Solar Encapsulation Market Outlook:

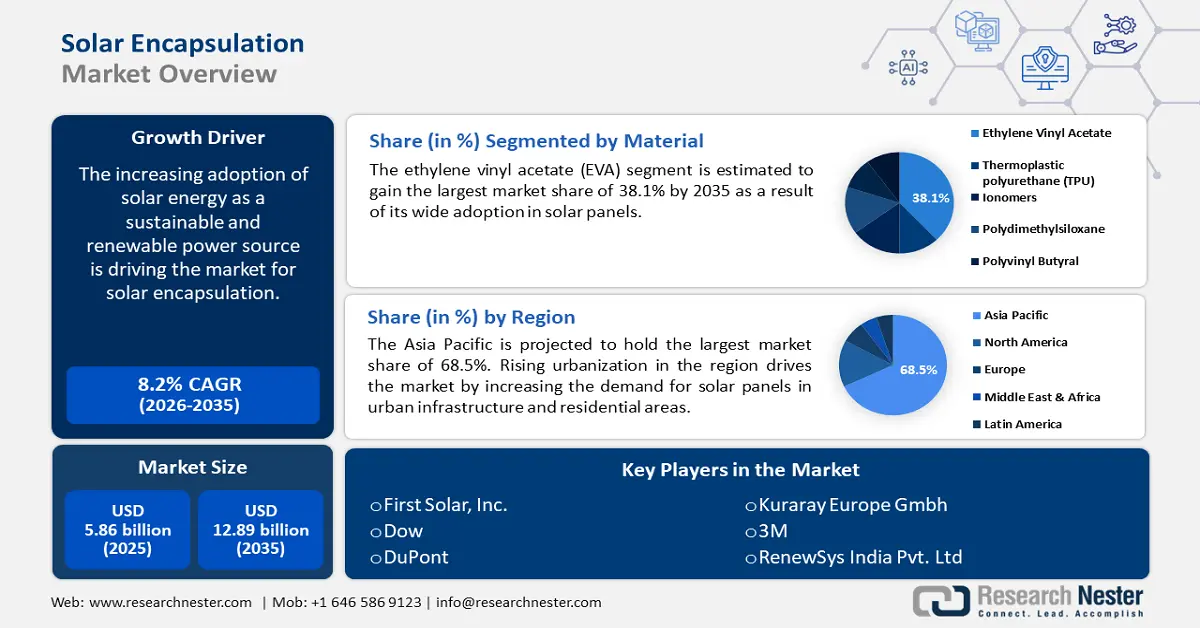

Solar Encapsulation Market size was over USD 5.86 billion in 2025 and is projected to reach USD 12.89 billion by 2035, witnessing around 8.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of solar encapsulation is evaluated at USD 6.29 billion.

The increasing adoption of solar energy as a sustainable and renewable power source is driving the solar encapsulation market. The International Energy Agency (IEA) reported that global annual renewable capacity additions increased by almost 50% to around 510 gigawatts (GW) in 2023, the highest growth rate in the last 20 years. As governments and organizations around the world promote cleaner energy solutions and offer incentives for solar energy projects, the demand for efficient and durable solar panels rises. Moreover, advancements in encapsulation technology, such as the development of more durable and efficient materials, also contribute to market expansion.

Key Solar Encapsulation Market Insights Summary:

Regional Highlights:

