Specialty Amines Market Outlook:

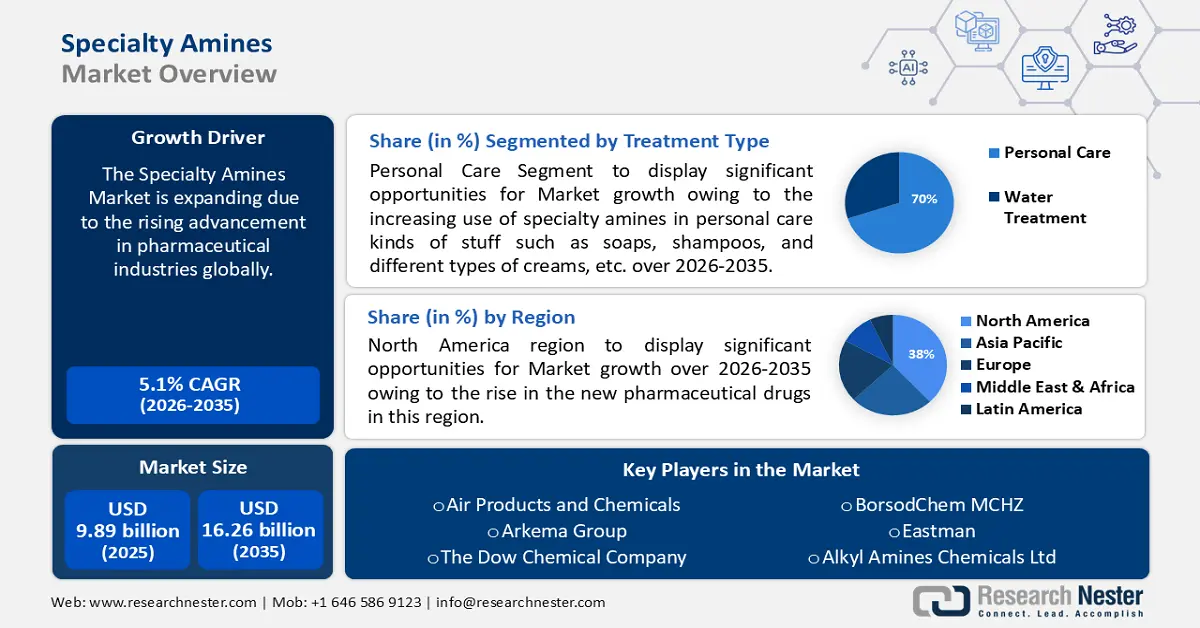

Specialty Amines Market size was over USD 9.89 billion in 2025 and is projected to reach USD 16.26 billion by 2035, growing at around 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of specialty amines is evaluated at USD 10.34 billion.

The rising advancement in pharmaceutical industries globally will exponentially help the specialty amines market to grow in the upcoming years. According to the data provided by the Congressional Budget Office of the U.S., compared to the preceding eleven years, the number of new pharmaceuticals licensed for sale climbed by 60% between 2010 and 2021, reaching a peak of 59 new drugs approved in 2018.

Key Specialty Amines Market Insights Summary:

Regional Highlights:

