Solid State Battery Market Outlook:

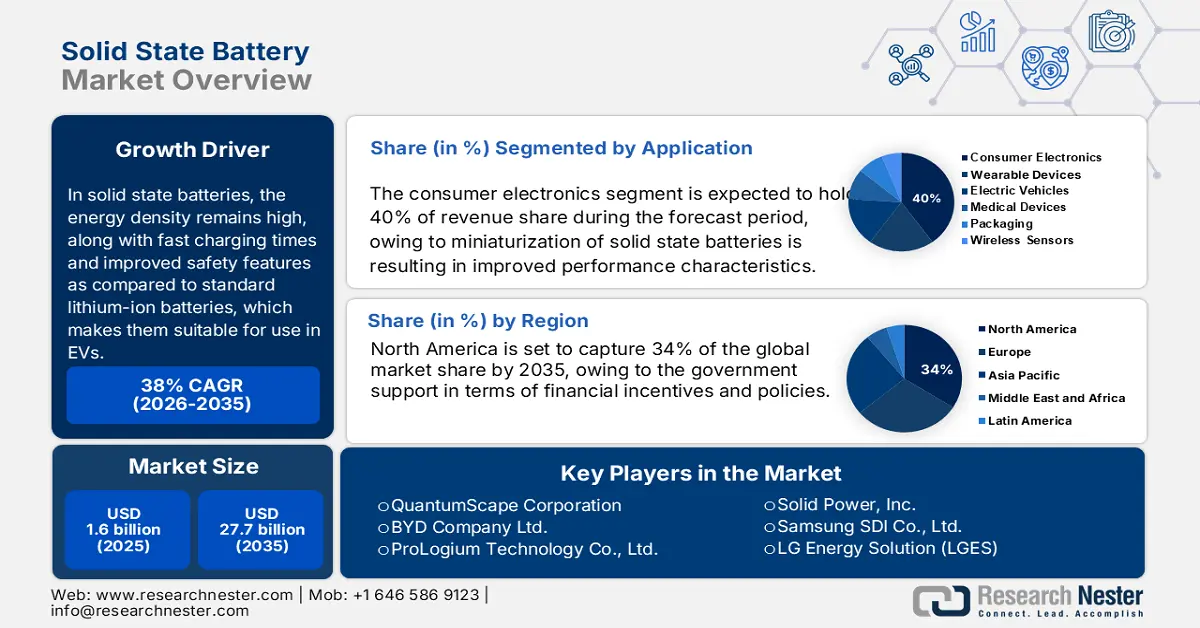

Solid State Battery Market was valued at USD 1.6 billion in 2025 and is expected to secure a valuation of USD 27.7 billion in 2035, expanding at a CAGR of 38% during the forecast period, i.e., 2026-2035. In 2026, the industry size of solid state battery is estimated at USD 2.3 billion.

The frequently rising demand for electric vehicles is contributing to the growing trade of solid state batteries. In these batteries, the energy density remains high, along with fast charging times and improved safety features as compared to standard lithium-ion batteries, which makes them suitable for use in EVs. The automotive industry is increasingly investing in solid state battery advancements, aimed at elevating performance standards and satisfying demand from consumers. For instance, in August 2025, Nissan Motor Co., Ltd. partnered with U.S.-based LiCAP Technologies, Inc. to develop dry cathode electrode production technology, enhancing efficient manufacturing and supporting the commercialization of all-solid-state batteries through improved production processes and streamlined industrial-scale deployment. Such strategic developments are creating lucrative avenues for market players’ revenue growth.

Various companies in solid state battery development are advancing their research from labs to near-term commercialization. In September 2023, Toyota Motor Corporation’s solid-state battery aims for a 20% longer driving range and sub-10-minute charging, while a higher-spec lithium-ion solid-state version targeting 50% greater range than performance batteries are also being developed. The strategies of leading automotive companies indicate their rising trust in solid state battery technologies. The deployment transition of R&D research combines innovative breakthroughs that are redefining energy storage solutions and mobile systems for applications.

