Solar Hybrid Inverter Market Outlook:

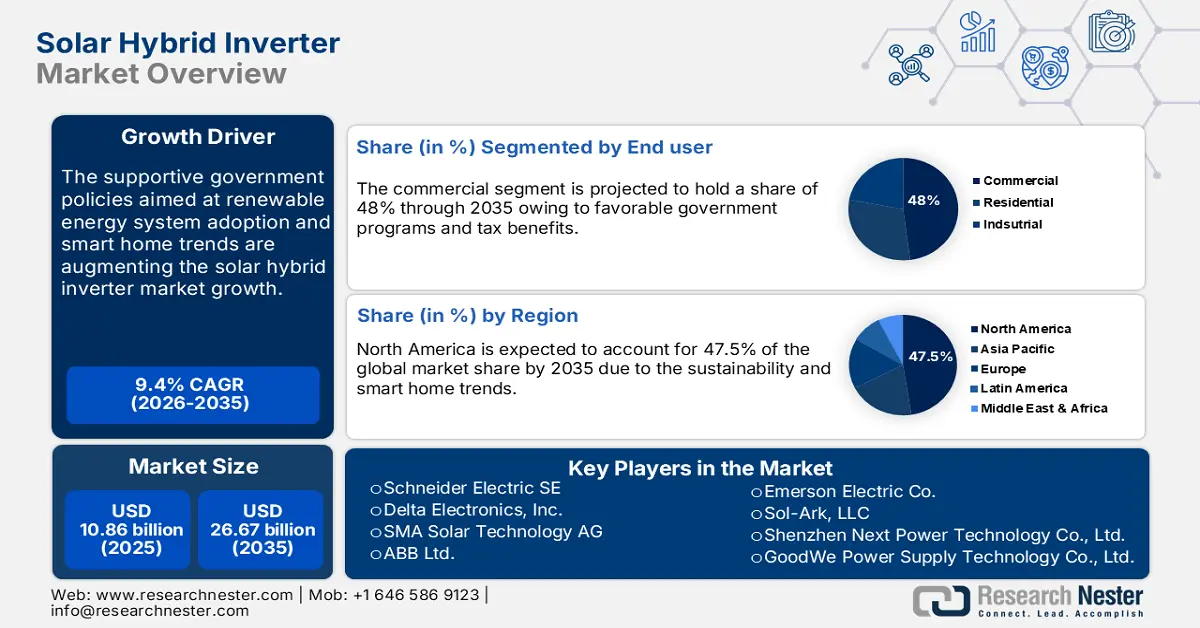

Solar Hybrid Inverter Market size was valued at USD 10.86 billion in 2025 and is likely to cross USD 26.67 billion by 2035, expanding at more than 9.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of solar hybrid inverter is assessed at USD 11.78 billion.

Solar a very modular photovoltaic (PV) technology is gaining widespread attention owing to its high environmental benefits. The robust energy demand across the world is augmenting the need for innovations in electricity production. Climate commitments are driving countries to invest in renewable energy sources such as solar, wind, and hydro. Solar is emerging as the most adopted solution in all residential, commercial, and industrial sectors. The International Energy Agency (IEA) reveals that the cost of electricity produced through solar PV has fallen drastically. This highlights that solar technologies are set to offer a high return on investments (ROI) in the long run. The same source also estimates that during the period 2024 to 2030, solar technology is anticipated to capture an 80.0% hike in the global renewable capacity. In the coming 10 years, solar PV technologies including inverters, cells, panels, and more are set to hold the top position as a renewable source.

|

Share of Renewable Electricity Generation by Technology, 2024-2030 |

|||||||

|

Technology |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

|

All Renewables |

32.1% |

34.5% |

36.7% |

38.8% |

41.0% |

43.2% |

45.6% |

|

Variable Renewables |

15.0% |

17.5% |

19.8% |

22.1% |

24.5% |

27.0% |

29.5% |

|

Hydropower |

14.3% |

14.2% |

14.1% |

13.8% |

13.6% |

13.3% |

13.1% |

|

Wind |

8.2% |

9.2% |

9.9% |

10.7% |

11.6% |

12.5% |

13.4% |

|

Solar |

6.8% |

8.3% |

9.8% |

11.4% |

12.9% |

14.5% |

16.1% |

|

Other Renewables |

2.8% |

2.8% |

2.9% |

2.9% |

2.9% |

3.0% |

3.0% |

Source: IEA

In 2023, the solar PV generation surpassed 320 TWh (up 25%), reaching over 1 600 TWh and holding the leading absolute generation growth out of all green technologies. The consistent growth in solar generation is anticipated to aid countries in meeting their climatic commitments by 2030. The most lucrative marketplaces that are expected to boost capacity growth in the years ahead are China, the European Union, the U.S., and India. All the above statistics underscoring the importance of renewable sources, especially solar represent how opportunistic is the coming decade for solar hybrid inverter companies.

