Specialty Chemicals Market Outlook:

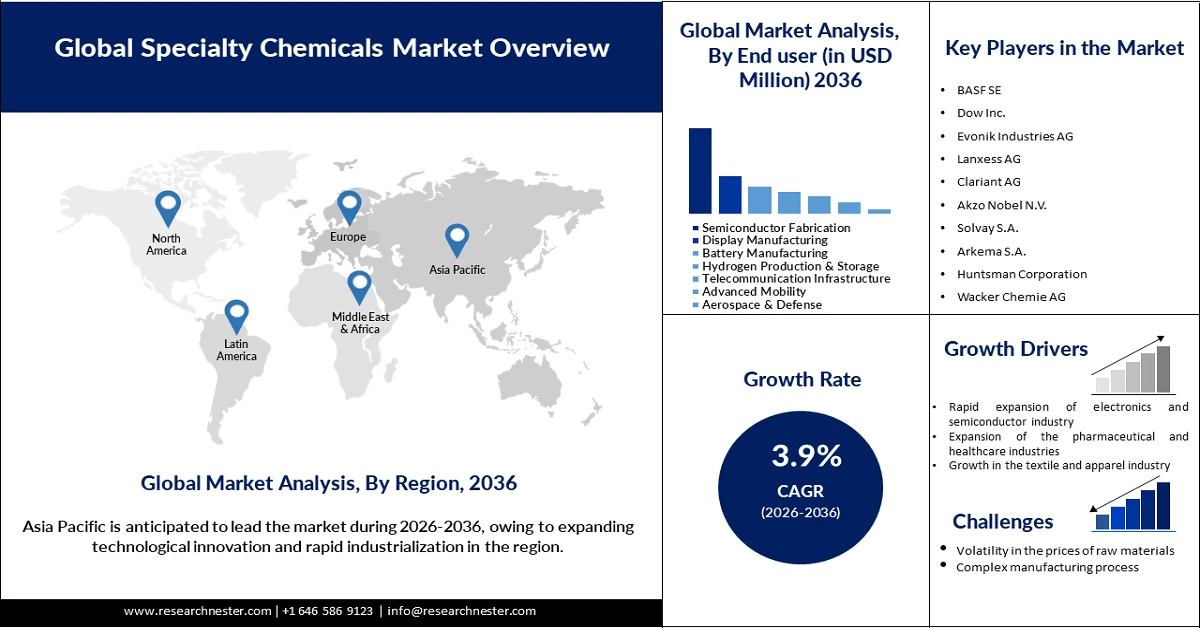

Specialty Chemicals Market size was valued at USD 940.72 billion in 2025 and is projected to reach USD 1.43 trillion by the end of 2036, rising at a CAGR of approximately 3.9% during the forecast period (2026–2036). In 2026, the industry size of the specialty chemicals is estimated at USD 978.79 billion.

The surge in the adoption of specialty chemicals in the construction sector is prominently fostering the market expansion by increasing the operational lifespan of buildings and structures. There has been increased investment in mass-scale infrastructure projects, amalgamated with the increased demand for energy-efficient and high-performance buildings. This has intensified the usage of repair chemicals and modern concrete admixtures during the operations. Furthermore, specialty chemicals are significantly strengthening weight-bearing capacity and resistance to corrosion, making them pivotal for modern infrastructure. According to the World Economic Forum, construction-related spending accounted for approximately 13% of global GDP in 2025, highlighting the sector’s pivotal role in sustaining long-term demand for specialty chemicals worldwide. Furthermore, the U.S. International Trade Commission stated that the chemical imports were USD 420 billion in 2023, representing 13.6% of the import share in the U.S. The high trade for chemicals represents lucrative earning opportunities for specialty chemical manufacturers. This highlights that strategic sourcing and pricing strategies aid in maintaining high profit margins. Overall, the positive foreign direct investments and public spending are estimated to propel the total trade of specialty chemicals during the foreseeable period.

Other than this, the surge in production of automotive products is propelling the growth of the specialty chemicals market. The industry is highly reliant on application-specific and high-performance chemical solutions. Modern vehicles need a myriad of specialty chemicals, such as lubricants, advanced polymers, adhesives, etc., to enhance the durability, aesthetics, and performance. With the rising demand for lightweight materials and high-strength composites, there has been an increased demand for specialty chemicals. Moreover, the transition towards electric vehicles is further increasing the demand for specialty chemicals in thermal fluid management. Subsequently, the expansion of automotive manufacturing volumes and the increasing complexity of vehicle design are fostering the robust growth in the specialty chemicals market.

