Speed Sensor Market Outlook:

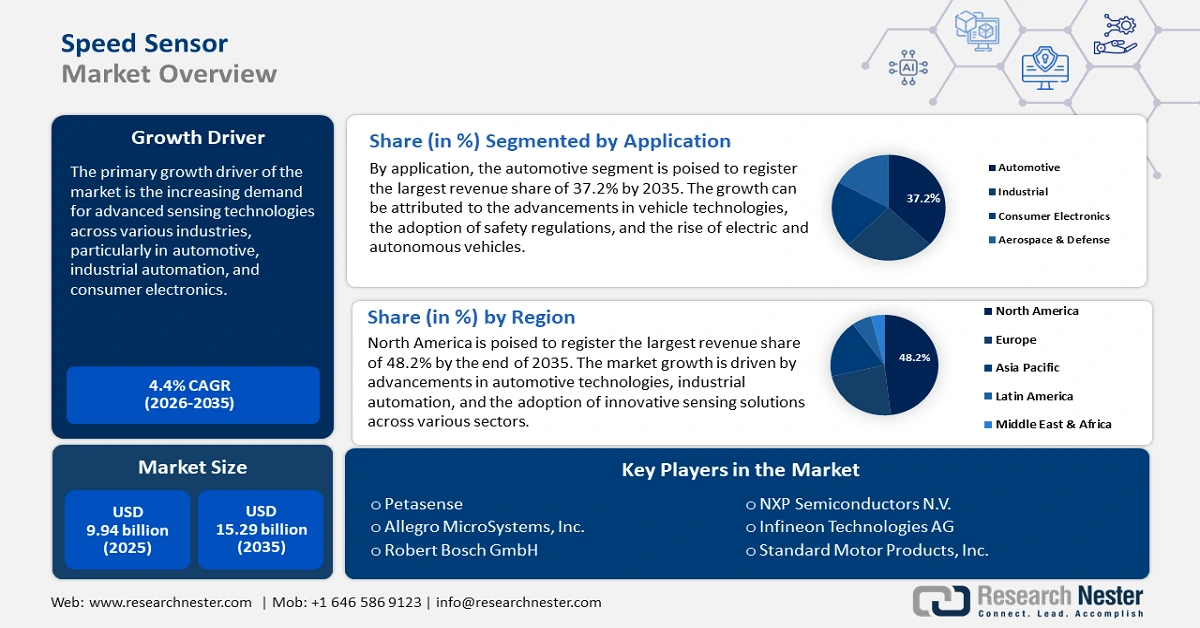

Speed Sensor Market size was over USD 9.94 billion in 2025 and is poised to exceed USD 15.29 billion by 2035, witnessing over 4.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of speed sensor is evaluated at USD 10.33 billion.

The primary growth driver of the speed sensor market is the increasing demand for advanced sensing technologies across various industries, particularly in automotive, industrial automation, and consumer electronics. Electric vehicles (EVs) require precise speed sensors for motor control, regenerative braking systems, and efficiency optimization. Speed sensors are critical components in antilock braking systems (ABS), traction control, and adaptive cruise control, which are increasingly mandated by safety regulations. Thus, the integration of advanced driver assistance systems (ADAS) is a significant growth driver for the speed sensor market, as these sensors play a crucial role in ensuring the accuracy and reliability of various ADAS functions. It has been reported that some advanced driver-assist features are present in more than 90% of new vehicles.

Speed sensors are essential in conveyor systems, robotics, and machinery for monitoring and controlling processes in real-time. Industries are using speed sensors to monitor equipment performance and predict failures, minimizing downtime and maintenance costs. Moreover, speed sensors are widely used in devices such as gaming consoles, drones, and smartphones for motion tracking, navigation, and stabilization.

