Specialty Pesticides Market Outlook:

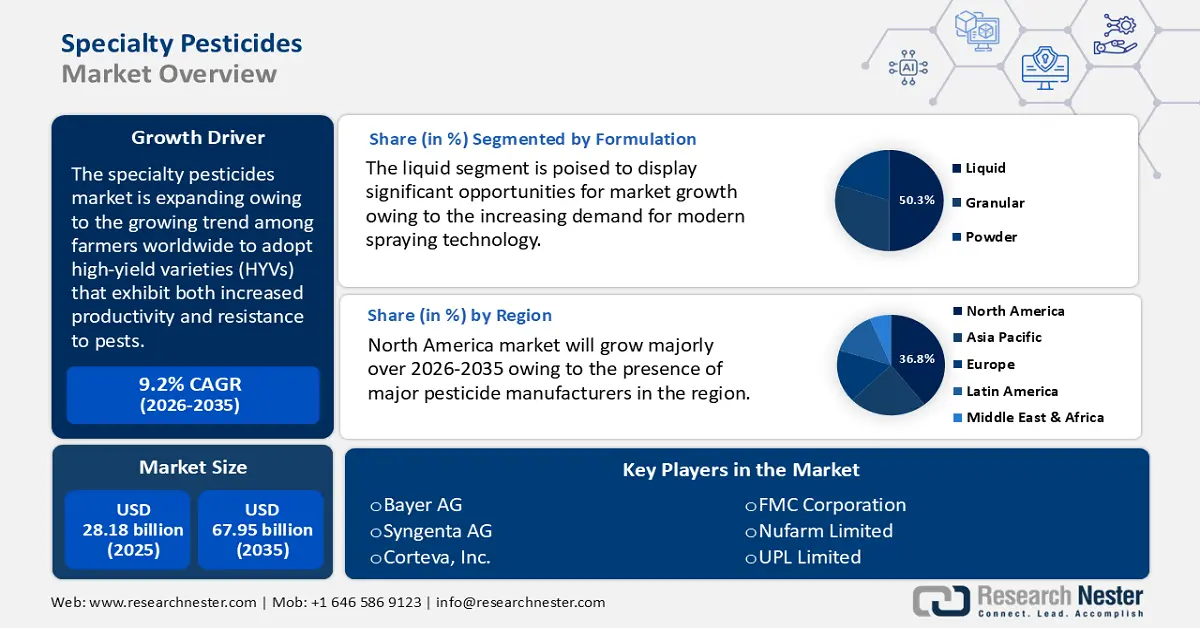

Specialty Pesticides Market size was over USD 28.18 billion in 2025 and is poised to exceed USD 67.95 billion by 2035, growing at over 9.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of specialty pesticides is estimated at USD 30.51 billion.

The global specialty pesticides market is anticipated to propel owing to rapid urbanization, which has led to the reduction of arable land available for agricultural purposes. The UN Trade and Development (UNCTAD) predicted that by 2022, the proportion of people living in cities will have grown to 56.9%. In general, it is more in industrialized nations (79.7% in 2022) compared to 52.3% in the underdeveloped world. In response to this challenge, farmers are under considerable pressure to enhance crop yields on land that has historically been used for agriculture.

Consequently, there is a growing trend among farmers worldwide to adopt high-yield varieties (HYVs) that exhibit both increased productivity and resistance to pests. The application of specialty pesticides, specifically formulated to protect certain crops, is crucial for augmenting agricultural output. High-yield cultivars are commonly utilized for various essential crops, including cereals and grains. However, these HYV crops are also susceptible to substantial infestations of numerous pests and diseases.

The recurrence of planting the same crop varieties further exacerbates their vulnerability to pest attacks. To mitigate these risks, farmers can employ specialty pesticides, such as biopesticides and other formulations containing bioactive compounds that target crop-specific pests. By integrating these strategies, farmers can maximize the yields of current agricultural lands.

