Software Testing Market Outlook:

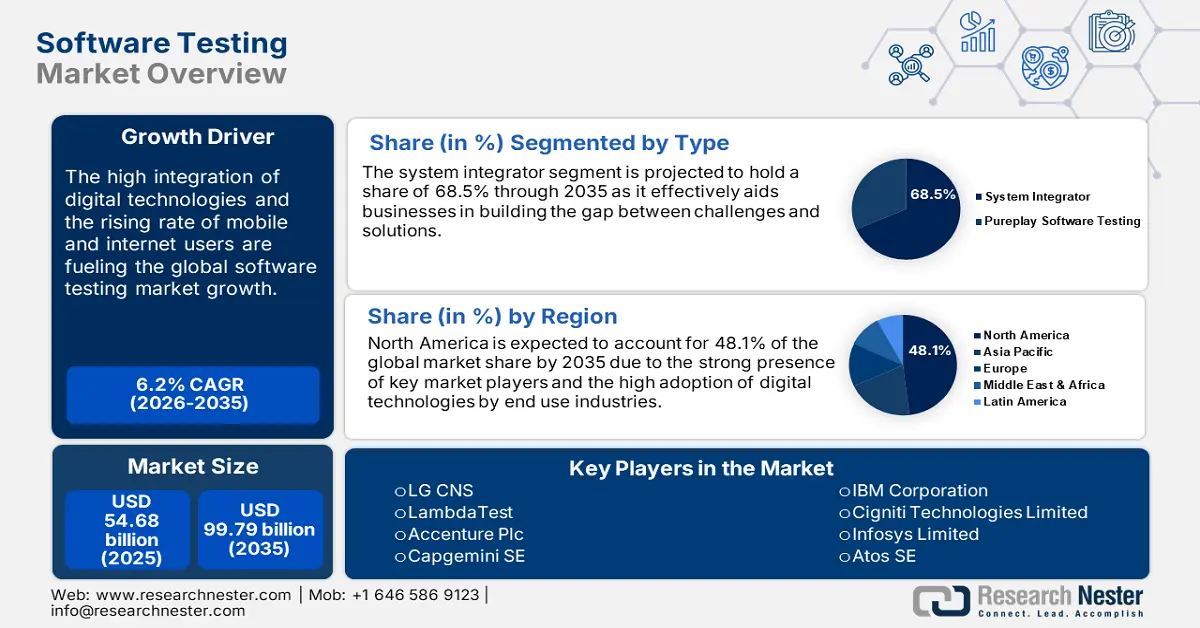

Software Testing Market size was over USD 54.68 billion in 2025 and is poised to exceed USD 99.79 billion by 2035, growing at over 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of software testing is estimated at USD 57.73 billion.

The swift digitalization of companies and the increasing adoption of cloud infrastructure are fueling the need for advanced software testing services. End use industries are employing cloud-based testing solutions as they are more flexible, scalable, and cost-effective than hardware counterparts. These solutions ensure that applications and systems function correctly across various platforms, devices, and network conditions without the limitations and overhead of traditional testing methods. For instance, the U.S. Bureau of Labor Statistics reveals that an estimated 203,040 software quality assurance analysts and testers employment opportunities were present in 2023. Furthermore, global spending on digital transformation was valued at USD 1.85 trillion in 2022. In 2023, over 90% of organizations globally adopted cloud technologies. Also, the adoption rate of any emerging technology with public cloud spending increased to USD 560 billion, globally.

The World Bank reveals that the integration of digital solutions doubled from 10% to 20% in micro firms whereas in large firms it tripled from 30% to 60% during the period April 2020 to December 2022. Particularly, among developing regions, East Asia is at the forefront of adopting digital solutions, its share quadrupled from 13% to 54% between 2020 to 2022. Furthermore, the software development and tech consulting services sector increased twice as fast as the worldwide economy. The sector's significant growth was highly concentrated in the economies namely the U.S., India, China, Japan, and the U.K. amounting to 70% of the global value.