Key Solar Hybrid Inverter Market Insights Summary:

Regional Highlights:

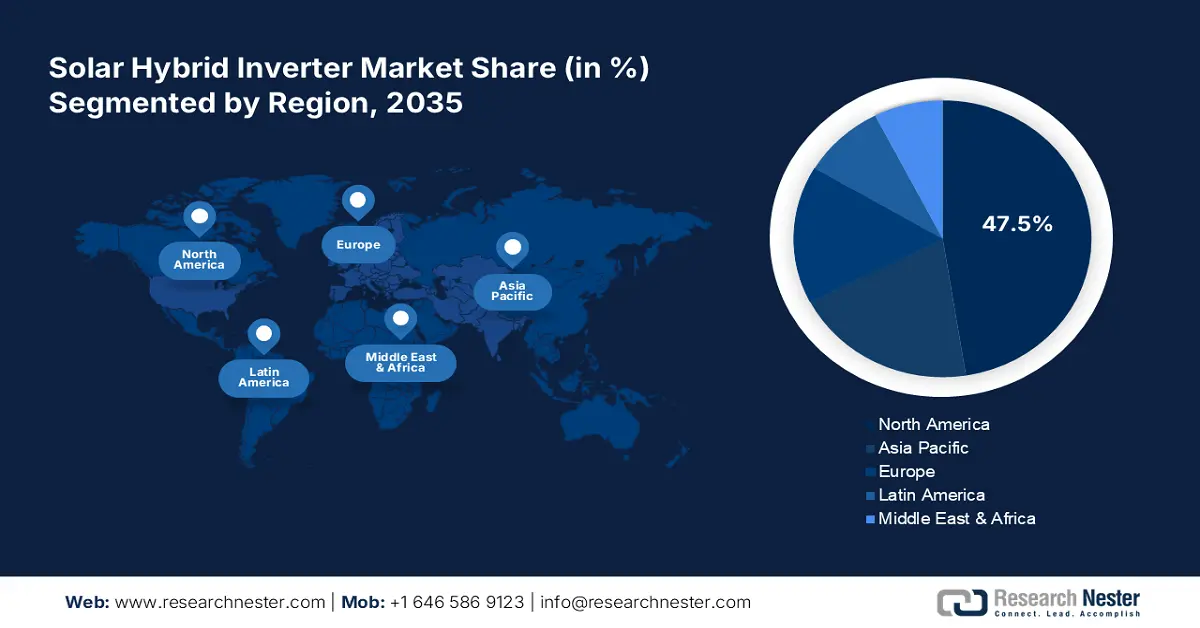

- North America commands a 47.50% share in the Solar Hybrid Inverter Market, driven by government incentives, technological adoption, and high awareness of renewable energy sources, ensuring robust growth by 2035.

Segment Insights:

- The Grid-tied Solar Hybrid Inverter segment of the Solar Hybrid Inverter Market is forecasted to expand significantly through 2035, fueled by grid modernization and energy security features.

- The Commercial segment of the Solar Hybrid Inverter Market is anticipated to hold over 48% share by 2035, driven by government incentives and cost savings motivating commercial investments in renewable energy solutions.

Key Growth Trends:

- Government policies & incentives encouraging businesses and individuals

- Technological advancements and smart home trends

Major Challenges:

- Limited adoption in price-sensitive markets

- Grid compatibility issues are a major challenge

- Key Players: Schneider Electric SE, Delta Electronics, Inc., SMA Solar Technology AG, ABB Ltd., and Emerson Electric Co.

Global Solar Hybrid Inverter Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.86 billion

- 2026 Market Size: USD 11.78 billion

- Projected Market Size: USD 26.67 billion by 2035

- Growth Forecasts: 9.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (47.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 13 August, 2025

Solar Hybrid Inverter Market Growth Drivers and Challenges:

Growth Drivers

- Government policies & incentives encouraging businesses and individuals: The supportive government policies in the form of tax benefits, incentives, or schemes are significantly set to drive the adoption of solar hybrid inverters in residential, industrial, and commercial settings. For instance, the U.S. Department of Energy (DOE) highlights that the solar technologies installed in the years 2020 and 2021 benefitted from a 26.0% tax credit. In August 2022, under the extension of the investment tax credit (ITC), it was increased to 30.0% for installation between 2022 to 2032. This explains government support is not only beneficial for customers but also for the producers of solar hybrid inverters. Furthermore, rebates, net metering, and performance-based incentives are set to uplift the adoption of solar hybrid inverters in the coming years. To benefit from government initiatives, many large-scale companies are investing in the installation of solar panels and inverters. Thus, government-sponsored solar energy programs attracting households and businesses are effectively promoting the demand for solar hybrid inverters.

