Spatial OMICS Market Outlook:

Spatial OMICS Market size was over USD 568.26 million in 2025 and is anticipated to cross USD 1.7 billion by 2035, growing at more than 11.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of spatial omics is assessed at USD 627.59 million.

The growing interest in advanced cancer research to understand genetic mutations and formations is boosting demand for innovative technologies available in the spatial OMICS market. The frequency and complexity of heterogeneity in various malignancies and tumors are becoming a public health concern globally. For instance, a collaborative academic study, published in August 2023 showcased that the 5-year survival rate in patients suffering from invasive and metastatic breast cancer, with unmet clinical needs, drops to 30.0%, from 90.0% in localized cases. Thus, the need for personalized treatments is rising, which requires rigorous clinical research and a better understanding of the biology of individual diseases to identify the most adequate targeted therapeutics.

The spatial OMICS market has significantly revolutionized the existing single-cell sequencing technology in developing these drugs by filling the gap in spatial context, referring to significant growth in this field. The capabilities and clinical evidence of these techniques showcase promising results in the molecular characterization of specific malignancies, pushing both public and private organizations to promote them. For instance, in September 2022, STOmics commenced a global research grant initiative, the SpatialTemporal Omics Grant Program, to penetrate its spatially-resolved single-cell resolution transcriptomics platform, Stereo-seq, in R&D on spatiotemporal omics.

The current trend of strategic collaborations and partnerships in the spatial OMICS market has specific objectives of attaining global commercialization and technological development. Their efforts to minimize operational and drug discovery costs are setting standards for worldwide pricing strategies. They are meticulously enhancing their capacities and expertise to bring affordability, increasing the accessibility and adoption rate in this sector. For instance, in March 2024, NLM released a review on the payers’ pricing of the available spatial transcriptomics technologies for 16 biopsies. The study was based on: GeoMx, 10x Visium for frozen tissues, 10x Visium for formalin-fixed paraffin-embedded (FFPE) tissue, and 10x Visium HD, which presented a generalized overview of the current market scenario.

Comparative presentation of payers’ pricing for available spatial transcriptomics technologies

|

Cost Divisions |

GeoMx (USD) |

10x Visium for Frozen Tissues (USD) |

10x Visium for FFPE Tissues (USD) |

10x Visium HD (USD) |

|

Reagent |

8,165.0 |

19,850.0 |

25,725.0 |

44,800.0 |

|

Library Preparation Reagents |

1,920.0 |

160.0 |

160.0 |

160.0 |

|

Sequencing |

2,300.0 |

2,300.0 |

2,300.0 |

2,300.0 |

|

Total Cost (16 Biopsies) |

12,385.0 |

22,310.0 |

28,315.0 |

47,260.0 |

|

Cost/Biopsy |

774.0 |

1,394.0 |

1,762.0 |

2,954.0 |

Source: 2024 NLM Study

Key Spatial OMICS Market Insights Summary:

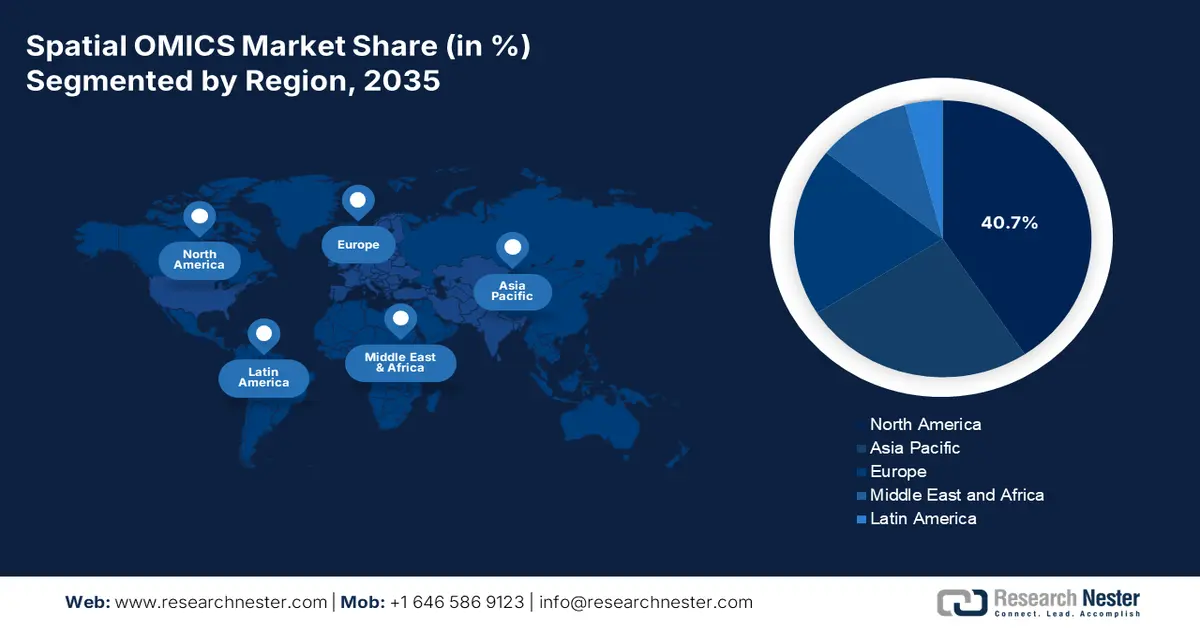

Regional Highlights:

- North America commands a 40.7% share in the Spatial OMICS Market, driven by the region being home to pioneers in genome sequencing and related industries, fostering strong growth prospects through 2035.

- Asia Pacific’s spatial OMICS market is set for rapid growth by 2035, driven by emerging pharmaceutical investment and precision medicine reducing cancer mortality.

Segment Insights:

- The Diagnostics segment of the Spatial OMICS Market is forecasted to hold more than 41.2% share by 2035, fueled by improved accuracy in detecting cell mechanisms for early interventions.

- The instruments segment of the Spatial OMICS Market is anticipated to dominate from 2026-2035, driven by increasing government investments to upgrade medical infrastructure.

Key Growth Trends:

- Increased R&D activities in the biotechnology industry

- Beneficial upgradation in data generation

Major Challenges:

- Shortage of skilled operators and proper management

- Limitations in complete implementation

- Key Players: NanoString Technologies, Inc., Illumina, Inc., 10x Genomics, Inc., Akoya Biosciences, Inc..

Global Spatial OMICS Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 568.26 million

- 2026 Market Size: USD 627.59 million

- Projected Market Size: USD 1.7 billion by 2035

- Growth Forecasts: 11.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.7% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

Spatial OMICS Market Growth Drivers and Challenges:

Growth Drivers

- Increased R&D activities in the biotechnology industry: With the growing demand for specificity and long-acting properties, more biotech leaders are being involved in the spatial OMICS market. For instance, in June 2023, Owkin and Nanostring joined the consortium of the University of Pittsburgh, Gustave Roussy, Lausanne University Hospital, Uniklinikum Erlangen/Friedrich-Alexander-Universität Erlangen-Nürnberg, and Charité - Universitätsmedizin Berlin to launch MOSAIC. The initiative presented an outlay of USD 50.0 million to escalate the use of spatial omics in oncology R&D. Such influx of capital from both the government and academic institutions is acting as a financial cushion for this sector, inspiring more companies to engage.

- Beneficial upgradation in data generation: Integration of advanced technologies such as AI and machine learning is evolving the efficacy of offerings from the spatial OMICS market. The accuracy and high resolution of the collected unprecedented datasets from these solutions are helping develop a more detailed understanding of biological processes, making them the highly desired tool for researchers. This urge is further fed by ongoing large-scale initiatives, backed by public-private relationships. For instance, in February 2025, the Chan Zuckerberg Initiative (CZI), in partnership with 10x Genomics and Ultima Genomics, launched the Billion Cells Project to fulfill the requirement of the upsurging AI-powered biology models.

