- Introduction

- Market Definition and Segmentation

- Study Assumptions and Abbreviation

- Research Methodology

- Secondary Research

- Primary Research

- Data Triangulation

- SPSS

- Executive Summary

- Global Industry Overview

- DROT

- Driver

- Restraint

- Opportunity

- Trend

- Regional Synopsis

- DROT

- Global Outlook and Projects

- Global Overview

- Market Value (USD Million), Volume (MW) Current and Future Projections, 2019-2037

- Regional Synopsis (USD Million), Volume (MW) 2019-2037

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

- North America Outlook and Projections

- Overview

- Market Value (USD Million), Volume (MW) Current and Future Projections, 2019-2037

- Country (USD Million), Volume (MW) 2019-2037

- US

- Canda

- US Outlook and Projection

- Overview

- Market Value (USD Million), Volume (MW) Current and Future Projections, 2019-2037

- Segmentation (USD Million), 2019-2037, By

- Material, Value (USD Million)

- High Speed Steel

- Cold Formed Steel

- Aluminum

- Galvanized Iron

- Others

- Product Type, Value (USD Million), Volume (MW)

- Roof Mounted Structure

- Ground Mounted Structure

- Top-of-pole Mounted Structure

- Side-of-pole Mounted Structure

- Tracking System Mounted Structure

- Thickness, Value ((USD Million)

- 0.5 to 2 mm

- 2 to 3 mm

- 3 to 6 mm

- Others

- End use, Value (USD Million)

- Residential

- Commercial

- Industrial

- Utility

- Europe Outlook and Projections

- Overview

- Market Value (USD Million), Volume (MW) Current and Future Projections, 2019-2037

- Country (USD Million), Volume (MW) 2019-2037

- UK

- Germany

- France

- Italy

- Spain

- NORDIC

- Turkey

- Rest of Europe

- UK Outlook and Projection

- Overview

- Market Value (USD Million), Volume (MW) Current and Future Projections, 2019-2037

- Segmentation (USD Million), 2019-2037, By

- Material, Value (USD Million)

- High Speed Steel

- Cold Formed Steel

- Aluminum

- Galvanized Iron

- Others

- Product Type, Value (USD Million), Volume (MW)

- Roof Mounted Structure

- Ground Mounted Structure

- Top-of-pole Mounted Structure

- Side-of-pole Mounted Structure

- Tracking System Mounted Structure

- Thickness, Value ((USD Million)

- 0.5 to 2 mm

- 2 to 3 mm

- 3 to 6 mm

- Others

- End use, Value (USD Million)

- Residential

- Commercial

- Industrial

- Utility

- Germany Outlook and Projection

- Overview

- Market Value (USD Million), Volume (MW) Current and Future Projections, 2019-2037

- Segmentation (USD Million), 2019-2037, By

- Material, Value (USD Million)

- High Speed Steel

- Cold Formed Steel

- Aluminum

- Galvanized Iron

- Others

- Product Type, Value (USD Million), Volume (MW)

- Roof Mounted Structure

- Ground Mounted Structure

- Top-of-pole Mounted Structure

- Side-of-pole Mounted Structure

- Tracking System Mounted Structure

- Thickness, Value ((USD Million)

- 0.5 to 2 mm

- 2 to 3 mm

- 3 to 6 mm

- Others

- End use, Value (USD Million)

- Residential

- Commercial

- Industrial

- Utility

- Asia Pacific Outlook and Projections

- Overview

- Market Value (USD Million), Volume (MW) Current and Future Projections, 2019-2037

- Country (USD Million), Volume (MW) 2019-2037

- China

- India

- Australia

- South Korea

- Vietnam

- Thailand

- Singapore

- Malaysia

- Rest of Asia Pacific

- Latin America Outlook and Projections

- Overview

- Market Value (USD Million), Volume (MW) Current and Future Projections, 2019-2037

