Specialty Alumina Market Outlook:

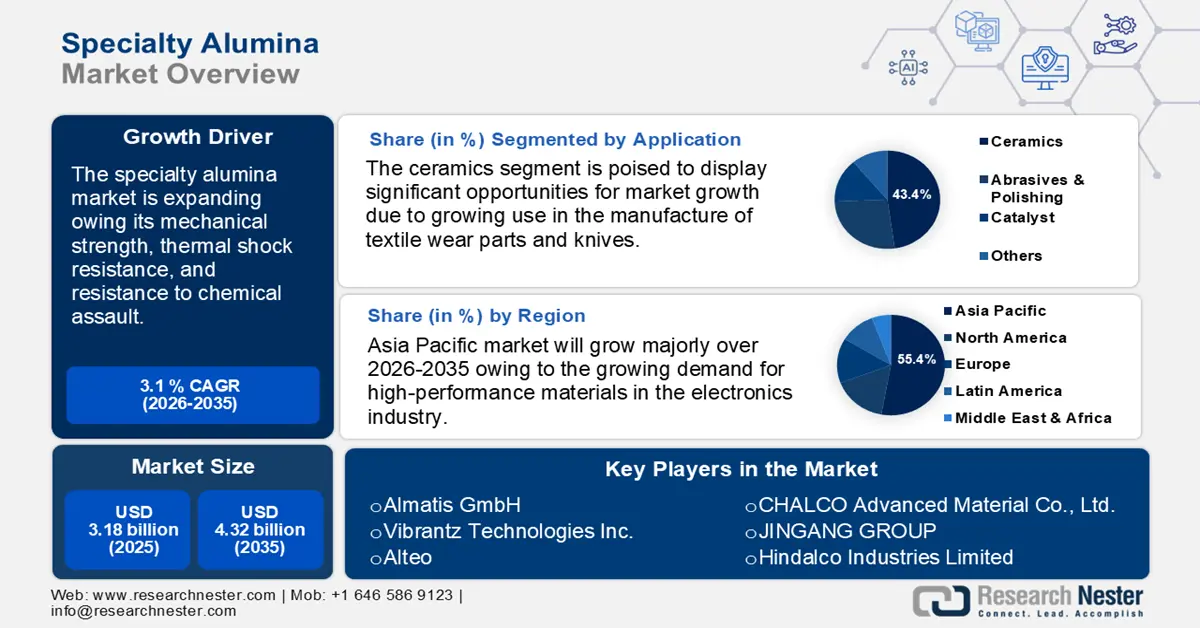

Specialty Alumina Market size was over USD 3.18 billion in 2025 and is anticipated to cross USD 4.32 billion by 2035, growing at more than 3.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of specialty alumina is assessed at USD 3.27 billion.

The global specialty alumina market is anticipated to grow owing to its mechanical strength, thermal shock resistance, and resistance to chemical assault. Specialty aluminas produced by the Bayer process have several advantages over natural minerals, such as consistent and uniform particle size and structure, supply stability, low to very low levels of impurities (Fe2O3, Na2O, sulfur, and Chlorine), and chemical consistency, especially at the levels of Na2O and Fe2O3. These characteristics are extremely important when seeking high-quality glasses and when good natural raw materials are either expensive, difficult to find, or inappropriate for novel glass compositions.

Furthermore, the global production of alumina is significantly driving the specialty alumina market by affecting both supply dynamics and pricing structures. Also, new alumina refineries in Indonesia and China are expected to increase global supply, potentially easing current tightness and stabilizing prices. In September 2024, the President of Indonesia, Joko Widodo, inaugurated a multimillion-dollar smelter-grade alumina refinery in the West Kalimantan region. This facility is operated by the state-owned aluminum manufacturer Inalum in collaboration with the state mining company Aneka Tambang (Antam). The refinery can produce one million metric tons of alumina annually, necessitating an input of 3.3 million tons of bauxite.