Challenges

- Shortage of skilled operators and proper management: Processing data generated by the tools from the spatial OMICS market requires special training and skills. The complexity and large scale of these datasets may become challenging for legacy systems, that are still present in a majority portion of research facilities. In addition, finding or affording a capable and trained professional to operate new sophisticated computational modules may become a hurdle due to shortage. These factors conjugately restrict full-fledged utilization and shrink the consumer base, constraining the profit margin and discouraging investors.

- Limitations in complete implementation: As the complete penetration of the spatial OMICS market gets hindered by the scalability and affordability issues, the scope of securing generic revenue becomes difficult for companies. The multi-omics integration is still under development, which is crucial for mitigating the challenges regarding the combination of analytic results from different levels of processing. Thus, the industry is currently lagging in achieving a holistic comprehension. In addition, the lack of high-quality samples is affecting the output quality and viability, creating uncertainty and hesitation among participants.

Spatial OMICS Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.6% |

|

Base Year Market Size (2025) |

USD 568.26 million |

|

Forecast Year Market Size (2035) |

USD 1.7 billion |

|

Regional Scope |

|

Spatial OMICS Market Segmentation:

Application (Diagnostics, Translation Research, Drug Discovery and Development, Single Cell Analysis, Cell Biology, Others)

Based on applications, the diagnostics segment is set to account for spatial OMICS market share of more than 41.2% by the end of 2035. This segment’s growth is majorly fed by improved accuracy and specificity in detecting cell mechanisms, enabling healthcare professionals to early and appropriate interventions. In this regard, the enlargement of associated industries, presenting significant consumer bases and resources of genome data, is inflating demand in this segment. This signifies the involvement of spatial OMICS in fostering progressive settings in the global diagnostic network, generating profitable revenues.

Solution Type (Instruments, Consumables, Software)

In terms of solution type, the instruments segment is anticipated to dominate the spatial OMICS market throughout the forecasted period. The unavoidable need for state-of-the-art equipment to attain high-resolution and accurate datasets encapsulates a significant portion of the revenue. In addition, the increasing investments from government bodies to upgrade medical infrastructure are fueling demand in this segment. Ongoing innovations in related tools are also propelling market exposure. For instance, in April 2024, Canopy Biosciences updated its CellScape Precise Spatial Multiplexing platform with the launch of CellScape Whole-Slide Imaging Chamber. It consists of a large window, with an imaging area of 710 mm2, making it a suitable option for microfluidic instruments by reducing the volume and cost of required reagents.

Our in-depth analysis of the global spatial OMICS market includes the following segments:

|

Application |

|

|

Solution Type |

|

|

Sample |

|

|

End users |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Spatial OMICS Market Regional Analysis:

North America Market Analysis

North America in spatial OMICS market is estimated to capture over 40.7% revenue share by 2035. The region is home to many pioneers in genome sequencing, making its proprietorship in the global landscape more prominent. This is also testified by its leadership in other genome-associated industries such as genomics, DNA sequencing, and DNA library preparation. Thus, the assurance of profit is attracting more companies to invest in this marketplace. On this note, 10x Genomics secured a gross margin of 67.0% by the fourth quarter of 2024, showcasing a 4.0% increment from the previous year. The company further looks forward to raising its annual revenue by USD 20.0 million in 2025.

The U.S. has secured a leading position in the spatial OMICS market with its significant participation in clinical discoveries. In addition, its strong emphasis on healthcare cloud computing technologies through the presence of tech leaders, such as NVIDIA and Illumina, is accelerating the development of digital tools. In this regard, the growing tendency of the medical industry to digitalize operations and data management is also dragging the focus of the domestic pioneers. For instance, in June 2022, Rebus Biosystems partnered with Rosalind, Inc. to jointly develop a multi-modal spatial omics software, for its R&D consumer base. The technology is equipped with multi-omics capabilities and a user-friendly interface to democratize data, making it an accessible option for researchers.

