Global Solid Oxide Fuel Cell Market

- Market Definition and Research Methodology

- Market Definition

- Market Segmentation

- Market Size Methodology

- Assumptions and Acronyms

- Research Methodology

- Research Process

- Primary Research

- Secondary Research

- Executive Summary – Global Solid Oxide Fuel Cell Market

- Market Dynamics

- Market Drivers

- Restraints

- Opportunities

- Trends

- Regulatory and Standards Landscape

- Industry Risk Analysis

- Impact of COVID-19 on the Solid Oxide Fuel Cell Market

- Technology Analysis

- Value Chain Analysis

- Industry Growth Outlook

- Pricing Analysis

- Regional Demand Analysis

- Comparative Analysis

- Competitive Positioning

- Competitive Landscape

- Market Share Analysis, 2023

- Competitive Benchmarking

- Kyocera Corporation

- SolydEra

- Elcogen AS

- Fuel Cell Energy

- POSCO Energy

- H2E Power

- ZTEK Corporation

- Sunfire

- Doosan Fuel Cell

- Bloom Energy

- Mitsubishi Power

- Aisin Seiki Co

- Ceres Power

- Hitachi Zosen

- Global Solid Oxide Fuel Market 2023-2036

- Market Overview

- By Value (USD Million)

- By Volume (Thousand Units)

- Global Solid Oxide Fuel Cell Market-Market Segmentation Analysis 2023-2036

- By Type

- Planar, 2023-2036F (USD Million & Thousand Units)

- Tubular, 2023-2036F (USD Million & Thousand Units)

- By Mobility

- Stationary, 2023-2036F (USD Million & Thousand Units)

- Portable, 2023-2036F (USD Million & Thousand Units)

- By Application

- Combined Heat & Power, 2023-2036F (USD Million)

- Power Generation, 2023-2036F (USD Million)

- Others, 2023-2036F (USD Million)

- By End User

- Data Centers, 2023-2036F (USD Million)

- Commercial & Retail, 2023-2036F (USD Million)

- Residential, 2023-2036F (USD Million)

- Others, 2023-2036F (USD Million)

- Global Solid Oxide Fuel Cell Market by Region

- North America, 2023-2036F (USD Million & Thousand Units)

- Latin America, 2023-2036F (USD Million & Thousand Units)

- Europe, 2023-2036F (USD Million & Thousand Units)

- Asia Pacific, 2023-2036F (USD Million & Thousand Units)

- Middle East & Africa, 2023-2036F (USD Million & Thousand Units)

- By Type

- Cross Analysis of Type w.r.t End User, 2023

- North America Solid Oxide Fuel Cell Market 2023-2036

- Leading Players in the Region

- By Value (USD Million)

- By Volume (Thousand Units)

- By Type

- Planar, 2023-2036F (USD Million & Thousand Units)

- Tubular, 2023-2036F (USD Million & Thousand Units)

- By Mobility

- Stationary, 2023-2036F (USD Million & Thousand Units)

- Portable, 2023-2036F (USD Million & Thousand Units)

- By Application

- Combined Heat & Power, 2023-2036F (USD Million)

- Power Generation, 2023-2036F (USD Million)

- Others, 2023-2036F (USD Million)

- By End User

- Data Centers, 2023-2036F (USD Million)

- Commercial & Retail, 2023-2036F (USD Million)

- Residential, 2023-2036F (USD Million)

- Others, 2023-2036F (USD Million)

- By Country

- U.S., 2023-2036F (USD Million & Thousand Units)

- Canada, 2023-2036F (USD Million & Thousand Units)

- By Type

- Europe Solid Oxide Fuel Cell Market 2023-2036

- Leading Players in the Region

- By Value (USD Million)

- By Volume (Thousand Units)

- By Type

- By Mobility

- By Application

- By End-User

- By Country

- U.K., 2023-2036F (USD Million & Thousand Units)

- Germany, 2023-2036F (USD Million & Thousand Units)

- Italy, 2023-2036F (USD Million & Thousand Units)

- France, 2023-2036F (USD Million & Thousand Units)

