Global Solid Electrolyte Market

- An Outline of the Global Solid Electrolyte Market

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Secondary Research

- Primary Research

- Data Triangulation

- SPSS Approach

- Executive Summary

- Growth Drivers

- Major Roadblocks

- Opportunities

- Prevalent Trends

- Government Regulation

- Technological Advancements

- Growth Outlook

- Patent Analysis

- Risk Overview

- SWOT

- Regional Demand

- Comparative Analysis of Solid Electrolyte Types: Ceramic vs. Solid Polymer

- Global Solid Electrolyte Market: Application Insights & Growth Potential

- Growth Potential for Application of Solid Electrolyte Market

- Root Cause Analysis (RCA) for discovering problems of the Solid Electrolyte Market

- Porter Five Forces

- PESTLE

- Comparative Positioning

- Competitive Landscape: Key Players

- Competitive Model

- Company Market Share - 2024

- Business Profile of Key Enterprise

- AGC Glass Europe SA

- Ampcera

- Empower Materials

- Ganfeng LiEnergy technology Co., Ltd.

- ProLogium Technology CO., Ltd.

- NEI Corporation

- OHARA INC.

- Solid Power Inc.

- Toshima manufacturing Co ltd

- XIAMEN TOB NEW ENERGY TECHNOLOGY Co., LTD

- Global Solid Electrolyte Market Outlook

- Market Overview

- Market Revenue by Value (USD Thousand) and Compound Annual Growth Rate (CAGR)

- Solid Electrolyte Market Segmentation Analysis (2025-2038)

- By Type

- Ceramic, Market Value (USD Thousand) and CAGR, 2025-2038F

- Solid Polymer, Market Value (USD Thousand) and CAGR, 2025-2038F

- By Application

- Thin-Film Battery, Market Value (USD Thousand) and CAGR, 2025-2038F

- Electric Vehicle Battery, Market Value (USD Thousand) and CAGR, 2025-2038F

- Fuel Cells, Market Value (USD Thousand) and CAGR, 2025-2038F

- Gas Sensors, Market Value (USD Thousand) and CAGR, 2025-2038F

- Electrochemical Sensors, Market Value (USD Thousand) and CAGR, 2025-2038F

- Medical Devices, Market Value (USD Thousand) and CAGR, 2025-2038F

- Others, Market Value (USD Thousand) and CAGR, 2025-2038F

- Regional Synopsis, Value (USD Thousand), 2025-2038

- North America Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Europe Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Asia Pacific Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Latin America Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Middle East and Africa Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- By Type

- Market Overview

- North America Market

- Overview

- Market Value (USD Thousand), Current and Future Projections, 2025-2038

- Increment $ Opportunity Assessment, 2025-2038

- Segmentation (USD million), 2025-2038, By

- By Type

- Ceramic, Market Value (USD Thousand) and CAGR, 2025-2038F

- Solid Polymer, Market Value (USD Thousand) and CAGR, 2025-2038F

- By Application

- Thin-Film Battery, Market Value (USD Thousand) and CAGR, 2025-2038F

- Electric Vehicle Battery, Market Value (USD Thousand) and CAGR, 2025-2038F

- Fuel Cells, Market Value (USD Thousand) and CAGR, 2025-2038F

- Gas Sensors, Market Value (USD Thousand) and CAGR, 2025-2038F

- Electrochemical Sensors, Market Value (USD Thousand) and CAGR, 2025-2038F

- Medical Devices, Market Value (USD Thousand) and CAGR, 2025-2038F

- Others, Market Value (USD Thousand) and CAGR, 2025-2038F

- Country Level Analysis, Value (USD Thousand)

- U.S. Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Canada Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- By Type