Key Speed Sensor Market Insights Summary:

Regional Highlights:

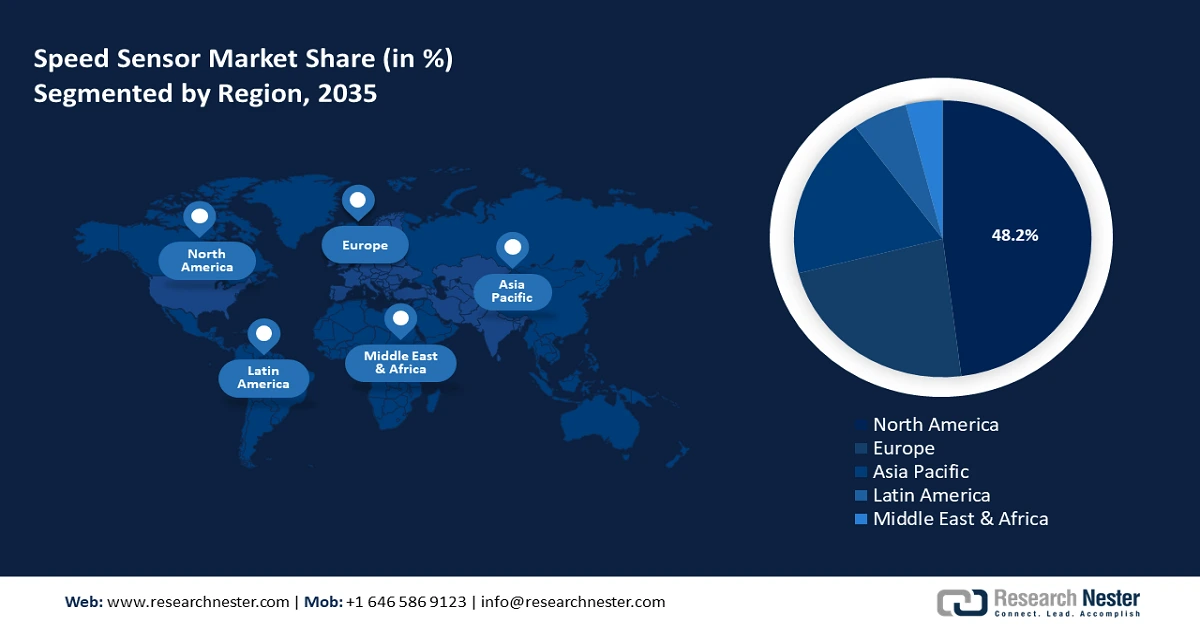

- North America dominates the Speed Sensor Market with a 48.2% share, fueled by advancements in automotive technologies and industrial automation, fostering strong growth through 2026–2035.

- Europe’s speed sensor market is poised for rapid growth through 2026–2035, driven by the EU's push for EV adoption and safety features.

Segment Insights:

- The Automotive segment of the Speed Sensor Market is projected to hold a 37.20% share by 2035, driven by advancements in vehicle technologies, safety regulations, and electric/autonomous vehicle adoption.

Key Growth Trends:

- Increasing demand for electronics in automotive

- Rapid development of renewable energy

Major Challenges:

- Lack of standardization

- Integration and calibration challenges

Key Players: Petasense, Allegro MicroSystems, Inc., Robert Bosch GmbH, NXP Semiconductors N.V., Infineon Technologies AG, Standard Motor Products, Inc., Sensoronix, Inc..

Global Speed Sensor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.94 billion

- 2026 Market Size: USD 10.33 billion

- Projected Market Size: USD 15.29 billion by 2035

- Growth Forecasts: 4.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (48.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Speed Sensor Market Growth Drivers and Challenges:

Growth Drivers

- Increasing demand for electronics in automotive: Modern vehicles are incorporating advanced electronic systems to enhance performance, safety, and efficiency. The automotive electronics market is expected to record significant growth during the forecast period. Modern cars are equipped with IoT-based systems and connected technologies for real-time monitoring and data analysis, relying on speed sensors to ensure accurate performance. Speed sensors enable data communication between vehicles and infrastructure for improved safety and traffic management in connected car ecosystems.

