Software-Defined Vehicle Market Outlook:

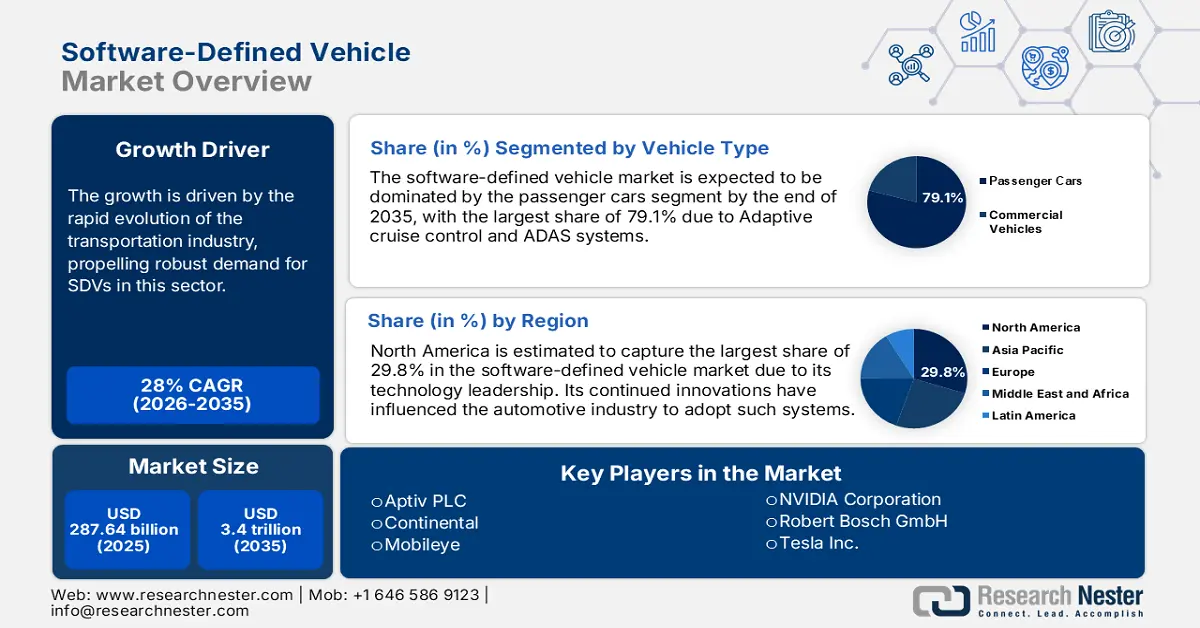

Software-Defined Vehicle Market size was over USD 287.64 billion in 2025 and is projected to reach USD 3.4 trillion by 2035, witnessing around 28% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of software-defined vehicle is assessed at USD 360.13 billion.

The growth is driven by the rapid evolution of the transportation industry. Companies are developing features such as connectivity, automation, and advanced mobility solutions, propelling robust demand in this sector. For instance, in May 2023, Renault partnered with Valeo to improvise its software-defined ecosystem. This partnership will supply SDVs with HPC to increase their capability to adopt new functionalities.

The developed electronic and electrical infrastructure further integrates innovations in the software-defined vehicle market. The unmatched connectivity and cloud computing technology can offer real-time navigation, remote evaluation, and predictive maintenance. Such enhanced features inspire companies to invest and collaborate to deliver more personalized user experiences. For instance, in May 2022, KPIT acquired SOMIT Solutions to add cloud-based capabilities to its vehicle diagnostics portfolio. This addition will create new opportunities to capture the large after-sales industry of automobiles through software intelligence. These further influence automakers to integrate advanced software capabilities in their latest vehicles.

Key Software-Defined Vehicle Market Insights Summary:

Regional Highlights:

