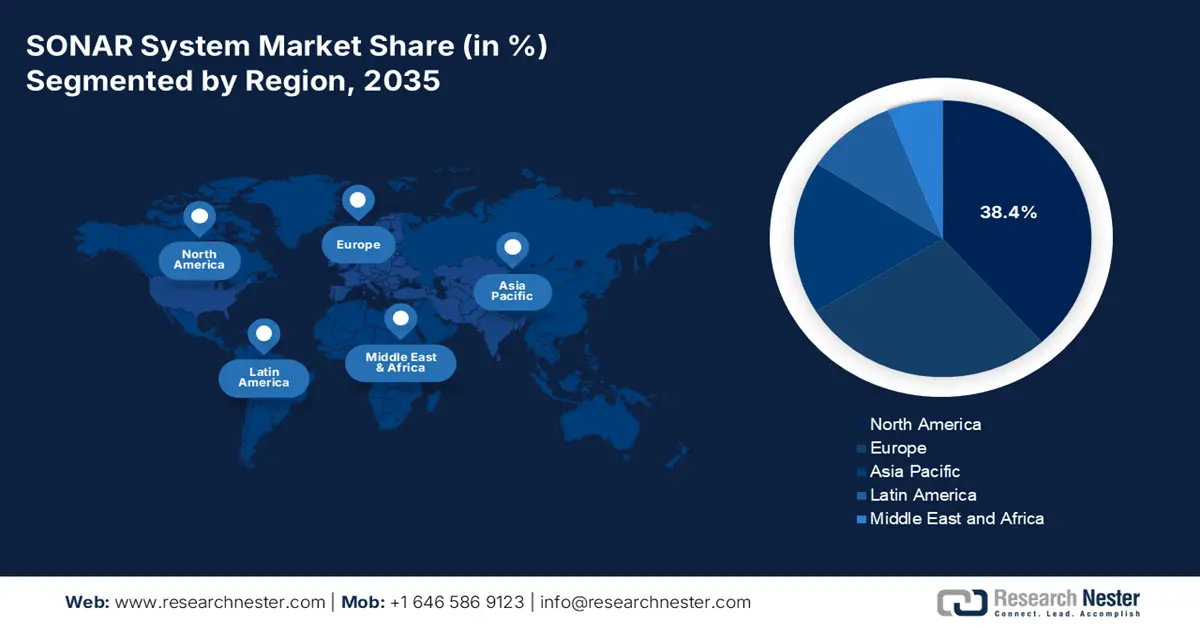

SONAR System Market - Regional Analysis

North America Market Insights

North America is dominating the market and is expected to hold a revenue share of 38.4% by 2035. The market dominance is driven by the high defense budgets focused on undersea warfare and technological sovereignty. The U.S. Department of Defense prioritizes acoustic superiority to counter peer competitors' funding next-generation systems for the Columbia and Virginia class submarines and the DDG(X) destroyer program. The key trends of the market include the integration of AI/ML for data processing, deployment of multi-static and distributed sonar networks using UUVs, and modernization of existing fleet assets. Strategic alliances such as AUKUS further accelerate advanced sonar development and cross-border collaboration with allied nations. The sustained mergers and acquisitions ensures the region's continued technological and market leadership throughout the forecast period.

SONAR Systems M&A in the U.S. and Canada

|

Year |

Acquirer |

Target/Acquired Company |

Country |

Description/Focus |

|

2023 |

NORBIT ASA |

Ping DSP |

Canada |

Acquisition of a Canadian maritime technology company specializing in advanced interferometric side scan sonar technology for shallow-water mapping and underwater discovery. |

|

2024 |

Kraken Robotics |

- (Contract awards) |

Canada |

Received contracts worth $1.1 million for AquaPix synthetic aperture sonar systems, expanding its sonar tech footprint, though not an acquisition. |

|

2025 |

Kongsberg Discovery |

Sonatech |

US |

Acquisition to expand underwater acoustics and sonar system capabilities, especially for defense applications. |

|

2023 |

General Oceans |

Tritech International (indirectly referenced) |

US |

Major player in underwater sonar systems, involved in various expansions and developments. |

Source: Kraken Robotics, October 2022, Kongsberg June 2025, General Oceans 2023, Ping DSP November 2023

The U.S. market is defined by high-value investments in integrated undersea warfare systems. The market is driven by the National Defense Strategy’s focus on maritime competition. A primary trend is the shift towards multi-static and distributed sonar networks using unmanned vehicles as remote sensing nodes to expand the surveillance areas. This is exemplified by DARPA’s Ocean of Things project. Furthermore, significant R&D is dedicated to AI-enabled signal processing to counter advanced acoustic threats. The foundational driver remains the Navy’s shipbuilding plan, with the Columbia class program alone representing a spend of USD 130 billion to acquire 12 Columbia class nuclear-powered ballistic missile submarines. This data highlights that the large procurement budget drives significant long-term demand for high-performance naval sonar technologies.

