 2019 that indicated a 33.4% increase in new fractures. WHO estimated 455 million prevalent cases of acute or long-term symptoms of fracture, a 70.1% increase since 1990. The rising cases of fractures drastically increase demands for K-wire solutions owing to improved biocompatibility and corrosion resistance. K-wires provide an anchor to hold bone fragments. Additionally, there is a rising awareness of minimally invasive surgery, which is poised to increase demands for K-wires of various diameters. Improvements in the healthcare sector for robust distribution channels also ensure the availability of K-wires in remote areas with clinics. The increased usage and accessibility to healthcare professionals are projected to continue boosting the stainless steel kirschner wires market’s growth by the end of 2037.

The opportunities for various segments within the global stainless steel kirschner wires market are vast. Key market players can take advantage of the rising emphasis on developing advanced surgical tools and materials. For instance, in September 2023, Tyber Medical gained Food and Drug Administration (FDA) clearance on implantable K-wires on stainless steel and titanium alloy. Additionally, the rising prevalence of sports-related injuries is a driving factor for the global market. The market trends estimate a profitable future during the forecast period, with rising investments in the healthcare sector in emerging economies leading to a surge in demand for K-wires.

Key Stainless Steel Kirschner Wires Market Insights Summary:

Regional Highlights:

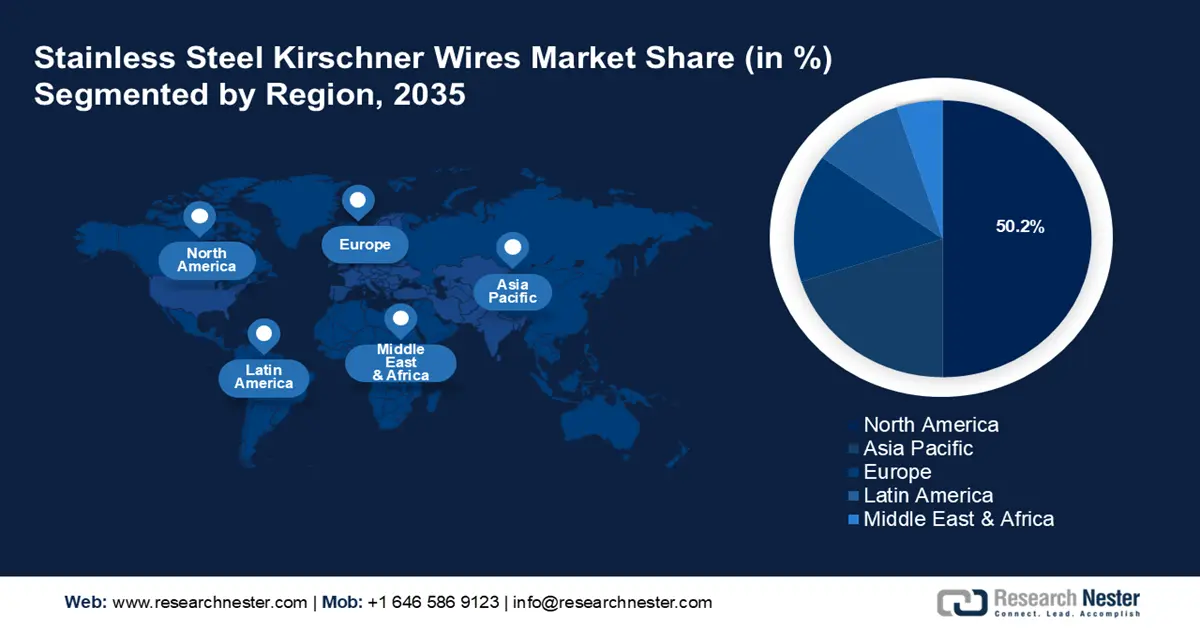

- North America stainless steel kirschner wires market will account for 50.20% share by 2035, driven by a robust healthcare infrastructure and rising demand for orthopedic care.

- Asia Pacific market will exhibit the fastest growth during the forecast period 2026-2035, attributed to fracture care needs for a large section of the population and improving healthcare sectors in emerging economies.

Segment Insights:

- The hospital segment in the stainless steel kirschner wires market is projected to capture a 41.50% share by 2035, driven by hospitals being primary centers for advanced surgical procedures requiring K-wire solutions.

Key Growth Trends:

- Advancements in minimally invasive surgeries

- Increasing use in veterinary procedures

Major Challenges:

- Risk of post-surgical infections

- Lack of cost effectiveness compared to molded casts

Key Players: Allegra Orthopedics, gSource, Orthofix Medical Inc., Arthrex Inc., Medline Industries, Stryker Corporation, Tyber Medical, DePuy Synthes, Zimmer Biomet, Globus Medical, Smith & Nephew.