- Country (USD Million), Volume (MW) 2019-2037

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East & Africa Outlook and Projections

- Overview

- Market Value (USD Million), Volume (MW) Current and Future Projections, 2019-2037

- Country (USD Million), Volume (MW) 2019-2037

- GCC

- Israel

- South Africa

- Rest of Middle East & Africa

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

Solar Panel Mounting Structures Market Outlook:

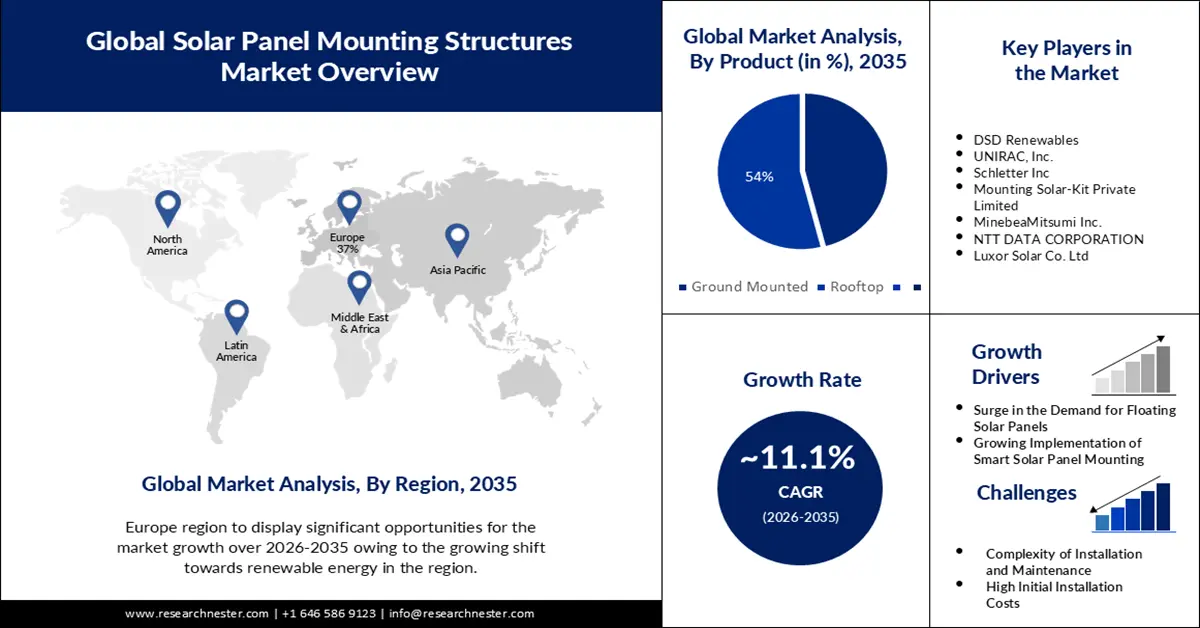

Solar Panel Mounting Structures Market size was over USD 18.51 billion in 2025 and is poised to exceed USD 53.03 billion by 2035, growing at over 11.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of solar panel mounting structures is estimated at USD 20.36 billion.

The rising population and industrialization across the globe have significantly increased the demand for electricity and according to the reports, it is expected to double by 2050. To meet the rising energy demands and combat current climate issues, public and private sectors are steadily shifting towards renewable energy, including solar power, boosting the demand for mounting structures. According to a report published by the International Energy Agency (IEA), the renewable power capacity is expected to increase over the decade and China is set to account for more than 60% of all renewable capacity installed between 2024 and 2030. Several governments and organizations worldwide are setting goals and targets for carbon neutrality and renewable targets. This has resulted in growing need for efficiency mounting solutions.

Rapid urbanization, industrialization and government initiatives in developing economies of Asia Pacific, Africa, and Latin America have led to the growing adoption of solar energy and the rising investments in developing solar panel mounting structures and systems in both utility-scale and decentralized projects. For instance, according to the International Solar Alliance (ISA), in 2022, Asia Pacific accounted for 55% of total investments in solar energy development.