- Moreover, growing consumer preference for vehicles with enhanced safety features is driving automakers to integrate more electronic systems reliant on speed sensors. Technological advancements like microelectromechanical systems (MEMS) technology enable the production of compact and efficient speed sensors. Modern speed sensors are designed to meet the stringent demands of advanced automotive electronics, increasing their adoption.

- Rapid development of renewable energy: Speed sensors are critical components in optimizing the efficiency and reliability of renewable energy systems. They monitor the rotational speed of wind turbine blades to maximize power generation and ensure safe operation. They also play a key role in controlling pitch mechanisms and detecting imbalances that lead to system failure.

- The wind energy sector requires more sophisticated monitoring systems, including speed sensors. Several countries including China, the U.S., and Germany are heavily investing in wind energy projects, driving the demand for speed sensors. According to the International Energy Agency (IEA), energy investments in China have been incredibly robust, contributing significantly to the country’s overall GDP growth and making up one-third of global clean energy investments. China installed as many solar photovoltaic systems in 2023 as the world did in 2022, while its wind installations increased by 66% annually.

- Demand for high-performance sensors in harsh environments: Industries that operate in extreme conditions require sensors that are reliable, durable, and capable of performing accurately despite factors such as temperature extremes, vibrations, dust, moisture, and corrosive substances. Speed sensors are vital for monitoring rotating machinery such as pumps, compressors, and turbines in oil rigs and refineries. These sensors help ensure operational efficiency and prevent failures that lead to costly downtime or hazardous situations.

- Mining operations involve heavy machinery such as excavators, crushers, and conveyors, which operate in harsh conditions like extreme temperatures, dust, and vibrations. Speed sensors are crucial in monitoring equipment health, preventing failures, and ensuring efficient operation. Thus, the rising mining industry is responsible for an increasing demand for rugged and high-performance sensors.

Challenges

- Lack of standardization: The absence of universally accepted standards for speed sensors can create compatibility issues between sensors and control systems, especially in industrial and automotive applications. Manufacturers often need to develop application-specific solutions, which increases complexity and costs. A lack of standardization slows adoption and integration in diverse industries.

- Integration and calibration challenges: Integrating speed sensors into complex systems, such as modern ADAS or industrial machinery, requires precise calibration and technical expertise. Improper integration can lead to system inefficiencies, increased downtime, and higher maintenance costs. These challenges deter end users from adopting speed sensors, especially in smaller operations with limited technical support.

Speed Sensor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.4% |

|

Base Year Market Size (2025) |

USD 9.94 billion |

|

Forecast Year Market Size (2035) |

USD 15.29 billion |

|

Regional Scope |

|

Speed Sensor Market Segmentation:

Application (Automotive, Industrial, Aerospace & Defense, Consumer Electronics)

In speed sensor market, automotive segment is projected to account for revenue share of more than 37.2% by the end of 2035. The growth can be attributed to the advancements in vehicle technologies, the adoption of safety regulations, and the rise of electric and autonomous vehicles. Speed sensors play a critical role in automotive systems by enabling precise measurement of wheel, engine, and vehicle speed, contributing to improved safety, efficiency, and performance. ADAS adoption is significantly boosting the demand for high-performance speed sensors. They provide real-time data for monitoring and controlling vehicle speed relative to road conditions and other vehicles. For instance, as of 2021, around 33% of new automobiles sold in the U.S., Europe, Japan, and China featured ADAS.

Autonomous vehicles depend on multiple sensors, including speed sensors, to process data for navigation, braking, and acceleration control. Integration with LiDAR, radar, and camera systems enhances vehicle autonomy. Moreover, electric vehicles require precise motor speed sensors for optimal energy management and performance. Sensors also aid in regenerative braking systems.

Technology (Magneto-Resistive, Hall Effect, and Variable Reluctance)

By technology, the magneto-resistive (MR) segment is poised to register a profitable revenue share in speed sensor market during the forecast period. The MR segment is driving growth in the speed sensor market due to its superior reliability, adaptability, and ability to meet the demands of modern applications. Its widespread adoption across the automotive, industrial, and aerospace sectors highlights its importance in enabling advanced safety systems, automation, and precision-driven operations.