- Spain, 2023-2036F (USD Million & Thousand Units)

- Russia, 2023-2036F (USD Million & Thousand Units)

- Netherland, 2023-2036F (USD Million & Thousand Units)

- Rest of Europe, 2023-2036F (USD Million & Thousand Units)

- Asia Pacific Solid Oxide Fuel Cell Market 2023-2036

- Leading Players in the Region

- By Value (USD Million)

- By Volume (Thousand Units)

- By Type

- By Mobility

- By Application

- By End-User

- By Country

- Australia, 2023-2036F (USD Million & Thousand Units)

- Japan, 2023-2036F (USD Million & Thousand Units)

- Singapore, 2023-2036F (USD Million & Thousand Units)

- South Korea, 2023-2036F (USD Million & Thousand Units)

- India, 2023-2036F (USD Million & Thousand Units)

- China, 2023-2036F (USD Million & Thousand Units)

- Rest of Asia Pacific, 2023-2036F (USD Million & Thousand Units)

- Latin America Solid Oxide Fuel Cell Market 2023-2036

- Leading Players in the Region

- By Value (USD Million)

- By Volume (Thousand Units)

- By Type

- By Mobility

- By Application

- By End-User

- By Country

- Brazil, 2023-2036F (USD Million & Thousand Units)

- Argentina, 2023-2036F (USD Million & Thousand Units)

- Mexico, 2023-2036F (USD Million & Thousand Units)

- Rest of Latin America, 2023-2036F (USD Million & Thousand Units)

- Middle East & Africa Solid Oxide Fuel Cell Market 2023-2036

- Leading Players in the Region

- By Value (USD Million)

- By Volume (Thousand Units)

- By Type

- By Mobility

- By Application

- By End-User

- By Country

- GCC, 2023-2036F (USD Million & Thousand Units)

- Israel, 2023-2036F (USD Million & Thousand Units)

- South Africa, 2023-2036F (USD Million & Thousand Units)

- Rest of Middle East & Africa, 2023-2036F (USD Million & Thousand Units)

- Bibliography

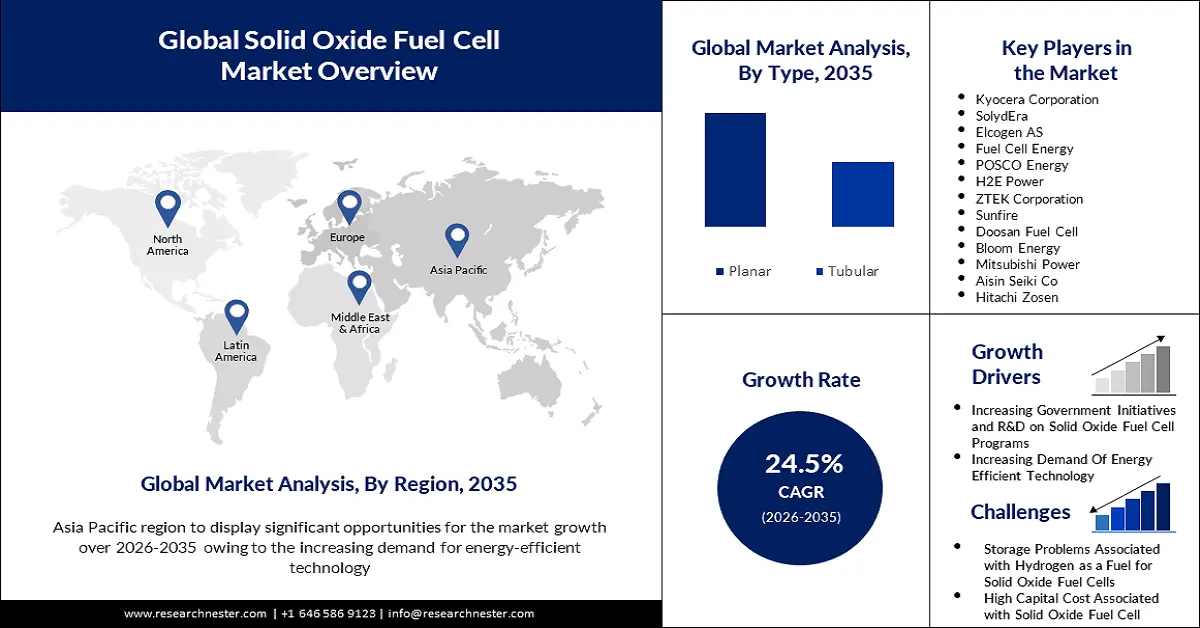

Solid Oxide Fuel Cell Market Outlook:

