Spinal Muscular Atrophy Treatment Market Outlook:

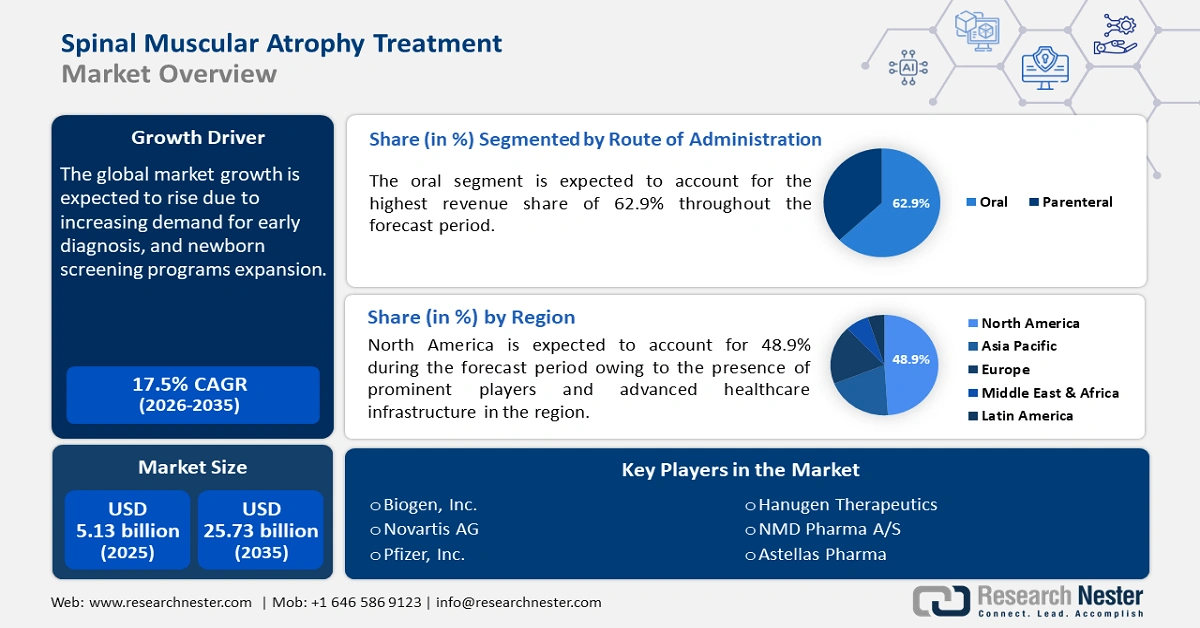

Spinal Muscular Atrophy Treatment Market size was valued at USD 5.13 billion in 2025 and is likely to cross USD 25.73 billion by 2035, registering more than 17.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of spinal muscular atrophy treatment is estimated at USD 5.94 billion.

According to the National Library of Medicine, in October 2023, the incidence of SMA is estimated at 1 in 6000–10,000, with a carrier frequency of 1/40–1/60. Even though spinal muscular atrophy is considered a rare disease, the rising incidence of the cases, especially among newborn children is anticipated to boost the spinal muscular atrophy treatment market during the forecast period.

The growing prevalence of the genetic disorder has led to a rising awareness and demand for early diagnosis. Advances in gene therapies, and increasing investments in R&D, particularly in RNA-based therapies, have propelled the demand for novel, effective treatments. Governments and healthcare organizations are also playing a crucial role by providing incentives and fast-tracking drug approvals for rare diseases. Personalized medicine approaches, aim to improve patient outcomes by tailoring treatments to specific genetic profiles. Collaborations between biotech firms and academic institutions are further accelerating drug discovery, while patient advocacy groups are raising awareness and driving demand for innovative therapies in the spinal muscular atrophy treatment market.

