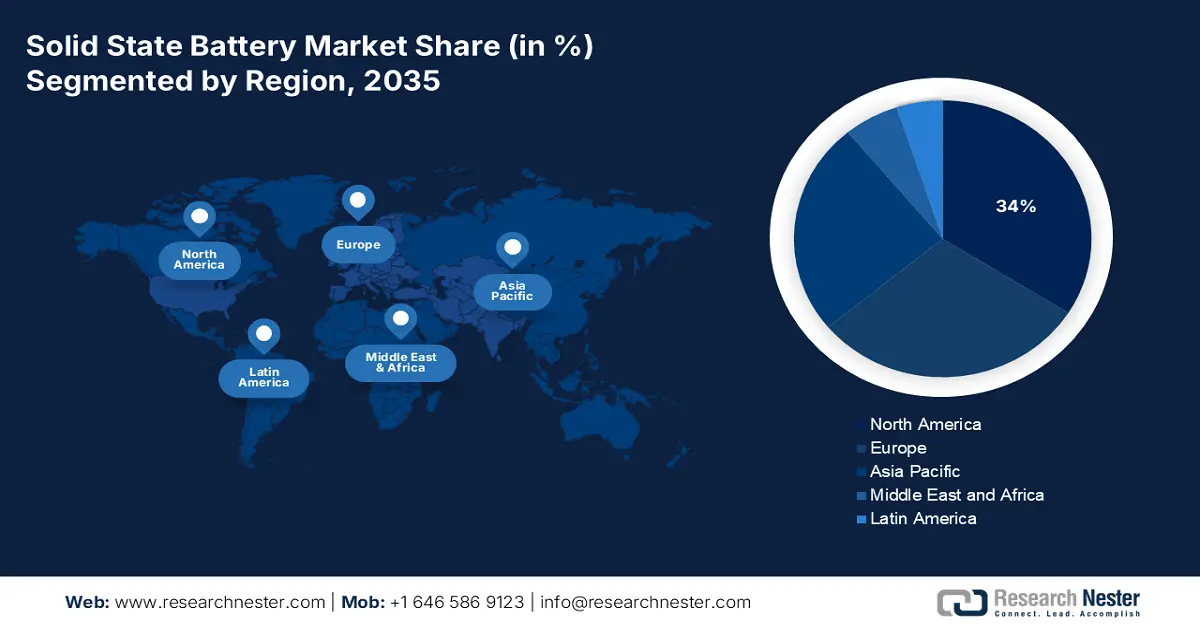

Solid State Battery Market - Regional Analysis

North America Market Insights

The North America solid state battery market is expected to account for 34% of the global revenue share by 2035, owing to the government support in terms of financial incentives and policies. Various public interventions deliver funding, financial assistance, and tax breaks, fueling the production of next-generation battery technologies. The implemented governmental policies facilitate research and development and private sector investments for solid state battery manufacturing procedures. Government policies are resulting in favorable conditions that allow companies to advance solid state battery innovations and commercialization processes, which contribute to the overall market growth.

Canada solid state battery development also benefits from ongoing technological advancements and growing partnerships between major key companies. Companies are advancing solid state battery material with manufacturing enhancement and scalability development. Blue Solutions has designed and manufactured solid-state batteries for over a decade, powering diverse global applications and enabling vehicles to collectively cover more than 600 million kilometers. Collaborations between battery developers, automakers, and research institutions are accelerating the process of moving from prototype research to the commercial manufacturing stage. Solid state battery implementation in consumer electronics and automotive sectors depends heavily on industry partnerships, which help solve performance hurdles and decrease manufacturing costs.

The solid state battery market in the U.S. is all set to hold a significant share during the analysis period, led by the growth of the electric vehicle industry. Solid state batteries are emerging as future battery technology, with the automobile industry considering them essential for boosting electric vehicle efficiency and safety while reducing their energy consumption. These batteries provide significant energy density combined with rapid charging ability and extended lifespan. Hence, the batteries are optimal for electric vehicle usage.

The U.S. Department of Energy (DOE) published a lab call for proposals worth $16 million to strengthen domestic capacity for solid-state and flow battery manufacturing. Scaling up domestic manufacturing of both solid state and flow batteries will assist the U.S. with grid, industry, and transportation energy efficiency and achieve an energy future that benefits all Americans. Automotive companies are actively researching solid state battery solutions to fulfil clean energy requirements and meet emission standards, further propelling the market growth.