- Overview

- Europe Market

- Overview

- Market Value (USD Thousand), Current and Future Projections, 2025-2038

- Increment $ Opportunity Assessment, 2025-2038

- Segmentation (USD million), 2025-2038, By

- By Type

- Ceramic, Market Value (USD Thousand) and CAGR, 2025-2038F

- Solid Polymer, Market Value (USD Thousand) and CAGR, 2025-2038F

- By Application

- Thin-Film Battery, Market Value (USD Thousand) and CAGR, 2025-2038F

- Electric Vehicle Battery, Market Value (USD Thousand) and CAGR, 2025-2038F

- Fuel Cells, Market Value (USD Thousand) and CAGR, 2025-2038F

- Gas Sensors, Market Value (USD Thousand) and CAGR, 2025-2038F

- Electrochemical Sensors, Market Value (USD Thousand) and CAGR, 2025-2038F

- Medical Devices, Market Value (USD Thousand) and CAGR, 2025-2038F

- Others, Market Value (USD Thousand) and CAGR, 2025-2038F

- Country Level Analysis, Value (USD Thousand)

- UK Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Germany Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- France Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Italy Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Spain Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Netherlands Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Russia Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Switzerland Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Poland Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Belgium Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Rest of Europe Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- By Type

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Thousand), Current and Future Projections, 2025-2038

- Increment $ Opportunity Assessment, 2025-2038

- Segmentation (USD million), 2025-2038, By

- By Type

- Ceramic, Market Value (USD Thousand) and CAGR, 2025-2038F

- Solid Polymer, Market Value (USD Thousand) and CAGR, 2025-2038F

- By Application

- Thin-Film Battery, Market Value (USD Thousand) and CAGR, 2025-2038F

- Electric Vehicle Battery, Market Value (USD Thousand) and CAGR, 2025-2038F

- Fuel Cells, Market Value (USD Thousand) and CAGR, 2025-2038F

- Gas Sensors, Market Value (USD Thousand) and CAGR, 2025-2038F

- Electrochemical Sensors, Market Value (USD Thousand) and CAGR, 2025-2038F

- Medical Devices, Market Value (USD Thousand) and CAGR, 2025-2038F

- Others, Market Value (USD Thousand) and CAGR, 2025-2038F

- Country Level Analysis, Value (USD Thousand)

- China Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- India Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- South Korea Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Australia Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Indonesia Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Malaysia Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Vietnam Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Thailand Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Singapore Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- New Zeeland Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Rest of Asia Pacific Excluding Japan Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- By Type

- Overview

- Latin America Market

- Overview

- Market Value (USD Thousand), Current and Future Projections, 2025-2038

- Increment $ Opportunity Assessment, 2025-2038

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2025-2038, By

- By Type

- Ceramic, Market Value (USD Thousand) and CAGR, 2025-2038F

- Solid Polymer, Market Value (USD Thousand) and CAGR, 2025-2038F

- By Application

- Thin-Film Battery, Market Value (USD Thousand) and CAGR, 2025-2038F

- Electric Vehicle Battery, Market Value (USD Thousand) and CAGR, 2025-2038F

- Fuel Cells, Market Value (USD Thousand) and CAGR, 2025-2038F

- Gas Sensors, Market Value (USD Thousand) and CAGR, 2025-2038F

- Electrochemical Sensors, Market Value (USD Thousand) and CAGR, 2025-2038F

- Medical Devices, Market Value (USD Thousand) and CAGR, 2025-2038F

- Others, Market Value (USD Thousand) and CAGR, 2025-2038F

- Country Level Analysis, Value (USD Thousand)

- Brazil Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Argentina Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Mexico Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Rest of Latin America Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- By Type

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Thousand), Current and Future Projections, 2025-2038

- Increment $ Opportunity Assessment, 2025-2038

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2025-2038, By

- By Type

- Ceramic, Market Value (USD Thousand) and CAGR, 2025-2038F

- Solid Polymer, Market Value (USD Thousand) and CAGR, 2025-2038F

- By Application

- Thin-Film Battery, Market Value (USD Thousand) and CAGR, 2025-2038F

- Electric Vehicle Battery, Market Value (USD Thousand) and CAGR, 2025-2038F

- Fuel Cells, Market Value (USD Thousand) and CAGR, 2025-2038F

- Gas Sensors, Market Value (USD Thousand) and CAGR, 2025-2038F

- Electrochemical Sensors, Market Value (USD Thousand) and CAGR, 2025-2038F

- Medical Devices, Market Value (USD Thousand) and CAGR, 2025-2038F

- Others, Market Value (USD Thousand) and CAGR, 2025-2038F

- Country Level Analysis, Value (USD Thousand)

