Solar Generator Market Outlook:

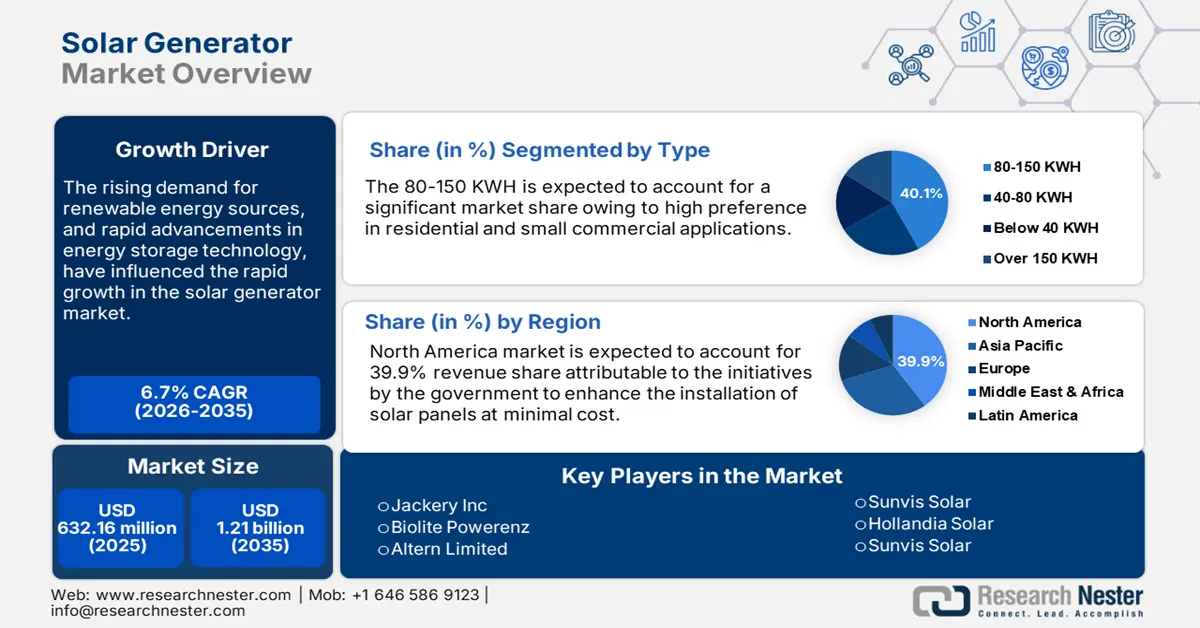

Solar Generator Market size was over USD 632.16 million in 2025 and is anticipated to cross USD 1.21 billion by 2035, growing at more than 6.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of solar generator is assessed at USD 670.28 million.

The rising demand for renewable energy sources, along with tumbled prices of solar panels and an increase in energy storage technology, has influenced the rapid growth in the solar generator market. The growing concerns about climate change, government initiatives related to sustainable energy, and the growing need for energy independence drive the market further. Moreover, the reduction in the prices of solar panels and batteries, with innovative designs of products, has made solar generators economically viable for residential, commercial, and industrial markets. Thus, it has ensured the rise in the adoption of solar generators in applications such as off-grid generation, grid-tie systems, and backup power solutions which has led the solar generator market to grow substantially over the period.

For instance, in 2023, India positioned itself as the world’s third-largest generator of solar energy. According to the Institute of Energy Economics and Financial Analysis (IEEFA), India added a record 13.7 gigawatts of electricity in the first quarter of 2024, with 71.5% of the new additional capacity coming from renewable sources.