Furthermore, the growing production and utilization of cereals are significantly driving the specialty pesticides market, as farmers seek advanced solutions to protect crops from pests, diseases, and weeds while maximizing yields. The Food and Agriculture Organization has revised its estimate for the world's cereal production in 2024 to approximately 2,841 million tons, reflecting a 0.6% decrease from the previous year. Additionally, global cereal consumption is projected to rise by 9.8 million tons to 2,869 million tons for 2024–2025, which is an increase of 0.9% compared to 2023–2024 levels.

The following table shows the production, utilization, and stock data for the global cereal industry:

Key Specialty Pesticides Market Insights Summary:

Regional Highlights:

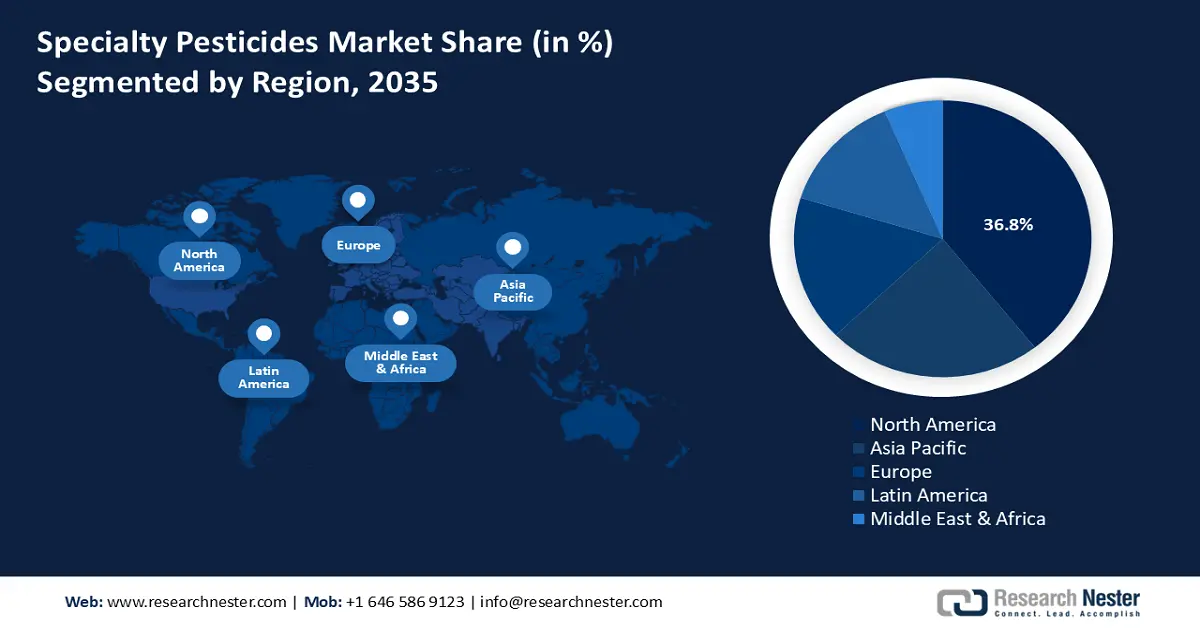

- By 2035, North America is expected to command around 36.8% share of the specialty pesticides market, enabled by strong agricultural infrastructure and timely regulatory approvals.

- Asia Pacific is projected to expand at a significant pace through 2035, fueled by rising agricultural output and the growing need for effective pest and disease management.

Segment Insights:

- By 2035, the liquid segment is anticipated to hold over 50.3% share in the specialty pesticides market, propelled by its ease of handling and precise application benefits.

- The herbicides segment is set to secure a notable share by 2035, supported by increasing demand for effective weed control in crop cultivation.

Key Growth Trends:

- Encouraging sustainable agricultural practices and responsible pest management

- Advancements in eco friendly pest control methods

Major Challenges:

- Stringent regulations

- High cost of Research & Development

Key Players: Bayer AG, Syngenta AG, Corteva, Inc., FMC Corporation, Nufarm Limited, UPL Limited, Lanxess AG, Hanfeng Evergreen Inc., American Vanguard Corporation, SABIC.

