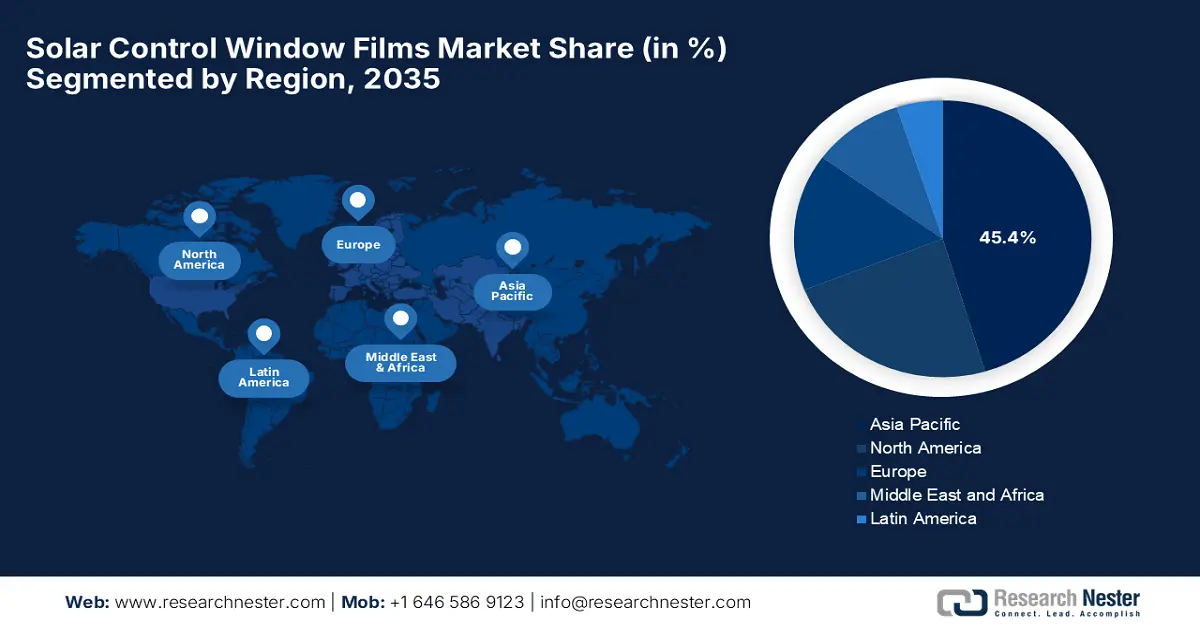

Solar Control Window Films Market - Regional Analysis

APAC Market Insights

The Asia Pacific solar control window films market is expected to dominate the entire global landscape, capturing around 45.4% of the total revenue share by 2035. Large-scale commercial, residential construction, rapid urbanization, energy efficiency policies, and infrastructure expansion are the key factors propelling the region’s leadership. For instance, in June 2023, Toray Industries announced that it had developed the PICASUS high heat-insulating solar control film for mobility applications by using nano-multilayer technology to block infrared rays while also maintaining glass-like transparency. It is applied to electric vehicle windshields, wherein the film reduces air-conditioning power consumption by approximately 30%, extends cruising range by 6%, and lowers cabin temperatures by 2°C, all by supporting 5G communications due to its metal-free design. Furthermore, Toray is conducting full-scale tests for commercial deployment, highlighting its potential in energy efficiency, passenger comfort, and carbon neutrality.

China solar control window films market is highly augmented by large-scale commercial construction and widespread residential high-rise development. The country’s market also benefits from regulatory emphasis on energy efficiency and green buildings, driving the integration of solar control films during initial glazing, particularly in curtain-wall and smart-building projects. In November 2025, YUXINFILM announced at the Warsaw Motor Show that it would debut its next-generation automotive window films and paint protection films, which consist of heat rejection, 99% UV protection, enhanced shatter resistance, and advanced self-healing technology. The company is mainly focused on improving interior comfort, safety, and vehicle aesthetics while demonstrating its innovations to global industry professionals. Hence, this launch reflects YUXINFILM’s prominent role in advancing solar control and protective film technologies in the automotive sector.

India market is positively influenced by a combination of factors such as rising temperatures, energy costs, and steadily progressing urban infrastructure. Solar control films are widely adopted in the country’s commercial offices, IT parks, and residential complexes with a prime focus on improving indoor comfort and reducing air-conditioning loads. In December 2024, ITPB CapitaLand upgraded its buildings in Bengaluru with Saint-Gobain Solar Gard exterior grade solar control films. The company also notes that EPD-verified films enhance building aesthetics by reducing solar heat gain, blocking harmful UV rays, and improving energy efficiency. Also, this project demonstrates the practical benefits of solar control window films in commercial buildings, showing how such films contribute to occupant comfort and operational energy savings, hence denoting a positive market outlook.