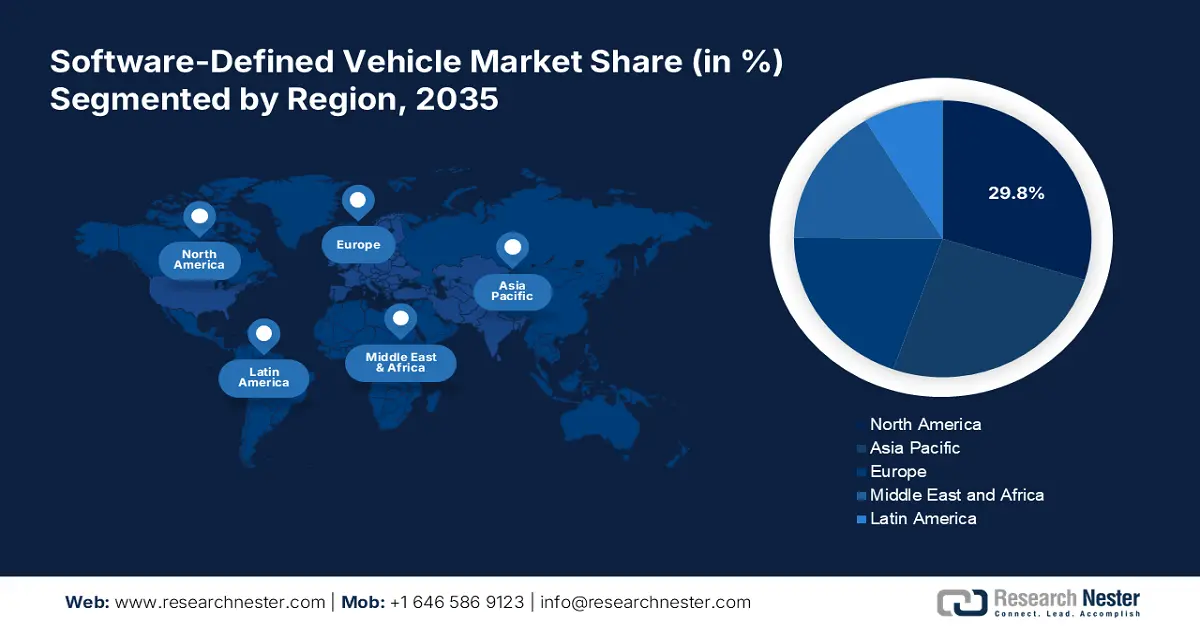

- North America’s 29.8% share in the software-defined vehicle market is propelled by tech leadership, driving growth through 2026–2035.

- The Asia Pacific software-defined vehicle market is set for lucrative growth by 2035, fueled by heavy investments from global leaders accelerating SDV tech adoption.

Segment Insights:

- The Electric Vehicle segment is poised for significant CAGR growth from 2026 to 2035, driven by the shift toward eco-friendly, zero-emission vehicles.

- The Passenger Cars segment of the Software-Defined Vehicle Market is projected to hold around 79.1% share by 2035, driven by the rising deployment of ADAS systems and OTA updates.

Key Growth Trends:

- Rising concern for driving safety

- Integration of AI and machine learning

Major Challenges:

- Lack of consumer trust in adoption

- High development and maintenance costs

- Key Players: Aptiv PLC, Continental, Mobileye, NVIDIA Corporation, Robert Bosch GmbH, Tesla Inc., Waymo LLC.

Global Software-Defined Vehicle Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 287.64 billion

- 2026 Market Size: USD 360.13 billion

- Projected Market Size: USD 3.4 trillion by 2035

- Growth Forecasts: 28% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (29.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, Japan, South Korea, India, Singapore

Last updated on : 14 August, 2025

Software-Defined Vehicle Market Growth Drivers and Challenges:

Growth Drivers

- Rising concern for driving safety: Increasing numbers of traffic fatalities are changing consumer preference towards enhanced safety and convenience. The software-defined vehicle market can offer driving smart features to prevent such accidents. For instance, in May 2024, AVL participated in the FEDERATE project with other partners. The Chips JU Framework aims to realize the concept of safe and reliable software-driven automobiles. The upgraded vehicles are equipped with collision detection, emergency braking, and lane-keeping assistance to ensure safety while driving. Such advanced technologies are pushing automakers to adopt more software-driven solutions.

- Integration of AI and machine learning: The inflated demand for autonomous driving solutions has influenced AI and ML integration in the software-defined vehicle market. This enables advanced functions such as self-driving and in-vehicle personalization. Its data analytic facility can optimize the key components of a vehicle including fuel efficiency and performance. Tech companies are also taking action to develop sophisticated software systems to accelerate EV adoption. For instance, in January 2024, Intel acquired Silicon Mobility SAS to establish its AI-everywhere strategy in the automobile industry. The acquisition will bring AI assistance to EV energy management and SDV SoC monitoring.

Challenges

- Lack of consumer trust in adoption: There is a significant gap in trust for driverless automobiles in the case of complex driving conditions. This may further make them hesitant to invest in the software-defined vehicle market. Rising questions on liability during system failures can also undermine user confidence. Controlling AI and ML in vehicles can show undetermined behavior, which further impacts its decision-making capabilities. This can further limit the adoption for usage on public roads.

- High development and maintenance costs: Along with expensive sale prices, the SDVs also present additional expenses in aftersales services. This may hinder the adoption in highly price-sensitive regions. The lack of a unified standard for SDV software may become a hurdle in the process of future development. This can also result in difficulty for manufacturers to design affordable, yet compliant models. In addition, it may decrease the possibility of implementation in business fleets due to uncertain profit margins.

Software-Defined Vehicle Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

28% |

|

Base Year Market Size (2025) |

USD 287.64 billion |

|

Forecast Year Market Size (2035) |

USD 3.4 trillion |

|

Regional Scope |

|

Software-Defined Vehicle Market Segmentation:

Vehicle Type (Passenger Cars, Commercial Vehicles)

In terms of vehicle types, passenger cars segment is estimated to dominate around 79.1% software-defined vehicle market share by the end of 2035. Adaptive cruise control and ADAS systems have made these models preferable to fit commercial transportation. The advanced cameras, sensors, and radars are capable of processing large data to deliver precise software outputs. Tech companies are increasingly prioritizing OTA updates and feature additions for improved performance. For instance, in June 2024, Renesas launched R-Car Open Access (RoX) for seamless integration of AI applications in SDVs. The market-ready platform enabled ASIL D-level sensing to elevate the in-cabin passenger experience.