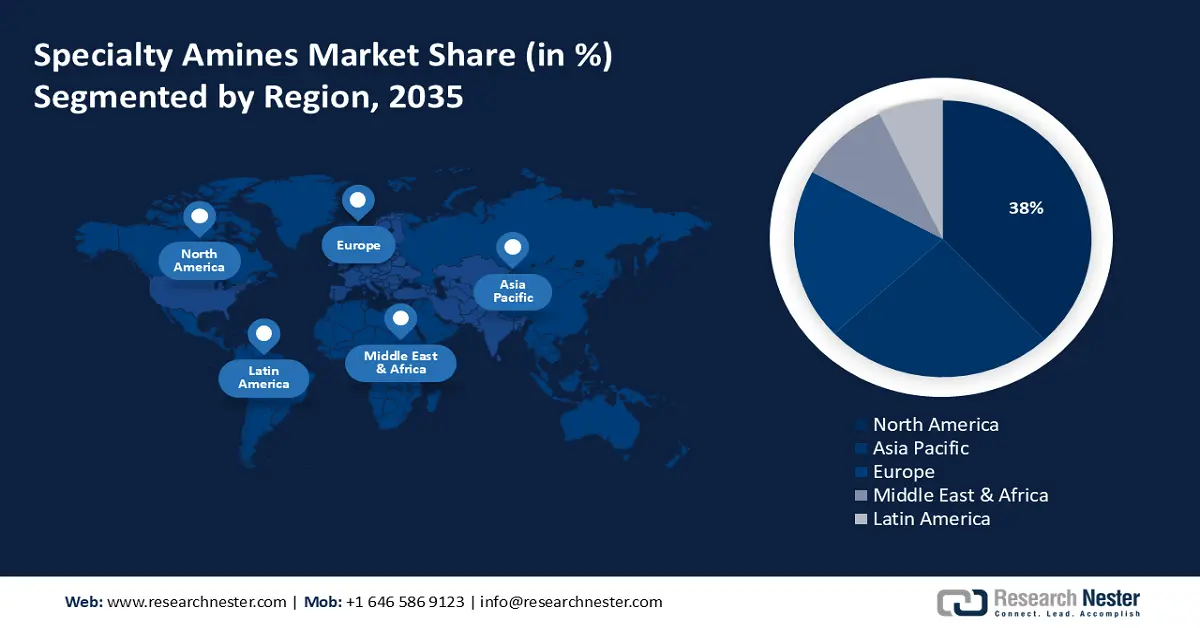

- North America specialty amines market will hold more than 38% share by 2035, driven by increasing use of raw materials in pharmaceutical industries.

- Asia Pacific market will register significant CAGR during 2026-2035, driven by modernization of agricultural sectors and rising demand for food production.

Segment Insights:

- The personal care segment in the specialty amines market is anticipated to hold a 70% share by 2035, fueled by increasing use of specialty amines in personal care products like soaps and shampoos.

- The ethanolamines (type) segment in the specialty amines market is projected to hold a 48% share by 2035, attributed to rising demand in emerging Asian markets, especially China.

Key Growth Trends:

- The increasing expansion of fertilizers and pesticides industries

- The rising demand for specialty chemicals in different types of industries

Major Challenges:

- The excessive cost accompanying specialty amines

- Rising adoption of a healthy lifestyle

Key Players: BASF SE, Air Products and Chemicals Inc., Arkema Group, The Dow Chemical Company, BorsodChem MCHZ, Eastman Chemical Company, Alkyl Amines Chemicals Ltd., Huntsman Corporation, Ascend Performance Materials LLC, SABIC, Solvay, Koei Chemical Co., Ltd., Chugai Pharmaceutical Co., Ltd., Akzo Nobel N.V., INEOS Group Limited.

Global Specialty Amines Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.89 billion

- 2026 Market Size: USD 10.34 billion

- Projected Market Size: USD 16.26 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Thailand, Brazil, Mexico

Last updated on : 17 September, 2025

Specialty Amines Market Growth Drivers and Challenges:

Growth Drivers

- The increasing expansion of fertilizers and pesticides industries - Pesticides are widely employed in contemporary agriculture because they are a cost-efficient and productive technique to improve production quality and volume, keeping food security for the growing global population.

Pesticides are extensively used in the crops and fiber production of the world is also growing. To illustrate, as described in the Global Environment Document Repository, global natural fiber output was projected to reach 32 million tons in 2018. The size of the global fiber industry is anticipated to expand rapidly until at least 2025. - The rising demand for specialty chemicals in different types of industries - The five biggest sectors of the specialty amines market worldwide in 2022 were water-soluble polymers, building chemicals, electronic chemicals, industrial & institutional cleaners, and specialty polymers, with a combined market share of around 40% as found in our in-depth research. There are multiple subsegments inside each specialty chemicals industry segment, each with its own unique product, market, and competitor profiles.

- Increasing adoption of chemical products across the world - Generally speaking, the manipulation and particularly the transformation of matter, usually at the molecular level, characterizes the activities of the chemical industry. All socioeconomic systems, including those in the agricultural, transportation, global health, and information economies, are still centered around these activities.

Challenges

- The excessive cost accompanying specialty amines - As per the American Chemistry Council, in 2020 the industry brought in over USD 553 billion and had over 870,000 employees, earning an average income of more than USD 87,000. However, to stay competitive, chemical firms must streamline their manufacturing processes in addition to dealing with escalating prices.

Costs vary from step to step, and inefficiencies at any one of these phases might result in increased expenses and decreased earnings. - Rising adoption of a healthy lifestyle - The adoption of a healthy lifestyle by end consumers and their increased awareness of the harmful effects of agrochemicals have emerged as key obstacles to the expansion of the amine industry. Because organic and biobased goods are safe for human consumption, more people are choosing them. Its overall expansion may be hampered by the constant fluctuations in raw material prices and availability.

Specialty Amines Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 9.89 billion |

|

Forecast Year Market Size (2035) |

USD 16.26 billion |

|

Regional Scope |

|

Specialty Amines Market Segmentation:

Type Segment Analysis

Ethanolamines segment is poised to account for around 48% specialty amines market share by 2035 because of the intensive use of ethanolamines as feedstock in the generation of detergents, pharmaceuticals, emulsifiers, etc. globally.