Key Software Testing Market Insights Summary:

Regional Highlights:

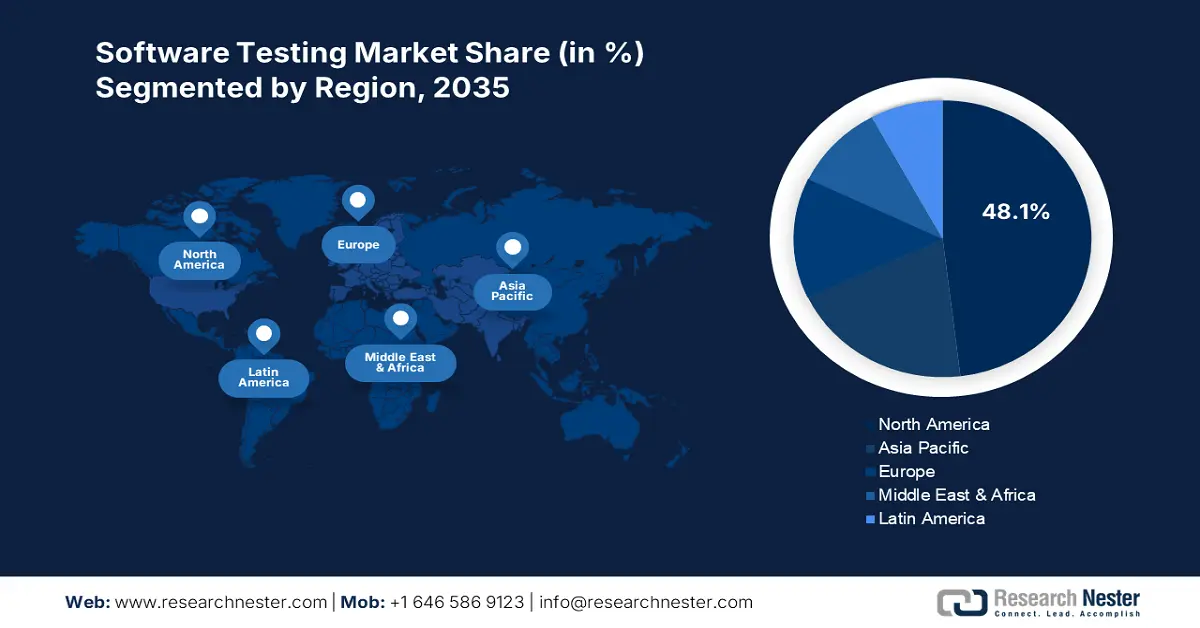

- North America's 48.1% share in the Software Testing Market is fueled by the swift digital transformation across multiple industries, solidifying its dominance with rising demand for advanced testing solutions in 2026–2035.

- Asia Pacific's software testing market is set for high growth through 2026–2035, driven by rapid digitalization, investments in technology, and increasing presence of key market players in the region.

Segment Insights:

- The Application Component segment is forecasted to exceed 54.1% share by 2035, driven by the adoption of advanced, integrated software systems requiring reliable testing.

- The System Integrator Type segment is anticipated to hold around 68.5% share by 2035, propelled by demand for cloud-based integration and digital transformation.

Key Growth Trends:

- Integration of digital technologies

- Rising demand for mobile testing apps

Major Challenges:

- High costs of advanced testing solutions

- Lack of skilled experts & complexity issues

- Key Players: Tricentis, LG CNS, LambdaTest, Accenture Plc, Capgemini SE, and Cognizant Technology Solutions Corporation.

Global Software Testing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 54.68 billion

- 2026 Market Size: USD 57.73 billion

- Projected Market Size: USD 99.79 billion by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (48.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, India, Germany, UK

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

Software Testing Market Growth Drivers and Challenges:

Growth Drivers

- Integration of digital technologies: The integration of artificial intelligence (AI) and machine learning (ML) into software testing tools is significantly enhancing their efficiency and accuracy. The advanced technology-integrated platforms smartly analyze areas of risk, generate test cases, and even detect anomalies that might be missed by human testers. These advanced solutions also improve test coverage and mitigate the testing times. For instance, in August 2024, LambdaTest announced the launch of Kane AI an end-to-end artificial intelligence test agent. The first GenAI-powered test solution effectively approaches the author, debugs, and performs end-to-end tests using natural language. This technology effectively streamlines complex workflows and enables complete test coverage.

