Stacker Truck Market Outlook:

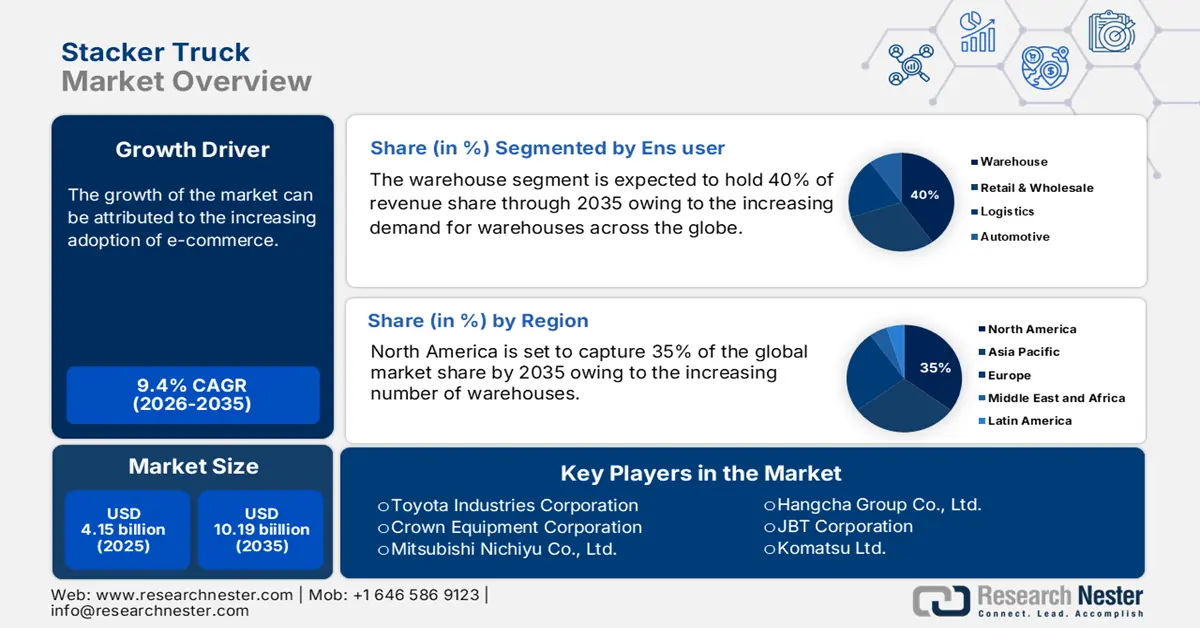

Stacker Truck Market size was valued at USD 4.15 billion in 2025 and is set to exceed USD 10.19 billion by 2035, expanding at over 9.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of stacker truck is evaluated at USD 4.5 billion.

The growth of the market can be attributed to the increasing adoption of e-commerce. The demand for efficient and effective material handling operations in warehouses and distribution centers has expanded as a result of the quick development of e-commerce and online retail. For instance, in order to meet the growing need for quick and effective order fulfillment, firms frequently use stacker trucks for duties such as stacking, lifting, and transferring goods within warehouses. By 2025, global retail e-commerce is expected to rise by more than 70%.

In addition to these, factors that are believed to fuel the market growth of stacker truck include the rise in technological advancements. The need for stacker trucks has also been fueled by the growing technological developments in material handling operations. For instance, modern stacker truck models offer greater productivity, accuracy, and safety in material handling activities, making them appealing solutions for companies wishing to update their warehouses.

In addition to these, factors that are believed to fuel the market growth of stacker truck include the rise in technological advancements. The need for stacker trucks has also been fueled by the growing technical developments in material handling operations. For instance, modern stacker truck models offer greater productivity, accuracy, and safety in material handling activities, making them appealing solutions for companies wishing to update their warehouses.

Key Stacker Truck Market Insights Summary:

Regional Highlights:

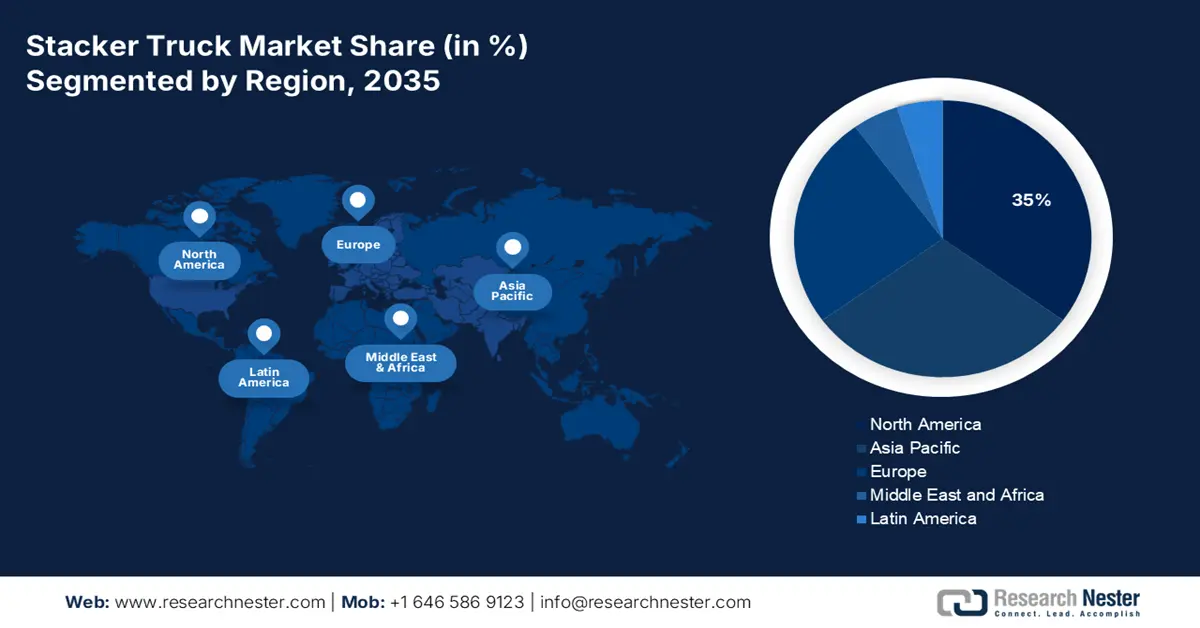

- North America is projected to capture a 35% share by 2035 in the stacker truck market over 2026–2035, stimulated by the rising number of warehouses and accelerated warehouse automation amid growing material-handling needs.

- The Asian Pacific region is anticipated to hold the second-largest share by 2035 during 2026–2035, supported by the expanding e-commerce landscape that is intensifying demand for storage facilities and agile material-handling equipment.

Segment Insights:

- The warehouse segment of the stacker truck market is projected to secure the largest share by 2035 during 2026–2035, supported by escalating global warehouse demand owing to increasing requirements for effective material-handling solutions.

- The hydraulic lift segment is anticipated to command a significant share by 2035 over 2026–2035, enhanced by the widening application of hydraulic systems that enable efficient vertical movement of palletized goods.

Key Growth Trends:

- Growing Labor Shortages

- Rising Need for Workplace Safety

Major Challenges:

- Presence of Inexpensive Labor in Low Income Countries

- Slow Uptake of Modern Technologies

Key Players: Lifting Equipment Store Inc., Toyota Industries Corporation, Crown Equipment Corporation, Mitsubishi Nichiyu Co., Ltd., UniCarriers Americas Corporation, Anhui Heli Co., Ltd., Clark Material Handling Company, Hangcha Group Co., Ltd., JBT Corporation, Komatsu Ltd.

Global Stacker Truck Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.15 billion

- 2026 Market Size: USD 4.5 billion

- Projected Market Size: USD 10.19 billion by 2035

- Growth Forecasts: 9.4%

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Mexico, Indonesia

Last updated on : 21 November, 2025

Stacker Truck Market - Growth Drivers and Challenges

Growth Drivers

-

Growing Labor Shortages – On account of the lack of availability of manual labor in some regions has led businesses to seek more efficient and cost-effective material handling solutions, such as stacker trucks as they can help in reducing reliance on manual labor, which as a result the market is estimated to drive market growth. According to statistics, by 2030, there will be a global labor shortfall of more than 80 million people.

-

Rising Need for Workplace Safety – The growing demand for workplace safety has led to an increase in demand for stacker trucks. For instance, to increase operator safety, decrease accidents, and adhere to safety requirements, stacker trucks are built with safety features such as stability controls, and operator protection systems. Every year, over 2 million men and women worldwide perish from work-related illnesses or accidents globally.

-

Increasing Demand for Automation – It is expected that the growing adoption of automation in material handling operations has also driven the demand for stacker trucks. According to the most recent data, global productivity will increase by over 1% a year as a result of automation.

-

Growing Construction Industry – It is expected that the increasing construction sector across the globe has led to an increase in demand for stacker trucks, which is anticipated to drive market growth. For instance, heavy items such as bricks, concrete blocks, steel beams, lumber, and other building supplies are lifted and moved using stacker trucks. By 2025, it is anticipated that India's construction market would be worth more than USD 1 trillion.

Challenges

-

Presence of Inexpensive Labor in Low-Income Countries - The increasing concern amongst individuals for the availability of cheap labor is one of the major factors predicted to slow down the market growth. For instance, businesses may rely more on physical labor for material handling operations in low-income countries with cheap labor as firms may choose to spend less on equipment and more on hiring cheaper people, this may lead to a decline in the need for automated material handling machinery such as stacker trucks.