- Technological advancements and smart home trends: The integration of advanced technologies such as remote monitoring, automatic fault detection, and enhanced grid support are leading to the development of smart solar hybrid inverters. These investors are finding high applications in smart home ecosystems. Advanced solar hybrid inverters reduce grid dependency and aid households and businesses in expanding their solar energy use. The smart home trends are backing the increasing adoption of solar hybrid inverters.

Challenges

- Limited adoption in price-sensitive markets: Even though solar technologies are gaining traction and their installation costs are estimated to decrease gradually, currently, these technologies including panels, hybrid inverters, and storage are exhibiting limited adoption in price-sensitive markets. Individuals with low spending power in both developed and developing countries hesitate to invest in advanced technologies which acts as a barrier to the solar hybrid inverter market growth. However, supportive government policies and initiatives are anticipated to aid budget-constraint individuals to invest in these solutions during the foreseeable period.

- Grid compatibility issues are a major challenge: Hybrid solar inverters being advanced technologies often face grid integration issues, particularly in outdated grid infrastructures. Small companies with conventional infrastructure also witness installation issues with complex solar hybrid inverters, which directly limits their adoption. Grid stability, communication protocols, and regulatory constraint issues are majorly impeding the sales of hybrid solar inverters. Manufacturers are focusing on R&D activities to resolve these grid compatibility issues.

Solar Hybrid Inverter Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.4% |

|

Base Year Market Size (2025) |

USD 10.86 billion |

|

Forecast Year Market Size (2035) |

USD 26.67 billion |

|

Regional Scope |

|

Solar Hybrid Inverter Market Segmentation:

Product (Grid-Tied Solar Hybrid Inverter, Off-Grid Solar Hybrid Inverter)

Grid-tied solar hybrid inverter segment is projected to dominate solar hybrid inverter market share of over 69.8% by 2035. Grid modernization and energy security features of grid-tied solar hybrid inverters are contributing to their sales growth. The shift towards energy independence is fueling the demand for grid-tied solar hybrid inverters, globally. High returns on investments coupled with tax benefits are set to propel the use of grid-tied solar hybrid inverters. Technological advancements including smart-load control and real-time monitoring are further expected to drive the sales of advanced grid-tied solar hybrid inverters. Manufacturers are employing innovation strategies to earn high profits and attract a wider customer base. For instance, in November 2024, EG4 Electronics announced the launch of the GridBOSS Microgrid Interconnection Device (MID) and the FlexBOSS21 hybrid inverter. These high-power and cost & energy-efficient solutions are estimated to gain traction in both residential and commercial settings.

End user (Residential, Commercial, Industrial)

In solar hybrid inverter market, commercial segment is expected to hold revenue share of over 48% by the end of 2035. Solar acts as an economic engine and is set to propel the use of renewable energy sources in the coming years. Benefits from the governments are driving commercial infrastructure to invest in solar hybrid inverters. Significant long-term cost savings and increasing fossil fuel electricity costs are appealing to businesses to invest in solar hybrid inverters. For instance, the Solar Energy Industries Association (SEIA) report reveals that top American companies such as Google, Apple, Meta, Amazon, and Walmart are major consumers of solar and storage systems. More than 18.0% of solar capacity is captured by the corporate sector and around 40 GW of solar capacity and over 1.8 GWh of battery storage were installed in the U.S. by corporate giants in Q1’24.

|

Top 10 Companies by Total Solar Capacity |

|

|

Company |

Total MWdc |

|

Meta Platforms, Inc. |

5,177 |

|

Amazon |

4,668 |

|

|

2,595 |

|

Apple, Inc. |

1,156 |

|

Walmart, Inc. |

860 |

|

Target Corporation |

598 |

|

Microsoft |

551 |

|

Digital Reality |

435 |

|

Verizon |

391 |

|

Home Depot |

343 |

Source: SEIA

Our in-depth analysis of the global solar hybrid inverter market includes the following segments:

|

Product |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Solar Hybrid Inverter Market Regional Analysis:

North America Market Forecast

North America solar hybrid inverter market is set to account for revenue share of more than 47.5% by the end of 2035. Government incentives, sustainability goals, technological adoption, and high awareness of renewable energy sources in residential as well as commercial sectors are substantially boosting the sales of solar hybrid inverters. The rising adoption of smart home devices and technologies both in Canada and the U.S. is propelling the growth of the solar hybrid inverter market.