Key Solar Panel Mounting Structures Market Insights Summary:

Regional Highlights:

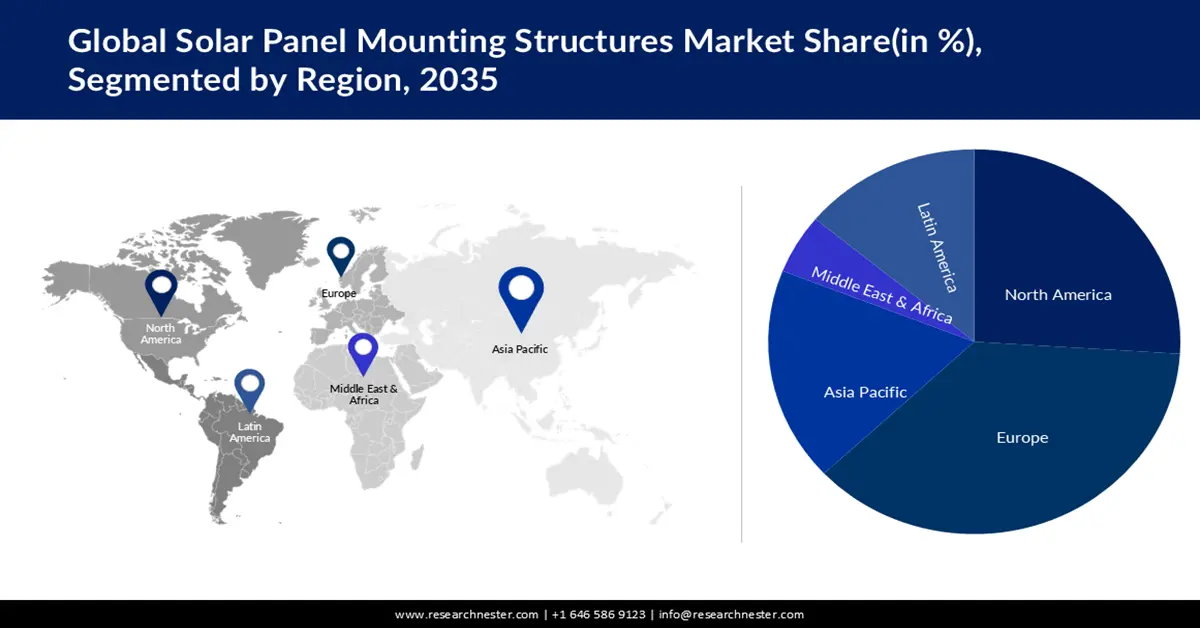

- Asia Pacific solar panel mounting structures market holds the largest share by 2035, attributed to rapid urbanization, industrialization, rising renewable energy demand, and presence of leading manufacturers.

- North America market grows rapidly during 2026-2035, driven by rapid adoption of advanced technologies, rising solar installations, and corporate sustainability initiatives.

Segment Insights:

- The roof mounted structure segment in the solar panel mounting structures market is expected to capture a 55.1% share by 2035, attributed to rooftop solar adoption in urban areas and energy cost-saving preferences.

- The utility segment in the solar panel mounting structures market is expected to experience robust growth through 2035, fueled by utility-scale solar adoption and supportive government policies.

Key Growth Trends:

- Rapid advancements in mounting technology

- Favorable government initiatives

Major Challenges:

- Rapid advancements in mounting technology

- Favorable government initiatives

Key Players: Professional Solar Products, Ratan Engineering Company, Hollaender Mfg. Co., Mahindra Susten, Kern Solar Structures, Schletter Inc, Esso Fab Tech Pvt Ltd, Mounting Solar-Kit Private Limited, Satec Envir Engineering Pvt. Ltd., PROINSO, and Nespro Renewable Energy Solutions.

