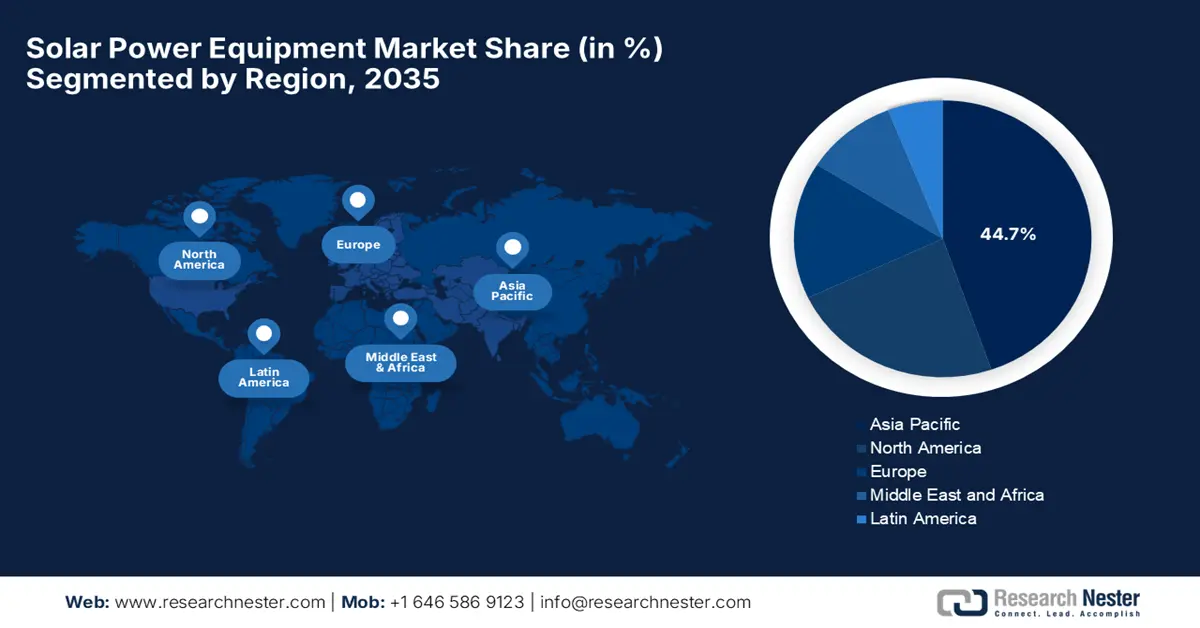

Solar Power Equipment Market - Regional Analysis

APAC Market Insights

Asia Pacific is all set to lead the entire solar power equipment market, capturing the largest revenue share of 44.7% by the end of 2035. The growth of the region is efficiently propelled by increasing industrialization, energy demands, and continued government support for renewable energy initiatives. In June 2025, Solarium Green Energy Limited announced that it is re-entering solar module manufacturing with a fully automated 1000 MW facility in Gujarat, at an estimated capex of ₹70 crore (USD 8.5 million), thereby aiming to enhance supply chain security and improve EPC project margins. Besides, the plant will produce advanced crystalline silicon PV modules using TOPCon, half-cut, and bifacial cell technologies, wherein the commercial operations are expected from the fourth quarter of the year. Furthermore, this backward integration is set to strengthen Solarium’s residential, commercial offerings by generating more than ₹1,000 crore (~USD 121 million) in revenue at 85% utilization.

China represents one of the largest landscapes for the solar power equipment market, due to its strong climate targets. The country is making continued investments in utility-scale solar projects and expanding distributed rooftop solar installations in both urban and industrial areas. JinkoSolar Holding Co., Ltd., in November 2025, announced its 2025 financial results for the 2nd and 3rd quarters, reporting total module shipments of 61.9 GW for the first three quarters, with more than 65% shipped overseas. Besides, the company has achieved record milestones, which include cumulative shipments of 370 GW and high-efficiency TOPCon cells reaching 27.2% to 27.4%. In addition, revenues were USD 2.51 billion in Q2 and USD 2.27 billion in Q3, whereas the adjusted net losses narrowed sequentially to USD 5 million and USD 4 million, respectively. The firm highlighted strong growth in its energy storage business with cumulative ESS shipments exceeding 3.3 GWh, hence positioning it as a key driver for future profitability.