Between 2026 and 2035, the world's consumption of ethanolamines is expected to increase at an average annual rate, mostly due to the growth of growing Asian markets, especially those in mainland China. The current global population growth and climate change make it imperative that innovative, practical, and affordable natural products be developed for the good of humanity.

Treatment Type Segment Analysis

By 2035, personal care segment is estimated to dominate over 70% specialty amines market share owing to the increasing use of specialty amines in personal care kinds of stuff such as soaps, shampoos, and different types of creams, etc.

Eastman's functional amines division produces basic alkyl amines and solvents, which serve as the foundation for many of its downstream derivative products. The specialized amines division of Eastman comprises formic acid solutions, performance products, and specialty intermediates. These offerings offer amine-derived building blocks that are commonly utilized in personal care end-use applications.

Function Segment Analysis

In specialty amines market, surfactants segment is predicted to account for around 37% revenue share by 2035 due to the increasing awareness associated with personal care in people globally.

According to the Personal Care Association Europe, the 500 million customers in Europe who use cosmetics and personal care products daily do so to safeguard their health, improve their well-being, and increase their self-esteem. Cosmetics, which include everything from antiperspirants to perfumes, shampoos, make-up, and sunscreen to soaps, tubes of toothpaste, and sunscreens, are vital at every stage of life and offer significant emotional and practical advantages.

Our in-depth analysis of the global specialty amines market includes the following segments:

|

Type |

|

|

Treatment Type |

|

|

Grade |

|

|

Function |

|

|

Application |

|

|

End-Users Industries |

|

|

Implementation Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Specialty Amines Market Regional Analysis:

North American Market Insights

North America industry is estimated to dominate majority revenue share of 38% by 2035. This growth will be noticed owing to the increasing use of raw materials in pharmaceutical industries for specialty amines in this region. The United States chemical industry stated that they transform raw materials into over 70,000 different products that are necessary for contemporary living and then supply those goods to over 750,000 final consumers across the country.

The rising chemical industry and the expanding export of chemicals will help the U.S. to have a huge expansion in the specialty amines industry. At almost 9 percent of all U.S. exports, the chemical industry is the country's largest exporter.

Canada will also encounter a huge expansion due to the rising pesticide industry in this country and specialty amines used to make pesticides like herbicides and fungicides. According to Innovation, Science, and Development Canada, in 2023 there was almost USD 124 million export has been made on pesticides in Canada.

APAC Market Insights

APAC region specialty amines market revenue is expected to witness significant growth till 2035 owing to the increasing modernization of agricultural sectors in this region. Firstly, modern agriculture is needed to meet the vast demands of a large population. With 76% of Asia’s poor living in rural regions, improving agricultural output and income is vital to eliminating poverty, according to the theme chapter of Asian Development Outlook 2021 Update issued in September 2021.

The rising need for food production with the rising population in China will expand the specialty amines industry growth. It is critical to match agriculture with the requirements of China's population of over 1.4 billion as it seeks modernization for its benefit.

The rising beauty care and cosmetics industry in Korea will help the specialty amines industry to grow at a rapid pace in this country. According to the International Trade Association (ITA), the Korean government revealed intentions in March 2023 to create big data and IoT-based individualized skin diagnostic programs and customized cosmetics to support the country's bio-health sector.

Recent developments in AI and digitalization in Japan will help this country expand specialty amines market demand in this region. NEC, a Tokyo-based company that has been actively involved in AI research, is a pioneer in the integration of network and IT technologies.

Specialty Amines Market Players:

- BASF SE

- Company Overview

- Business Planning

- Main Product Offerings

- Financial Execution

- Main Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Air Products and Chemicals Inc.

- Arkema Group

- The Dow Chemical Company

- BorsodChem MCHZ

- Eastman Chemical Company

- Alkyl Amines Chemicals Ltd

- Huntsman Corporation

- Ascend Performance Materials LLC

- SABIC

- Solvay

Recent Developments

- BASF SE and Shandong Wiskind Architectural Steel Co., Ltd. (Wiskind) have grown their strategic cooperation with renewable polyurethanes (PU) sandwich panels for cold chain utilizations.

- BASF SE uncovered a total solution photovoltaic (PV) frame, co-developed with Jiangsu Worldlight New Material Co., Ltd (Worldlight), an international producer of PV composite frames. The PV frame, created with an industry-leading total solution that blends polyurethanes (PU) with a water-borne coating solution, outcomes in an 85% limitation in product carbon footprint (PCF) vs aluminum frames.

- Report ID: 5999

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Specialty Amines Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.