Canada is augmenting the spatial OMICS market with its genome sequencing capabilities and government investments. For instance, in March 2024, the Federal Government invested USD 7.4 million in Sinai Health to boost the capabilities of genomic data collecting and sharing business in Canada. This was also an effort to strengthen the country’s R&D infrastructure and fill the gap between clinicians and researchers. Such funds from the government help create a larger volume of database, which is further capable of supporting the integration of AI-powered tools. This encourages both domestic and foreign forces to expand their territory in Canada by distributing their technologically upgraded solutions.

APAC Market Statistics

Asia Pacific is anticipated to register the fastest CAGR in the spatial OMICS market during the assessed timeframe. Being an emerging landscape for pharmaceutical investors, the region presents a lucrative scope of generating a notable profit margin for research-based companies. Particularly, the recent introduction of precision medicine in reducing the heightened cancer mortality rate in APAC is pushing companies to engage in deep exploration in this category.

China, with the close association of healthcare IT with improved outputs from single-cell sequencings is indicating its potential to its leadership in the spatial OMICS market. It has a large network of medical device manufacturing facilities. According to OEC, China became the 4th largest exporter of medical instruments in 2023, registering a value of USD 12.3 billion. On this note, in September 2024, MGI Tech unveiled its line of spatial OMICS tools, addressed as SEQ ALL landscape, at conferences in Shenzhen and Hong Kong. This pipeline introduced DNBSEQ for T, G, and E Series genetic sequencers. Moreover, its recent achievements in clinical studies and other life science segments are presenting a great future for this marketplace.

India is propagating the spatial OMICS market with the rapid expansion of the biotechnology industry. An IBEF report stated that the biotechnology industry in this country is poised to obtain USD 150.0 billion by 2025 and USD 270-300 billion by 2030. This is positively impacting the adoption in this sector. Another propelling factor is the growing participation of the government in genome collection through intuitive programs and campaigns. For instance, in January 2025, the Central Government and the Union Ministry of India collaboratively launched a solely drafted Indian Genomic Data Set and Indian Biological Data Centre (IBDC) Portals. With 10,000 samples, this set is now open for both domestic and foreign R&D teams. Such initiatives foster a suitable environment for this field’s extension.

Key Spatial OMICS Market Players:

- NanoString Technologies, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Illumina, Inc.

- 10x Genomics, Inc.

- Akoya Biosciences, Inc.

- Visiopharm A/S

- GE Healthcare

- Fluidigm Corporation

- Advanced Cell Diagnostics, Inc.

- PerkinElmer, Inc.

- ZEISS Group

- RareCyte, Inc.

- Bio-Rad Laboratories, Inc.

- ImaBiotech

- Indica Labs, Inc.

- Ultivue, Inc.

- Vizgen, Inc.

- Bruker Corporation

In September 2024, the Translational Genomics Research Institute (TGen) launched a spatial biology service center, the Center for Spatial Multi-Omics (COSMO) to evolve clinical research abilities. Such academic innovations are heavily encouraging key players in the spatial OMICS market to bring their offerings into play, streamlining technology development for better performance and convenience. Their efforts to mitigate issues with complexity and accuracy are creating a competitive scenario in this sector. For instance, in December 2024, Inopath introduced a groundbreaking genre in multimodal imaging, MIBIslide Blue to enable integration, precision, and simplification in spatial workflows. Thus, global leaders are engaging their every resource to advance in spatial OMICS market. These key players are:

Recent Developments

- In October 2024, Bruker Corporation built a new division, Bruker Spatial Biology, in operational collaboration with NanoString Technologies and Canopy Biosciences. The new formation is aimed at delivering diverse and comprehensive solutions with cutting-edge spatial technologies such as GeoMx, CosMx, AtoMx, and CellScape.

- In October 2024, Ultivue merged with Vizgen to foster a unified solution, representing a spatial multi-OMICS, for technological breakthroughs and research needs. The combined force of single-cell spatial genomics expertise and AI-driven spatial tissue profiling capabilities is intended to evolve clinical findings and development.

- Report ID: 7245

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Spatial OMICS Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.