Therefore, the growing global production of alumina is escalating the specialty alumina market. The International Aluminum Institute (IAI) reported that in February 2025, the global alumina production reached 11,540 thousand metric tons. The following table shows the global production of alumina in February 2025:

|

Country |

Alumina Production (in thousand metric tons) |

|

China |

6855 |

|

Oceania |

1348 |

|

Africa & Asia (excluding China) |

1056 |

|

South America |

941 |

|

Europe |

615 |

|

North America |

571 |

|

Unreported to IAI |

154 |

Source: IAI

Key Specialty Alumina Market Insights Summary:

Regional Highlights:

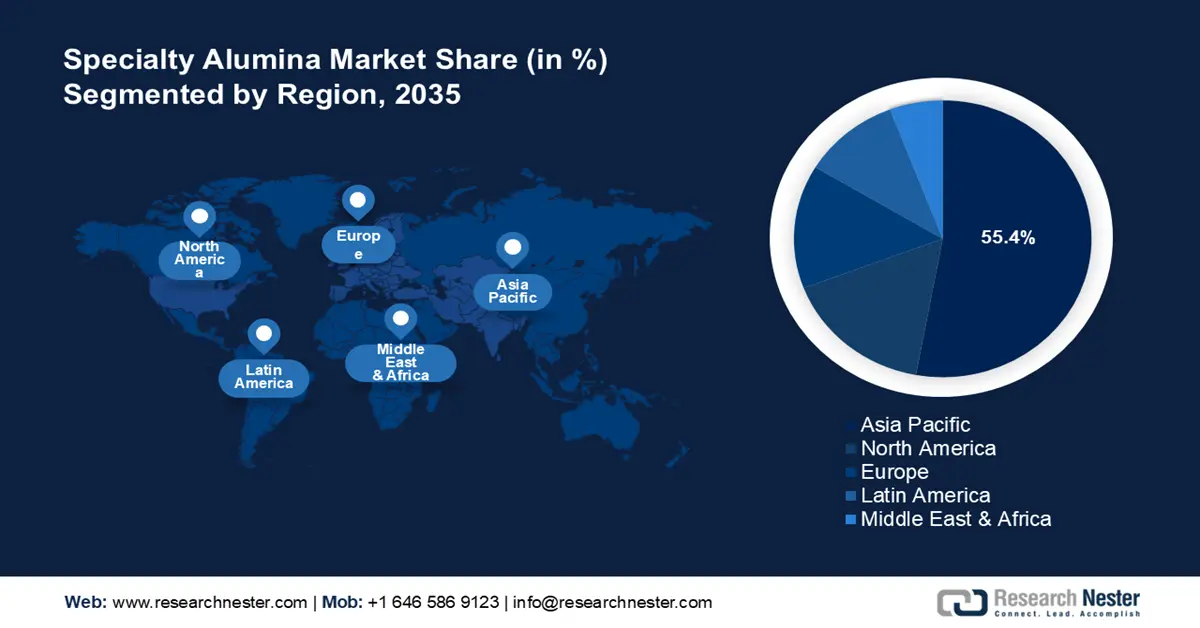

- Asia Pacific dominates the specialty alumina market with a 55.4% share, driven by growing demand from aluminum smelters and rapid industrialization in China, ensuring robust growth through 2035.

- North America's Specialty Alumina Market is set for significant growth through 2026–2035, driven by increasing demand in electronics, cosmetics, and semiconductor sectors.

Segment Insights:

- The Ceramics segment is expected to achieve a 43.4% share by 2035, fueled by the strong properties of calcined alumina in ceramic applications.

Key Growth Trends:

- Expanding aerospace & defense sectors

- Growing demand for aluminum extrusions

Major Challenges:

- Increasing environmental concerns

- Limited awareness regarding uses

- Key Players: Almatis GmbH, Vibrantz Technologies Inc., Alteo, CHALCO Advanced Material Co., Ltd., JINGANG GROUP, Hindalco Industries Limited, National Aluminum Company Limited, Nabaltec AG, Shandong Aofeng Metal Material Co., Ltd., J.M. Huber Corporation.