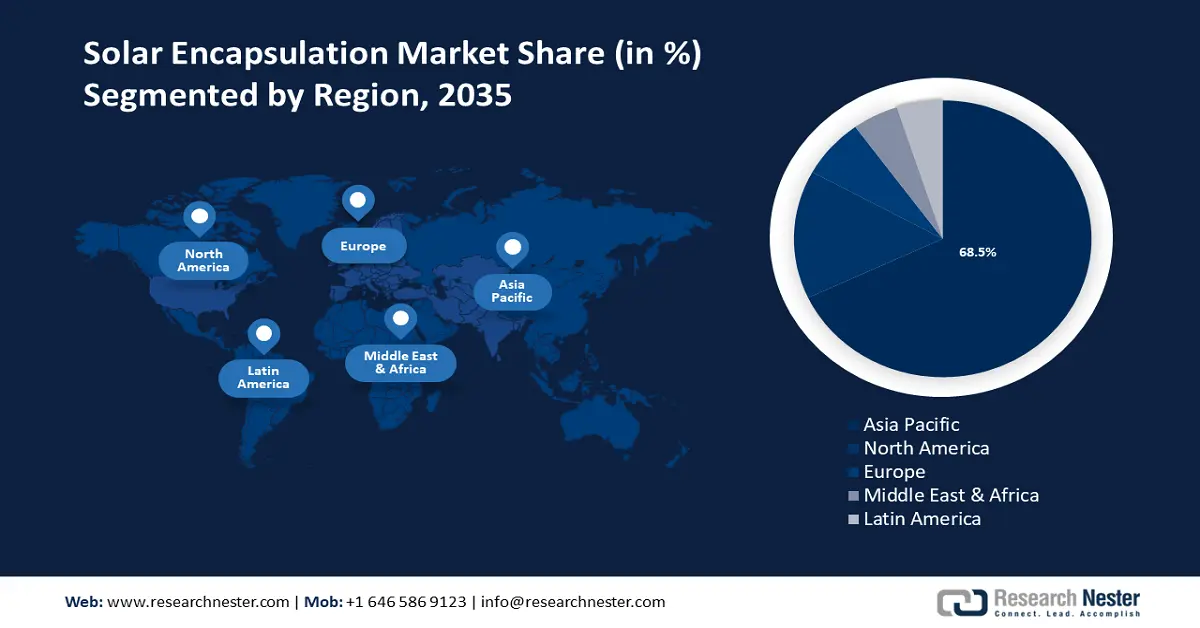

- The Asia Pacific solar encapsulation market will dominate around 68% share by 2035, driven by rising urbanization increasing demand for solar panels.

Segment Insights:

- The ethylene vinyl acetate segment in the solar encapsulation market is projected to hold a 38.10% share by 2035, influenced by the cost-effectiveness, durability, and widespread use of EVA encapsulants in photovoltaic panels.

- The crystalline silicon solar segment in the solar encapsulation market is anticipated to experience significant growth till 2035, driven by the widespread adoption of crystalline silicon technology, especially in emerging markets and large-scale solar installations.

Key Growth Trends:

- Increased spending in the construction industry

- Surging production of automobiles

Major Challenges:

- Market saturation

- Supply chain disruption

Key Players: First Solar, Inc., HANGZHOU FIRST APPLIED MATERIAL CO., LTD., Dow, DuPont, Cambiosolar, Kuraray Europe Gmbh, 3M, RenewSys India Pvt. Ltd.

Global Solar Encapsulation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.86 billion

- 2026 Market Size: USD 6.29 billion

- Projected Market Size: USD 12.89 billion by 2035

- Growth Forecasts: 8.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (68% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Thailand, Indonesia, Brazil

Last updated on : 17 September, 2025

Solar Encapsulation Market Growth Drivers and Challenges:

Growth Drivers

- Increased spending in the construction industry - Many new construction projects adhere to green building standards and sustainability certifications, which often include solar energy systems. Building Research Establishment Environmental Assessment Methodology (BREEAM) is an internationally recognized measure of a building’s sustainability. Approximately 1.5 million buildings have been BREEAM certified, with a further 2.9 million registered for certification across 103 countries.

Moreover, government policies promoting energy efficiency and renewable energy in construction projects further drive the demand for solar panels and their encapsulation. Overall, the growing investments in construction and infrastructure development are creating a favorable environment for the expansion of the solar encapsulation market. - Surging production of automobiles - The automotive industry is exploring the integration of solar panels into vehicles, such as solar roofs or auxiliary power systems. These applications require advanced encapsulation materials to ensure durability and performance. Moreover, rising investments in solar technology along with collaborative efforts between automotive and solar industries can lead to the development of new encapsulation technologies. For instance, leading national renewable energy provider Pivot Energy proudly announced with American EV maker Rivian on a total of 60 Megawatts (MWdc) of solar energy.

Challenges

- Market saturation - In regions where solar energy adoption is already high, there may be fewer new installations, reducing the demand for additional encapsulation materials. High market saturation can lead to increased competition among manufacturers, driving down prices for encapsulation materials and affect profit margins.

- Supply chain disruption - Encapsulation materials such as ethylene-vinyl acetate (EVA) or specialized resins rely on specific raw materials. Disruptions in the supply of these materials can lead to shortages, affecting production schedules and increasing costs. Moreover, in efforts to address supply chain disruptions, manufacturers might turn to alternative suppliers or materials that could affect the quality and performance of encapsulation products.