Key Solid State Battery Market Insights Summary:

Regional Highlights:

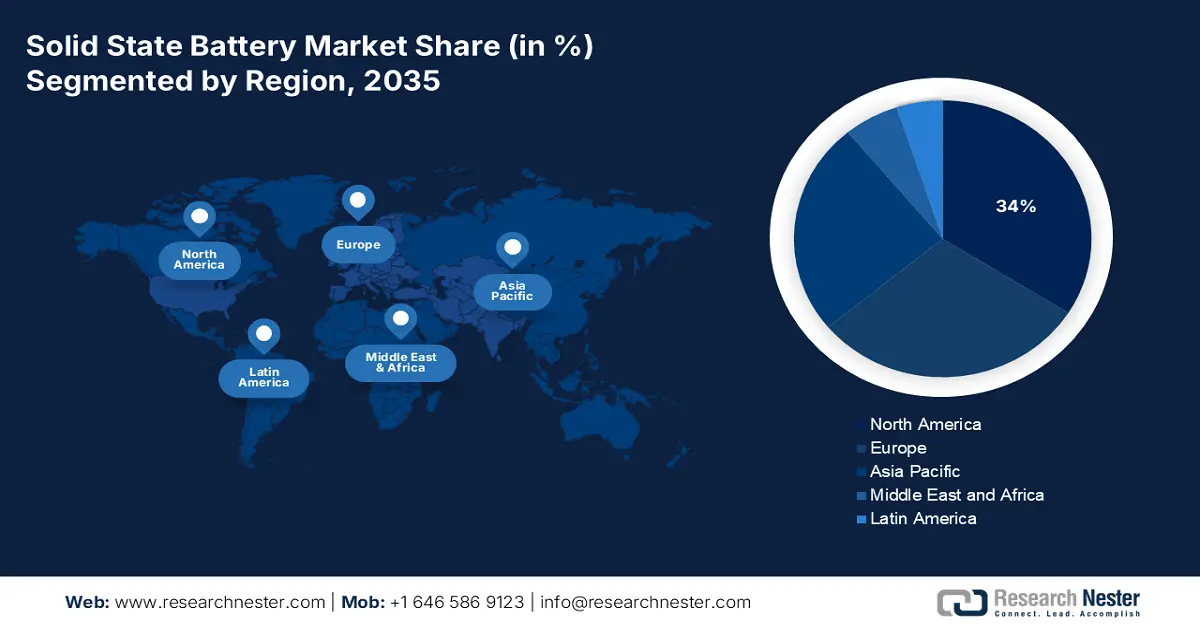

- By 2035, North America is anticipated to capture 34% share of the Solid State Car Battery Market, supported by expanding government-backed financial incentives and policy frameworks owing to government support in terms of financial incentives and policies.

- Europe is projected to secure a 30% revenue share during 2026–2035, underpinned by the rising requirement for high-capacity energy storage systems attributable to increasing demand for energy storage systems.

Segment Insights:

- By 2035, the consumer electronics segment is poised to account for around 40% share of the Solid State Car Battery Market, sustained by advancements in compact high-density battery architectures impelled by the miniaturization of solid state batteries.

- The multi-cell battery segment is projected to command nearly 60% share through 2035, reinforced by enhanced multilayer cell engineering and optimized manufacturing processes propelled by advancements in multi-layer solid state cell design.

Key Growth Trends:

- Advancements in solid state batteries

- Decreasing material costs

Major Challenges:

- Scale-up and mass production challenges

- Material challenges

Key Players: QuantumScape Corporation, Contemporary Amperex Technology Co., Ltd. (CATL), BYD Company Ltd., ProLogium Technology Co., Ltd., Solid Power, Inc., Samsung SDI Co., Ltd., LG Energy Solution (LGES), Toyota Motor Corporation, Panasonic Holdings Corporation, Blue Solutions, Factorial Energy, Inc., Johnson Matthey PLC, Ilika plc, Altech Batteries Ltd., Log9 Materials Pvt. Ltd.

Global Solid State Battery Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.6 billion

- 2026 Market Size: USD 2.3 billion

- Projected Market Size: USD 27.7 billion by 2035

- Growth Forecasts: 38% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Singapore, Australia, France, Canada

Last updated on : 6 October, 2025

Solid State Battery Market - Growth Drivers and Challenges

Growth Drivers

- Advancements in solid state batteries: Advancements in solid state battery technologies enable major enhancements in manufacturing methods, fueling large-scale production ability and reduced costs. Companies are focusing on full-scale manufacturing strategies to address rising market requirements. For instance, in January 2024, ProLogium established its first giga-scale solid state battery manufacturing facility in Taoyuan, Taiwan. The production capacity of this plant is expected to produce 26,000 electric vehicles annually, with mass-scale production to commence from 2027. This development is highlighting the industry’s shift toward large-scale production for advanced energy storage solution manufacturing. The newly developed advanced manufacturing capabilities are driving automakers to collaborate with battery developers to improve production efficiency. The intensification of commercialization is driving stakeholders to work on key technical issues and production problems involved with the solid state batteries. Companies are significantly investing in solid electrolyte material optimization as well as enhancing interface compatibility while improving cell assembly procedures. Scaling up manufacturing operations and minimizing operational expenses depends on these innovations to ensure consistent performance with enhanced scalability. Solid state batteries demonstrate advanced potential as an energy solution, as manufacturers are initiating performance-enhancing developments that make them ideal for electric vehicles and complex electronic systems.