- Saudi Arabia Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- UAE Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Israel Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Qatar Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Kuwait Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Oman Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- South Africa Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- Rest of Middle East & Africa Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2025-2038F

- By Type

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

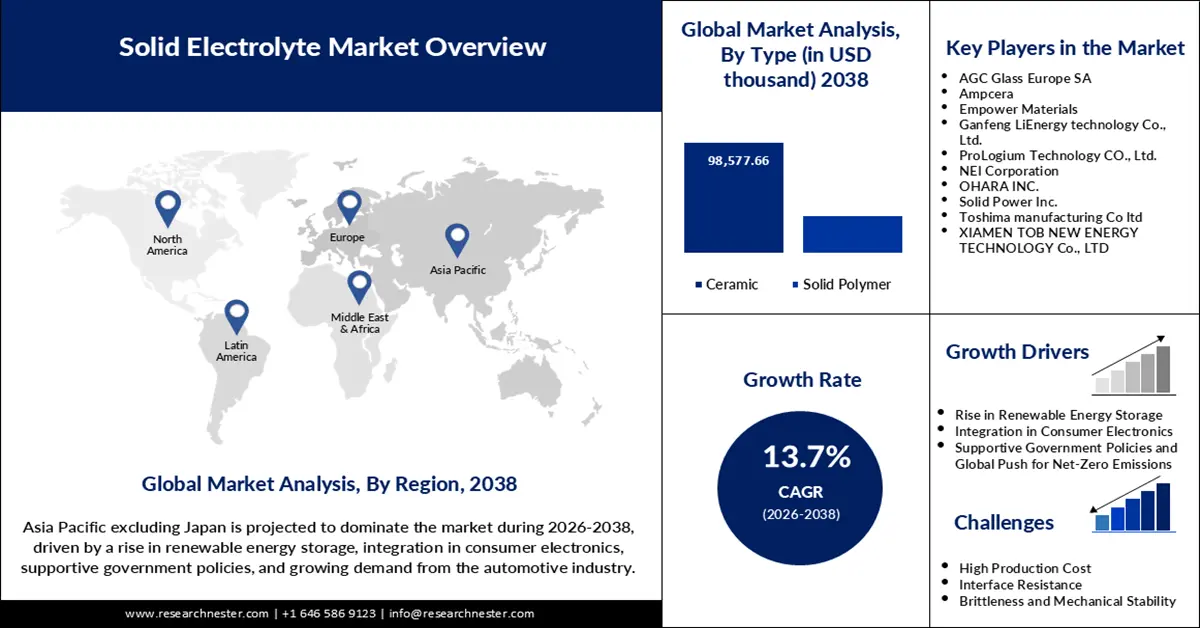

Solid Electrolyte Market Outlook:

Solid Electrolyte Market size was valued at USD 23,980 thousand in 2025 and is projected to reach a valuation of USD 132,844.2 thousand by the end of 2038, rising at a CAGR of 13.7% during the forecast period, i.e., 2026-2038. In 2026, the industry size of solid electrolyte is assessed at USD 28,353.2 thousand.

The solid electrolyte market is expanding rapidly as vehicle manufacturers and producers propel investment in next-generation battery technologies. In September 2024, NEI Corporation launched a chlorine-doped lithium phosphorus sulfur chloride solid electrolyte, Li₅.₅PS₄.₅Cl₁.₅, with high ionic conductivity and stability appropriate for premium battery applications. This launch demonstrates an emphasis in the industry for increased performance and safety in all-solid-state batteries. Strategic partnerships are also formed in the market, as seen in the January 2024 agreement between SK On and Solid Power, which aims to accelerate the commercialization of all-solid-state batteries and establish stronger market positions for both companies. In 2021, SK On spent USD 30 million in Solid Power and jointly developed next-generation ASSBs. With growing demand for denser and safer batteries, players are stepping up pilot facilities and R&D activities to offset supply chain and productivity challenges.

The solid electrolytes supply chain is dependent on lithium, sulfide, and oxide-based raw materials, with China’s total new lithium ore discoveries exceeding 30 million metric tons (since 2021), lifting its global reserve share from 6% to 16.5 %. The U.S. is increasing domestic mining as a method of mitigating the risk of supply, with the Inflation Reduction Act requiring 60% of critical minerals to be mined within the U.S. or its allies by 2025. The manufacturing capacity is increasing, and the Department of Energy (DOE) announced a $25 million investment in 11 projects to develop machinery, equipment, materials, and methods for domestic next-generation battery manufacturing.

