Solid Phase Extraction Market Outlook:

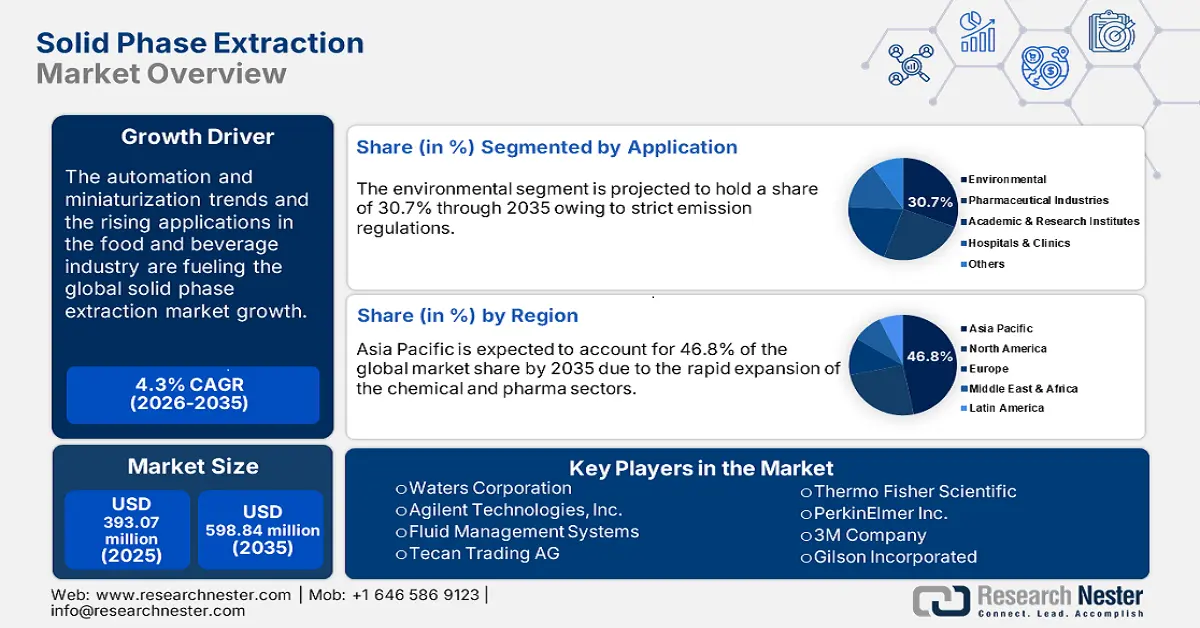

Solid Phase Extraction Market size was over USD 393.07 million in 2025 and is poised to exceed USD 598.84 million by 2035, witnessing over 4.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of solid phase extraction is estimated at USD 408.28 million.

The rapidly expanding pharmaceutical and biotechnology sectors are offering lucrative opportunities for solid phase extraction solution producers. The need for purity and consistency in drug production and molecular biology and rising regulatory demands for product testing are set to augment the adoption of solid phase extraction technologies. For instance, the global pharmaceutical market was evaluated at USD 1.6 trillion in 2023. Pharma companies headquartered in New Brunswick and New Jersey totaled revenues of around USD 85.0 billion. Johnson & Johnson is the pharmaceutical leader across the world followed by Pfizer, Merck & Co., and AbbVie. North America and Europe followed by Asia Pacific are leading the future of the pharma and biopharma sectors. Furthermore, the International Federation of Pharmaceutical Manufacturers and Associations (IFPMA) reveals that the biopharmaceutical sector is anticipated to witness a rise in R&D sending from USD 179.0 billion in 2020 to USD 213.0 billion by 2026. .