North America Market Insights

The North America market is efficiently propelled by the rising emphasis on energy efficiency and sustainability in both commercial and residential sectors. Companies in the region are leveraging innovative film technologies that maintain optical clarity at the same time, enhancing thermal performance. In June 2025, American Window Film (AWF) announced that it had acquired Solar Vision, which is a 3M authorized dealer, to expand AWF’s presence in Colorado. Therefore, this acquisition strengthens AWF’s national footprint and enables broader delivery of solar control, security, decorative, and anti-graffiti window films to commercial, government, as well as residential clients. Furthermore, this move reflects AWF’s strategy to grow its market reach by leveraging Solar Vision’s established expertise and high-profile project portfolio.

The U.S. solar control window films market is dominating the entire regional landscape through federal and state energy efficiency programs, which incentivize building owners to implement heat-rejecting solutions. The commercial sector, such as in office complexes and institutional facilities, is a key adopter due to the rising cooling costs and sustainability targets. In this context IRS reported that from January 1, 2023, through December 31, 2025, U.S. homeowners can claim the energy-efficient home improvement credit, receiving up to 30% of qualifying expenses for energy-efficient upgrades, including exterior windows and skylights that reduce solar heat gain and improve building performance. The credit was applied to primary residences, by covering new systems and materials, and requires compliance with energy efficiency standards such as Energy Star's Most Efficient. In addition, this federal incentive encourages the adoption of solar control films and other energy-saving building envelope improvements, supporting reduced cooling costs and sustainability goals.

The aspect of extreme temperature variations and the heightened demand for energy-efficient buildings are the key fueling factors for the Canada solar control window films market. The construction industry in the country is mainly opting for these films during new builds and retrofits, integrating them into curtain walls, glass facades, and residential glazing projects. In this context, in March 2023, 3E Nano Inc., which was co-founded by University of Toronto Engineering Professor Nazir Kherani, announced that it received USD 5 million in federal funding from Sustainable Development Technology Canada to commercialize its solar-energy-control window coatings. It also notes that this nano-thin, multi-layer dielectric–metal–dielectric film is reported to enhance thermal insulation, reflecting near- and mid-infrared light by also allowing visible light through, effectively reducing building heating as well as cooling loads. This funding supports the startup’s goal of scaling production for both residential and commercial applications.

Europe Market Insights

The Europe solar control window films market holds a prominent position in the international landscape owing to the presence of strict energy performance directives and sustainability mandates. The region’s market also benefits from the heightened demand for non-metallic and low-reflectivity films that align with both environmental goals and occupant comfort requirements. In April 2023, Saint-Gobain Solar Gard reported that it became the first window film brand to obtain verified environmental product declarations (EPDs) for 92 architectural window films, thereby covering solar control, safety, low-E, interior and exterior (SENTINEL) films, as well as decorative designs across Europe and other nations. The company states that these solar control films balance light transmission and heat rejection, reducing energy consumption by also improving summer and winter comfort, and the safety films enhance protection against impact, breakage, and intrusion. The EPDs are valid until 2028, are based on life cycle assessments from cradle to grave, and verified against international standards ISO 14044 and ISO 14025 by The International EPD System.

Germany solar control window films market mainly focuses on emphasizing green construction and retrofit activities to comply with national energy efficiency standards. Manufacturers in the country concentrate on high-performance films that combine durability, clarity, and heat rejection for long-term use. In this regard, Heliatek in May 2024 reported that it completed a double‑façade installation of its HeliaSol solar films on buildings at Erlanger Stadtwerke (ESTW) in Germany by installing around 100 films in just three days using professional high-altitude climbers. The films’ integrated backside adhesive allowed efficient application directly to metal façades, demonstrating that building surfaces can generate clean energy. Moreover, such instances underscore ESTW’s commitment to sustainability and innovation by showcasing Heliatek’s easy-to-install solar film technology, hence denoting a positive market outlook.

The France solar control window films market is witnessing increased adoption of these films, especially in commercial and institutional buildings, which also include offices, schools, and hospitals. Retrofit installations are common in the country owing to historic building stock, with films providing enhanced UV protection and reduced glare by efficiently preserving the window aesthetics. In November 2025, Solar Grad stated that at CHU Grenoble Alpes University Hospital in France, Luxiglass installed Sentinel Plus Silver 35 solar control films to reduce excessive heat and glare by improving thermal comfort for staff. This upgrade refreshed the building by preserving natural light, enhancing workplace conditions. Therefore, this project demonstrates the practical benefits of premium solar control films in commercial healthcare facilities, encouraging both national and international players to make investments in this field.