Canada’s SONAR market is mainly driven by the imperative to protect Arctic sovereignty and modernize the North American Aerospace Defense Command capabilities. The vital trend is the procurement of new platforms, which are equipped with modern ASW systems, notably the Canadian Surface Combatant program that will feature advanced sonar suites for open ocean and Arctic operations. This aligns with the Strong, Secure, Engaged defense policy that commits USD 62.3 billion in new funding over 20 years for USD 553 billion total defense spending. Investments aimed at addressing the unique acoustic challenges of the Arctic environment require specialized sonar for under-ice detection and monitoring, a critical capability for domain awareness in its northern approaches. This strategic focus establishes Canada as a key market and innovator in specialized Arctic sonar technologies.

APAC Market Insights

Asia Pacific is the fastest-growing SONAR system market and is expected to grow at a CAGR of 7.5% during the forecast period 2026 to 2035. The market is driven by the intense naval modernization, territorial disputes, and the need to secure strategic sea lanes. China’s comprehensive naval expansion, including its submarine fleet, is a primary market driver compelling regional neighbors to invest heavily in anti-submarine warfare capabilities. The key trends include the indigenous development of sonar systems to minimize the import dependency, mainly in South Korea and India, and a growing focus on integrating sonar with unmanned surface and underwater vehicles. Collaborative security agreements such as the Australia, UK, US pact further accelerate advanced technology transfer and create a layered demand structure across allied and non-allied nations in the region.

China’s market is defined by a rapid state-driven expansion focused on achieving acoustic parity with Western powers. The primary driver is the unprecedented growth of the People’s Liberation Army Navy that has become the world's largest navy by number of vessels. This expansion includes a massive submarine fleet, both nuclear and conventional, each requiring advanced indigenous sonar suits. A key trend is the heavy investment in research to overcome China’s traditional weakness in underwater acoustics and signal processing. This is supported by the data from the Brussels School of Governance in June 2024, stating China’s defense budget has increased to CN¥ 1.67 trillion in 2024, ensuring sustained funding for next-generation systems across surface, subsurface, and unmanned platforms to secure China’s near seas and global maritime interests.

The SONAR system market in Japan is defined by the strategic change based on the rising regional maritime threats. This is highlighted by a fundamental policy change, illustrated by its new National Defense Strategy, which identifies counterstrike capabilities as essential. A central driver is the urgent need to enhance anti-submarine warfare capabilities against increasingly active and quiet submarines in surrounding waters. The key trend involves a major fleet modernization with significant investments in new Taigei-class attack submarines and Mogami-class multi-role frigates, all integrated with the most advanced Japan-made sonar systems. According to the East Asia Forum in May 2023, Japan plans to invest 43 trillion yen in defense over the 2023 to 2027 period, directly fueling the sonar procurement and R&D. This concerted national effort boosts Japan's position as a leader in advanced ASW technology and a core driver of the regional SONAR market.

Europe Market Insights

The SONAR system market in Europe is expanding rapidly and is driven by the collaborative defense initiatives and national modernization programs aimed at enhancing maritime security and anti-submarine warfare capabilities. The primary driver is the collective response to the increased undersea activity in the North Atlantic and Baltic Sea, necessitating advanced detection systems. The key trends include the development of unmanned systems with projects such European Defense Fund’s allocates significant funds for naval unmanned systems that include sonar payloads. There is also a strong push for interoperability among NATO allies, leading to standardized procurements. Furthermore, national programs such as the UK’s Type 26 frigate and France’s FDI frigates are incorporating the next-gen sonar suites, fueling the regional market growth and technological advancement.

The UK is projected to hold the highest revenue share in Europe by 2035 and is driven by its independent naval strategy and commitment to a global presence. The key growth factors include the ongoing delivery of the eight-ship Type 26 frigate program for ASW and the planned Type 32 frigates. The UK’s dedication is highlighted by its pledge to increase defense spending, with a significant portion directed to the Royal Navy. The National Shipbuilding strategy outlines a pipeline of new vessels to ensure a sustained demand for advanced sonar systems to maintain underwater dominance in the North Atlantic and beyond. Further, companies' mergers and acquisitions are leading the market, for example, in September 2025, HII and Thales announced the successful integration and field exercise of the Thales SAMDIS1 600 sonar with HII’s next-generation REMUS 620 medium unmanned underwater vehicle. This synergy between the national strategy and industry collaboration stimulates the UK's position as a central hub for next-generation undersea warfare technology.

France is expected to lead Europe’s SONAR system market and is fueled by its commitment to defense sovereignty and a successful naval export market. The growth is driven by the ongoing procurement of five FDI frigates for the French Navy, all equipped with the Kingclip Mk II sonar system, and the development of the SNLE 3G next-generation ballistic missile submarine. According to the RFI July 2025 report, the French Ministry of Armed Forces' 2024 to 2030 military programming law allocates €413 billion with a substantial investment in defense forces. A key trend is the Europe-centric collaboration, such as the Maritime Mine Countermeasures program with the UK, which utilizes unmanned surface vessels with integrated sonar, reinforcing France’s role as a core developer of European undersea warfare technology.