Key Solid Phase Extraction Market Insights Summary:

Regional Highlights:

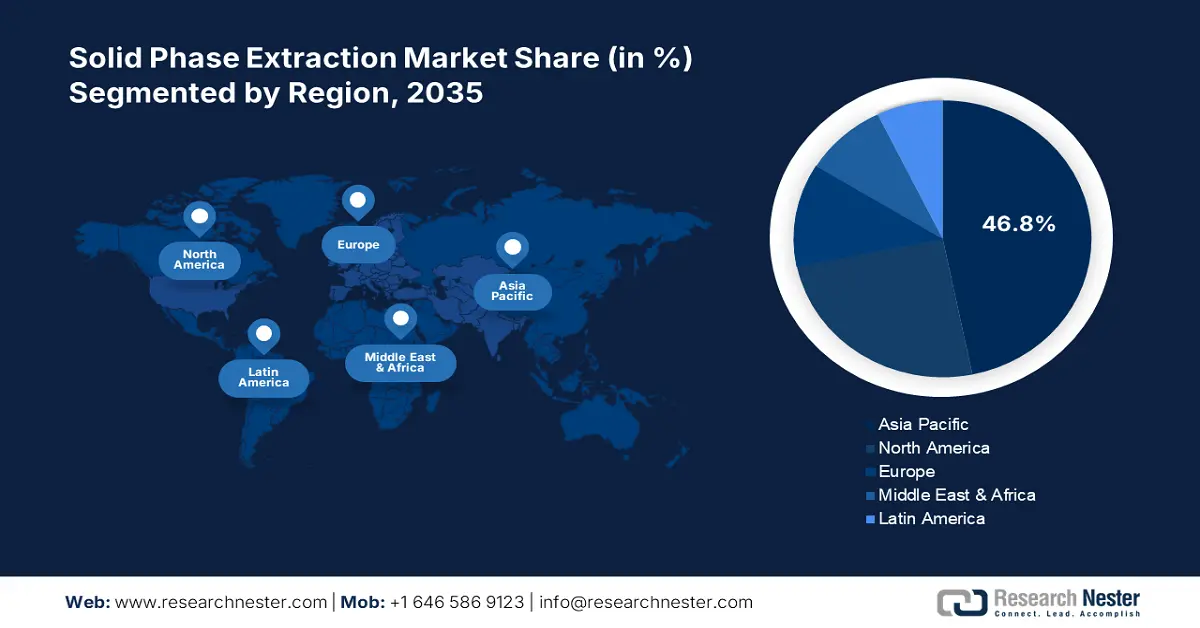

- Asia Pacific dominates the Solid Phase Extraction Market with a 46.80% share, propelled by expanding pharma and biotech sectors, healthcare investments, and supportive government policies boosting demand for solid phase extraction systems, positioning it for growth by 2035.

- The solid phase extraction market in North America is projected to have the fastest CAGR by 2035, attributed to strict environmental regulations, rising research activities, and increased application in food and safety testing in the U.S. and Canada.

Segment Insights:

- The Environmental segment is anticipated to capture a 30.70% share by 2035, driven by strict environmental regulations and the need to trace pollutants in environmental matrices.

Key Growth Trends:

- Rise in forensic analysis & drug abuse detection

- Automation and miniaturization trends

Major Challenges:

- High cost of advanced SPE systems

- Availability of alternatives

- Key Players: Agilent Technologies Inc., GL Sciences Inc., Waters Corporation, and Fluid Management Systems.

Global Solid Phase Extraction Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 393.07 million

- 2026 Market Size: USD 408.28 million

- Projected Market Size: USD 598.84 million by 2035

- Growth Forecasts: 4.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (46.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 13 August, 2025

Solid Phase Extraction Market Growth Drivers and Challenges:

Growth Drivers

-

Rise in forensic analysis & drug abuse detection: Solid phase extraction systems are finding wide applications in drug abuse detection and forensic analysis. The rising cases of drug abuse and other related criminal activities are augmenting the use of SPE in forensic testing. The major factor boosting the use of solid phase extraction in this segment is due to its precision and accuracy. For instance, in June 2024, the United Nations revealed that there are around 300 million drug abusers worldwide. Around 228 million individuals consume cannabis, opioids (30 million), cocaine (23 million), and ecstasy (20 million). Blood, urine, oral fluid, and hair testing through solid phase extraction systems offer effective results, contributing to their high demand. SCIEX, Aurora Biomed, Inc., and DPX Technologies are some of the top producers of solid phase extraction technologies that aid in forensic analysis and drug abuse detection.