Key Solid Electrolyte Market Insights Summary:

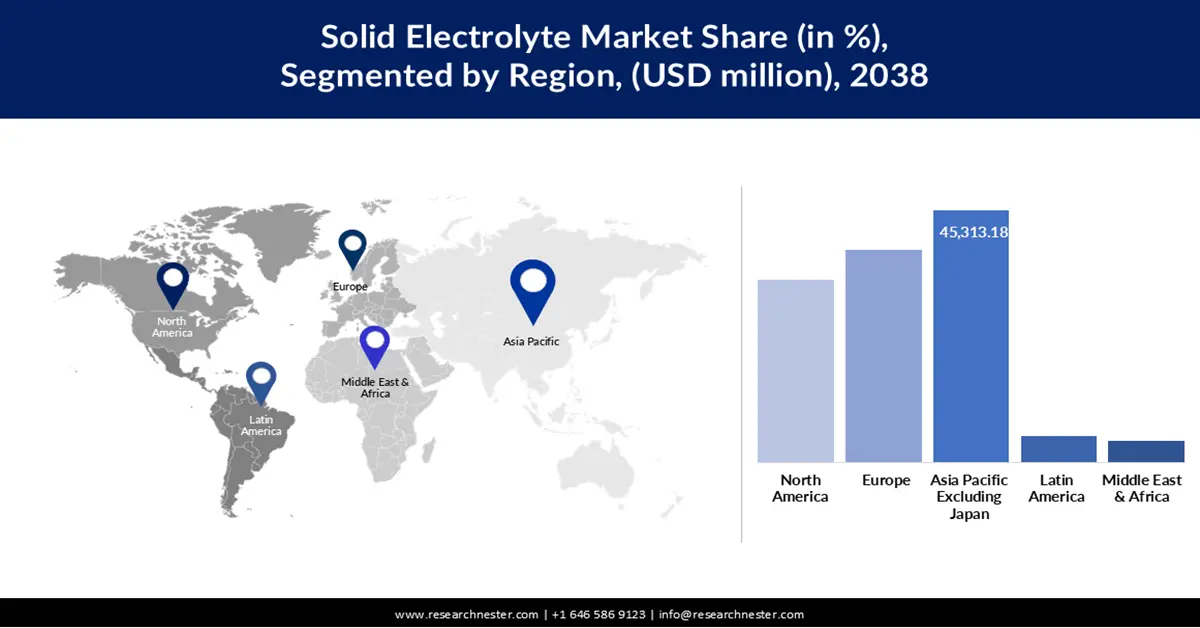

Regional Insights:

- Asia Pacific excluding Japan Solid Electrolyte Market is projected to hold a 34.1% share by 2038, owing to rising industrialization, government subsidies, and expansion of large-scale battery manufacturing facilities.

- North America is anticipated to grow at a 14.5% CAGR from 2026 to 2038 due to increasing R&D investments, automotive collaborations, and federal support for battery production and supply chain resilience.

Segment Insights:

- The ceramic segment in the Solid Electrolyte Market is forecast to account for 73.2% share during the forecast period, propelled by its superior ionic conductivity, thermal stability, and compatibility with high-energy battery chemistry.

- The electric vehicle battery segment is anticipated to capture a 43.9% market share by 2038, driven by the rapid adoption of solid-state batteries for their safety, energy density, and fast-charging advantages.

Key Growth Trends:

- Automotive electrification and all-solid-state batteries

- Innovation in solid electrolyte materials and manufacturing

Major Challenges:

- Scalability and complexity of solid electrolyte manufacture

- Integration and commercialization in EV batteries

Key Players: NEI Corporation, Ohara Inc., Empower Materials, Ampcera Corp., Iconic Material Inc., Toshima Manufacturing Co., Solid Power, Panasonic, Samsung SDI, LG Energy, Idemitsu Kosan, Samyang Corporation, Altech Batteries Ltd, Lithium Australia, Neogen Chemicals.