The U.S. is the most lucrative marketplace for solar hybrid inverter manufacturers and is expected to record significant growth during the forecast period. The government's beneficial programs are significantly driving the adoption of solar hybrid inverters in residential, commercial, and industrial settings. In October 2024, the U.S. DOE revealed that the country installed around 14.1 GW-hrs of energy storage onto the electric grid in Q1 and Q2 of 2024. Furthermore, SEIA states that solar electricity powers over 37.0 million U.S. homes. Texas and Florida are dominating states with 7.9 GWdc and 3.1 GWdc installed capacity, respectively, in Q3’24.

Canada’s strong focus on climatic commitments and zero emission goals are fueling the importance of renewable energy sources among businesses and households. Supportive government policies and green grants are propelling the sales of solar hybrid inverters. The country’s 30.0% refundable ITC for clean energy technologies is backing the solar hybrid inverter demand. The growing popularity of smart homes and long winter periods are necessitating individuals to invest in energy storage systems including solar hybrid inverters.

Asia Pacific Market Statistics

The Asia Pacific solar hybrid inverter market is set to increase at the fastest pace during the forecast period. The rapidly increasing urban and industrial activities are leading to high energy demand. Strict emission regulations and environmental protection agreements are necessitating the governments to introduce various tax benefits, incentives, and schemes to uplift the adoption of renewable energy systems. Technological advancements and decreasing costs of solar are also estimated to promote the demand for solar hybrid inverters in Asia Pacific countries. China, India, Japan, and South Korea are offering profitable opportunities for solar hybrid inverters.

China is a dominant solar hybrid inverter market for solar hybrid inverters owing to the abundant availability of key minerals required for PV production. The country’s 14th Five-Year Plan aiming for environmental protection and renewable energy protection is directly supporting the solar hybrid inverter market growth. Booming industrial and urban activities are further increasing the adoption of both grid and off-grid solutions. The Ember Energy Organization states that China’s solar exports capture 80% of the global solar hybrid inverter market.

India accounts for 4th position in renewable energy capacity installation owing to the government’s aim to increase the use of clean energy sources. The India Brand Equity Foundation (IBEF) states that around USD 1.02 billion was allocated for solar power grid infrastructure development in the 2024-2025 interim budget. Furthermore, the PM-KUSUM Scheme is effectively assisting farmers to install solar power plants, solarize grid-connected agriculture pumps, and standalone solar agriculture pumps, by offering financial assistance. Overall, India is an opportunistic market for solar hybrid inverter companies backed by supportive government policies and schemes.

Key Solar Hybrid Inverter Market Players:

- Schneider Electric SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Delta Electronics, Inc.

- SMA Solar Technology AG

- ABB Ltd.

- Emerson Electric Co.

- Sol-Ark, LLC

- Shenzhen Next Power Technology Co., Ltd.

- GoodWe Power Supply Technology Co., Ltd.

- Growatt New Energy Technology Co., Ltd.

- Fronius International GmbH

- SolarEdge Technologies Inc.

- KACO New Energy GmbH

- Huawei Technologies Co., Ltd.

- Ginlong Technologies Co., Ltd.

- OutBack Power Technologies, Inc.

- Luminous Power Technologies Pvt. Ltd.

The solar hybrid inverter market is characterized by the presence of key players and the increasing emergence of new companies. The zero carbon emission goals and increasing fossil fuel electricity prices are set to boost the sales of solar hybrid inverters in the coming years and subsequently uplift the revenue growth of manufacturers. Dominant companies are employing several organic and inorganic marketing strategies such as new product launches, investments in research and development activities, collaborations & partnerships, mergers & acquisitions, and global expansions to maximize their revenue shares and reach a wider customer base. The key players in the solar hybrid inverter market are highly benefitted from governments’ major role in expanding awareness of renewable energy technologies and tax benefits.

Some of the key players include:

Recent Developments

- In October 2024, Sol-Ark, LLC revealed that its Sol-Ark 60K-3P-480V hybrid inverters are leading the U.S. commercial and industrial sectors. 5-millisecond transfer time for grid backup, improved power capacity, and high ratings are driving their adoption rates.

- In January 2024, Shenzhen Next Power Technology Co., Ltd. an ISO9001 quality management system certified company stated that its CE-certified solar products are finding wide applications in the residential sector. Through a high focus on independent innovation, the company has received over 10 national patents.

- Report ID: 7125

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Solar Hybrid Inverter Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.