- Decreasing material costs: The decreasing costs of manufacturing raw materials required for solid state batteries are resulting in affordability due to advanced research and production advancements. Companies are developing novel material formulation methods and scalable production technologies to decrease their need for expensive or rare materials while enhancing their cell fabrication process and decreasing error rates. The advancements in active material utilization enable businesses to decrease the cost per kilowatt-hour. Industrial research initiatives are accelerating the development of low-cost solid electrolytes that maintain both high conductivity and thermal stability to lower overall costs. Production lines implementing solid state batteries are transitioning from pilot stages to commercial readiness, while these collaborations are resulting in cost competitiveness for these batteries. Solid state batteries are emerging as a transformational technology with the increasing demand for clean energy and the electrified transport transition.

- Miniaturization for consumer electronics and wearables: The demand for small, lightweight, high-capacity energy sources in the consumer electronics industry is growing. Solid-state batteries, offered as both thin-film and micro-batteries, meet this energy need. These batteries enable increasingly thinner designs in smartphones, laptops, medical devices, and wearables due to their ultra-high energy density, improved safety, and longer lifespan. While all manufacturers aim for higher performance and safety, solid-state batteries are increasingly viewed as the next power source and will help establish solid-state technologies in the consumer electronics market. Technological miniaturization advances include power-efficient design (35%) for reduced consumption and longer battery life, semiconductor technologies (40%) enabling smaller, faster transistors, and microfabrication (25%) delivering ultra-small, high-performance components through precise manufacturing for increasingly compact, efficient electronic devices.

Growing Battery Demand in the Market

Export and Import of Batteries in 2023

|

Leading Exporters |

Export Value (USD) |

Leading Importers |

Import Value (USD) |

|

China |

$3.11B |

United States |

$1.24B |

|

United States |

$849M |

Germany |

$662M |

|

Germany |

$782M |

Mexico |

$413M |

Source: OEC

Challenges

- Scale-up and mass production challenges: Transitioning from prototypes built at the lab-scale to gigafactory-scale production is complicated. Solid-state cell assembly involves new manufacturing equipment, cleanroom standards, and processes that are not compatible with today’s lithium-ion production lines. Constructing new facilities or retrofitting existing facilities will require billions in capital investment and a long timeline. In addition, quality control on solid layers and interfaces will be more stringent than for liquid cells. Until there are proven production methods that can be scaled to high volumes, meeting the demand for electric vehicles and grid storage will still be a critical challenge.

- Material challenges: The advancement of solid state batteries is facing substantial barriers due to material-related issues. The solid electrolytes and electrodes need to provide high ionic conductance properties as well as stability characteristics to operate properly at industrial scales. The search for suitable materials that can deliver these properties at affordable costs is facing difficulties. The high conductivity of solid electrolytes, such as sulfides or oxides, comes with stability or manufacturing challenges that restrict their use. The expense of high-performance materials remains high, which is obstructing the development of commercial-grade solid state batteries with reliable affordability, therefore hindering their market deployment.

Solid State Battery Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

38% |

|

Base Year Market Size (2025) |

USD 1.6 billion |

|

Forecast Year Market Size (2035) |

USD 27.7 billion |

|

Regional Scope |

|

Solid State Battery Market Segmentation:

Application Segment Analysis

The consumer electronics segment is estimated to capture around 40% of the solid state battery market share by the end of 2035. The miniaturization of solid state batteries is resulting in improved performance characteristics in wearable consumer electronic devices. The businesses are innovating to develop advanced power solutions that meet consumer electronics requirements for small and robust systems. For instance, in June 2024, TDK reached a major milestone in solid state battery material by developing a battery with 1,000 Wh/L capacity, which outpaces their existing battery performance by approximately 100 times. This advancement enables the development of lightweight batteries to extend the operational time of smartwatches and wireless earbuds. Such advancements are boosting the deployment of these batteries in small consumer devices as they provide enhanced safety and extended battery duration.