Global Specialty Alumina Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.18 billion

- 2026 Market Size: USD 3.27 billion

- Projected Market Size: USD 4.32 billion by 2035

- Growth Forecasts: 3.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (55.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, Australia

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

Specialty Alumina Market Growth Drivers and Challenges:

Growth Drivers

- Expanding aerospace & defense sectors: These days, aluminum is used extensively in airplane construction. The advantages of aluminum have remained constant despite changes in the composition of aluminum alloys. Engineers can design airplanes that are as light as possible, able to carry heavy loads, use the least amount of fuel, and don't rust, due to aluminum. The fuselage, wing panels, rudder, flooring and doors, exhaust pipes, seats, engine turbines, and cockpit instrumentation of contemporary aircraft are all made of aluminum. Between 50 and 90 percent of all modern spacecraft are composed of aluminum alloy. Aluminum alloys were used extensively in the Apollo spacecraft, the Space Shuttles, the International Space Station, and the Skylab space station.

- Other benefits of aluminum for aircraft applications include resistance to extremes in temperature and pressure, as well as durability in high-stress environments. Formability makes it simple to build smaller airplane parts. Aluminum alloys have excellent electrical conductivity. Because aluminum is lightweight, it offers a more cost-effective alternative to other materials. The benefits of lighter aircraft include reduced fuel consumption and total cost savings.

- Growing demand for aluminum extrusions: Steel and aluminum are two of the most commonly used metals in the manufacturing industry. Aluminum weighs almost one-third less than steel or copper, making it a lightweight metal. However, aluminum extrusions are a fantastic option for the construction industry due to their exceptional strength-to-weight ratio. Aluminum can be up to 43 times stronger than steel, and some steel grades when alloyed or handled properly.

- The maximum tensile strength of aluminum is 90,000 psi (pounds per square inch) or higher. Consequently, the manufacturing industry is working to switch from steel to aluminum. The worldwide manufacturing sector is gradually transitioning to a non-plastic world as a result of the detrimental effects that oil-based plastics have on the environment. Aluminum is one of the most well-known sustainable resources and the most common metal in the earth's crust.

Challenges

- Increasing environmental concerns: Given that the sector is a significant source of airborne pollutants, emission removal solutions need to be addressed. Because aluminum production generates dangerous pollutants such as particulate matter, NOx, SO2, dioxins, mercury chloride, furans, and fluorine compounds, it is a burgeoning industry that requires planning and care. In the best-case scenario, the aluminum electrolysis and alumina-producing facilities produce 1.07, 4.73, and 1.32 kg of sulfur dioxide, nitrogen dioxide, and particle pollutants for each ton of final aluminum produced, resulting in significant pollution.

- Limited awareness regarding uses: Many prospective customers in industries such as electronics, renewable energy, automotive, and construction may still be ignorant of how specialized alumina might improve the functionality and longevity of their goods. As a result of this ignorance, specialty alumina may be underutilized in important applications, depriving manufacturers of chances to highlight its advantages. Additionally, a lack of understanding may prevent specialty alumina from being used in new and developing technologies where its qualities could be very beneficial. Manufacturers may thus find it difficult to meet anticipated sales and market share, which can cause investment and development in the specialty alumina market to stall.

Specialty Alumina Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.1% |

|

Base Year Market Size (2025) |

USD 3.18 billion |

|

Forecast Year Market Size (2035) |

USD 4.32 billion |

|

Regional Scope |

|

Specialty Alumina Market Segmentation:

Application (Ceramics, Abrasives & Polishing, Catalyst, Others)

In specialty alumina market, ceramics segment is poised to account for revenue share of around 43.4% by 2035. Among the many types of ceramics used in industry are advanced ceramics, technical ceramics, honeycomb ceramics, worn components, high voltage insulators, and spark plugs. Calcined alumina is a raw material commonly used in almost every ceramic application because of its strong mechanical, electrical, thermal, and chemical properties, such as hardness, dielectric qualities, and a high melting point.

Type (Standard Calcined Alumina, Tubular Alumina, White Fused Alumina, Medium Soda Calcined Alumina, Low Soda Alumina, Others)

The standard calcined alumina segment in specialty alumina market is anticipated to garner a significant share during the assessed period. The increasing prevalence of electronic devices, including computers, televisions, and mobile phones, is projected to drive the expansion of the electronics sector. These devices rely on electronic ceramics, which are essential in the production of various electronic components such as semiconductors and capacitors. Furthermore, the demand for high-quality polishing materials is anticipated to grow across multiple industries, including the aerospace, automotive, and medical sectors, due to their superior polishing capabilities. Additionally, standard calcined alumina is extensively utilized as a catalyst support material within the chemical industry.

