Spoolable Pipes Market Outlook:

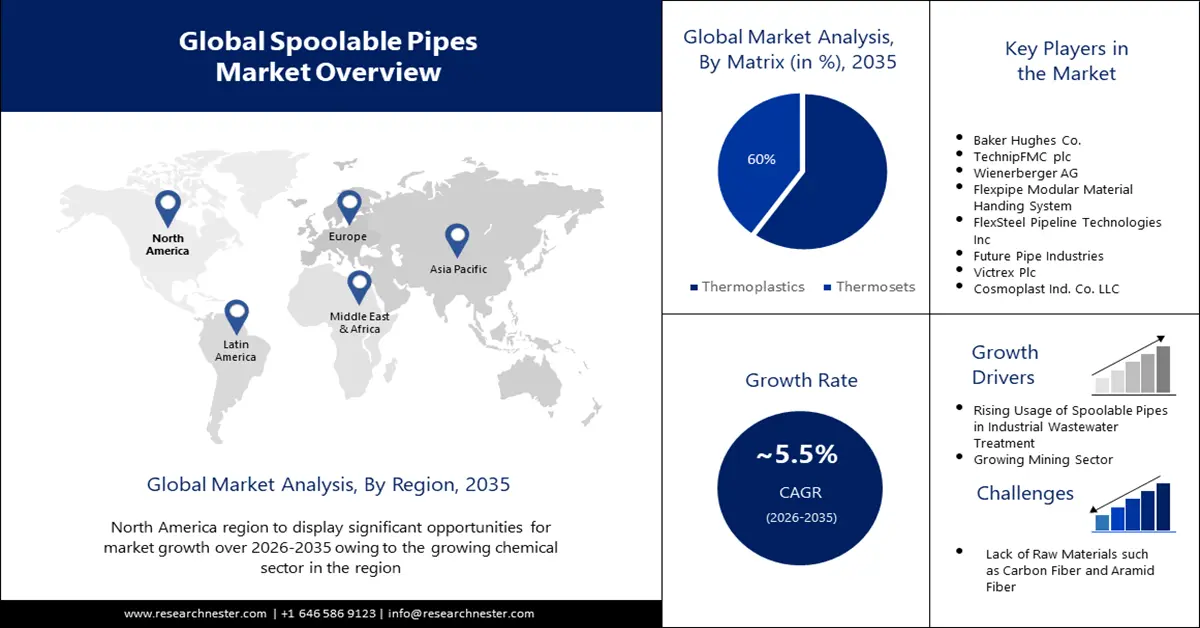

Spoolable Pipes Market size was over USD 1.67 billion in 2025 and is projected to reach USD 2.85 billion by 2035, witnessing around 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of spoolable pipes is evaluated at USD 1.75 billion.

The reason behind the growth is due to the increasing consumption of natural gas across the globe. For the past 20 years, there has been an increase in the global consumption of natural gas driven by the US shale gas revolution and the rapidly expanding liquefied natural gas industries.

For instance, more than 3 trillion cubic meters of natural gas was consumed globally in 2022, and this figure is projected to increase at an average yearly rate of over 0.7%, or over 4,220 billion cubic meters by 2025.

The growing introduction of efficient pipe technology is believed to fuel the spoolable pipes market growth. For instance, in November 2023 Baker Hughes introduced a new PythonPipe portfolio that allows for over 55% installation time reduction, helps in achieving up to 74% reduction in carbon emissions over its lifecycle, more than 75% reduction in maintenance expenses, and provides both efficient and sustainable operations. Furthermore, the PythonPipe portfolio provides the only 8-inch spoolable, non-metallic RTP product available on the market and cutting-edge co-extruded liner technology which makes it appropriate for harsh and corrosive situations.

Key Spoolable Pipes Market Market Insights Summary:

Regional Highlights:

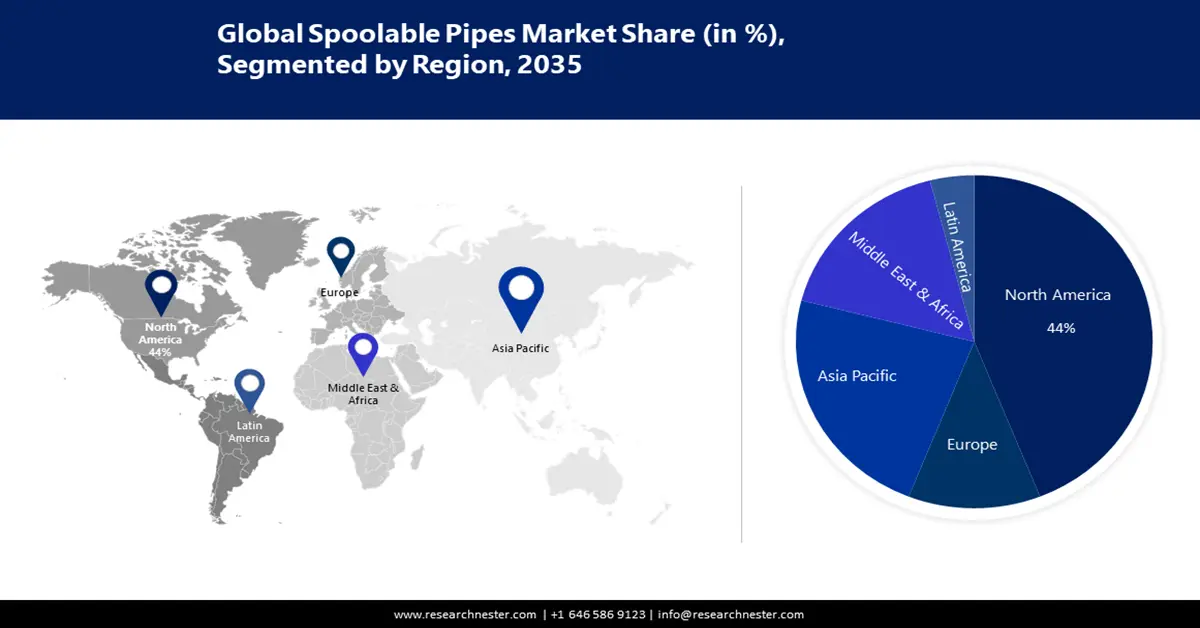

- The North America spoolable pipes market will hold more than 44% share by 2035, fueled by the growing chemical sector.

Segment Insights:

- The thermoplastics segment in the spoolable pipes market is anticipated to secure a 60% share by 2035, driven by the growing extraction of gas and increasing demand for effective piping solutions.

- The on-shore segment in the spoolable pipes market is forecasted to achieve a notable revenue share by 2035, attributed to the benefits of spoolable pipes in the onshore oil and gas industry, including flexibility, fewer joints, and ease of installation.

Key Growth Trends:

- Rising Usage of Spoolable Pipes in Industrial Wastewater Treatment

- Growing Mining Sector

Major Challenges:

- Rising Usage of Spoolable Pipes in Industrial Wastewater Treatment

- Growing Mining Sector

Key Players: Baker Hughes Co., TechnipFMC plc, Wienerberger AG, Flexpipe Modular Material Handing System, FlexSteel Pipeline Technologies Inc, Future Pipe Industries, Victrex Plc, Cosmoplast Ind. Co. LLC, Hebei Heng An Tai Pipeline Co. Ltd..

Global Spoolable Pipes Market Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.67 billion

- 2026 Market Size: USD 1.75 billion

- Projected Market Size: USD 2.85 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Canada, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 16 September, 2025

Spoolable Pipes Market Growth Drivers and Challenges:

Growth Drivers

- Rising Usage of Spoolable Pipes in Industrial Wastewater Treatment - Spoolable pipes are flexible pipes that are easy to handle which makes them a great option for applications in industries like water and wastewater to mend and renovate broken sewer lines to stop toxic water from leaking dangerously.

- Growing Mining Sector- Spoolable pipes are multi-layered composite pipes that are often used technique in mining to carry hydraulic oils and drilling fuels, which are used to extract natural gas and petroleum from the formation.

- Increasing Focus on Sustainability- Spoolable pipes are lightweight in nature, and they require less potentially environmentally hazardous protective coatings, which helps to promote environmental sustainability.

Challenges

- Lack of Raw Materials such as Carbon Fiber and Aramid Fiber - Spoolable pipes are made from advanced composites which are categorized as high-performance materials and are considered to be different in certain ways. Carbon fiber is being utilized more and more in many industries the manufacture of which requires a lot of energy and cannot be recycled or remelted, leading to a critical shortage in the world. Besides this, the development of aramid fibers involves high costs which may limit their production capacity and impact its full potential utilization.

- Strict Rules and Regulations Leading to Complexity in Manufacturing Processes and Higher Production Costs

- Exorbitant Costs of Manufacturing and Installation May Limit the Adoption of Spoolable Pipes

Spoolable Pipes Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 1.67 billion |

|

Forecast Year Market Size (2035) |

USD 2.85 billion |

|

Regional Scope |

|

Spoolable Pipes Market Segmentation:

Matrix Segment Analysis

The thermoplastics segment in the spoolable pipes market is estimated to gain a robust revenue share of 60% in the coming years owing to the growing extraction of gas. For instance, the Canadian oil and gas extraction industry's overall revenue increased by more than 53% to around USD 268 billion in 2022. The extraction of gas increases the need for effective piping solutions such as thermoplastic spoolable pipes.