Category Segment Analysis

The multi-cell battery segment is projected to hold 60% share of the solid state battery market through 2035. Companies are upgrading cell designs in multi-layer solid state batteries to improve their performance and extend manufacturing capability. For instance, Ilika Technologies leads the £8 million (USD 9.9 million) Faraday Battery Challenge HISTORY project, launched February 1, 2023, to integrate high-silicon electrodes into its Goliath solid-state EV battery. Ilika secured a £2.8 million grant and partners with UK battery-materials leader Nexeon. The automotive application standardization work required the project to enhance manufacturing processes and material compatibility, which established vital progress toward extensive electric vehicle-scale production. Research into material compatibility and manufacturing process optimization within companies is enabling large-scale solid state battery production that establishes these batteries as a promising automotive energy storage technology for use.

Type Segment Analysis

The portable battery segment is projected to hold a significant share of the solid state battery market through 2035. Mainly because they are widely used in consumer electronics, electric vehicles, and energy storage systems. Portable batteries have compelling performance characteristics, such as high energy density, safety, and long cycle life, that meet the increasing demand for compact and reliable power sources. Government incentives and electric vehicle adoption further enhance large-scale production with portable batteries, which far exceed the applications of thin-film batteries, which have relatively niche usages. Approved in May 2021, the ₹18,100-crore PLI-ACC scheme supports 50 GWh advanced chemistry cell capacity, spurring Indian manufacturers and prompting over ten additional companies to plan cell production units exceeding 100 GWh beyond PLI beneficiaries.

Our in-depth analysis of the solid state battery market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Capacity |

|

|

Category |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Solid State Battery Market - Regional Analysis

North America Market Insights

The North America solid state battery market is expected to account for 34% of the global revenue share by 2035, owing to the government support in terms of financial incentives and policies. Various public interventions deliver funding, financial assistance, and tax breaks, fueling the production of next-generation battery technologies. The implemented governmental policies facilitate research and development and private sector investments for solid state battery manufacturing procedures. Government policies are resulting in favorable conditions that allow companies to advance solid state battery innovations and commercialization processes, which contribute to the overall market growth.

Canada solid state battery development also benefits from ongoing technological advancements and growing partnerships between major key companies. Companies are advancing solid state battery material with manufacturing enhancement and scalability development. Blue Solutions has designed and manufactured solid-state batteries for over a decade, powering diverse global applications and enabling vehicles to collectively cover more than 600 million kilometers. Collaborations between battery developers, automakers, and research institutions are accelerating the process of moving from prototype research to the commercial manufacturing stage. Solid state battery implementation in consumer electronics and automotive sectors depends heavily on industry partnerships, which help solve performance hurdles and decrease manufacturing costs.

The solid state battery market in the U.S. is all set to hold a significant share during the analysis period, led by the growth of the electric vehicle industry. Solid state batteries are emerging as future battery technology, with the automobile industry considering them essential for boosting electric vehicle efficiency and safety while reducing their energy consumption. These batteries provide significant energy density combined with rapid charging ability and extended lifespan. Hence, the batteries are optimal for electric vehicle usage.

The U.S. Department of Energy (DOE) published a lab call for proposals worth $16 million to strengthen domestic capacity for solid-state and flow battery manufacturing. Scaling up domestic manufacturing of both solid state and flow batteries will assist the U.S. with grid, industry, and transportation energy efficiency and achieve an energy future that benefits all Americans. Automotive companies are actively researching solid state battery solutions to fulfil clean energy requirements and meet emission standards, further propelling the market growth.

Europe Market Insights

The Europe solid state battery market is expected to hold 30% of the global revenue share between 2026 to 2035. This growth is attributed to the increasing demand for energy storage systems. Efficient high-capacity energy storage solutions are required at an increasing pace as renewable energy sources, particularly wind and solar, are gaining prevalence. The application requirements for these purposes support solid state batteries as they provide enhanced energy density and better safety functions. The batteries prefer ESS applications owing to their exceptional ability to handle powerful energy transfers without losing capacity, thus accelerating the market expansion.

The climate commitments and zero emission goals are fueling the registration of electric vehicles in the U.K., and subsequently the application of solid state batteries. The development of solid state batteries remains crucial for electric mobility growth since these batteries enhance their energy density and vehicle range while improving overall safety performance. The United Kingdom has its first-ever battery strategy along with the Advanced Manufacturing Plan. As part of this plan, the government is committing to more than £2 billion in new capital and R&D funding to support the automotive sector in the manufacturing and technology development of zero-emission vehicles, including batteries and their supply chain, for up to 5 years to 2030. The leading automotive manufacturers are partnering with battery manufacturers to build advanced EVs, which is accelerating the demand for solid state batteries.

Germany is boosting its position in the global battery manufacturing supply chain through an expansion of domestic solid state battery production capabilities. Manufacturing plants as well as innovation hubs are working to foster the local industry. The rising focus on improving production scale is aimed at enhancing solid state technology to reduce battery imports and reach significant industry status with benefits for automotive and clean energy. The emphasis on emission reductions and renewable transition is resulting in significant demand for clean battery systems, including solid state energy technologies.