China’s Solar Cell, Wafer, and Panel Exports and India’s Import Trends (H1 2025)

|

Metric |

Value (H1 2025) |

Notes |

|

China’s share of cells & wafers in solar exports |

>40% |

Cells are now larger than wafers in share |

|

Year-on-year growth of China’s cell exports |

+76% |

+19 GW vs H1 2024 |

|

Year-on-year growth of China’s wafer exports |

+26% |

+8.6 GW vs H1 2024 |

|

China’s panel exports growth |

-5.2% |

-6.7 GW vs H1 2024 |

|

Combined China solar product exports (capacity) |

+11% |

Compared to H1 2024; total 208 GW |

|

China cell exports 2022 → 2024 |

23 GW → 57 GW |

+144% over 2 years |

|

China wafer exports 2022 → 2024 |

36 GW → 60 GW |

+67% over 2 years |

|

Average monthly exports H1 2025 |

Cells: 7.5 GW, Wafers: 7 GW |

Each month > Portugal’s total installed capacity (6.3 GW) |

|

Fall in China solar cell prices since Aug 2022 |

USD 0.19/W → USD 0.03/W |

-82% |

|

Fall in China panel prices since Aug 2022 |

USD 0.29/W → USD 0.09/W |

-63% |

|

India’s share of the China cell export growth |

52% |

Largest contributor globally |

|

India’s imports of Chinese cells (H1 2025) |

21 GW |

Almost double H1 2024 (11 GW) |

|

India’s solar manufacturing capacities (March 2025) |

Panels: 68 GW, Cells: 25 GW |

Target: Panels 120 GW by 2030 |

|

India’s solar capacity addition in 2024 |

Panels: 36 GW, Cells: 16 GW |

Domestic installation growth |

Source: Ember

India is continuously growing in the solar power equipment market, efficiently fueled by government backing, with a prime focus on expanding renewable energy capacity and providing affordable energy access across urban and rural regions. The country’s solar power equipment market also benefits from the push for residential rooftop solar, utility-scale projects, which are rapidly accelerating adoption, with extended support from policy measures. Maruti Suzuki India in June 2025 Limited announced that it had commissioned a 20 MWp project at Kharkhoda and added 10 MWp at Manesar, thereby increasing total capacity from 49 MWp to 79 MWp, hence expanding its solar capacity by 30 MWp. Besides, the company also aims to reach 319 MWp by FY2030-31, making an investment of more than INR 925 crore (USD 112 million), targeting 85% of electricity consumption from renewable sources. Hence, these initiatives reflect the firm’s commitment to sustainable manufacturing and alignment with India’s renewable energy goals.

North America Market Insights

North America is exponentially growing in the global solar power equipment market owing to the presence of suitable government policies and rising consumer demand for renewable energy. The presence of pioneering companies and their strategic initiatives also positions North America as a predominant leader in this field. As per the article published by NREL in August 2024, the U.S. market saw a significant shift in 2024, wherein the utility-scale PV installations (12.7 GWac) and commercial & industrial projects (1.2 GWac) grew 111% and 76% respectively, whereas the residential installations (1.6 GWac) declined 52%. Besides, Texas, Florida, and California continued to lead installations, though a broader set of states contributed increasingly to overall growth, reflecting nationwide adoption. Furthermore, it projects a steady increase in U.S. PV deployment by 2028, wherein the residential PV shows the highest CAGR of 5% to 6%, hence highlighting sustained solar power equipment market expansion across all segments.