Our in-depth analysis of the global specialty alumina market includes the following segments:

|

Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Specialty Alumina Market Regional Analysis:

Asia Pacific Market Statistics

In specialty alumina market, Asia Pacific region is expected to capture around 55.4% revenue share by the end of 2035. Due to the growing demand for this product from large aluminum smelters, the market is expanding tremendously. In November 2020, Aluminum Corporation of China Ltd. (Chalaco) started building the second production line for the alumina refinery located in Huasheng, China. Because of the new production line, the company will be able to produce more alumina, which will increase their market share.

Furthermore, China’s rapid industrialization across various sectors has increased the demand for high-performance materials such as specialty alumina, known for its thermal stability, strength, and corrosion resistance. This trend is particularly evident in the electronics industry, where the nation’s robust semiconductor manufacturing base and expanding LED lighting sector heavily rely on high-purity alumina for producing substrates and components. Additionally, the automotive industry’s shift toward electric vehicles has spurred demand for specialty alumina in battery applications. The International Energy Agency reported that in 2023, there were 8.1 million new electric car registrations in China, a 35% increase over 2022. The overall car market expanded by 5% overall but shrank by 8% for conventional (internal combustion engine) cars, which was mostly driven by rising sales of electric vehicles. This suggests that sales of electric vehicles are still doing well as the market develops.

Similarly, India’s industrial production capacity is tremendously increasing, which is driving the specialty alumina market growth. The Press Information Bureau reported that for November 2024, the three industries—mining, manufacturing, and electricity—are expected to increase at respective rates of 1.9%, 5.8%, and 4.4%. In November 2023, the IIP Quick Estimates were 141.1, and now they are 148.4. For November 2024, the mining, manufacturing, and electricity sectors' respective Indices of Industrial Production are 133.8, 147.4, and 184.1.

North American Market Analysis

North America specialty alumina market is expected to grow at a significant rate during the projected period. Over the course of the forecast period, the cosmetics & personal care sectors are anticipated to increase their need for alumina, which is good news for the North American specialty alumina market. High-quality aluminum products from North America are in constant demand due to the growing applications in end-use industries.

Furthermore, in the U.S., its world-class electronics industry and substantial semiconductor manufacturing capabilities are driving the specialty alumina market's expansion. Additionally, growing consumer demand fuels market expansion, especially in the semiconductor sector. Additionally, significant expenditures on new production facilities and research capacities demonstrate the nation’s dedication to preserving its position as the world leader in the manufacture of high-quality alumina.

Key Specialty Alumina Market Players:

- Almatis GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Vibrantz Technologies Inc.

- Alteo

- CHALCO Advanced Material Co., Ltd.

- JINGANG GROUP

- Hindalco Industries Limited

- National Aluminum Company Limited

- Nabaltec AG

- Shandong Aofeng Metal Material Co., Ltd.

- J.M. Huber Corporation

In the specialty alumina market, product innovation is becoming a major trend. To stay competitive, big players are concentrating on innovations like HYCal. Reactive additive manufacturing (RAM) is one of the cutting-edge technologies being developed by top firms in the specialty alumina market to enhance product performance and expand application possibilities. Chemical reactions occur during the layer-by-layer deposition of materials in the novel 3D printing technique known as reactive additive manufacturing (RAM).

Recent Developments

- In August 2024, Vibrantz Technologies announced the acquisition of Micro Abrasives Corporation, a specialty alumina manufacturer situated in Westfield, Massachusetts. Micro Abrasives is a major U.S. manufacturer of calcined alumina for automotive refinishing, optical polishing, and industrial lapping applications.

- In March 2024, Alteo, a global leader in specialty alumina production, completed a fourth grinding capacity expansion in Korea and a second expansion in France. This will strengthen the company's position in the global alumina market for semiconductors (HYCal) and batteries. Alteo's fourth grinding capacity extension at its Korean location solidifies its position as a market leader in super-grinding for specialized alumina in Asia. This puts the business in a strong position to support the region's customer growth.

- Report ID: 7503

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Specialty Alumina Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.