Global Solid Electrolyte Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 23,980 thousand

- 2026 Market Size: USD 28,353.2 thousand

- Projected Market Size: USD 132,844.2 thousand by 2038

- Growth Forecasts: 13.7% CAGR (2026-2038)

Key Regional Dynamics:

- Largest Region: Asia Pacific excluding Japan (34.1% Share by 2038)

- Fastest Growing Region: North America

- Dominating Countries: China, Japan, South Korea, United States, Germany

- Emerging Countries: India, France, Canada, United Kingdom, Singapore

Last updated on : 6 October, 2025

Solid Electrolyte Market - Growth Drivers and Challenges

Growth Drivers

- Automotive electrification and all-solid-state batteries: A major driver is the surge in car electrification, coupled with the intense competition to introduce all-solid-state batteries to the market. Volkswagen's PowerCo partnered with QuantumScape in November 2024 to initiate the mass production of solid-state cells, with the goal of expanding EV manufacturing capabilities with longer-range, quick-charging batteries. The partnership highlights the automotive sector's central role in propelling solid electrolyte uptake. The sector is also benefiting from improvements in energy density and lifespan, with Toyota's technological advances reducing battery size and cost while boosting performance. Demand for solid electrolytes is set to grow as automakers compete on safety and range. As the players in the automotive industry vie for improved range and safety, demand for robust solid electrolytes is poised to surge.

- Innovation in solid electrolyte materials and manufacturing: The second key driver of the market is the pace of innovation in solid electrolyte materials and manufacturing. Ampcera Inc. launched nano sulfide solid electrolyte powders for global shipping in May 2025 to charge high-performance all-solid-state batteries. The material's consistent particle morphology and submicron grain size ensure improved battery applications and enable global commercialization. Additionally, the European Commission's launch of the European Energy Storage Inventory in March 2025 is enabling industry and policy scale-up of solid electrolyte deployments. These projects are establishing an active research, production, and market development ecosystem.

- Expanding electric vehicle (EV) production: Automakers around the world are rapidly moving into electric vehicle, or EV, production to reduce emissions goals and meet demand from consumers, creating a strong pull for next-generation batteries. Solid electrolytes will allow for rapid charging, long cycle life, and lighter overall battery packs, making them suitable for use in EVs. Globally, 17.3 million electric vehicles were manufactured in 2024, which is around 25% more than in 2023. This was mostly due to China's increasing output, which reached 12.4 million electric vehicles. In addition, government incentives, such as the U.S. Inflation Reduction Act and Europe’s Green Deal, fast-track investments and efficiency for solid-state battery production. Meanwhile, automakers are forming alliances with materials suppliers to increase their competitiveness in range, safety, and costs.

Challenges

- Scalability and complexity of solid electrolyte manufacture: The scalability and complexity of solid electrolyte manufacture are key challenges. In March 2025, South Korea's ETRI developed a solid electrolyte membrane with a thickness of 18 μm through a solvent-free dry process, offering a 10 times higher energy density compared to conventional approaches. Even though this innovation allows production at scale, sophisticated but economical manufacturing remains a sticking point. New processes and quality control must be invested in to be capable of consistently producing high-performance at commercial volume. This is compounded by the need to balance performance, safety, and cost-effectiveness in a competitive market.

- Integration and commercialization in EV batteries: The integration and commercialization of EV batteries is another crucial challenge for the solid electrolytes market. Stellantis and Factorial Energy demonstrated FEST solid-state battery cells with 375 Wh/kg energy density in April 2025, aiming for integration into a demonstration EV fleet by 2026. Technical improvements aside, ramping from pilot to volume production involves overcoming obstacles in cell formation, module assembly, and supply chain logistics. Regulatory standards and the need for robust, reliable performance only add to this, stifling mass adoption and necessitating ongoing investment in R&D and manufacturing infrastructure.