Solid Oxide Fuel Cell Market size was valued at USD 2.51 billion in 2025 and is set to exceed USD 22.46 billion by 2035, registering over 24.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of solid oxide fuel cell is estimated at USD 3.06 billion.

Over the past few decades, energy technologies have emerged as the key end users of critical metals to cope with the paradigm shift of energy transition. This has resulted in a huge demand for noble metals such as cobalt and nickel, which are the critical raw materials required for solid oxide fuel cells. China accounts for 63% of the total rare earth mining, making it a strategic resource on the global map. Most cobalt (70%) is sourced in the Democratic Republic of the Congo (Kinshasa) and China with fewer production projects outside of these countries.

As of 2022, the world cobalt mine reserve was 8,300,000 metric tons and 190,000 metric tons were mined, primarily by Kinshasa and China remained the largest consumer. Nickel reserve was over 100,000,0000 metric tons and 3,300,000 metric tons was mined. Indonesia has increased its nickel mining, amounting to 20% of the globally mined share. Zirconium was the third largest sourced earth element, with a production volume of 1,400,000 metric tons of 68,000,000 metric tons reserve. The leading exporters of zirconium concentrates were Senegal, South Africa, and Australia. Both cobalt and nickel are the key materials used in solid oxide fuel cells (SOFCs) and solid oxide electrolyzer cell (SOEC) batteries, and the demand for both is expected to be 2 and 5 times higher in 2040 than in the 2010s.

By the year 2033, SOFCs are expected to find widespread adoption in industrial and commercial sectors, stationary power segments, data centers, and defense and military institutions, with residential sectors following closely behind. On the other hand, it has become vitally important to continue R&D to identify advanced chemical alternative materials to move solid oxide cell manufacturing away from dependency on critical element mining. In May 2024, the U.S. Department of Energy’s (DOE) Office of Fossil Energy and Carbon Management (FECM) initiated a RFI to promote the development of efficient reversible solid oxide fuel cells (R-SOFC). The prospects are aligned with near-zero emissions of CO2 by increasing hydrogen production capacity.

Solid Oxide Fuel Cells Projects Review through 2022

|

Project Number |

Title |

Lead Organization |

Total Funding |

Project Duration |

||

|

|

|

|

DOE |

Cost Share |

From |

To |

|

FE0031975 |

A Highly Efficient and Affordable Hybrid System for Hydrogen and Electricity Production |

Phillips 66 Company |

$3,000,000 |

$450,000 |

09/27/2020 |

09/26/2023 |

|

FE0031976 |

Low Cost Solid Oxide Fuel Cells for Small-Scale Distributed Power Generation |

Redox Power Systems LLC |

$2,060,653 |

$665,177 |

12/01/2020 |

11/30/2023 |

|

FE0031639 |

MW-Class SOFC Pilot System Development |

FuelCell Energy Inc |

$1,500,000 |

$375,001 |

08/17/2018 |

02/16/2023 |

|

FWP1022460 |

Solid Oxide Fuel Cell Integrated Energy System |

National Energy Technology Laboratory |

$4,000,002 |

$0 |

04/01/2019 |

03/31/2022 |

|

|

$10,560,655 |

$1,490,178 |

|

|||

|

|

$12,050,833 |

|

||||

Source: NETL

Key Solid Oxide Fuel Cell Market Insights Summary:

Regional Highlights:

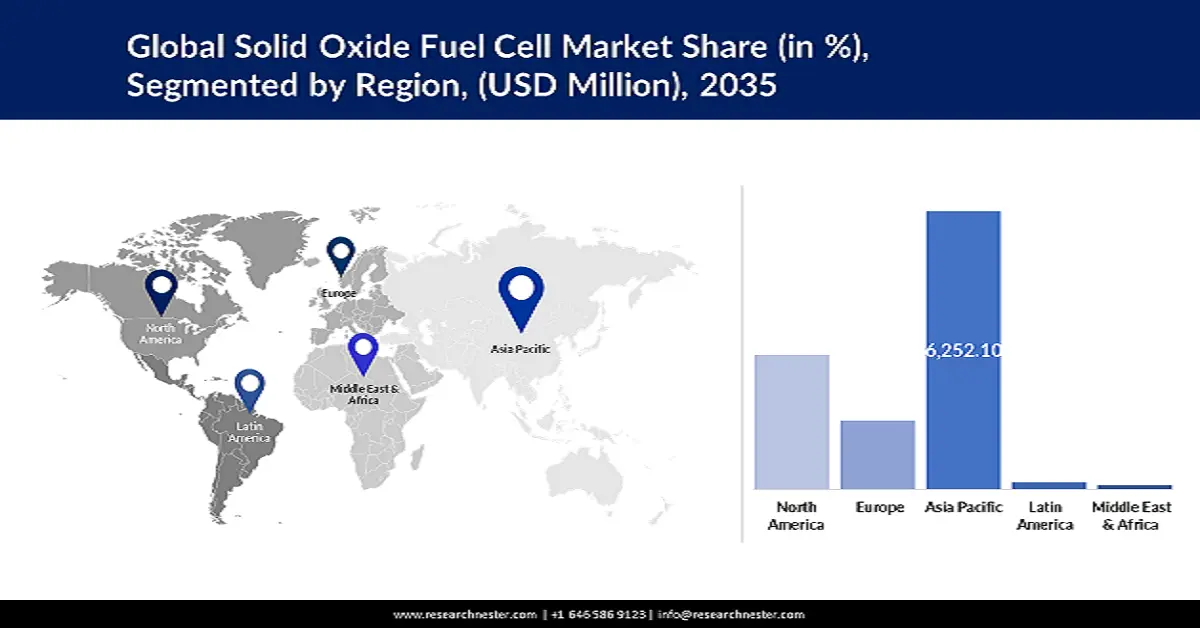

- Asia Pacific solid oxide fuel cell market will dominate over 56% share by 2035, fueled by public and private initiatives for energy-efficient power production.

Segment Insights:

- The commercial & retail segment in the solid oxide fuel cell market is expected to hold a majority share by 2035, influenced by the affordability, compact size, and thermal integration capabilities of SOFCs.

- The planar segment in the solid oxide fuel cell market is expected to capture a significant share by 2035, fueled by the uncomplicated geometry and high efficiency of planar solid oxide fuel cells.

Key Growth Trends:

- Increasing government initiatives and R&D on solid oxide fuel cell programs

- Increasing mergers and acquisitions

Major Challenges:

- High capital cost associated with solid oxide fuel cell

Key Players: Kyocera Corporation, SolydEra, Elcogen AS, Fuel Cell Energy, POSCO Energy, H2E Power, ZTEK Corporation, Sunfire, Doosan Fuel Cell, Bloom Energy, Mitsubishi Power, Aisin Seiki Co, Ceres Power, Hitachi Zosen.

Global Solid Oxide Fuel Cell Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.51 billion

- 2026 Market Size: USD 3.06 billion

- Projected Market Size: USD 22.46 billion by 2035

- Growth Forecasts: 24.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (56% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Japan, China, Germany, South Korea

- Emerging Countries: China, Japan, South Korea, India, Singapore

Last updated on : 9 September, 2025

Solid Oxide Fuel Cell Market Growth Drivers and Challenges:

Growth Drivers

- Increasing government initiatives and R&D on solid oxide fuel cell programs: The increasing government incentives support solid oxide fuel cell market growth. In the U.S., several programs provide various incentives to strengthen the domestic supply chain. For instance, the Office of Fossil Energy (FE), U.S. Department of Energy, for USD 2.8 million in funding for cost-shared research and development projects. This will facilitate the development of cost-competitive fossil-based power generation with limited emissions. Besides, in September 2020, the U.S. Department of Energy (DOE) announced the selection of 12 projects to receive approximately the USD 34 million for small-scale solid oxide fuel cell systems.