-

Slow Uptake of Modern Technologies

- Safety Concerns Related to Stacker Trucks

Stacker Truck Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.4% |

|

Base Year Market Size (2025) |

USD 4.15 billion |

|

Forecast Year Market Size (2035) |

USD 10.19 billion |

|

Regional Scope |

|

Stacker Truck Market Segmentation:

End-user Segment Analysis

The global stacker truck market is segmented and analyzed for demand and supply by end-user into retail & wholesale, warehouse, logistics, automotive, and others. Out of the five end-users of stacker truck, the warehouse segment is estimated to gain the largest market share in the year 2035. The growth of the segment can be attributed to the increasing demand for warehouses across the globe. The requirement for effective material handling solutions is expected to increase as warehouse space becomes more in demand to manage rising inventory levels. As more warehouses are built or expanded to meet the growing demand for storage, the demand for stacker trucks is projected to grow, as they are versatile pieces of machinery capable of transporting and arranging goods in a warehouse setting. Furthermore, as businesses expand their operations and require larger warehouse footprints to accommodate their inventory, demand for stacker trucks may rise to handle the increased volume of goods kept and delivered inside warehouses. According to projections, the global demand for warehousing would reach over USD 325 billion in 2024.

Technology Segment Analysis

The global stacker truck market is also segmented and analyzed for demand and supply by technology into the hydraulic lift, and winch. Amongst these two segments, the hydraulic lift segment is expected to garner a significant share in the year 2035. In order to lift and move palletized items in warehouses and other industrial settings, stacker trucks, a form of material handling equipment, primarily utilize hydraulic lifts. For instance, stacker trucks can raise and lower the load using a hydraulic lift, which facilitates the effective vertical movement of goods. Besides this, hydraulic systems power the lifting mechanism of stacker trucks. This, as a result, is anticipated to create numerous opportunities for the growth of the segment in the coming years.

Our in-depth analysis of the global market includes the following segments:

|

By Technology |

|

|

By Power Source |

|

|

By End User |

|

|

By Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Stacker Truck Market - Regional Analysis

North American Market Insights

North America industry is estimated to hold largest revenue share of 35% by 2035. The growth of the market can be attributed majorly to the increasing number of warehouses. The need for stacker trucks is projected to rise along with the warehouse automation in the region. For instance, larger warehouses would require more materials to be moved, stacked, and transported inside the warehouses. To support the increasing material handling requirements, an increase in the number of warehouses is anticipated to lead to a higher demand for stacker trucks since they are a necessary piece of equipment for these operations. Further, the adoption of cutting-edge technology owing to a workforce shortage in the area, along with, increasing advancements in stacker truck technology is also anticipated to contribute to the market growth in the region. As of 2023, there are more than 4,200,400 transportation and warehousing enterprises in the US.

APAC Market Insights

The Asian Pacific stacker truck market is estimated to be the second largest, registering a share by the end of 2035. The growth of the market can be attributed majorly to the increasing popularity of e-commerce in developing countries, such as India, China, Japan, and others. Storage and warehouse facilities are becoming more and more necessary as e-commerce is expanding in the region. For instance, for moving and arranging goods in a warehouse, stacker trucks are a must. The need for stacker trucks is projected to rise along with the demand for warehouse space to accommodate e-commerce inventory. Also, stacker trucks offer effective and versatile material handling solutions, enabling facilities to quickly satisfy the rising demand for order fulfillment. Further, the rapid urbanization in the region, along with the development of the retail industry, are also anticipated to contribute to the market growth in the region.

Europe Market Insights

Further, the market in Europe, amongst the market in all the other regions, is projected to hold a majority of the share by the end of 2035. The growth of the market can be attributed majorly to the increasing concerns regarding safety. The demand for stacker trucks, may rise in response to growing worker safety concerns in the region. For instance, in order to protect the safety of the operators while working the equipment, stacker trucks are becoming more popular as they are equipped with safety features including operator safety cages, safety sensors, and better visibility features. Further, the surge in the number of warehouses in the region, along with the growing construction industry, is also anticipated to contribute to the market growth in the region.

Stacker Truck Market Players:

- Lifting Equipment Store Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Toyota Industries Corporation

- Crown Equipment Corporation

- Mitsubishi Nichiyu Co., Ltd.

- UniCarriers Americas Corporation

- Anhui Heli Co., Ltd.

- Clark Material Handling Company

- Hangcha Group Co., Ltd.

- JBT Corporation

- Komatsu Ltd.

Recent Developments

-

Crown Equipment Corporation introduced IC and Electric Counterbalance Forklifts capable of carrying up to 5.5 tons to provide access to a full suite of products that facilitate efficient processes and provide the strength and performance necessary for demanding applications. Further, they can handle a wide range of material handling jobs in both indoor and outdoor settings.

-

UniCarriers Americas Corporation launched two new, larger-capacity model upgrades to the BX Electric Counterbalanced Forklift Series. Additionally, the previously efficient BX Cushion series can now operate for even longer intervals and is suitable for a variety of heavy-duty applications.

- Report ID: 4071

- Published Date: Nov 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Stacker Truck Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.