Europe Market Insights

The Europe solid state battery market is expected to hold 30% of the global revenue share between 2026 to 2035. This growth is attributed to the increasing demand for energy storage systems. Efficient high-capacity energy storage solutions are required at an increasing pace as renewable energy sources, particularly wind and solar, are gaining prevalence. The application requirements for these purposes support solid state batteries as they provide enhanced energy density and better safety functions. The batteries prefer ESS applications owing to their exceptional ability to handle powerful energy transfers without losing capacity, thus accelerating the market expansion.

The climate commitments and zero emission goals are fueling the registration of electric vehicles in the U.K., and subsequently the application of solid state batteries. The development of solid state batteries remains crucial for electric mobility growth since these batteries enhance their energy density and vehicle range while improving overall safety performance. The United Kingdom has its first-ever battery strategy along with the Advanced Manufacturing Plan. As part of this plan, the government is committing to more than £2 billion in new capital and R&D funding to support the automotive sector in the manufacturing and technology development of zero-emission vehicles, including batteries and their supply chain, for up to 5 years to 2030. The leading automotive manufacturers are partnering with battery manufacturers to build advanced EVs, which is accelerating the demand for solid state batteries.

Germany is boosting its position in the global battery manufacturing supply chain through an expansion of domestic solid state battery production capabilities. Manufacturing plants as well as innovation hubs are working to foster the local industry. The rising focus on improving production scale is aimed at enhancing solid state technology to reduce battery imports and reach significant industry status with benefits for automotive and clean energy. The emphasis on emission reductions and renewable transition is resulting in significant demand for clean battery systems, including solid state energy technologies.

A consortium led by the University of Duisburg-Essen aims to deliver solid-state battery prototypes within two years, backed by €1.7 million funding from the German Federal Ministry of Education and Research. The market perceives solid state batteries as revolutionary solutions for electric vehicle storage, along with EV and grid energy storage, due to their high energy density coupled with safety qualities and extended life cycle. The sustainability initiatives are also enabling the adoption of solid state batteries as a means to reach environmental objectives while minimizing fossil fuel consumption.

Asia Pacific Market Insights

The Asia Pacific solid state battery market is expected to hold a significant global revenue share between 2026 to 2035. The solid-state battery industry in the Asia Pacific is experiencing tremendous growth due to the increase of electric vehicles (EVs), planned renewable energy storage projects, and government support. In Japan and South Korea, the industry is mainly focused on research and development, while Southeast Asian countries seek manufacturing capital. Policy support, along with the increasing demand for consumer electronics, and partnerships between vehicle and battery manufacturers are speeding up commercialization in Asia Pacific and increasing the potential region as a driver of next-generation energy storage solutions and high-performing batteries that deliver long life and safety.

China is dominating the Asia Pacific solid-state battery landscape through significant investments in electric vehicles, grid-based storage, and advanced battery technical research. Government policies like the "Made in China 2025” option and investment financing into the development of domestic supply chains for solid electrolytes have further established this landscape. Compared to conventional liquid lithium-ion batteries, which have an energy density of 200–300 Wh/kg, solid-state batteries, which use solid electrolytes rather than liquid ones, attain an energy density of up to 500 Wh/kg. This lowers battery size and delivers more energy in the same volume. Key players are leading the charge of rapid scaling of battery cell production through partnerships with major global automakers. Strong patent activity, easy access to many forms of raw materials, and strong government programs to support new materials and technologies underpin China's position of leadership in next-generation solid-state technologies.

The solid-state battery market in India is gaining momentum as attention from initiatives such as the PLI-ACC (Production Linked Incentive for Advanced Chemistry Cell) and the National Programme on Advanced Chemistry Cell Battery Storage grows. With the growth of the electric vehicle market, increased integration of renewables, and attention on local manufacturing initiatives, domestic and foreign capital is flowing into this emerging segment. Startup companies and research institutions partner with international technology companies to advance the development of cost-effective solid electrolytes. The yearly demand for batteries worldwide was approximately 933 GWh in 2021, but by 2030, it is anticipated to have increased fivefold to 5,100 GWh. Considering the increasing demand for energy and strong government support, India is likely to be an emerging regional player by 2030.