Global Specialty Pesticides Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 28.18 billion

- 2026 Market Size: USD 30.51 billion

- Projected Market Size: USD 67.95 billion by 2035

- Growth Forecasts: 9.2%

Key Regional Dynamics:

- Largest Region: North America (36.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, India, Germany, Japan

- Emerging Countries: Brazil, Indonesia, Vietnam, Mexico, Thailand

Last updated on : 3 December, 2025

Specialty Pesticides Market - Growth Drivers and Challenges

Growth Drivers

- Encouraging sustainable agricultural practices and responsible pest management: Concern over the detrimental impacts of excessive pesticide use on the environment and human health is developing globally. Broad-spectrum pesticides are sprayed continuously and erratically, resulting in several problems such as soil and water contamination and biodiversity loss. At a startling rate, many pests are becoming resistant to the active chemicals in conventional pesticides. Furthermore, more stringent laws governing the Maximum Residue Limits (MRLs) of pesticides in crops are being implemented in several nations.

The need for integrated pest management programs and environmentally friendly specialist pest management products is rising sharply as a result.

IPM uses mechanical, chemical, biological, and cultural treatments in the best possible combination to manage pests, with a focus on monitoring pest population levels. Because they target certain pests and are less destructive to the natural enemies of pests, specialty pesticides are essential to integrated pest management (IPM). IPM-practicing farmers are increasingly using biopesticides made from natural sources such as bacteria, plants, animals, and certain minerals. Likewise, more recent semi-chemicals that imitate natural insect pheromones are making it possible to capture pests efficiently. As part of IPM, farmers who are concerned about sustainability also favor lower-risk pesticides in the last stages of crop growth. All of these elements are contributing to the market expansion for specialized pesticides market. - Advancements in eco-friendly pest control methods: There is a significant opportunity in the worldwide specialty pesticides market due to the expanding development of biopesticides and eco-friendly substitutes. For instance, in November 2024, Provivi, a global leader in pheromone-based crop protection, and Godrej Agrovet Limited (GAVL), a leading Indian food and agribusiness conglomerate focused on R&D, announced a strategic partnership to deliver long-term pest control solutions tailored to India's critical rice and corn farmers.

Customers are choosing food items and crops produced without harmful chemical pesticide residues as a result of growing environmental consciousness. A workable approach is the creation of insecticides made from natural substances including bacteria, plants, animals, and specific minerals. The biopesticides often help promote organic farming and have few negative impacts on human health. To meet demand and take advantage of growth opportunities, numerous agrochemical behemoths and up-and-coming firms are making significant investments in the research and development of biopesticides. Businesses can also portray themselves as sustainability-driven and assuage concerns about strict laws due to the growing trend towards greener products. - Increasing global commerce of pesticides: As global agricultural practices evolve, farmers seek pesticides that are more effective against specific pests while minimizing environmental impact. The expansion of international trade has facilitated the availability of advanced formulations, including bio-based and precision-targeted pesticides, improving crop protection and yield. The Observatory of Economic Complexity reported that pesticides were the world's 99th most traded product in 2023, accounting for USD 43.7 billion in total. Pesticide exports fell 12.1% between 2022 and 2023, from USD 49.7 billion to USD 43.7 billion. Pesticides account for 0.19% of global trade.

|

Exporters |

Export Value of Pesticides (in USD billion) |

Importers |

Import Value of Pesticides (in USD billion) |

|

China |

9.47 |

Brazil |

4.94 |

|

U.S. |

5.04 |

France |

2.29 |

|

France |

3.99 |

Canada |

2.03 |

|

Germany |

3.97 |

U.S. |

1.84 |

|

India |

2.46 |

Germany |

1.7 |

Challenges

- Stringent regulations: To reduce the negative impacts of chemical pesticides on the environment and human health, regulatory bodies are enacting safety regulations and placing more limitations on their use. This is having a detrimental effect on demand and sales. Due to increased R&D and regulatory compliance expenses, several agrochemical businesses, including BASF SE, are having difficulty creating bioequivalent pesticide products promptly. Farmers now have fewer options for products due to the prohibition or restrictions on a few common pesticides. Manufacturers of pesticides must invest heavily and conduct extensive testing on their products to receive authorization under stringent guidelines.