Solid Electrolyte Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2038 |

|

CAGR |

13.7% |

|

Base Year Market Size (2025) |

USD 23,980 thousand |

|

Forecast Year Market Size (2038) |

USD 132,844.2 thousand |

|

Regional Scope |

|

Solid Electrolyte Market Segmentation:

Type Segment Analysis

The ceramic segment is predicted to account for 73.2% market share during the forecast period with its superior ionic conductivity, thermal stability, and high-energy battery chemistry compatibility. ProLogium Technology introduced a film-free battery architecture on a ceramic separator in September 2024, which enhances battery performance and enables scalable mass manufacturing. Ceramic electrolytes are favored due to their safety record and suitability for enabling lithium metal anodes, which are optimally suited for next-generation grid and EV storage applications. The segment growth is also stimulated by innovation in processing ceramics as well as integration with advanced electrode materials. As energy density and safety needs grow, ceramics will continue to be the leading segment in the market.

Application Segment Analysis

The electric vehicle battery market is expected to reach a 43.9% share by 2038, demonstrating the central role of solid electrolytes in the future of mobility. For instance, Mercedes-Benz revealed its initial solid-state battery test car in February 2025, based on a modified EQS featuring Factorial Energy's lithium-metal solid-state battery. The battery delivers up to 450 Wh/kg and supports more than 1,000 km range, demonstrating the technology's revolutionary potential in EVs. The automotive sector prefers solid-state batteries due to their safety, quick charging, and energy density advantage, resulting in quick adoption in the EV segment.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Solid Electrolyte Market - Regional Analysis

APEJ Market Insights

Asia Pacific excluding Japan solid electrolyte market is anticipated to maintain a 34.1% market share during the forecast period as a result of increased industrialization, government subsidies, and strong battery manufacturing facilities. In September 2024, LOTTE Energy Materials completed a pilot plant for sulfide-based solid electrolytes with an annual production capacity of up to 70 tons in South Korea, supporting next-generation all-solid-state battery production. The region is also witnessing mass production milestones, with Ganfeng Lithium’s 4 GWh solid-state battery line and Xiaomi’s entry into advanced battery R&D. APAC’s leadership in EV adoption and battery innovation is fueling robust market growth.

China solid electrolyte sector is developing at a rapid rate with the support of government policy, R&D spending, and large-scale manufacturing. In 2025, Ganfeng Lithium initiated mass production of its first-generation solid-state battery, achieving 260 Wh/kg energy density and a 4 GWh annual capacity. Chinese companies are building in-house manufacturing methods and scaling up supply chains to meet domestic and international demand. Government incentives and EV and grid storage leadership push are placing China at the forefront of solid electrolyte commercialization and innovation globally.

India solid electrolyte market is developing at a robust pace as the country invests in the R&D of batteries, manufacturing, and EV adoption. In April 2023, CIDETEC launched CIDEcell, a flexible battery manufacturing platform for high-speed prototyping and validation for solid-state materials. Indian startups and research institutions are leveraging such platforms for accelerating commercialization and innovation. Government policies on clean energy and domestic manufacturing are promoting the development of advanced solid electrolytes for grid and automotive applications. Focus on scalability, safety, and performance in the market is driving applications in various industries.

North America Market Analysis

North America is anticipated to expand at a 14.5% CAGR from 2026 to 2038, driven by strong R&D spending, car partnerships, and high-end battery production incentives by governments. In May 2025, US-based firm Ampcera launched nano sulfide solid electrolyte powders for export, further strengthening the region's leadership in high-performance battery materials. Automakers and battery producers are adding pilot lines and demonstration fleets, as federal initiatives support local supply chain resilience. Regional focus on commercialization, innovation, and sustainability is positioning North America as a global hub for solid electrolyte technology and manufacturing.

The U.S. solid electrolyte market is witnessing a surge in commercialization and innovation driven by strong investment in advanced battery technology and government incentives for local production. US-based Ampcera Inc. in May 2025 started global shipments of its new nano sulfide solid electrolyte powders with well-controlled morphology and submicron grain size for high-performance all-solid-state batteries. This is a crucial development to make ultra-thin separators possible and allow next-generation battery applications. The U.S. is also benefiting from the addition of new pilot lines and demonstration projects by large auto and battery makers in anticipation of boosting supply chain resilience and accelerating the transition to electric vehicles.

