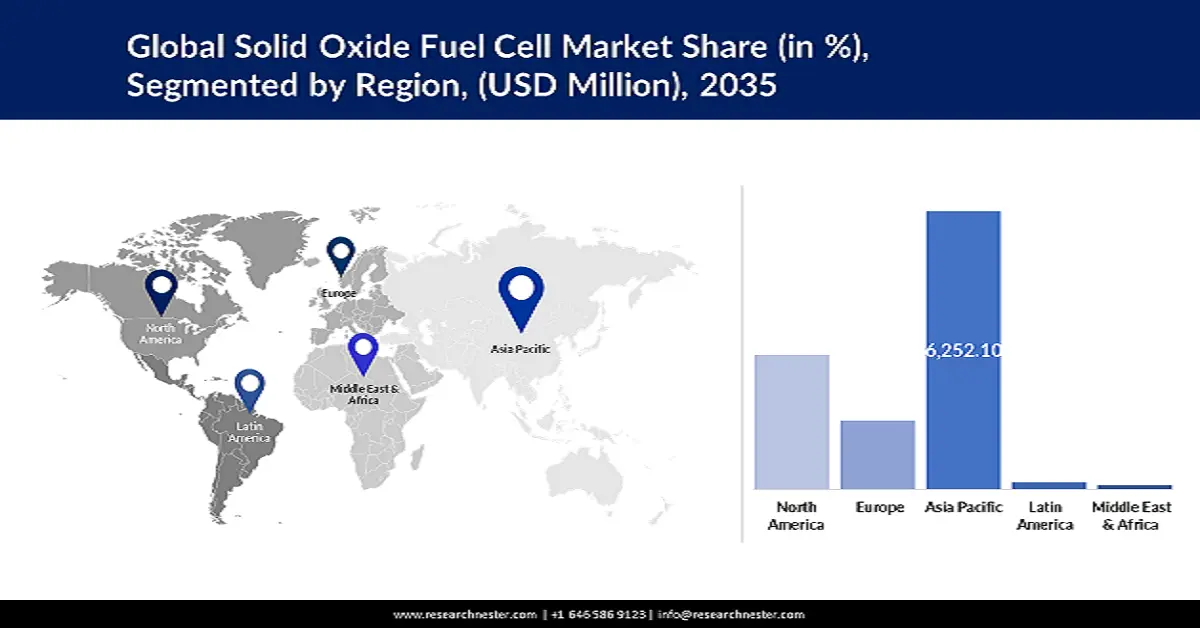

Solid Oxide Fuel Cell Market Regional Analysis:

APAC Market Insights

The Asia Pacific solid oxide fuel cell market is poised to dominate 56% revenue share by 2035. The region’s growth is accredited to public and private initiatives to transform electricity and power production. For instance, programs funded by the government such as ENE-FARM in Japan, along with rising demand for energy-efficient power generation, are likely to boost the market's growth. A new department was formed in CSIR-CGCRI, Kolkata, India known as Fuel Cell & Battery (FCB) to develop viable technologies in different important and upcoming areas in the non-conventional energy sector namely solid oxide fuel cell (SOFC).

China is among the world leaders in terms of fuel cell and hydrogen production. The country exported hydrogen worth USD 3.34 billion, followed by Japan and South Korea. Graphite, another raw material in SOFCs, is also primarily produced and exported from China (supplying 62% of total world output as of 2021). The U.S. was 76% dependent on cobalt imports to meet domestic requirements. Whereas, cobalt mining is primarily concentrated in China and the Democratic Republic of Congo.

North America Market Insights

The North America solid oxide fuel cell market is driven by mounting energy demand, rapid urbanization, and increasing electricity demand, especially from renewable sources. For instance, according to the U.S. Energy Information Administration, total electricity consumption in 2022 was 14 times greater than in 1950, which is equivalent to approximately 4.05 trillion kWh. Besides, in 2021, annual energy production was equal to 97.78 quads and consumption equaled 97.33 quads. Furthermore, about 61% of total electricity generation in 2021 in the United States was produced from fossil fuels.

Key North America Companies through 2021

|

Name |

Country |

Market cap (in USD billion) |

Technology |

|

Plug Power, Inc. |

The U.S. |

24,4 |

PEM |

|

Ballard Power Systems, Inc. |

Canada |

8.55 |

PEM |

|

Fuelcell Energy, Inc. |

The U.S. |

5.76 |

Solid oxide |

|

Bloom Energy Corp |

The U.S. |

4.76 |

Solid oxide |

Source: World Hydrogen Leaders

The U.S. DOE has a dedicated hydrogen and fuel cell technologies office (HFCT) that offers grants to aid R&D activities in the field. The particular sub-program objectives are to develop a 68-72% peak-efficient direct H2 fuel cell power systems catering heavy-duty vehicles that can achieve approximately 30,000-hour durability and mass production at USD 80/kw by the end of 2030. The hydrogen sector is more than 10 million MMT/yr in the country and 65100 MMT/yr globally. Considering its pathways to Princeton Net-Zero America E+RE+ and Net-Zero Greenhouse Gas Emissions scenarios, the U.S. is estimated to reach 100 MMT H2/yr in 2050, thereby aiding solid oxide fuel cell market growth.