- Rising demand for mobile testing apps: The rise in the adoption of smartphones coupled with the high use of mobile apps and mobile-first strategies are augmenting the demand for mobile app testing services. The testing on multiple devices, OS versions, and network conditions, as well as integrating performance and security testing is generating lucrative opportunities for service providers.

The World Bank reveals that in 2022, over 90% of individuals in high-income countries were using online platforms. Whereas, a high internet penetration of around 84% was observed in Europe and Central Asia. Furthermore, the average mobile broadband traffic per capita in developed countries is over 20 times greater and fixed broadband traffic is 1,700 times higher than that of underdeveloped economies. The installation of various apps related to education, entertainment, finance, health, and online shopping is over 60%.

Challenges

- High costs of advanced testing solutions: Even if the automation tools and AI-driven testing solutions offer multiple advantages, their implementation expense is high. The cost of adopting and maintaining these tools and the need for skilled resources and experts to operate them drive up costs to the company. Thus, these advanced software testing solutions are often deterred from small and budget-constraint end use companies.

- Lack of skilled experts & complexity issues: The unavailability of skilled professionals particularly in areas such as test automation, AI-based testing, and security testing majorly challenges the overall software testing market growth. Furthermore, the increasing complexity of software architecture such as microservices, distributed systems, and hybrid cloud solutions is making software testing more challenging. The inability to comprehensively test complex systems directly affects the quality and customer experience.

Software Testing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 54.68 billion |

|

Forecast Year Market Size (2035) |

USD 99.79 billion |

|

Regional Scope |

|

Software Testing Market Segmentation:

Type (System Integrator, Pureplay Software Testing)

System integrator segment is set to dominate software testing market share of around 68.5% by the end of 2035. As businesses are shifting towards digital environments the adoption of system integrators is exhibiting a boom owing to its ability to help organizations to migrate, integrate, and manage cloud-based solutions. The spending on digital transformation technologies and services is estimated to increase from USD 2.5 trillion in 2024 to USD 3.9 trillion by 2027.

System integrators (SIs) aid businesses that are running in hybrid environments by ensuring seamless operation across diverse platforms, optimizing processes, and reducing silos. Industries such as manufacturing, healthcare, and finance have specific regulatory requirements and operational complexities. System integrators help these businesses meet requirements by designing and implementing industry-specific solutions that ensure compliance, enhance productivity, and mitigate operational risks.

For instance, the Control System Integrators Association reveals that SIs play a unique role in bridging the gap between challenges and solutions. By 2030, over 2.1 million jobs in the manufacturing sector are expected to be unfilled, creating new challenges for every industry. To combat these obstacles, many organizations are adopting digital solutions to bridge the gap between consumer demand and workflow capacity, generating lucrative opportunities for system integrator solution providers.

Component (Application, Services)

In software testing market, application segment is anticipated to dominate revenue share of over 54.1% by 2035. The application segments are bifurcated into functional and non-functional software testing solutions. The rise of automation, artificial intelligence, cloud technologies, and increasing emphasis on security and compliance is augmenting the demand for these testing solutions. The increasing adoption of modern software systems that are feature-rich and often integrated with multiple third-party services is driving the demand for functional testing to ensure the performance of such software. Furthermore, non-functional testing such as security and scalability testing is also vital to ensure the applications can handle increasing complexity without compromising quality. Thus, the booming adoption of advanced software solutions is significantly contributing to segmental growth.

Our in-depth analysis of the global software testing market includes the following segments:

|

Component |

|

|

Application |

|

|

Type |

|

|

Industry |

|

|

Business Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Software Testing Market Regional Analysis:

North America Market Forecast

North America software testing market is predicted to account for revenue share of more than 48.1% by the end of 2035. The swiftly expanding healthcare, finance, transportation, retail, and manufacturing industries are highly employing digital technologies to enhance their overall productivity. This aspect is positively influencing the need for advanced software testing solutions. Furthermore, the region held around 40.0% of the global cloud technology adoption share in 2023.