Global Stainless Steel Kirschner Wires Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 973.84 million

- 2026 Market Size: USD 1.01 billion

- Projected Market Size: USD 1.51 billion by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (50.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 18 September, 2025

Stainless Steel Kirschner Wires Market Growth Drivers and Challenges:

Growth Drivers

- Advancements in minimally invasive surgeries: Advancements in minimally invasive surgeries are a key driver of the global stainless steel kirschner wires market. For instance, in December 2020, a paper published in the Journal of Laparoscopic & Robotic Surgeons estimated a 36% increase in minimally invasive surgeries (MIS) over a 16-year period.

The rising prevalence of robotic surgery in MIS has improved the efficacy of the procedure as the use of robotic arms offers greater precision in the use of K-wires in surgeries. For instance, in November 2020, research published in the International Journal of Medical Robotics and Computer Assisted Surgery on a novel robotic system termed Orthbot that will serve as a surgical assistant for auto placement of K-wire in lumbar fusion that is poised to improve surgical procedure success rates. - Increasing use in veterinary procedures: The demand for advanced veterinary care has witnessed a massive surge globally, leading to a rise in demand for orthopedic care. K-wires are used to fix fractures in small animals such as dogs and cats to stabilize bones with minimal invasion.

Additionally, growing awareness among pet owners and animal care NGOs on high-quality surgical options pushes for veterinary clinics to adopt K-wire solutions to treat animals. For instance, in October 2024, VCA Animal Hospitals launched a 3D printing lab for pet orthopedic surgeries aimed at providing customized solutions in pet care. - Innovations in material science: The global stainless steel kirschner wires market’s growth benefits from advancements in material science that improve Kirschner wire properties such as flexibility, corrosion resistance, and strength. For instance, in August 2024, a research conducted on durable antibacterial coatings on Kirschner wires indicated several advantages over conventional techniques, such as uniformity, high coverage, strong adhesion, and scalability. New innovations open the market for manufacturers to differentiate their products and answer demands for high-performance surgical tools.

Challenges

- Risk of post-surgical infections: The stainless steel kirschner wires market faces a major constraint owing to the prevalence of post-surgical infections associated with the use of K-wires. In case infections are not managed in time, then it can lead to additional surgeries. There is growing pressure on manufacturers to develop antimicrobial wires. Additionally, there is a potential for migration in the use of K-wires, such as migration to the thorax from an adjacent fracture fixation that can lead to major complications. The risk of damage to tendons and nerves can also stymie the adoption of K-wires in surgeries.

- Lack of cost effectiveness compared to molded casts: The market’s growth can also be affected due to a lack of cost-effectiveness in comparison to molded casts, especially in less complex fractures. Molded casts are the preferred choice of treating fractures owing to their non-invasive nature, and ease of application. In comparison, surgeries with K-wires can be more expensive and require specialized treatment. The lack of robust infrastructure in emerging economies may reduce the application of K-wires in different surgical procedures, slowing the stainless steel kirschner wires market’s growth.

Stainless Steel Kirschner Wires Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 973.84 million |

|

Forecast Year Market Size (2035) |

USD 1.51 billion |

|

Regional Scope |

|

Stainless Steel Kirschner Wires Market Segmentation:

End use Segment Analysis

The hospital segment is poised to dominate the revenue share with a 41.5% stainless steel kirschner wires market share in 2024 that is poised to increase by the end of 2035. Hospitals are poised to remain the largest end user segment for the global market owing to hospitals being the primary centers for advanced surgical procedures requiring fracture fixation. The segment’s rapid growth is attributed to large footfall of patients seeking surgical procedures that require K-wire solutions.

Investments in orthopedic care also boost the segment’s profitable growth as more patients visit hospitals seeking advanced orthopedic care. For instance, in April 2024, Skanska announced an agreement with Skane to build a futuristic orthopedic center in Sweden. Additionally, rising cases of road accidents and bone disorders globally are poised to increase the demands for K-wires in hospitals.

The ambulatory surgical centers (ASC) segment is projected to increase its revenue share by end-user segment during the forecast period. The growth of the ASC segment is attributed to cost-effective and efficient solutions for minor same day surgeries. ASCs are seeing increased footfall owing to outpatient orthopedic procedures where K-wires are used. Additionally. ASCs deliver high-quality patient care and faster access to surgical care, especially in trauma cases where immediate bone stabilization is required with K-wires.

The growth of the segment is evident from the increasing percentage of ASCs being set up, especially in developed economies. For instance, in October 2023, Hoag Orthopedic Institute announced the opening of a new ambulatory surgery center in Aliso Viejo focusing on general musculoskeletal care.

Diameter Segment Analysis

The 1.0 mm to 2.0 mm segment in stainless steel kirschner wires market is projected to witness a rapid growth in profit share during the forecast period owing to its versatility and wide applicability across various orthopedic procedures. The usage of 1.0 mm to 2.0 mm K-wires offers versatility to healthcare professionals due to its use in the fixation of small bones in surgeries involving hands, feet, ankles, and wrists. K-wires of 1.1 mm are used in most adult phalangeal fractures. In August 2022, a study published in the National Library of Medicine estimated the small finger to have the highest number of fractures, accounting for 26% of cases in the U.S., and rising cases are poised to maintain the demand for K-wires between 1.0 mm and 2.0 mm in length.