-

Automation and miniaturization trends: The miniaturization and automation trends are set to significantly drive the solid phase extraction market growth. These advanced SPE systems are gaining widespread adoption in laboratories owing to their consistency, efficiency, and human error mitigation. High-volume labs are prime end users of automated solid phase extraction technologies. To grab these opportunities key market players continuously investing in R&D to introduce advanced solid phase extraction devices and consumables. For instance, in October 2024, Raykol Group (XiaMen) Corp., Ltd. revealed that its SPEVA 08N Automatic Sample Purification-Concentration Apparatus and SPEVA Automated Solid Phase Extraction & Evaporation System coupled with Agilent Technologies’s 1260 Infinity II High-Performance Liquid Chromatograph offer effective results in the determination of Benzo(a)pyrene residues in food. Technologically advanced SPE systems are set to boost the revenues shares of the manufacturers in the coming years.

Challenges

-

High cost of advanced SPE systems: Technologically advanced solid phase extraction technologies and consumables are more expensive than conventional techniques. This high product cost acts as a challenge for small-scale laboratories and research institutions running on limited budgets. Thus, budget-conscious end users deter from adopting advanced solid phase extraction solutions, hampering the solid phase extraction (SPE) market growth to some extent.

-

Availability of alternatives: The presence of alternative techniques is expected to hinder the growth of the solid phase extraction market. Techniques such as liquid-liquid extraction (LLE), solid phase microextraction (SPME), and supported liquid extraction (SLE) offer competitive advantages such as cost-effectiveness, efficiency, and simplicity. Advancements in these technologies are further expected to hamper the market dominance of solid phase extraction technologies.

Solid Phase Extraction Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.3% |

|

Base Year Market Size (2025) |

USD 393.07 million |

|

Forecast Year Market Size (2035) |

USD 598.84 million |

|

Regional Scope |

|

Solid Phase Extraction Market Segmentation:

Type (SPE Disk, SPE Cartridge, Others)

The SPE cartridge segment in solid phase extraction market is anticipated to hold a dominant share throughout the forecast period. The advancements in analytical technologies and their widespread applications in food safety, clinical, forensic, and environmental are augmenting the sales of solid phase extraction (SPE) cartridges. The efficiency in isolating and purifying analytes from complex mixtures is driving the adoption of advanced SPE cartridges. Innovation strategies are aiding manufacturers to develop improved SPE cartridges and maximize their revenue shares. For instance, in March 2024, Waters Corporation announced the introduction of Oasis WAX/GCB and GCB/WAX for PFAS Analysis Cartridges. These newly designed cartridges effectively and accurately streamline and accelerate sample preparation and analysis of per- and polyfluoroalkyl substances.

Application (Pharmaceutical Industries, Academic & Research Institutes, Environmental, Hospitals & Clinics, Others)

In solid phase extraction market, environmental segment is set to capture revenue share of over 30.7% by 2035. The automated solid phase extraction systems effectively trace pollutants in environmental water, air, and soil. For instance, in October 2024, the European Environment Agency revealed that the transport emission of ammonia surpassed 121% and nitrous oxide by 35%, in 2022, respectively. As per the U.S. Environmental Protection Agency, six commonly found air pollutants referred to as criteria air pollutants are ozone, particulate matter, carbon monoxide lead, sulfur dioxide, and nitrogen dioxide. The strict environmental regulations on emissions are set to augment the use of solid phase extraction systems.

Our in-depth analysis of the global solid phase extraction market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Solid Phase Extraction Market Regional Analysis:

Asia Pacific Market Forecast

Asia Pacific solid phase extraction market is expected to capture revenue share of over 46.8% by 2035. The swiftly expanding pharma and biotech sectors, increasing investments in healthcare innovations, economic changes, and sustainability goals are augmenting the demand for solid phase extraction systems. Supportive government policies are set to boost the sales of advanced solid phase extraction systems in China and India. Technological innovation strategies are further augmenting the market growth in Japan and South Korea.

