Solid Oxide Fuel Cell Market Outlook:

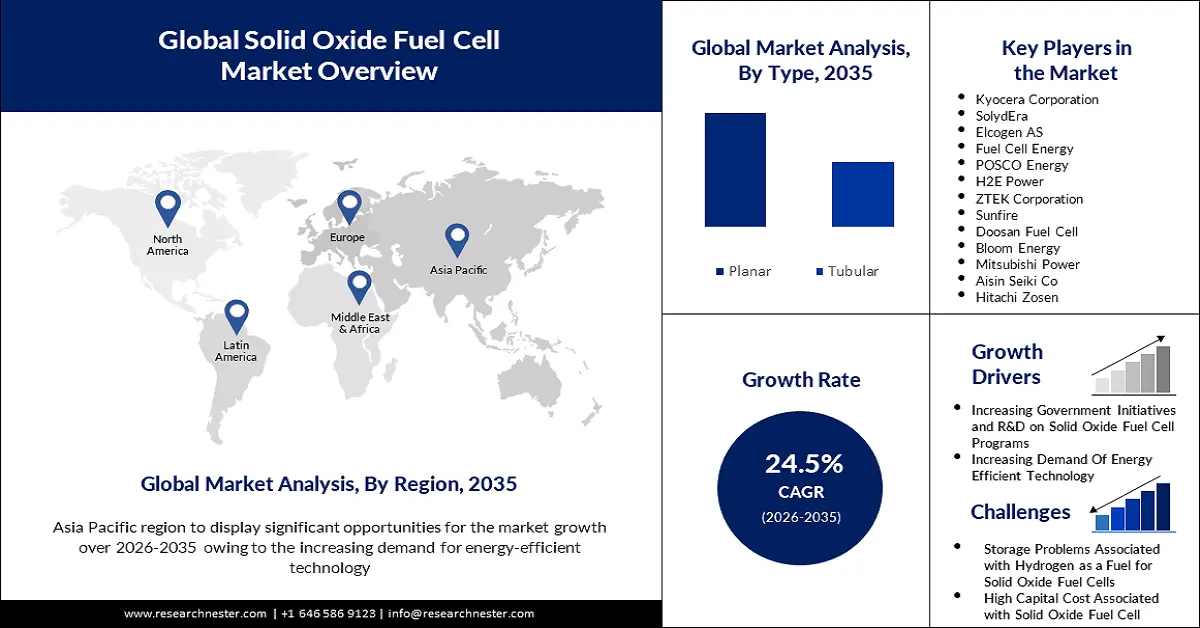

Solid Oxide Fuel Cell Market size was valued at USD 2.51 billion in 2025 and is set to exceed USD 22.46 billion by 2035, registering over 24.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of solid oxide fuel cell is estimated at USD 3.06 billion.

Over the past few decades, energy technologies have emerged as the key end users of critical metals to cope with the paradigm shift of energy transition. This has resulted in a huge demand for noble metals such as cobalt and nickel, which are the critical raw materials required for solid oxide fuel cells. China accounts for 63% of the total rare earth mining, making it a strategic resource on the global map. Most cobalt (70%) is sourced in the Democratic Republic of the Congo (Kinshasa) and China with fewer production projects outside of these countries.

As of 2022, the world cobalt mine reserve was 8,300,000 metric tons and 190,000 metric tons were mined, primarily by Kinshasa and China remained the largest consumer. Nickel reserve was over 100,000,0000 metric tons and 3,300,000 metric tons was mined. Indonesia has increased its nickel mining, amounting to 20% of the globally mined share. Zirconium was the third largest sourced earth element, with a production volume of 1,400,000 metric tons of 68,000,000 metric tons reserve. The leading exporters of zirconium concentrates were Senegal, South Africa, and Australia. Both cobalt and nickel are the key materials used in solid oxide fuel cells (SOFCs) and solid oxide electrolyzer cell (SOEC) batteries, and the demand for both is expected to be 2 and 5 times higher in 2040 than in the 2010s.

By the year 2033, SOFCs are expected to find widespread adoption in industrial and commercial sectors, stationary power segments, data centers, and defense and military institutions, with residential sectors following closely behind. On the other hand, it has become vitally important to continue R&D to identify advanced chemical alternative materials to move solid oxide cell manufacturing away from dependency on critical element mining. In May 2024, the U.S. Department of Energy’s (DOE) Office of Fossil Energy and Carbon Management (FECM) initiated a RFI to promote the development of efficient reversible solid oxide fuel cells (R-SOFC). The prospects are aligned with near-zero emissions of CO2 by increasing hydrogen production capacity.

Solid Oxide Fuel Cells Projects Review through 2022

|

Project Number |

Title |

Lead Organization |

Total Funding |

Project Duration |

||

|

|

|

|

DOE |

Cost Share |

From |

To |

|

FE0031975 |

A Highly Efficient and Affordable Hybrid System for Hydrogen and Electricity Production |

Phillips 66 Company |

$3,000,000 |

$450,000 |

09/27/2020 |

09/26/2023 |

|

FE0031976 |

Low Cost Solid Oxide Fuel Cells for Small-Scale Distributed Power Generation |

Redox Power Systems LLC |

$2,060,653 |

$665,177 |

12/01/2020 |

11/30/2023 |

|

FE0031639 |

MW-Class SOFC Pilot System Development |

FuelCell Energy Inc |

$1,500,000 |

$375,001 |

08/17/2018 |

02/16/2023 |

|

FWP1022460 |

Solid Oxide Fuel Cell Integrated Energy System |

National Energy Technology Laboratory |

$4,000,002 |

$0 |

04/01/2019 |

03/31/2022 |

|

|

$10,560,655 |

$1,490,178 |

|

|||

|

|

$12,050,833 |

|

||||

Source: NETL