- High cost of Research & Development: Developing innovative and targeted pesticide formulations requires extensive testing, advanced technologies, and compliance with safety standards, all of which demand significant investment. Smaller companies often struggle to compete with larger firms due to the financial burden associated with product innovation and market entry. Additionally, the long approval process of new specialty pesticides delays commercialization, reducing profitability. Therefore, the high cost of R&D is impeding the specialty pesticides market from growing.

Specialty Pesticides Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 28.18 billion |

|

Forecast Year Market Size (2035) |

USD 67.95 billion |

|

Regional Scope |

|

Specialty Pesticides Market Segmentation:

Formulation Segment Analysis

Liquid segment is anticipated to hold specialty pesticides market share of more than 50.3% by 2035. The segment is growing as a result of its advantages over other formulations in terms of easy handling and application. With foliar feeding, liquid insecticides effectively permeate plant surfaces and are easily diluted with water. They enable accurate application using techniques including soaking, misting, and spraying. Large farms also make considerable use of them owing to modern spraying technology. Since they cover plant surfaces uniformly and extensively, liquid pesticides are therefore very easy to employ and aid in crop treatment optimization.

Product Type Segment Analysis

The herbicides segment in specialty pesticides market is predicted to hold a notable share during the forecast period. The increasing demand for efficient weed control in agricultural fields is driving the segment's growth. Farmers can manage weeds that compete with agricultural plants for nutrients, water, and sunlight by using herbicides. Herbicide-resistant crop types have become widely used as weed infestation strain on agricultural lands throughout the world increases as a result of factors like shifting farming practices.

Increased product launches by major players are anticipated to propel the segment expansion since characteristics such as glyphosate resistance in maize and soybean crops have increased the adoption of non-selective herbicides that offer broad-spectrum weed control. For instance, in October 2024, FMC, a prominent worldwide agricultural sciences firm, announced the launch of Ambriva herbicide for wheat for the upcoming growing season at a customer event in Chandigarh, India. Ambriva herbicide contains Isoflex active, a group 13 herbicide that has a novel mode of action in cereal crops and gives Indian farmers a new tool for resistance management. These cutting-edge herbicides effectively suppress weeds, assisting farmers in increasing crop yields and preserving the condition of their fields.

Our in-depth analysis of the global specialty pesticides market includes the following segments:

|

Product Type |

|

|

Application |

|

|

Formulation |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Specialty Pesticides Market - Regional Analysis

North America Market Insights

North America specialty pesticides market is expected to account for revenue share of around 36.8% by 2035. The agricultural industries in the U.S. and Canada are highly established, and pesticides are widely used to safeguard crops. Several major pesticide producers, such as BASF SE, have headquarters in the region and invest extensively in R&D for novel products. North American farmers are open to innovative pest management techniques. This enables enterprises to easily pilot and deploy new formulas. The regulatory environment allows for timely approvals, supporting the introduction of new products consistently.

In the U.S., growing demand for high-value crops, stricter environmental regulations, and the rise of integrated pest management (IPM) practices. Farmers and businesses are adopting targeted pesticide solutions to enhance crop protection while minimizing environmental impact. Additionally, the expansion of commercial landscaping, golf courses, and turf management is driving demand for specialized pesticides and fungicides. The shift toward organic farming and sustainable agriculture has also boosted the use of biopesticides. Also, increased consumption of organic food is expanding the specialty pesticides market in the nation.

The USDA reported that since the beginning of the organic food industry's retail sales, the most popular category of organically cultivated food has been fresh fruits and vegetables. Over the previous 20 years, there has been a consistent increase trend in the retail sales of organic fresh fruits and vegetables, with an expected USD 19.2 billion in 2021 (NBJ, 2022). In 2021, 40 percent of U.S. organic food sales were in produce, followed by dairy and eggs (13 percent), beverages (12 percent), packaged/prepared foods (11 percent), bread/grains (9 percent), snack foods (6 percent), condiments (5 percent), and meat/fish/poultry (4 percent), according to the Nutrition Business Journal.