Canada solid electrolytes market is expanding at s significant rate, fueled by strategic investment in battery technology and research programs sponsored by the government. Canada’s Innovation Minister announced a second SDTC investment of $4.1 million in Polar Sapphire to advance high-purity alumina production for next-generation solid-state lithium-ion batteries. The effort aims to fill the key gap between laboratory breakthroughs and commercial manufacturing, enabling Canada to establish itself as a top player in North America's battery supply chain. Apart from this, collaborations with the world's players are bringing in new talent and funding to Canadian firms, making the country competitive globally when it comes to solid electrolytes.

Europe Market Insights

Europe is expected to garner significant growth between 2026 and 2038, supported by regulatory initiatives, investment in supply chains, and industrial scale-up. The EU-funded SEATBELT project under Horizon Europe develops a safe, cost-effective all-solid-state lithium battery using a hybrid organic-inorganic electrolyte, targeting >380 Wh/kg energy density and >500-cycle lifespan by 2026. EU companies like AGC Glass Europe are constructing in-house manufacturing technology for sulfide electrolytes, improving efficiency and quality. The focus in the EU on sustainability, circular economy, and battery development is attracting investment and forming a competitive, cooperative market climate.

Germany's solid electrolyte industry is expanding steadily on the back of its automotive and high-performance materials sectors. Volkswagen's PowerCo and QuantumScape started mass production of solid-state cells in July 2024, targeting longer-range and faster-charging electric vehicles. German producers are investing in ceramic and sulfide-based electrolytes, leveraging their precision engineering and scalable manufacturing. The government's regulatory push towards EV adoption and supply chain protection is fueling demand for high-performance, durable solid electrolytes. With Germany at the forefront of automotive technology, the country's market for solid electrolytes is poised to keep growing.

The UK market for solid electrolytes is also gaining momentum, with both government and industry prioritizing cutting-edge battery research and production. In June 2025, Xiaomi unveiled a new patent for a multi-layered electrode structure for a solid-state battery, a milestone in the UK's growing contribution to battery R&D. The industry is also being driven by collaboration between start-ups and established manufacturers, focused on upscaling pilot lines and commercializing new materials. The UK's emphasis on innovation, regulatory compliance, and sustainability is propelling the application of solid electrolytes in automotive, grid, and consumer electronics.

Key Solid Electrolyte Market Players:

- NEI Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ohara Inc.

- Empower Materials

- Ampcera Corp.

- Iconic Material Inc.

- Toshima Manufacturing Co.

- Solid Power

- Panasonic

- Samsung SDI

- LG Energy

- Idemitsu Kosan

- Samyang Corporation

- Altech Batteries Ltd

- Lithium Australia

- Neogen Chemicals

The solid electrolyte market is highly competitive with leading players investing in material R&D, scale-up production, and collaboration. A recent development was observed in May 2025, when Ampcera launched a sulfide solid electrolyte powder with uniform particle morphology and submicron grain size, nano-engineered for high-performance applications in all-solid-state batteries worldwide. This development is enabling the creation of ultra-thin separators as well as the commercialization of higher energy density as well as safer batteries. In light of rising global competition, companies are concentrating on R&D, pilot line expansion, and cross-industry partnerships to acquire market share in the next phase of solid electrolyte technology.

Here are some leading companies in the solid electrolyte market:

Recent Developments

- In June 2025, Xiaomi filed a patent for a layered electrode solid-state battery featuring solid polymer-metal salt electrolytes. The design enables vertical ion conduction, improving energy efficiency and supporting mass production.

- In May 2025, Ampcera’s proprietary nano sulfide solid electrolyte powders enabled the fabrication of ultra-thin separator layers (10 microns or less). These advancements unlock superior performance for solid-state batteries in EVs and electronics.

- In November 2024, Honda Motor Co., Ltd. unveiled a demonstration production line for all-solid-state batteries at its Sakura City, Tochigi Prefecture facility. The line is designed to support Honda’s independent efforts toward mass production, marking a significant step in the company’s electrification strategy.

- In October 2024, NEI Corporation launched Li₃InCl₆ halide solid electrolyte powders for research and development. The product offers high ionic conductivity and processability, supporting advanced battery research.

- Report ID: 7946

- Published Date: Oct 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Solid Electrolyte Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.