The U.S. is identified as the leader in the regional solar power equipment market, highly propelled by the tax credits and the presence of a wide range of solar technologies such as photovoltaic and concentrated solar power systems. The companies in the country are elevating the market potential with their innovative solutions. In June 2024, Hanwha Qcells announced that it had completed the 50 MW Ocotillo Wells Solar project in Borrego Springs, California, coupled with a 200 MWh battery energy storage system, thereby supplying renewable energy to Meta. Besides, the company also managed the EPC, leveraging its U.S. solar manufacturing and utility-scale expertise to deliver an integrated clean energy solution. Hence, this project strengthens Hanwha Qcells’ role in supporting corporate renewable goals by the U.S. solar and energy storage sectors, thus contributing to stronger solar power equipment market expansion.

Canada also gained strong exposure in the solar power equipment market, driven by increasing adoption of renewable energy solutions, government incentives, and a national focus on decarbonization. Additionally, rising electricity demand and growing environmental awareness among both consumers and businesses are also boosting the uptake of solar power solutions. In June 2025, Canadian Solar presented its first-quarter 2025 results, which underscore the firm’s strong presence in the market, since it has 6.9 GW of solar module shipments across more than 70 countries and a gross margin of 11.7%. Besides, its recurrent energy segment holds a global solar project pipeline of 26.9 GWp and a battery energy storage pipeline of 75.7 GWh, whereas its e-STORAGE division maintains a turnkey pipeline of over 91 GWh with a USD 3.2 billion contracted backlog. Hence, this combination of large-scale manufacturing and energy storage solutions positions the company as a dominant force in this solar power equipment market.

Europe Market Insights

Europe is rearranging the growth dynamics in the global solar power equipment market, capturing a significant revenue stake from 2026 to 2035. The regional growth is highly attributed to stringent regulatory bodies and climatic goals. Simultaneously, the European Union leverages the Green Deal and other national incentives, which play a highly essential role in promoting solar energy adoption. In July 2025, SolarPower Europe announced the launch of the Battery Storage Europe platform, which highlights the growing integration of battery energy storage with solar power systems across the EU. Also, the initiative calls for a tenfold increase in battery storage capacity by the conclusion of 2030 to support rising solar deployments, strengthen grid resilience, and enhance energy security. Hence, such developments underscore strong regulatory and industry momentum for advanced solar power equipment and storage solutions, reinforcing the region’s leadership in the clean energy transition.

In Germany, the solar power equipment market is progressing on account of a strong commitment to the energy transition and support for renewable energy adoption. Simultaneously, the continuous expansion of rooftop and utility-scale solar projects, coupled with a mature grid infrastructure, is sustaining heightened demand for advanced solar modules, inverters, mounting systems, and balance-of-system components. In November 2025, Statkraft announced that it had commissioned the country’s largest solar-plus-battery hybrid power plant under the EEG in Zerbst, combining a 46.4 MW solar park with a 16 MW / 57 MWh battery storage system, developed and grid-connected in-house within a 12-month construction timeline. The firm also mentioned that this project generates nearly 50,000 MWh of renewable electricity on a yearly basis, supplying power to around 14,000 households while reducing approximately 32,000 tonnes of CO₂ emissions each year. Furthermore, with an investment of about EUR 45 million (USD 49 to 50 million), the hybrid plant enhances grid stability, improves solar profitability through storage.

The U.K. is also solidifying its position in the regional solar power equipment market owing to the ever-increasing adoption of rooftop solar, growing utility-scale installations, and increasing interest in hybrid systems. In addition, growing corporate sustainability initiatives and community-led renewable projects are efficiently expanding market reach in the country. In September 2025, Solarwatt announced that it had introduced commercial and industrial battery storage solutions, thereby enabling large-scale solar-plus-storage projects to be delivered from a single source across Europe. Besides the new AC and DC hybrid storage systems support higher self-consumption, grid optimization, and emergency power supply, thereby helping businesses significantly reduce energy costs and improve return on investment. Furthermore, this expansion strengthens Solarwatt’s position in the commercial solar power equipment market, hence aligning with growing demand for integrated solar and energy storage solutions.