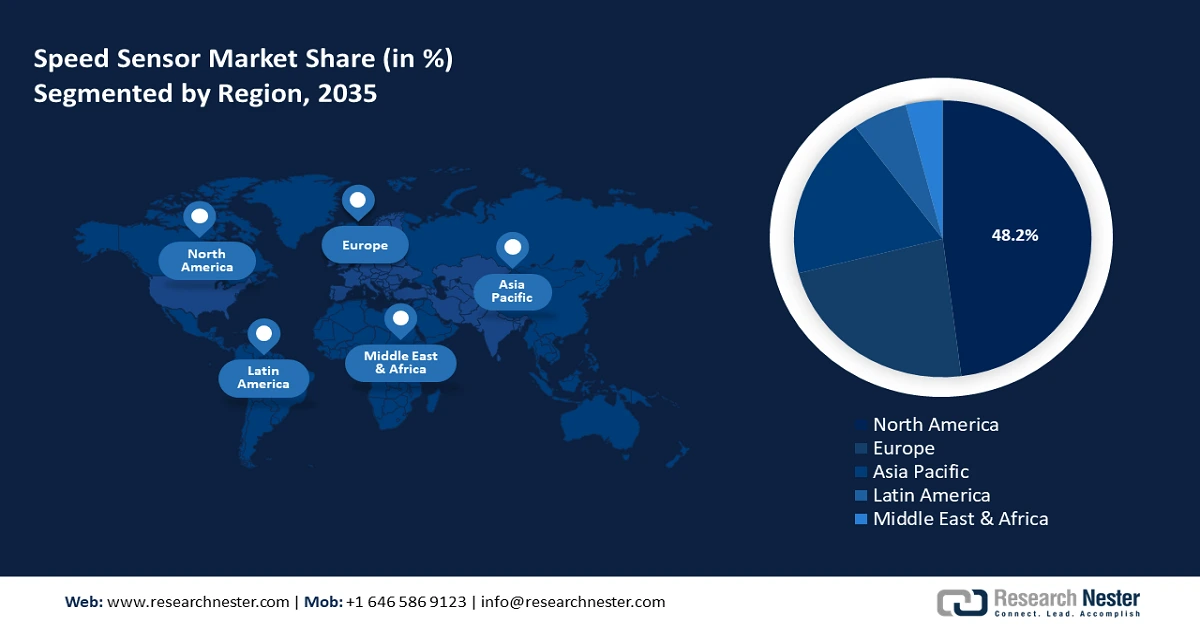

Speed Sensor Market Regional Analysis:

North America Market Forecast

North America industry is estimated to hold largest revenue share of 48.2% by 2035. The speed sensor market growth is driven by advancements in automotive technologies, industrial automation, and the adoption of innovative sensing solutions across various sectors. The region’s robust automotive industry, increasing demand for electric vehicles, and focus on safety regulations contribute significantly to the speed sensor market’s expansion.

In the U.S. the automotive industry is a key consumer of speed sensors, used in ABS, and ADAS. Rising demand for EVs and autonomous vehicles further increases the need for advanced speed sensors. According to IEA, in the U.S., new electric car registrations totaled 1.4 million in 2023, up by more than 40% from 2022. Additionally, organizations like the National Highway Traffic Safety Administration (NHTSA) mandate safety features such as ABS and ESC in all new vehicles, which require speed sensors. Compliance with these regulations ensures consistent demand for speed sensors in vehicle production and retrofitting.

In Canada, the manufacturing sector is increasingly adopting Industry 4.0 principles, including automation, robotics, and IoT. Speed sensors are used in automation systems, to monitor motor speeds, conveyor systems, and production line equipment. With Canada’s focus on reaching net-zero emissions by 2050, there is an expected increase in the adoption of EVs, driving the demand for high-performance sensors.

Europe Market Analysis

The speed sensor market of Europe is poised to register the fastest revenue growth by 2035. The region is a major hub for the EV sector, with countries like Germany, France, and the UK leading the transition. The European Union has set ambitious targets for EV adoption, which drives the demand for advanced speed sensors in motor control, wheel speed measurement, and braking systems.

Germany is home to some of the world’s leading automotive manufacturers, including Volkswagen, BMW, Mercedes-Benz, and Audi. These companies are increasingly incorporating advanced technologies into their vehicles, such as ADAS, ABS, and ESC, all of which rely on speed sensors. Moreover, the country adheres to stringent EU safety standards for automobiles, such as the Euro NCAP crash testing and safety systems. This regulatory framework drives the mandatory use of safety features that require speed sensors.

The UK government has committed to banning the sale of new petrol and diesel cars by 2030, which is expected to drive the growth of the EV sector and in turn, increase the demand for speed sensors in automotive applications. The UK’s electric vehicle sector is expected to grow significantly and reach USD 544.30 billion by 2035. Additionally, the UK government’s emphasis on sustainability and reducing carbon emissions by 2050 is contributing to the adoption of green technologies, which rely on speed sensors for efficient operations.