Key Spinal Muscular Atrophy Treatment Market Insights Summary:

Regional Highlights:

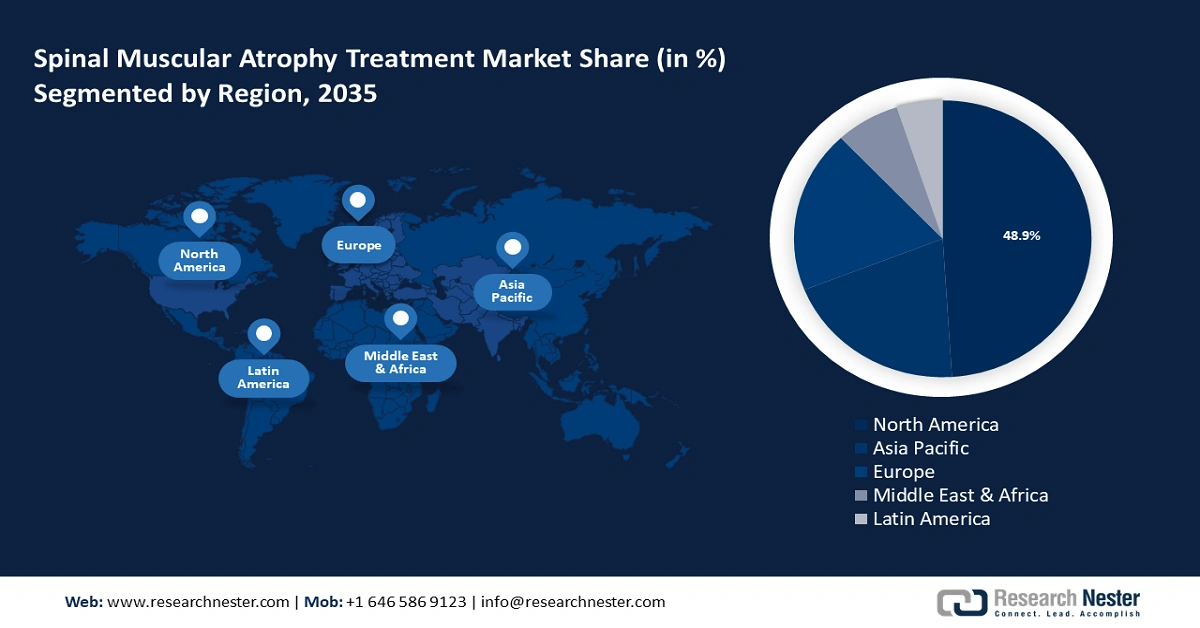

- North America spinal muscular atrophy treatment market will dominate over 48.90% share by 2035, driven by the presence of leading biotechnology firms at the forefront of developing novel therapies, a robust healthcare infrastructure, and strong government support in North America.

- North America spinal muscular atrophy treatment market will command a 48.90% share by 2035, driven by the presence of leading biotechnology firms at the forefront of developing novel therapies, a robust healthcare infrastructure, and strong government support in North America.

Segment Insights:

- The oral segment in the spinal muscular atrophy treatment market is anticipated to capture a 62.9% share by 2035, driven by the convenience of at-home administration and reduced clinical visits.

- The medication segment in the spinal muscular atrophy treatment market is projected to hold a considerable share by 2035, driven by widespread use of RNA-based drugs and newer, accessible treatment options.

Key Growth Trends:

- Increased government support for rare disease treatments

- Rise in rate of diagnosis of SMA in infants and children

Major Challenges:

- The low success rate in clinical trials

- Stringent regulatory approval for new therapies

Key Players: PTC Therapeutics, Voyager Therapeutics, Inc, Astellas Pharma Inc., Novartis AG, Pfizer, Inc., F. Hoffmann-La Roche Ltd, CYTOKINETICS, INC., Ionis Pharmaceuticals, Inc., Regeneron Pharmaceuticals, Inc.