MR sensors are compact and lightweight, enabling integration into modern devices and systems where space is a constraint. These sensors are also crucial for industrial automation systems to monitor and control motor speeds, conveyor belts, and robotic arms.

Our in-depth analysis of the speed sensor market includes the following segments

|

Technology |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Speed Sensor Market Regional Analysis:

North America Market Forecast

North America industry is estimated to hold largest revenue share of 48.2% by 2035. The speed sensor market growth is driven by advancements in automotive technologies, industrial automation, and the adoption of innovative sensing solutions across various sectors. The region’s robust automotive industry, increasing demand for electric vehicles, and focus on safety regulations contribute significantly to the speed sensor market’s expansion.

In the U.S. the automotive industry is a key consumer of speed sensors, used in ABS, and ADAS. Rising demand for EVs and autonomous vehicles further increases the need for advanced speed sensors. According to IEA, in the U.S., new electric car registrations totaled 1.4 million in 2023, up by more than 40% from 2022. Additionally, organizations like the National Highway Traffic Safety Administration (NHTSA) mandate safety features such as ABS and ESC in all new vehicles, which require speed sensors. Compliance with these regulations ensures consistent demand for speed sensors in vehicle production and retrofitting.

In Canada, the manufacturing sector is increasingly adopting Industry 4.0 principles, including automation, robotics, and IoT. Speed sensors are used in automation systems, to monitor motor speeds, conveyor systems, and production line equipment. With Canada’s focus on reaching net-zero emissions by 2050, there is an expected increase in the adoption of EVs, driving the demand for high-performance sensors.

Europe Market Analysis

The speed sensor market of Europe is poised to register the fastest revenue growth by 2035. The region is a major hub for the EV sector, with countries like Germany, France, and the UK leading the transition. The European Union has set ambitious targets for EV adoption, which drives the demand for advanced speed sensors in motor control, wheel speed measurement, and braking systems.

Germany is home to some of the world’s leading automotive manufacturers, including Volkswagen, BMW, Mercedes-Benz, and Audi. These companies are increasingly incorporating advanced technologies into their vehicles, such as ADAS, ABS, and ESC, all of which rely on speed sensors. Moreover, the country adheres to stringent EU safety standards for automobiles, such as the Euro NCAP crash testing and safety systems. This regulatory framework drives the mandatory use of safety features that require speed sensors.

The UK government has committed to banning the sale of new petrol and diesel cars by 2030, which is expected to drive the growth of the EV sector and in turn, increase the demand for speed sensors in automotive applications. The UK’s electric vehicle sector is expected to grow significantly and reach USD 544.30 billion by 2035. Additionally, the UK government’s emphasis on sustainability and reducing carbon emissions by 2050 is contributing to the adoption of green technologies, which rely on speed sensors for efficient operations.

Key Speed Sensor Market Players:

- SICK AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Petasense

- Allegro MicroSystems, Inc.

- Robert Bosch GmbH

- NXP Semiconductors N.V.

- Infineon Technologies AG

- Standard Motor Products, Inc.

- Sensoronix, Inc.

- TE Connectivity, Inc.

- SPECTEC

- Sensor Solutions Corporation

- ABB

Key players are contributing to advancements in the automotive, industrial, and renewable energy sectors. These companies are leading innovation through technological developments, expanding product portfolios, and entering strategic partnerships to meet the growing demand for high-performance speed sensors across various applications.

Here are some key players in the speed sensor market:

Recent Developments

- In March 2023, SMP is expanding its ABS Speed Sensor product portfolio for both import and domestic automobiles. It is well understood that the quality and effectiveness of ABS sensors influence how long a car takes to stop, but as technology advances, ABS sensors are being pushed to do more. Many electronic safety systems, including electronic stability control, hill hold assist, and automated braking, rely on reliable, real-time data from these sensors.

- Report ID: 6735

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Speed Sensor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.