Our in-depth analysis of the stainless steel kirschner wires market includes the following segments:

|

End use |

|

|

Diameters |

|

|

Application |

|

|

Usage |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Stainless Steel Kirschner Wires Market Regional Analysis:

North America Market Insights

North America stainless steel kirschner wires market is expected to capture revenue share of around 50.2% by the end of 2035 owing to a robust healthcare infrastructure and a rising demand for orthopedic care. Increasing demands for K-wire usage in trauma care and elective surgeries are major drivers of the stainless steel kirschner wires market market. Additionally, large-scale investments in the healthcare sector and innovations such as the integration of robotic assistants for surgery enhance the use of K-wire solutions for surgical care. For instance, in May 2024, the New York City Health + Hospitals announced the completion of one year of its robotic surgery program and reported over 400 successful surgeries.

The U.S. has the dominant share in the North America stainless steel kirschner wires market owing to a high volume of orthopedic surgeries and an advanced healthcare system that is ushering innovations in surgical care. For instance, the Lehigh Valley Health Network estimates around 6.8 million fractures every year in the U.S., and an average person in the country suffers two fractures in their lifetime. The high-rates of fracture boost the demand for K-wires in the healthcare sector.

Additionally, in November 2023, a study published in the National Library of Medicine estimated the rising prevalence of wrist and vertebral fractures among US adults aged 50 or above to have increased by 50% from 1999 to 2020. Another major driver in the stainless steel kirschner wires market is the rising prevalence of robotic assistance solutions for surgery. The use of robot assistants allows precision use of K-wires, improving patient care.

Canada is projected to increase its stainless steel kirschner wires market share in North America during the forecast period owing to the rapid integration of robotic surgery assistance, improving fracture care, and boosting demands for K-wires. The stainless steel kirschner wires market benefits from the universal healthcare system in Canada that encourages more patients to actively seek fracture care. Additionally, robot-assisted surgery is gaining popularity in the country which is set to boost the market’s growth. For instance, in December 2021, Medtronic Canada ULC announced that it had received a Health Canada license for the Hugo robotic assistance surgery (RAS) system.

APAC Market Insights

The Asia Pacific stainless steel kirschner wires market is poised to register the fastest growth during the forecast period. The market’s growth is attributed to fracture care needs for a large- section of the population. Emerging economies in APAC are investing in improving their healthcare sectors to cater to the needs of a significantly large section of the population. India, China, and Japan are leading the stainless steel kirschner wires market growth in APAC.

Additionally, the medical tourism sector in APAC is witnessing steady growth owing to affordable and advanced orthopedic solutions. This attracts patients with high disposable incomes from North America and Europe to leverage affordable care in APAC economies. Growth in medical tourism is poised to boost demands for K-wires solutions as fracture cases increase.

India accounts for a significant market share in APAC owing to large-scale demand for fracture care and a growing healthcare ecosystem boosting demands for K-wires. A major market driver in India is the large-scale import of medical wires owing to growing usage in the healthcare sector. India is reported to be among the top 3 importers of medical wire. Additionally, national public health insurance schemes such as the Ayushman Bharat Yojana bolster demands for K-wire solutions by improving quality healthcare access in both urban and rural areas.

China is set to account for a considerable revenue share in APAC and is positioned to increase its market share by the end of 2038. The rising cases of fracture in China are poised to maintain the demands for K-wire solutions. For instance, in January 2024, a study published in the National Library of Medicine on the economic burden of traumatic fractures estimated the traumatic fracture rate in China to be 1.565 per 1000 in males and 1.302 per 1000 in females in 2020. Additionally, the World Health Organization estimated the healthcare spending in China to have tripled from USD 68.6 billion in 2009 to USD 233.4 billion in 2018. The increase in healthcare spending is poised to improve minimally invasive surgery procedures for surgical care, boosting demands for K-wire solutions.

Stainless Steel Kirschner Wires Market Players:

- Allegra Orthopedics

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- gSource

- Orthofix Medical Inc.

- Arthrex Inc.

- Medline Industries

- Stryker Corporation

- Tyber Medical

- DePuy Synthes

- Zimmer Biomet

- Globus Medical

- Smith & Nephew

The global stainless steel kirschner wires market is poised to exhibit a profitable growth curve. Key market players are seeking to improve K-wire solutions by offering coated, antimicrobial stainless steel Kirschner wires to differentiate themselves in the market. The global market is marked by local and global manufacturers offering solutions to the healthcare sector.

Here are some key players in the stainless steel kirschner wires market:

Recent Developments

- In February 2024, Virtual Incision received authorization from the Food and Drugs Administration (FDA) for the MIRA Surgical system as the first miniaturized robotic-assisted surgery device.

- In September 2021, a paper published on the Plastic and Reconstructive Surgery-Global Open studied and found that pre-marking of K-wire trajectory helps in reducing procedure and fluoroscopy time and minimizes bone and soft tissue injury in the management of phalangeal finger fractures.

- Report ID: 6528

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.