Global Spinal Muscular Atrophy Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.13 billion

- 2026 Market Size: USD 5.94 billion

- Projected Market Size: USD 25.73 billion by 2035

- Growth Forecasts: 17.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (48.9% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Japan, Germany, United Kingdom, France

- Emerging Countries: United States, Germany, Japan, United Kingdom, France

Last updated on : 8 September, 2025

Spinal Muscular Atrophy Treatment Market Growth Drivers and Challenges:

Growth Drivers

- Increased government support for rare disease treatments: More than 7,000 rare diseases affect more than 30 million people in the U.S. Support from the government for rare disease treatments, including SMA, is acting as a significant driver for the spinal muscular atrophy treatment market. Governments in many countries are offering incentives such as grants, tax credits, and funding for R&D to encourage the development of therapies for rare diseases. For instance, in April 2024, the Canadian Institutes of Health Research Rare Disease Research Initiative provided UBC Faculty of Medicine researchers with USD 20 million in federal funding, for creating RareKids-CAN: Pediatric Rare Disease Clinical Trials and Treatment Network.

- Rise in rate of diagnosis of SMA in infants and children: This is a crucial spinal muscular atrophy treatment market driver due to the implementation of newborn screening programs and technological advancements. Many countries have begun including SMA in their routine newborn screening, allowing for earlier detection and intervention. The Australian Government Department of Health and Aged Care published an article in October 2023 related to SMA therapies. It states that the Albanese Government offers families extended access to life-changing gene therapy for SMA through the Pharmaceutical Benefits Scheme (PBS).

Challenges

-

The low success rate in clinical trials: Developing novel therapies for SMA often involves complete biological processes, particularly in gene and RNA-based therapies, where achieving consistent efficacy can be difficult. Many promising treatments fall in late-stage trials due to unexpected safety issues or insufficient therapeutic benefits. This further leads to significant financial losses and delays in bringing new treatments to market. This not only discourages smaller firms but also increases the overall cost and timeline for drug development.

- Stringent regulatory approval for new therapies: This presents a considerable barrier in the SMA treatment market. Regulatory bodies such as the FDA and EMA impose rigorous standards to ensure the safety and efficacy of new treatments, particularly for advanced therapies. The complex approval process requires extensive clinical data, long-term studies, and post-marketing surveillance. These regulatory hurdles can also limit the market entry of innovative treatments, especially I countries with less flexible approval frameworks.

Spinal Muscular Atrophy Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

17.5% |

|

Base Year Market Size (2025) |

USD 5.13 billion |

|

Forecast Year Market Size (2035) |

USD 25.73 billion |

|

Regional Scope |

|

Spinal Muscular Atrophy Treatment Market Segmentation:

Treatment Type Segment Analysis

The medication segment is expected to register a considerable share in the spinal muscular atrophy treatment market. The segment is driven by the widespread use of RNA-based drugs such as Biogen’s Spinraza. Additionally, newer medicines including Evrysdi have provided more convenient and accessible options for patients, further bolstering the medication segment. These drugs are favored as they offer ongoing treatment options compared to one-time, high-cost gene therapies. Moreover, both oral and injectable formulations’ availability, improved accessibility to treatment, permitting different preferences and needs to be met with effective therapy. The continuous need for dosage over time provides a steady demand, making medications a key revenue-generating segment in the market.

Route of Administration Segment Analysis

Oral segment is likely to dominate spinal muscular atrophy treatment market share of over 62.9% by 2035. Administration of oral SMA treatments at home does not require clinical visits, reducing the load on patients and their families. It is particularly convenient for long-term treatment regimens, as visits to hospitals can be disruptive. This thereby drives the market growth significantly. Furthermore, oral therapies eliminate the need for healthcare resources including nursing support for injections or infusion centers. Cost savings due to this make oral treatments a more appealing option for payers and providers, hence, accelerating their adoption and boosting market growth.