Global Solar Panel Mounting Structures Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 18.51 billion

- 2026 Market Size: USD 20.36 billion

- Projected Market Size: USD 53.03 billion by 2035

- Growth Forecasts: 11.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, India, Germany, Japan

- Emerging Countries: China, India, Japan, South Korea, Vietnam

Last updated on : 16 September, 2025

Solar Panel Mounting Structures Market Growth Drivers and Challenges:

Growth Drivers

-

Rapid advancements in mounting technology: one of the key factors expected to surge solar panel mounting structures market revenue growth is the technological developments in single-axis and dual-axis tracking systems that enable solar panels to follow the sun’s movement throughout the day, resulting in maximum energy generation. In addition, the development of lightweight materials and corrosion-resistant designs to improve efficiency and durability is expected to increase the sales of solar panel mounting systems. One of the notable developments is the launch of a single-axis tracker by Azgard Solar in August 2023. This is a cutting-edge east/west-facing solar solution designed especially for residential and commercial applications.

- Favorable government initiatives: Governments across the globe are implementing several policies and programs to support the adoption of renewable energy, including incentives for installing solar panels. The U.S. for instance, offers Investment Tax Credits (ITCs) that enable businesses and homeowners to deduct a substantial portion of solar installation costs from their taxes. This is expected to increase the installations of solar panels in the coming years and support solar panel mounting structures market growth.

Challenges

-

Challenges associated with materials and manufacturing: The prices of primary materials, steel, and aluminum used for making mounting structures can vary according to availability and demand. Thus, an increase in raw material costs can result in high prices of overall products. Moreover, the mounting structures in coastal and humid areas require advanced coatings, that can increase overall manufacturing costs. Thus, uncertainty in raw material prices and the rising need for advanced coating materials can lead to low adoption of these solar panel mounting structures and affect market growth.

- Technological barriers: One of the key factors expected to affect the solar panel mounting structures market growth going ahead is the rapid advancements in solar technology that make existing solar technology obsolete. This results in frequent redesigns that may be an additional burden on the budget-constraint modalities. In addition, installing the advanced solutions requires skilled labor. Thus, lack of skilled labor for proper alignment and safety can hamper overall marker growth going ahead.

Solar Panel Mounting Structures Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.1% |

|

Base Year Market Size (2025) |

USD 18.51 billion |

|

Forecast Year Market Size (2035) |

USD 53.03 billion |

|

Regional Scope |

|

Solar Panel Mounting Structures Market Segmentation:

Product Type Segment Analysis

Based on product type, the roof mounted structure segment is anticipated to capture over 55.1% solar panel mounting structures market share by 2035. This growth can be attributed to the increasing adoption of solar energy across the globe, the growing deployment of rooftop solutions in residential and commercial buildings due to limited ground space availability in urban areas, and high preference for rooftop structures to offset overall energy costs. Several public and private organizations are promoting the use of rooftop solar solutions. For instance, in June 2024, Tata Power Solar Limited launched the Pan India Campaign- GharGharSolar, Tata Power ke Sangh in order to support the adoption of residential rooftop solar solutions. Through this campaign, the company aimed to foster a sustainable future with the widespread adoption of solar energy.

End use Segment Analysis

Based on end use, the utility segment in solar panel mounting structures market is likely to register a robust CAGR between 2026 and 2035 due to the rapidly expanding utility sector, which caters to rising consumption of electricity, power, and water, and the increasing adoption of solar panel mounting solutions to cover vast utility-scale solar farms. Large-scale utility farms reduce the per unit of energy produced due to bulk purchase of materials and streamlined operations. Other factors such as government subsidies and tax redemptions for large scale projects and increasing partnerships between large corporations and utility solar providers to reach decarbonization goals are expected to support segment growth during the forecast period.

For instance, in September 2024, Silfab announced the launch of 640 W utility-scale solar panels with a temperature coefficient of -0.29% per C and a 30-year power outage assurance for 89.3% of the initial yield.