The California Energy Commission (CEC) in October 2020 approved USD 384 million in funds for clean transportation plan. It aims at closing gaps in infrastructure and zero-emissions fuels in order to phase out the sale of gasoline-powered passenger vehicles by the end of 2035. Additionally, the following investment has been dedicated toward medium- to heavy-duty EV workforce development and charging infrastructure:- USD 129.8 million for heavy- and medium-duty zero emissions EVs (ZEVs)

- USD 70 million for hydrogen infrastructure

- USD 25 million for near-zero-carbon fuel manufacturing and supply

- USD 9 million for ZEV production

In July 2020, a MOU was signed by the governors of Colorado, California, Connecticut, Hawaii, Maine, the District of Columbia, Maryland, New Jersey, Massachusetts, New York, Oregon, North Carolina, Pennsylvania, Vermont, Rhode Island, and Washington. It devised a multi-state action plan to achieve 30% of all new medium- to heavy-duty vehicle purchases be ZEVs by 2030 and reach 100% in sales by 2050. Another regional effort was the ZEV Task Force to foster the deployment of 3.3 million zero emission vehicles by the end of 2025.

- Increasing mergers and acquisitions: The Fayetteville Public Works Commission (PWC) announced in May 2022 that it had reached an agreement with Bloom Energy to design the installation and operation of 1.5 megawatts of solid oxide fuel cells. The new project will cut emissions and enhance the municipality of Fayetteville's attempts to achieve North Carolina's clean energy criteria. The system generates power from numerous biogas streams, and the fuel cell installation will be situated next to PWC's P.O. Hoffer Water Treatment Center.

Challenge

- High capital cost associated with solid oxide fuel cell: A solid oxide fuel cell is an intricate synthesis of multiple chemical components that electrocatalytically oxidizes methane, LPG, and other natural gas-based fuels to generate electricity. Since, the fundamental chemical reaction is exothermic, SOFC runs at extremely high temperatures, typically between 700°C-1,200°C. Conventional ceramic electrolytes are ineffective at these temperatures. Yttria-stabilized zirconia (YSZ) is therefore required as an electrolyte. Zirconium possesses properties that resemble those of titanium and a melting point of 1,852 °C. Zirconium, however, costs about twice as much per unit as the ceramic-based electrolytes.

Solid Oxide Fuel Cell Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

24.5% |

|

Base Year Market Size (2025) |

USD 2.51 billion |

|

Forecast Year Market Size (2035) |

USD 22.46 billion |

|

Regional Scope |

|

Solid Oxide Fuel Cell Market Segmentation:

Type Segment Analysis

The planar segment in the solid oxide fuel cell market is estimated to gain a significant revenue share over the projected time frame. The uncomplicated geometry and relatively simple construction method are contributing to the emergence of the planar solid oxide fuel cell. Planar solid oxide fuel cells are a preferred choice for power backup and voltage variations due to their high efficiency, large capacity, and continuous power generation capability. Planar SOFCs reach larger power densities than tubular SOFCs. For instance, Elcogen AS provides solid oxide cells which are compatible with third-party stacks. These are anode-supported, planar, ceramic cells. The operating temperature of the cell which is low i.e., (650°C) allows for extended lifetimes and the use of low-cost components at the stack and system levels.

End user Segment Analysis

By the end of 2035, the commercial & retail segment in the solid oxide fuel cell market is anticipated to garner a majority revenue share. Due to their affordability, compact size, and quiet operation, solid oxide fuel cells (SOFCs) are the perfect source of energy for commercial customers. Thermal integration with current boilers and HVAC systems is also possible owing to the high-temperature waste heat from SOFC. For instance, German company Bosch has created a solid oxide fuel cell system for business and industrial uses and is prepared to ramp up manufacturing in by 2035. This system can run on hydrogen, natural gas, biomethane, or different blending, with an electrical efficiency of greater than 60% and an overall efficiency of approximately 85%.