A consortium led by the University of Duisburg-Essen aims to deliver solid-state battery prototypes within two years, backed by €1.7 million funding from the German Federal Ministry of Education and Research. The market perceives solid state batteries as revolutionary solutions for electric vehicle storage, along with EV and grid energy storage, due to their high energy density coupled with safety qualities and extended life cycle. The sustainability initiatives are also enabling the adoption of solid state batteries as a means to reach environmental objectives while minimizing fossil fuel consumption.

Asia Pacific Market Insights

The Asia Pacific solid state battery market is expected to hold a significant global revenue share between 2026 to 2035. The solid-state battery industry in the Asia Pacific is experiencing tremendous growth due to the increase of electric vehicles (EVs), planned renewable energy storage projects, and government support. In Japan and South Korea, the industry is mainly focused on research and development, while Southeast Asian countries seek manufacturing capital. Policy support, along with the increasing demand for consumer electronics, and partnerships between vehicle and battery manufacturers are speeding up commercialization in Asia Pacific and increasing the potential region as a driver of next-generation energy storage solutions and high-performing batteries that deliver long life and safety.

China is dominating the Asia Pacific solid-state battery landscape through significant investments in electric vehicles, grid-based storage, and advanced battery technical research. Government policies like the "Made in China 2025” option and investment financing into the development of domestic supply chains for solid electrolytes have further established this landscape. Compared to conventional liquid lithium-ion batteries, which have an energy density of 200–300 Wh/kg, solid-state batteries, which use solid electrolytes rather than liquid ones, attain an energy density of up to 500 Wh/kg. This lowers battery size and delivers more energy in the same volume. Key players are leading the charge of rapid scaling of battery cell production through partnerships with major global automakers. Strong patent activity, easy access to many forms of raw materials, and strong government programs to support new materials and technologies underpin China's position of leadership in next-generation solid-state technologies.

The solid-state battery market in India is gaining momentum as attention from initiatives such as the PLI-ACC (Production Linked Incentive for Advanced Chemistry Cell) and the National Programme on Advanced Chemistry Cell Battery Storage grows. With the growth of the electric vehicle market, increased integration of renewables, and attention on local manufacturing initiatives, domestic and foreign capital is flowing into this emerging segment. Startup companies and research institutions partner with international technology companies to advance the development of cost-effective solid electrolytes. The yearly demand for batteries worldwide was approximately 933 GWh in 2021, but by 2030, it is anticipated to have increased fivefold to 5,100 GWh. Considering the increasing demand for energy and strong government support, India is likely to be an emerging regional player by 2030.

Key Solid State Battery Market Players:

- QuantumScape Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Contemporary Amperex Technology Co., Ltd. (CATL)

- BYD Company Ltd.

- ProLogium Technology Co., Ltd.

- Solid Power, Inc.

- Samsung SDI Co., Ltd.

- LG Energy Solution (LGES)

- Toyota Motor Corporation (solid-state programs)

- Panasonic Holdings Corporation

- Blue Solutions (Bolloré/Blue Solutions)

- Factorial Energy, Inc.

- Johnson Matthey PLC (battery materials / SSB work)

- Ilika plc

- Altech Batteries Ltd. (and other Australian developers)

- Log9 Materials Pvt. Ltd.

The solid state battery market is highly competitive, with numerous players striving to commercialize this next-generation technology. Key companies are leading the development of solid state batteries, focusing on enhancing energy density, safety, and manufacturing scalability. These firms are engaged in strategic partnerships, collaborations, and research to accelerate production and reduce costs. Additionally, new entrants and startups are driving innovation, focusing on advanced materials and alternative manufacturing techniques. As the market matures, companies are vying to gain a competitive edge by securing patents, expanding production capacities, and forging alliances to dominate the rapidly growing industry.

Here are some key players operating in the solid state battery market:

Recent Developments

- In February 2025, Hyundai announced plans to commence full-scale production of solid state batteries by March 2025. This move is part of the company's strategy to enhance the energy density and safety of its electric vehicle lineup, aiming to reduce charging times and improve overall performance.

- In January 2025, Microvast Holdings announced a breakthrough in solid state battery technology with its True All-Solid-State Battery (ASSB). The battery utilizes a bipolar stacking architecture, eliminating liquid electrolytes and enabling higher voltages. The company is advancing to the pilot production phase, aiming to set new industry standards for high-performance battery solutions.

- Report ID: 4984

- Published Date: Oct 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Solid State Battery Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.