In China, the rapid urban and industrial activities are directly augmenting the growth in the pharma, food & beverages, chemical, biotechnology, and healthcare sectors, which is subsequently increasing the adoption of solid phase extraction technologies. The sustainability goals and strict regulations on emissions are further driving the solid phase extraction market growth in China. For instance, the Information Technology and Innovation Foundation (ITIF) revealed that China accounted for 44.0% of global chemical production in 2022.

In India, an extensive network of universities and research institutions engaged in pharmaceutical, chemical, and environmental science are fueling the sales of solid phase extraction (SPE) market. The rise in the chemical, pharma, and biotech industries in the country is also generating lucrative opportunities for solid phase extraction system manufacturers. The India Brand Equity Foundation (IBEF) report reveals that the country under the National Biopharma Mission is supporting over 101 projects. The India pharmaceutical industry is set to reach USD 130.0 billion by 2030 owing to the large number of FDA-approved plants in the country after the U.S.

North America Market Statistics

The North America solid phase extraction market is estimated to increase at the fastest CAGR throughout the projected period. The expanding research activities, strict environmental regulations, high investments in drug development, and integration of automated technologies are contributing to the market growth. The rising application of solid phase extraction technologies in food and safety testing is anticipated to create high-earning opportunities for key players in the U.S. and Canada.

In the U.S., strict environmental regulations are expected to augment the overall solid phase extraction market growth. High investments in water, air, and soil monitoring for containments and environmental justice moves are driving the sales of solid phase extraction systems. The Office of Enforcement and Compliance Assurance (OECA) and Regions conducted around 45% of yearly on-site inspections at facilities in communities with potential environmental justice concerns.

Canada’s pharma and biotech industries are expanding at a healthy pace, which is directly fueling the sales of solid phase extraction technologies. Canada is the 8th largest market for pharmaceuticals and holds around 2.2% of the global solid phase extraction market share. The pharmaceutical sales are expanding at a high 6.4% CAGR since 2017 in the country, reveals the Innovation, Science, and Economic Development Canada. Research and development funding and supportive government policies are directly augmenting the solid phase extraction market growth.

Key Solid Phase Extraction Market Players:

- Thermo Fisher Scientific

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- PerkinElmer Inc.

- 3M Company

- Gilson Incorporated

- Gerstel GmbH & Co. KG

- Merck KGaA

- GL Sciences Inc.

- Waters Corporation

- Agilent Technologies, Inc.

- Fluid Management Systems

- Tecan Trading AG

- Cytiva

- Pall Corporation

- Phenomenex Inc.

- SCIEX

- Aurora Biomed, Inc.,

- DPX Technologies

- Raykol Group (XiaMen) Corp., Ltd.

Leading players in the solid phase extraction market are employing several organic and inorganic strategies to increase their market reach and revenue shares. Strategic collaborations and partnership tactics are aiding them in introducing innovative solid phase extraction technologies and uplifting their position in the competitive landscape. Technological innovations, mergers & acquisitions, and global expansion strategies are also driving the net revenue shares of the key players. Agilent Technologies, Inc., one of the major manufacturers of solid phase extraction systems revealed that it totaled USD 6.51 billion in revenues in the fiscal year 2024 and offered employment to around 18,000 individuals. The company also estimates that nearly 2,85,000 labs across the world are using its solutions.

Some of the key players include:

Recent Developments

- In December 2022, Fluid Management Systems and Agilent Technologies, Inc. entered into a strategic partnership to automate sample preparation of environmental and food testing workflows. Agilent’s solid phase extraction cartridges combined with FMS’s automated extractors are offering end users a rapid automated sample extraction method leading to lab productivity and efficiency.

- In October 2022, Waters Corporation announced the launch of Extraction+ Connected Device. This software-controlled product with Waters Andrew+ Pipetting Robot automates and documents the preparation of food, forensics, environmental, and biological samples using the solid phase extraction method.

- Report ID: 6913

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Solid Phase Extraction Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.