Global All-Vehicle Sales by Region (Year-to-Date, Q1–Q3, in Units)

|

Units |

YTD 2019 (Q1–Q3) |

YTD 2021 (Q1–Q3) |

YTD 2022 (Q1–Q3) |

YTD 2023 (Q1–Q3) |

YTD 2024 (Q1–Q3) |

YTD 2025 (Q1–Q3) |

|

Developed Countries/Region |

33,012,224 |

25,291,787 |

26,376,009 |

30,112,073 |

28,874,456 |

28,549,120 |

|

Emerging Countries/Regions |

34,235,664 |

31,830,473 |

34,523,711 |

36,939,025 |

37,364,940 |

40,206,004 |

|

Total |

67,247,888 |

57,122,260 |

60,899,720 |

67,051,098 |

66,239,396 |

68,755,124 |

Source: OICA

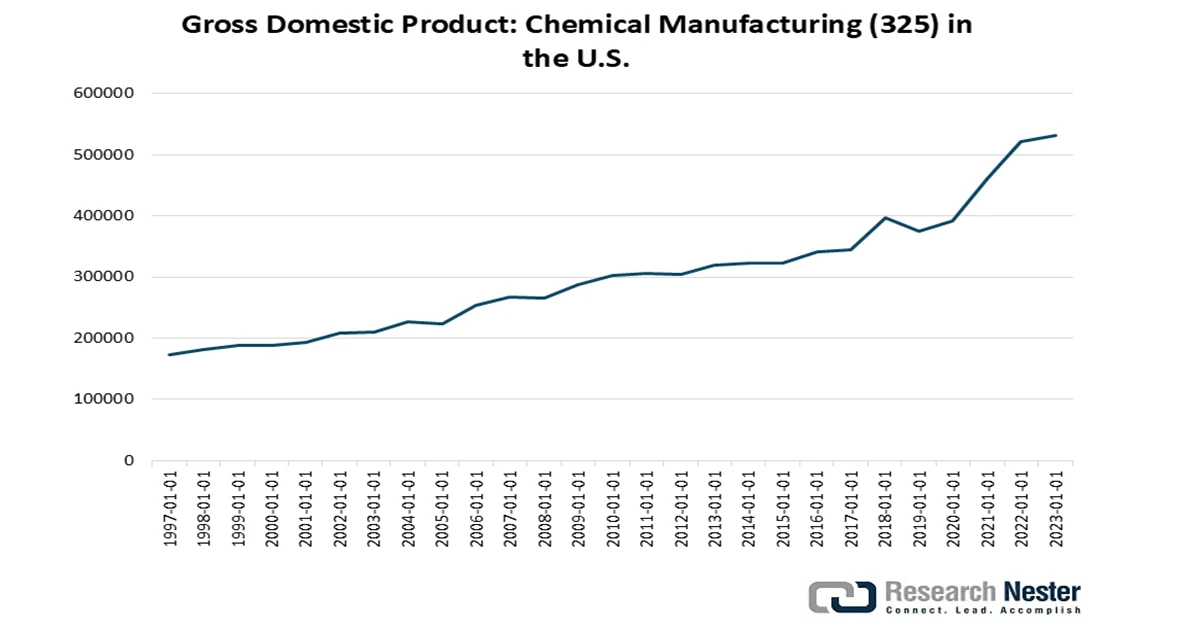

Further, in 2020, the average U.S. consumer’s expenditure on soaps and detergents was USD 75.53, and the overall shipments distributed were worth USD 90.9 billion, whereas the segment’s value stood at USD 635 billion. U.S. specialty chemicals were estimated at USD 77.2 billion in shipment value by CISA. The coatings, paints, and adhesive specialty chemical production employed 64,423 individuals in the U.S. Moreover, flavors and fragrances held USD 40 billion in yearly sales, whereas 4.5 billion tons of explosives were used in the U.S. Moreover, the government is keen on strengthening the overall supply chain of critical chemicals and initiated two tabletop exercises in 2025. The government’s efforts to build a robust domestic manufacturing scenario have impacted the producer pricing and GDP contribution of chemicals.

Source: FRED

China is the largest market in terms of chemical sales and accounts for a significant share globally. The U.S. is still strong with companies such as DuPont and Dow Chemical. However, China-based companies are striving to invest heavily in R&D and gain a competitive edge in the fine chemicals segment. The worldwide chemicals sales were USD 4.7 trillion in 2022, says the Information Technology & Innovation Foundation (ITIF). Despite an array of products, the chemicals industry can be categorized into specialty chemicals, basic chemicals, and consumer products.

