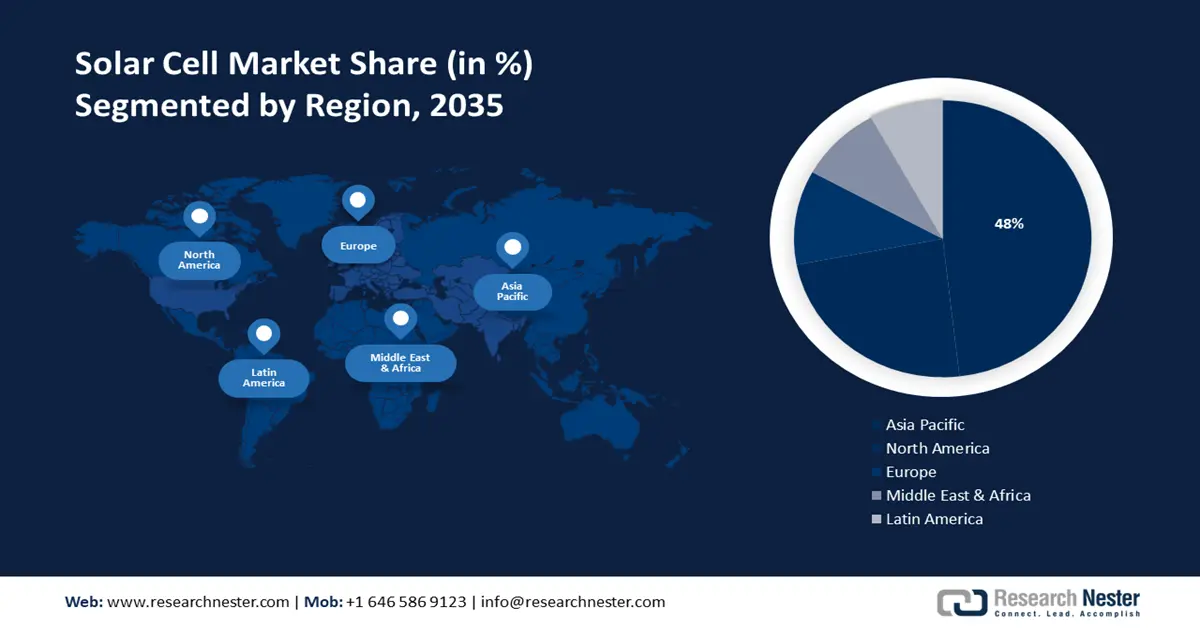

Solar Cell Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is set to hold largest revenue share of 48% by 2035. The market expansion in the region is expected on account of the slated increase in the aerospace industry along with defense as they use more PV energy. A report by Boeing Aircraft in 2023, estimated that by 2042 the airline fleet growth rate would be 6.9% as compared to the airline traffic growth of 9.5%. Presently, Southeast Asia represents the largest exporter of solar cell and module supply to the U.S. The products have demonstrated the expected quality, compliance, and economy necessary to underwrite warranties for U.S. consumers.

China is presently the predominant player in the solar cell and storage supply chains. In China, there has been an increase in urbanization and industrialization which demand more PV panels in highways and residential complexes. The State Council of China published a report in 2022 stating that the urbanization rate crossed 60% in 2019, while in 2021 this rate surpassed 64.72% in this country. This also augments demand for solar PV mounting systems during the forecast period.

The increasing infrastructure development in Japan acts as a growing factor for the solar cell market expansion. According to the World Bank, with a population of 1.6% of the global population in 2021, Japan continues to lead in terms of rapid development in the modern age.

North America Market Insights

In solar cell market, North America region is projected to capture considerable revenue share by 2035 credited to the surge in energy demand. A report by the U.S. Energy Information Administration in 2023 stated that renewable energy consumption and production had made records in 2022, crossing 13% (13.18 quads and 13.40 quads respectively.

In the United States, there has been an increase in government campaigns and investments aimed at raising awareness about the use of renewable energy. According to a survey conducted in 2023, it was revealed that more than 66% of U.S. adults prioritize using an alternative energy source like solar, hydrogen, and wind power. the U.S. can and is breaking free from an overreliance on imports while building a resilient and equitable U.S. solar and storage manufacturing base.

As a direct result of the Inflation Reduction Act (IRA), a new influx of investments in domestic solar modules, inverters, trackers, racking capacity, solar ingot, and cell capacity has been observed. The IRA will be instrumental in facilitating the U.S. solar industry’s domestic solar harvesting goal of 50 gigawatts (GW) by 2030. The IRA has led to a series of announcements for new manufacturing capacity including 16 GW of ingots and wafers, 16 GW of cells, 47 GW of new modules, nearly 9 GW of inverters, and 100 GWh of battery manufacturing. Furthermore, over 20,000 tons of annual domestic polysilicon capacity will attract a multitude of investments in racking and tracker expansion.

Canada is predicted to have a high electricity demand which encourages collaboration with the energy & power sector. Hence, this factor is estimated to impact the overall growth of the solar cell market in Canada. According to a report in 2023, the energy consumption in Canada tremendously increased to 8585 petajoules from 2022 to 2021.