Our in-depth analysis of the global solid oxide fuel cell market includes the following segments:

|

Type |

|

|

Mobility |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Solid Oxide Fuel Cell Market Regional Analysis:

APAC Market Insights

The Asia Pacific solid oxide fuel cell market is poised to dominate 56% revenue share by 2035. The region’s growth is accredited to public and private initiatives to transform electricity and power production. For instance, programs funded by the government such as ENE-FARM in Japan, along with rising demand for energy-efficient power generation, are likely to boost the market's growth. A new department was formed in CSIR-CGCRI, Kolkata, India known as Fuel Cell & Battery (FCB) to develop viable technologies in different important and upcoming areas in the non-conventional energy sector namely solid oxide fuel cell (SOFC).

China is among the world leaders in terms of fuel cell and hydrogen production. The country exported hydrogen worth USD 3.34 billion, followed by Japan and South Korea. Graphite, another raw material in SOFCs, is also primarily produced and exported from China (supplying 62% of total world output as of 2021). The U.S. was 76% dependent on cobalt imports to meet domestic requirements. Whereas, cobalt mining is primarily concentrated in China and the Democratic Republic of Congo.

North America Market Insights

The North America solid oxide fuel cell market is driven by mounting energy demand, rapid urbanization, and increasing electricity demand, especially from renewable sources. For instance, according to the U.S. Energy Information Administration, total electricity consumption in 2022 was 14 times greater than in 1950, which is equivalent to approximately 4.05 trillion kWh. Besides, in 2021, annual energy production was equal to 97.78 quads and consumption equaled 97.33 quads. Furthermore, about 61% of total electricity generation in 2021 in the United States was produced from fossil fuels.

Key North America Companies through 2021

|

Name |

Country |

Market cap (in USD billion) |

Technology |

|

Plug Power, Inc. |

The U.S. |

24,4 |

PEM |

|

Ballard Power Systems, Inc. |

Canada |

8.55 |

PEM |

|

Fuelcell Energy, Inc. |

The U.S. |

5.76 |

Solid oxide |

|

Bloom Energy Corp |

The U.S. |

4.76 |

Solid oxide |

Source: World Hydrogen Leaders

The U.S. DOE has a dedicated hydrogen and fuel cell technologies office (HFCT) that offers grants to aid R&D activities in the field. The particular sub-program objectives are to develop a 68-72% peak-efficient direct H2 fuel cell power systems catering heavy-duty vehicles that can achieve approximately 30,000-hour durability and mass production at USD 80/kw by the end of 2030. The hydrogen sector is more than 10 million MMT/yr in the country and 65100 MMT/yr globally. Considering its pathways to Princeton Net-Zero America E+RE+ and Net-Zero Greenhouse Gas Emissions scenarios, the U.S. is estimated to reach 100 MMT H2/yr in 2050, thereby aiding solid oxide fuel cell market growth.

Solid Oxide Fuel Cell Market Players:

- Bloom Energy

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- FuelCell Energy

- Cummins, Inc.

- Nexceris

- Mitsubishi Power, Ltd.

- Kyocera

- SOLIDPower

- Hitachi

- Robert Bosch

- Special Power Sources

- Ceres Power Holdings

- OxEon Energy

Here is a list of key players operating in the global hallervorden-spatz disease drugs market:

Recent Developments

- In November 2024, Export-Import Bank of the United States (EXIM) finalized a transaction with a loan guarantee of USD 10 million under its Project & Structured Finance Program to support Connecticut-based exporter FuelCell Energy Inc.

- In September 2024, the U.S. Department of Energy (DOE) Office of Fossil Energy and Carbon Management (FECM) announced up to USD 4 million in federal funding to make clean hydrogen a more available and affordable fuel for electricity generation, industrial decarbonization, and transportation.

- In August 2024, Bloom Energy announced the launch of the Bloom Energy Server power solution with 60% electrical efficiency, using 100% hydrogen.

- Report ID: 3514

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Solid Oxide Fuel Cell Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.