Key Solar Generator Market Insights Summary:

Regional Highlights:

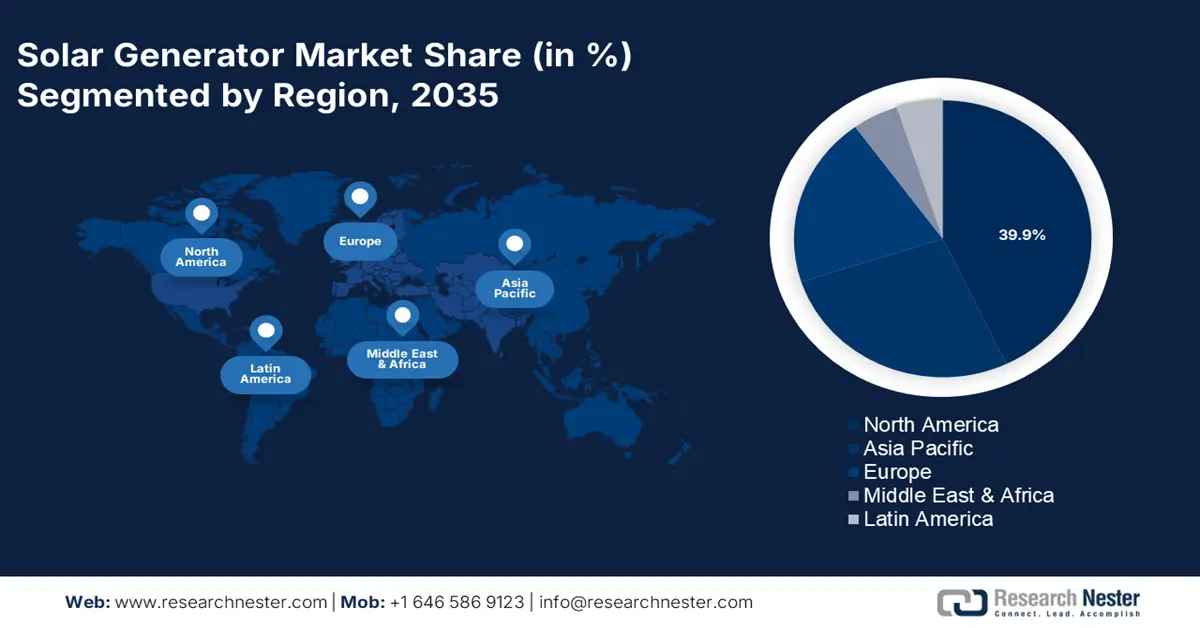

- North America solar generator market will account for 39.90% share by 2035, driven by abundant sunlight, technological advances, falling solar panel prices, and government incentives.

- Asia Pacific market will exhibit the fastest growth during the forecast timeline, driven by increasing energy demands and rising climate change concerns driving solar energy solutions.

Segment Insights:

- 80-150 kwh segment in the solar generator market is forecasted to achieve 40.10% growth by the forecast year 2035, driven by its perfect balance between power output and cost for residential and small commercial use.

- The lithium-ion batteries segment in the solar generator market is projected to dominate by 2035, fueled by superior energy density, long life cycle, and high discharge rates.

Key Growth Trends:

- Emerging need for energy independence

- Technology innovations

Major Challenges:

- Intermittent energy supply

- Comparison with traditional energy sources

Key Players: Goal Zero LLC, Jackery Inc., Renogy, EcoFlow Inc., Anker Innovations Limited, Bluetti Power Inc., SolarEdge Technologies, Inc., SunPower Corporation, Inergy Solar, Lion Energy LLC.

Global Solar Generator Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 632.16 million

- 2026 Market Size: USD 670.28 million

- Projected Market Size: USD 1.21 billion by 2035

- Growth Forecasts: 6.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 18 September, 2025

Solar Generator Market Growth Drivers and Challenges:

Growth Drivers

-

Emerging need for energy independence: The need for energy independence is gaining demand thus solar generators are being greatly preferred by individuals, businesses, and communities to reduce dependence on grid electricity and increase self-sufficiency. The trend of growing demand for solar generators draws focus from concerns such as grid reliability, energy security, and sustainability, besides cost-saving and autonomy. Solar generators allow individuals and the community at large to take responsibility for generating cleaner energy, reducing their carbon emissions, and mitigating risks related to price volatility. As a result, solar generators are increasingly adopted as they render backup power to people in grid outages and natural disasters, ensuring continuity of energy supply and supporting emergency preparedness.