Solar Encapsulation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.2% |

|

Base Year Market Size (2025) |

USD 5.86 billion |

|

Forecast Year Market Size (2035) |

USD 12.89 billion |

|

Regional Scope |

|

Solar Encapsulation Market Segmentation:

Material Segment Analysis

The ethylene vinyl acetate segment in the solar encapsulation market is estimated to gain the largest revenue share of 38.1% by 2035. EVA is the most widely used encapsulant in solar panels. Nearly 80% of photovoltaic (PV) modules are encapsulated by EVA materials. It provides a protective layer that enhances the durability and performance of solar cells by protecting them from environmental factors like moisture and UV radiation. EVA’s adhesive properties ensure strong bonding between solar cells and the protective glass or backsheet, contributing to higher efficiency and longer lifespans of solar panels. Moreover, it is relatively cost-effective compared to other encapsulation materials thus, supporting the growth and development of the market.

Technology Segment Analysis

Throughout the projected period, the crystalline silicon solar segment in the solar encapsulation market is foreseen to register a significant CAGR. Crystalline silicon technology, including monocrystalline and polycrystalline solar panels, is the most prevalent type of solar technology used globally. This dominance ensures a consistent and high demand for encapsulation materials to protect these panels. As the adoption of crystalline silicon technology expands, particularly in emerging markets and large-scale solar installations, the need for effective encapsulation solutions grows.

End user Segment Analysis

By the end of 2035, the rooftop solar segment is predicted to hold substantial share of the global solar encapsulation market. Rooftop solar installations are becoming increasingly popular for residential and commercial buildings as homeowners and businesses seek to reduce energy costs and carbon footprints. This growth translates into higher demand for solar panels and, consequently, encapsulation materials.

Our in-depth analysis of the solar encapsulation market includes the following segments:

|

Material |

|

|

Technology |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Solar Encapsulation Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is likely to dominate majority revenue share of 68% by 2035. Rising urbanization in the region drives the market by increasing the demand for solar panels in urban infrastructure and residential areas. According to the World Economic Forum, the share of the world’s population living in cities is expected to rise from 55% in 2022 to 80% by 2050. Urbanization fosters technological advancements and innovation. As cities evolve, there is need for better, more efficient solar technologies, including improved encapsulation materials that can withstand urban environmental conditions.

China is at the forefront of advancements in solar technology. Innovations in encapsulation materials such as improved EVA formulations and alternative materials are driven by the need for higher efficiency and durability in solar panels.

India is one of the fastest-growing countries adopting solar panels. The government provides various incentives, including subsidies, tax benefits, and favorable policies to promote solar energy. These incentives boost the installation of solar panels and increase the need for high-quality encapsulation materials.

North America Market Insights

North America solar encapsulation market will register significant revenue by 2035, propelled by the increasing number of solar farms, which are massive solar PV panel systems that feed the grid with electricity. This may significantly augment the market demand for solar encapsulation, as it is essential to provide structural support to the solar cell in the solar panels.

In the U.S., the solar encapsulation market is driven by the expansion of solar parks and large-scale solar farms, particularly in sunny states like California, Texas, and Arizona. To withstand the harsh environmental conditions, there is an increase in the demand for effective encapsulation solutions. In 2023, the U.S. Energy Information Administration stated that there are more than 5,000 solar farms in the nation. In 2022, they produced 3.4% of the nation's electricity.

Additionally, Government of Canada has introduced new regulations aimed at growing the renewable energy sector, whereby all electricity used in government buildings and operations by 2025 will come from renewable sources. Also, investments by major firms contribute significantly to the solar encapsulation market expansion.

Solar Encapsulation Market Players:

- STR Holdings, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- First Solar, Inc.

- HANGZHOU FIRST APPLIED MATERIAL CO., LTD.

- Dow

- DuPont

- Cambiosolar

- Kuraray Europe Gmbh

- 3M

- RenewSys India Pvt. Ltd

The solar encapsulation market key players play a crucial role in advancing solar encapsulation technologies and driving industry growth through innovation, quality, and extensive product offerings.

Recent Developments

- In May 2023, First Solar, Inc. announced the acquisition of Swedish manufacturing startup Evolar AB to broaden the development of highly efficient tandem photovoltaic technology and intends to combine Evolar's experience with its current R&D streams.

- In May 2023, Dow announced the addition of DOWSIL PV to its silicone sealant product line, to produce cutting-edge, next-generation silicone materials that meet customer demands and contribute to the development of a more sustainable global community.

- Report ID: 6317

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Solar Encapsulation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.