In the U.S., rapid digital transformation of end use industries is generating high-earning opportunities for software testing analysts. For instance, the U.S. Bureau for Labor Statistics reveals that in 2023, around 1,897,100 job vacancies for software developers, quality assurance analysts, and testers were available in the country. Thus, the growing job opportunities signify the high adoption rate of software testing market.

In Canada, the government introduced Bill C-27, the Digital Charter Implementation Act with advanced rules and regulations for artificial intelligence systems in June 2022. The International Trade Administration (ITA) projections indicate that the country has more than 670 AI start-ups and 30 generative AI companies. The artificial intelligence market was valued at USD 4.13 billion in 2024. The country’s overall digital economy is projected to expand at a CAGR of 9.0% through 2025. Thus, the country’s continuous investments in technology and innovation are propelling the software testing market growth.

Asia Pacific Market Statistics

The Asia Pacific software testing market is poised to increase at a high pace during the study period. The rapid digitalization of companies, the increasing presence of key market players, and the rising investments in research & innovations in technology fields are collectively contributing to the software testing market growth in the region. India, China, Japan, and South Korea are the most profitable marketplaces in Asia Pacific.

India is one of the rapidly expanding economies with over 1,30,00 start-ups in 2023 from 350 in 2014. Being the major exporter of IT products, the country has the 3rd largest pharma sector and the fastest-growing contract research segment. The India Brand Equity Foundation estimates that AI adoption across key industries amounted to around 40.0% in 2024. The AI market is anticipated to increase at a CAGR of 35% and reach USD 17 billion by 2027.

China’s strong manufacturing and e-commerce sectors are investing highly in advanced technologies such as AI, ML, and the Internet of Things to reduce human error and maximize productivity level. This digital move is increasing the demand for software testing services in these companies. For instance, the State Council Information Office revealed that the country’s digital economy totaled USD 6.99 trillion, in 2022. The Internet penetration surpassed 76.4% from 42.1% between 2021 to 2023.

Key Software Testing Market Players:

- Tricentis

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- LG CNS

- LambdaTest

- Accenture Plc

- Capgemini SE

- Cognizant Technology Solutions Corporation

- IBM Corporation

- Micro Focus International Plc

- TCS

- Wipro

- SmartBear Software

- Parasoft

- Cigniti Technologies Limited

- Keysight Technologies Inc.

- Invensis Technologies Pvt. Ltd.

- Infosys Limited

- Atos SE

- HCL Technologies

Key players in the software testing market are employing several organic and inorganic tactics such as new product launches, technological innovations, strategic collaborations & partnerships, and regional expansion to maximize their profit shares. Leading companies are integrating digital technologies such as artificial intelligence and machine learning to automate repetitive and time-consuming tasks such as regression testing and bug detection. AI-driven tools are widely adopted by large enterprises, boosting the revenues of software testing service providers.

Leading companies are forming strategic partnerships with other players to develop more scalable, efficient, and automated testing solutions. They are also adopting mergers and acquisition strategies to maximize the product offering. By employing regional expansion strategies, software testing market players are earning high profits from untapped markets.

Some of the key players include in software testing market:

Recent Developments

- In March 2024, Tricentis announced the launch of SAP Test Automation an SAP Solution Extension. This SaaS-based test automation solution aids companies in managing end-to-end transformation initiatives seamlessly by testing applications virtually through hosted simulation capabilities.

- In March 2022, LambdaTest announced that it raised USD 45.0 million in its Series C funding to build AWS for testers led by Premji Invest. Furthermore, the existing investors including Telstra Ventures, Sequoia Capital India, Leo Capital, Blume Ventures, and Tricentis, also participated in the round, bringing the startup’s all-time funding to USD 70.0 million.

- Report ID: 6819

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Software Testing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.