Reinforced thermoplastic pipe (RTP) is an alternative to conventional pipelining materials that can be produced in continuous spoolable lengths via filament winding or tape placement techniques to offer more flexible options for gas extraction. Moreover, these pipes don't become rusted and are simple to spool and lightweight. Additionally, the flexible composite pipes (FCP) are composed of a thermoplastic liner that has been reinforced and is shielded by another layer which is a proven technology for offshore operations.

Furthermore, the oil and gas industry's primary choice for pipeline and pipe structural materials was steel until ten years ago but now thermoplastic composite pipes are extensively being adopted as an alternative to steel to address its drawbacks including corrosion, fatigue, and weight.

End-User Segment Analysis

Spoolable pipes market from the on-shore segment is set to garner a notable share shortly. The spoolable pipe is an engineered solution that is typically made up of multiple layers and has been widely used in the onshore oil and gas industry as it offers several benefits, including good flexibility, few joints, long single lengths, lightweight, and ease of installation. Moreover, spoolable pipes are utilized in high-pressure onshore applications such as portable well test lines, pipeline relining, production gathering lines, gas lift injection lines, water-alternating gas lines, and water injection lines.

Additionally, spoolable composite tubing may find applications in the off-shore industry that include use in pipelines, flowlines, risers, jumpers, expansion spools, chemical injection, methanol injection, gas lift, wellbore access, choke and kill, decommissioning, and the removal of hydrate blockages. Furthermore, the use of thermoplastic composite pipes is not simply restricted to off-shore and on-shore applications but new uses are also being discovered for a downhole industry where steel is susceptible to corrosion.

Reinforcements Segment Analysis

The glass fiber segment is anticipated to garner a noteworthy share in the coming years. Glass fiber reinforcement pipes (GFRP) are intended for production, and injection applications, and are currently used in pipelines for the collection and distribution of natural gas to meet the growing need for energy. Moreover, GFRP is more flexible and less expensive than carbon fiber reinforcement pipes (CFRP) and has numerous other benefits over steel, making it a good substitute or complementary material for use in high-pressure transmission lines.

Our in-depth analysis of the global market includes the following segments:

|

Matrix |

|

|

End-User |

|

|

Application |

|

|

Reinforcements |

|

|

Diameter |

|

|

Sales Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Spoolable Pipes Market Regional Analysis:

North American Market Insights

Spoolable Pipes market in North America is predicted to account for the largest share of 44% by 2035 impelled by the growing chemical sector. One of the biggest manufacturing sectors in the US is the chemicals sector, which is one of the top producers of chemical products worldwide. For instance, in 2022, the US chemical sector expanded its output volume by more than 4%. Moreover, a quarter of the GDP of the United States is derived from this industry and is also among the major industrial users of gas and oil.

APAC Market Insights

The Asia Pacific spoolable pipes market is estimated to be the second largest, during the forecast timeframe led by the growing spending on infrastructure projects. India is undertaking ambitious infrastructure projects which may necessitate the need for efficient pipelines including spoolable pipes. For instance, to achieve its goal of having around USD 4 GDP by 2025, India is predicted to need to invest more than USD 4 trillion in infrastructure by 2030.

Spoolable Pipes Market Players:

- Changchun Gaoxiang Special Pipe Co. Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Baker Hughes Co.

- TechnipFMC plc

- Wienerberger AG

- Cactus, Inc.

- FlexSteel Pipeline Technologies Inc.

- Future Pipe Industries

- Victrex Plc

- Cosmoplast Ind. Co. LLC

- Hebei Heng An Tai Pipeline Co. Ltd.

- NOV Inc.

- Shawcor Ltd.

- Smartpipe Technologies

- Strohm B.V

Recent Developments

- Baker Hughes Co. an energy technology company introduced a New Onshore Composite Pipe with a proven spoolable design, making it easier, faster, and more cost-effective to transport and install for multiple sectors to provide a more cost-effective and ecologically friendly substitute for resource-intensive onshore steel pipes and solve the issues of corrosion and ownership costs associated with traditional steel pipe in the oil and gas, industrial, and energy industries.

- Cactus, Inc. announced the acquisition of FlexSteel Technologies Holdings, Inc., a market-leading manufacturer of spoolable pipe technologies to strengthen Cactus' standing as a leading producer of specialized technologies and help to achieve cost savings by making use of the infrastructure of the combined company to supply specialized products to a larger customer base.

- Report ID: 5511

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Spoolable Pipes Market Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.