- Technology innovations: The solar generator market is being powerfully driven by technological innovations. The continuous development in improving solar panel efficiency, energy storage, and smart grid technologies yields benefits in improved performance, better cost-effectiveness, and wider accessibility of solar generators. The better integration of solar generators into the existing energy infrastructure has been made even easier with the incorporation of such smart grid technologies as grid-tie inverters and monitoring systems, thus making them increasingly deployable and resilient.

Furthermore, all these technological advancements have contributed to increased solar generator market growth and thus have made solar generators an increasingly viable and attractive option for renewable energy generation. For instance, according to ArcVera Renewables, bifacial designs allow to capture of sunlight from both sides of the panel increasing the solar generation capacity up to 25%. - Advancement in energy storage: Energy storage advancements have been crucial in increasing the viability and acceptance of solar generators to store excess energy supply generated at times of high production. Improvements in the development of lithium-ion batteries by increasing capacity and durability are cost-effective, thereby being instrumental in driving recent solar generator market growth. For instance, Tesla Powerwall is a fully integrated AC battery system for residential or light commercial use. It comes with a rechargeable lithium-ion battery pack that provides energy storage for solar self-consumption, time-based control, and backup.

These advancements have addressed the concerns of energy storage, the reliability of solar generators, and being a consistent source of renewable energy during periods of low sunlight or high energy demand. Thus, making energy storage an integral and inseparable function in solar generator systems, further pushing the use of sustainable energy solutions.

Challenges

-

Intermittent energy supply: The intermittency of energy supply by solar generators, heavily depends on weather, season, and time of day. For example, a generator can function at its highest capacity of 100% or even more on a sunny day but on a cloudy day, it might produce only 20-30%. The change in weather patterns can bring about energy deficiencies making solar generators inadequate in supplying sufficient energy for baseload needs. This intermittency shows the growing need for advanced energy storage systems, grid management technologies, and hybrid power solutions to curb the variability in solar energy generation.

- Comparison with traditional energy sources: Solar generators are in intense competition with conventional sources of energy, such as fossil fuels, that have built infrastructure, achieved economies of scale, and captured a larger solar generator market share. For instance, natural gas, the most preferred energy mix is characterized by relatively low electricity generation costs an average of 6-8 cents per kWh compared to the average cost of solar energy generation at 10-15 cents per kWh. Moreover, conventionally derived resources are assisted by government subsidies, tax concessions, and other supportive regulations unlike solar generators, which strengthen their market dominance thus, making traditional sources more reliable.

Solar Generator Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.7% |

|

Base Year Market Size (2025) |

USD 632.16 million |

|

Forecast Year Market Size (2035) |

USD 1.21 billion |

|

Regional Scope |

|

Solar Generator Market Segmentation:

Type Segment Analysis

80-150 KWH segment is likely to capture over 40.1% solar generator market share by 2035. This is widely preferred in residential and small commercial applications as this range is well-suited, giving a perfect balance between power output and cost. For instance, a normal residential solar generator system can store 100 kWh of energy and can power an average-sized home with ease, it hence becomes very effortless for every homeowner who intends to cut down his reliance on the grid for electricity supply. The dominance of the 80-150 kWh segment is further cemented by its wide usage basis in regions with medium-level energy requirements, such as single-family homes and small businesses.

By Application Segment Analysis

The residential segment in solar generator market is expected to witness significant growth during the forecast period due to a rise in demand for renewable sources of energy, reduction of cost in solar panels, and government incentives for the installation of solar energy by homeowners. Residential solar generators provide power for homes for lighting, heating, and cooling purposes, and also for charging electric vehicles. The commercial and industrial sectors also hold a sizeable share due to the increasing trend of using solar energy in offices, warehouses, and manufacturing sectors. The dominant share held by the residential sector is poised to continue with the rise in demand for the need to employ sustainable and efficient sources of energy in the residential sector.