In Canada, climate change is contributing to the proliferation of pests, necessitating advanced and eco-friendly pesticide solutions. The most used herbicide in Canada is glyphosate, which is crucial for controlling weeds in both agricultural and non-agricultural areas. Glyphosate-containing products are used to eradicate poisonous plants including poison ivy and invasive weeds. Moreover, technological advancements, including bio-based and precision-targeted pesticides, are also fueling specialty pesticides market growth, as farmers and landscapers seek safer, more efficient alternatives that align with IPM practices.

APAC Market Insights

Asia Pacific specialty pesticides market is expected to grow at a significant rate during the projected period. In nations such as China and India, agricultural production has greatly grown as a result of rapid population expansion and rising wages. This has increased the requirement for efficient pest and disease management to lower crop losses before and after harvest.

Many Asian countries have tropical climates, which increases the vulnerability of crops to insect infestations. Through technical partnerships with global leaders, regional agrochemical producers are continuously expanding their product lines. Additionally, governments have offered financial aid for the purchase of imported agricultural inputs. Even smallholder farmers are using agrochemicals widely owing to the availability of inexpensive generic versions.

In India, with the rise in horticultural and cash crop cultivation, farmers are shifting towards advanced pesticides that offer higher efficiency with minimal environmental impact. The emergence of resistant pests as a result of excessive use of generic pesticides has led to greater reliance on specialty formulations. India's rapidly growing population is the primary driver of the sector. This is further supported by the growing income levels in both rural and urban areas, which have helped to raise the demand for agricultural products nationwide. Additionally, the expansion of contract farming, growing exports of agricultural produce, and government support for modern farming techniques further fuel demand. The India Brand Equity Foundation (IBEF) revealed that in 2024–25, India exported USD 4.34 billion worth of agricultural and processed food items (April–May).

|

Year |

Agricultural Export from India (in USD billion) |

|

2016 |

32.08 |

|

2017 |

33.87 |

|

2018 |

38.21 |

|

2019 |

38.54 |

|

2020 |

35.09 |

|

2021 |

41.25 |

|

2022 |

50.21 |

|

2023 |

53.21 |

|

2024 |

48.77 |

Source: Agricultural & Processed Food Products Export Development Authority (APEDA)

Furthermore, as China transitions towards modern farming practices, farmers are investing in advanced crop protection solutions to improve yields and quality. The expansion of horticulture, floriculture, and organic farming further drives the need for targeted pesticides. Additionally, stringent regulations on conventional agrochemicals and the emergence of bio-based alternatives are pushing the adoption of specialty chemicals. The Sino-German Agricultural Center highlighted that China's organic food and agriculture industry has overtaken major international manufacturers and marketplaces in recent decades. As of 2023, 2.9 million hectares of China's arable land were certified organic, compared to just 4,000 hectares in 2000. At present, China is the country with the fourth largest area of certified organic agricultural land or agricultural land under conversion behind Australia, India, and Argentina.

Specialty Pesticides Market Players:

- Bayer AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Syngenta AG

- Corteva, Inc.

- FMC Corporation

- Nufarm Limited

- UPL Limited

- Lanxess AG

- Hanfeng Evergreen Inc.

- American Vanguard Corporation

- SABIC

The specialty pesticides market is defined by the existence of well-established competitors who compete based on technological breakthroughs, product quality, and innovation. Key market players frequently use strategic moves such as mergers, acquisitions, and expansions to increase specialty pesticides market presence and effectively fulfill the growing demand.

Recent Developments

- In April 2024, Bayer signed an agreement with UK-based company AlphaBio Control to secure an exclusive license for a new biological insecticide. This new insecticide was discovered by AlphaBio, with whom Bayer distributes FLiPPER, an award-winning bioinsecticide-acaricide. The initial launch is scheduled for 2028, subject to further development and registration.

- In February 2024, Corteva continued to provide farmer-focused solutions with the launch of Enversa herbicide, which offers farmers a wide treatment window — pre-plant up to R2 for soybeans and replant up to first bloom for cotton — to assist them in negotiating adverse weather conditions.

- Report ID: 7231

- Published Date: Dec 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Specialty Pesticides Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.