Our in-depth analysis of the global solar panel mounting structures market includes the following segments:

|

Product Type |

|

|

Material |

|

|

Thickness |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Solar Panel Mounting Structures Market Regional Analysis:

Asia Pacific Market Insights

The Asia Pacific solar panel mounting structures market is expected to account for the largest revenue share during the forecast period owing to rapid urbanization and industrialization in the region, rising demand for renewable energy, and presence of leading manufacturers. Key countries such as China, Japan, South Korea, India, and Australia are introducing a range of incentives such as subsidies and tax incentives to stimulate solar energy investments, boosting demand for mounting structures.

In India, the government is supporting the adoption of solar panel mounting solutions by providing several subsidies and initiatives such as Solar Investment Tax Credits (ITC), Feed-in Tariffs (FiTs), grants, and rebates. For instance, India’s National Solar Mission aims for 280 GW of installed solar capacity by 2030 with a focus on rooftops and utility-scale solar projects.

China is one of the world’s largest producers of solar panels and solar infrastructure, including mounting systems. In addition, the presence of a vast industrial base, rising number of large-scale ground-mounted solar farms across the country, and increasing investments in developing advanced solar mounting infrastructure solutions are expected to boost the market growth in China going ahead.

North America Insights

The North America solar panel mounting structures market is projected to register rapid revenue growth between 2026 and 2035 owing to the rapid adoption of advanced technologies, rising solar installations across the region, and corporate initiatives to meet sustainability and carbon neutrality goals. In addition, the rising number of utility-scale solar farms in the U.S. and Canada, technological improvements in grid interconnectivity, and favorable government support are expected to boost the market in North America.

The U.S. is one of the leading solar panel mounting structures markets in North America driven by technological advancements in mounting systems, government initiatives, and policies to support clean energy adoption and rising adoption of solar solutions in large corporations, institutions, and residential sectors. For instance, according to a report by the International Energy Agency published in 2022, the number of households that may rely on solar PV is expected to reach 100 million by 2030.

The Canada solar panel mounting structures market is expected to register rapid revenue growth during the forecast period owing to presence of favorable policies such as federal and provincial incentives supporting solar energy adoption, and rising demand for solar panel mounting structures across residential, industrial, and commercial settings.

Solar Panel Mounting Structures Market Players:

- Xiamen Fasten Solar Technology Co., Ltd

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Professional Solar Products

- Ratan engineering Company

- Hollaender Mfg. Co.

- Mahindra Susten

- Kern Solar Structures

- Schletter Inc.

- Esso Fab Tech Pvt Ltd

- Mounting Solar-Kit Private Limited

- Satec Envir Engineering Pvt. Ltd.

- PROINSO

- Nespro Renewable Energy Solutions

The global solar panel mounting structures market is highly competitive, comprising key players operating at regional and global levels. Schetter Group, Mahindra Susten, Mounting Systems GmbH, and SolarEdge Technologies are some leading players focused on innovation, cost optimization, and market expansion. Several mounting system manufacturers are partnering with solar panel producers to develop advanced, comprehensive solutions for consumers. The key players in the market are also adopting several strategic alliances such as mergers and acquisitions, partnerships, collaborations, joint ventures, and license agreements. Here are some key players operating in the global solar panel mounting structures market:

Recent Developments

- In September 2024, Solar Mounting Ltd announced the launch of a new solar carport at the prestigious Solar and Storage Live Show at NEC Birmingham from 24th to 26th September 2024. The product is an efficient and eco-friendly way of generating solar power while providing a modern shelter for vehicles.

- In July 2023, APL Apollo partnered with Ornate Solar to design, build, and manufacture innovative solar mounting solutions for India market.

- In May 2023, Mibet Energy launched a new solar mounting structure specially designed for solar projects installed on balconies. This product is pre-bolted and fixed and doesn’t need welding and drilling during installation.

- Report ID: 5564

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.