Battery type Segment Analysis

The lithium-ion batteries segment in dominates the solar generator market attributable to their advanced features such as superior energy density, long life cycle, along high discharge rates, hence making it favorable for storing solar energy. It features effective energy storage solutions which makes it viable for utilization across various applications and creating more demand in the market. For instance, in July 2024, the Chinese Academy of Sciences (CAS) researchers discovered that discarded solar panels can be instrumental in creating lithium batteries which can be further used for EVs and grid-scale energy storage.

Our in-depth analysis of the global solar generator market includes the following segments:

|

Type |

|

|

Grid connectivity |

|

|

Application |

|

|

Power Rating |

|

|

Battery type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Solar Generator Market Regional Analysis:

North America Market Insights

North America industry is set to dominate majority revenue share of 39.9% by 2035, owing to multiple factors such as vast areas of land, abundant sunlight, and good conditions for solar energy harvesting. Other factors contributing to growth include falling solar panel prices and technological advances. Also, the presence of key players in the industry, such as Tesla, SunPower, and SolarEdge, has contributed to driving breakthroughs via their research and development activities and has carved an advanced definition of solar resource advantages by making it more accessible and affordable.

This has positioned North America as the hub for innovation and adoption, as many residential and commercial customers in the region have been using solar generators due to their energy requirements. The strong economy of the region is coupled with a green environment and growing demand for renewable sources of energy, which is expected to further drive the demand for the solar generator market in the region of North America.

Besides this, the government of the U.S. is aiding in the solar generator adoption through a range of initiatives such as solar investment tax credit, and funding, streamlining the processes to facilitate its installation. For instance, homeowners and businesses can claim up to 26% of tax credit which was increased up to 30% for systems installed between years 2022-2032.

In Canada, the companies have invested heavily in research and development, manufacturing, and marketing, thus making solar generators more reliable and efficient for use by consumers. For instance, the breakthrough of the EG4 product by The Cabin Depot company has a collection of off-grid systems, offering reliable and sustainable solar energy solutions tailored to meet the needs of residential users, commercial users, and industrial users.

Asia Pacific Market Insights

Asia Pacific is deemed to be the fastest-growing region in the solar generator market owing to the increasing energy demands and rising concerns over climatic changes. The need for solar energy solutions has driven companies to embark on continuous research and developments to make it more result-driven and cost-effective, thus the region is influenced greatly by the support of key players such as Trina Solar, Jinko Solar, and TATA Power to meet the growing necessity. The region is likely to experience substantial growth in the solar generator market in the coming years.

In India, the 400MW Pavagada Solar Plant is a pivotal source of clean, renewable energy, serving the energy needs of Karnataka, which is a testament to India’s determination to acquire renewable energy as a major source and drive growth in the solar generator market.

Solar Generator Market Players:

- Duracell

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Jackery Inc.

- Voltaic

- Solar line

- Solar Rover

- Powerenz

- Sunvis Solar

- Jaspak

- Hollandia Solar

- Goal Zero

- Sunvis Solar

- Altern Limited

- Biolite Powerenz

- SolSolutions LLC (DolMan)

The solar generator market is poised for remarkable growth owing to the demand for clean and sustainable sources of power. Key players in the market are making significant contributions towards achieving renewable energy-oriented solutions and providing energy security to consumers thus meeting the increasing demand. During the forecast timeline i.e. 2025-2037 the market will experience more innovations and sustainable solutions. A list of prominent players in the market are:

Recent Developments

- In September 2024, EcoFlow launched four portable power station series equipped with an integrated architecture system that offers simple, flexible, and reliable power solutions.

- In May 2024, Jackery unveiled its latest solar generator, the Jackery 1000 v2, at Overland West with enhanced charging speed, output, and capacity. With its advanced technology and eco-friendly design, the product aims to provide reliable and sustainable power solutions for adventurers and homeowners alike.

- Report ID: 6454

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Solar Generator Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.