Our in-depth analysis of the market includes the following segments:

|

Treatment Type |

|

|

Type |

|

|

Route of Administration |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Spinal Muscular Atrophy Treatment Market Regional Analysis:

North America Market Insights

Leading biotechnology firms, at the forefront of developing novel therapies, robust healthcare infrastructure, and strong government support are the leading factors driving the North America spinal muscular atrophy treatment market. The region has witnessed significant progress in terms of drug approvals and treatment availability. Advanced diagnostic capabilities, and established screening programs further fuel the growth of the SMA market in the region. Region’s reimbursement programs and insurance coverage options also help improve patient access across the region.

The U.S. spinal muscular atrophy treatment market is the largest globally, benefitting from the presence of key market players such as Biogen, and Novartis. The FDA’s supportive regulatory framework, including orphan drug designations, and fast-track approvals, has accelerated the development and commercialization of SMA therapies. For instance, in February 2023, Biohaven Ltd. received Fast Track designation from the U.S. FDA for taldefgrobep alfa which is a novel anti-myostatin adnectin, developed for the treatment of SMA.

Canada spinal muscular atrophy treatment market is supported by government-backed healthcare policies that provide access to expensive treatments through public health programs. Advancements in genetic testing and personalized medicine treatment are driving the market growth in Canada. Collaborations between research institutions and global biotech companies are also accelerating clinical trials and the development of innovative therapies in the country.

APAC Market Insights

APAC spinal muscular atrophy treatment market is experiencing steady growth, driven by increasing awareness of SMA and improving healthcare infrastructure in countries such as India, Japan, Australia, and China. Government initiatives in the region are supporting the development and commercialization of SMA therapies. Furthermore, due to the region’s large population base, and growing focus on rare disease treatments, the Asia Pacific market is anticipated to register considerable growth.

India spinal muscular atrophy treatment market is in its early stages of development, with rising awareness and advocacy efforts to bring attention to the disease. However, the high cost of SMa treatments poses a barrier in the India market. The local government and healthcare organizations are making efforts to improve awareness, introduce affordable treatment options, and expand diagnostic capabilities. The country’s large population offers potential for future market growth as healthcare infrastructure improves.

Australia market is significantly more developed with established newborn screening programs, allowing early diagnosis and intervention. According to the country’s Department of Health and Aged Care, one in 35 Australians unknowingly carry the spinal muscular atrophy gene and one in 10,000 babies born in the country is affected by the disease. The government has been proactive in supporting rare disease treatments and offering reimbursement schemes such as the PBS. The country is hence anticipated to witness growth.

Spinal Muscular Atrophy Treatment Market Players:

- American Physical Therapy Association

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Astellas Pharma

- Beijing Jinlan Gene Technology Co., Ltd.

- Biogen Inc.

- Boston's Children Hospital

- Children's Hospital of The King's Daughters

- F. Hoffmann-La Roche Ltd.

- Hanugen Therapeutics

- Nationwide Children’s Hospital

- NMD Pharma A/S

- Novartis AG

- Pfizer, Inc.

- Scholar Rock, Inc.

Companies in the spinal muscular atrophy treatment market are focusing on offering more effective long-term solutions. Many are investing in personalized medicines, targeting specific genetic mutations, while others are enhancing patient access through pricing strategies, reimbursement partnerships, and early screening programs. In October 2024, Roche presented two-year positive data from the ongoing study RAINBOWFISH at the 29th World Muscle Society assessing the efficacy and safety of risdiplam in children with SMA. Gaining regulatory approvals, and entering new markets are also a key strategy adopted by the prominent players.

Recent Developments

- In January 2024, Voyager Therapeutics, Inc. announced a strategic collaboration and capsid license agreement with Novartis Pharma AG to advance potential gene therapies for spinal muscular atrophy.

- In March 2021, PTC Therapeutics, Inc. partnered with the Spinal Muscular Atrophy (SMA) Foundation to further advance scientific research in SMA and other neuromuscular disorders to develop new treatments.

- Report ID: 2724

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.