Global value-added chemical output by the top 10 producers and the rest of world in 2020

|

Producer |

Value-added Chemical Output |

|

China |

USD 334 billion |

|

The U.S. |

USD 210 billion |

|

Japan |

USD 64 billion |

|

Germany |

USD 57 billion |

|

India |

USD 38 billion |

|

France |

USD 26 billion |

|

Saudi Arabia |

USD 24 billion |

|

South Korea |

USD 36 billion |

|

Brazil |

USD 20 billion |

|

Italy |

USD 17 billion |

|

Rest of the World |

USD 320 billion |

Source: ITIF

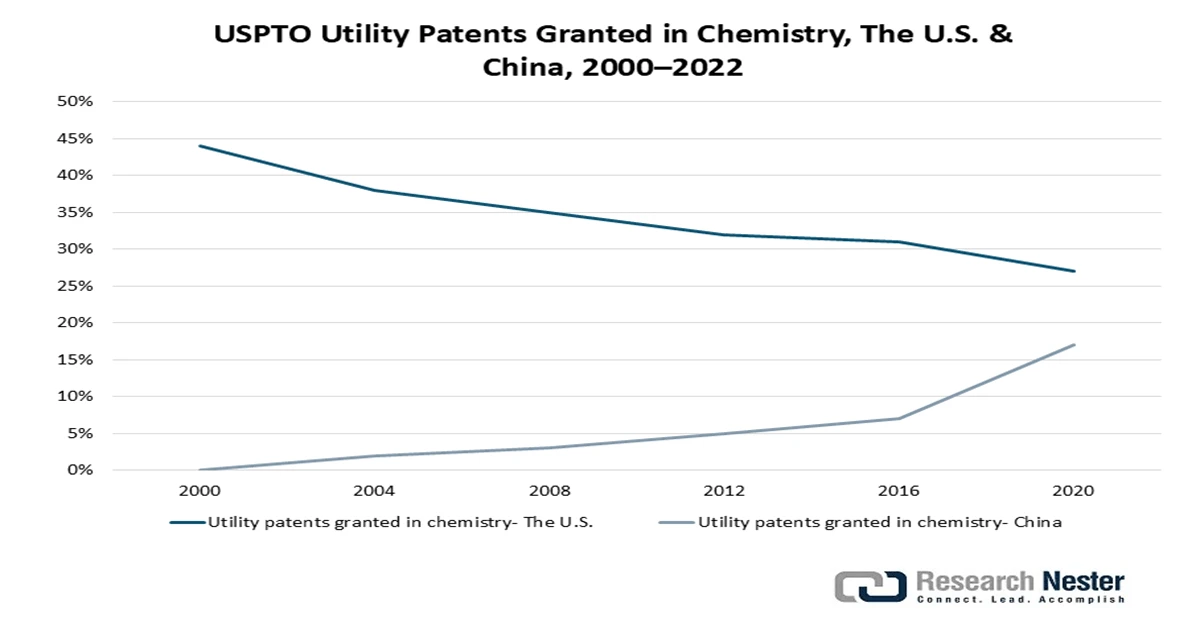

China witnessed the highest growth between 1995 and 2020 (up by 25.3%) and accounts for roughly 55% of the total acetic acid capacity, carbon black about 50% capacity, and 45% of titanium dioxide. For many commodity chemicals, China began as a net importer, then transitioned to a leading exporter by building up its in-house capacity. The country’s R&D (by both (by domestic and foreign players) grew from 22% to 34% between 2012 and 2022. During the same period, a comparative analysis by ITIF shows that China’s R&D rose from 8% higher than the U.S. to 72%. Additionally, U.S. firm patents share granted in chemistry under the U.S. Patent Office (USPTO) declined to 45% in 2022 from 54% in 2000, whereas China’s patents rate surged by 7% over this timeline.

Source: ITIF

Disinfectant and sanitizer product segment is set to garner a prominent share in the market during the forthcoming years. The global disinfectant trade stood at USD 3.4 billion in 2023 and grew at an annual rate of 7.2%. In 2023, China (USD 275 million), Belgium (USD 219 million), and the United Kingdom (USD 171 million) are Japan (-USD 78.5 million), Australia (-USD 70.6 million), and France (-USD 66.6 million) the countries with the largest trade surpluses.

World Disinfectant Trade, Packaged for Retail Sales (2023)

|

Country |

Exporters |

Country |

Imports |

|

Germany |

USD 397 million |

Germany |

USD 281 million |

|

China |

USD 389 million |

The U.S. |

USD 248 million |

|

The U.S. |

USD 382 million |

France |

USD 226 million |

Source: OEC