Propulsion Type (ICE, Electric Vehicle)

Based on propulsion type, the software-defined vehicle market is expected to witness significant progress in the EV segment. The rising concern about sustainability is pushing automakers to manufacture eco-friendly solutions. Electric vehicles are setting the future of this concept, promoting zero-emission in transportation. Software can enhance the operational value of these cars to deliver optimal performance. The advanced control systems can increase energy efficiency through smart battery management and regenerative braking features. Leading tech companies are now investing to develop technologies to reduce footprint. For instance, in April 2024, intel acquired in-tech to accelerate its R&D for e-mobility engineering. It aims to utilize in-tech assets in automobile-specific software systems to upgrade EVs in the UK.

Our in-depth analysis of the global software-defined vehicle market includes the following segments:

|

Vehicle Type |

|

|

Propulsion Type |

|

|

Level of Autonomy |

|

|

Offering |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Software-Defined Vehicle Market Regional Analysis:

North America Market Analysis

North America industry is expected to dominate majority revenue share of 29.8% by 2035. due to its technology leadership. Its continued innovations have influenced the automotive industry to adopt such systems. Leading automakers including General Motors, Ford, and Stellantis are heavily investing in SDVs. This further inspires other regional startups to adopt advanced technologies in delivering enhanced vehicle performance. For instance, in June 2022, Apple launched a new software-driven car dashboard, CarPlay. The tool enables the monitoring of crucial vehicle components including speed and gas mileage. Automakers such as Ford, Nissan, and Honda shared their plan to implement this software in their upcoming models.

Being home to winning cloud companies such as Apple, Google, and Microsoft has inflated SDV demand in the U.S. software-defined vehicle market. The country is also opening doors to imported technologies to boost its software implementation. For instance, in February 2023, Hyundai and Kia announced to offer advanced software systems to 8.3 million cars in this country. The protection software will indulge in existing vehicle features to enhance traffic safety in response to the increasing thefts.

Canada is pushing towards remarkable growth in the software-defined vehicle market with its established automobile manufacturing industry. Domestic tech companies in this country are collaborating with global leaders to bring innovative software solutions to the auto industry. For instance, in March 2024, LeddarTech collaborates with Arm to develop new technology, LeddarVision for ADAS, AD, and parking. The AI-powered tool is capable of enhancing SDV navigation by accessing Arm’s next-generation hardware and software solutions.

APAC Market Statistics

Asia Pacific is expected to generate lucrative opportunities in the software-defined vehicle market during the forecast period. The developing auto industry of this region holds the potential to bring innovative solutions in this sector. Global leaders including Hyundai, Nissan, BMW, and BYD are heavily investing to accelerate development in this region by adopting SDV technologies. Tech leaders are introducing advanced software tools to offer elevated vehicle performance, safety, and infotainment systems. In September 2024, Hyundai Motors partnered with Kia and Samsung to develop improved connectivity for SDVs. The alliance will empower the vehicle-to-smartphone connection to create a user-specific ecosystem. This further inspires other domestic competitors to invest in smart auto technologies.

The rapidly evolving auto industry and supportive government are revealing the growth potential of India software-defined vehicle market. Many well-established companies in this country are contributing to the optimum implementation of tech ecosystems. They are taking the initiative to support the transition of the domestic automotive industry. For instance, in July 2024, Tata Elxsi opted for River Studio Developer to be the partner in leveraging their technology and design for SDVs. The collaboration will take off the speed of development and deployment of its DevSecOps platform.

With global leaders such as BYD, China is predicted to gain traction in the software-defined vehicle market. The country is also improvising software technologies to elevate its EV industry. Many business fleets including Didi Chuxing are incorporating such advancement in their MaaS offerings. This further creates the scope of investment to help generate greater revenue from this sector. In October 2023, Didi received funding worth USD 149 million from GAC Group and Guangzhou for R&D in autonomous driving. Such support is helping the country to convert urban mobility through autonomous technology and V2I communication.

Key Software-Defined Vehicle Market Players:

- Aptiv PLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Continental

- Mobileye

- NVIDIA Corporation

- Robert Bosch GmbH

- Tesla Inc.

- Waymo LLC

- Karma Automotive

- Stellantis

Growth in the software-defined vehicle market is highly dependent on consumer acceptance of new technologies. Many tech companies are taking the responsibility to educate drivers about the benefits and effectiveness of these SDVs. For instance, in March 2024, Accenture launched a skill development platform, LearnVantage to help SDV drivers to gain essential operational knowledge. This is further supplying skilled professionals to encourage auto business fleets to adopt software-driven cars. The software monitoring and battery optimizing systems are being utilized for new EV models, contributing to sustainability. Companies are investing to promote software-driven EVs to consolidate their leading position. Such key players include:

Recent Developments

- In August 2024, Karma Automotive partnered with Intel to produce a new genre of software-defined luxury vehicles. The company made a bold move to develop an SDV architecture, offering B2B solutions to OEMs and Tier 1 suppliers.

- In January 2024, Stellantis acquired Cloud Made’s AI, machine learning models, intellectual property rights, and patents. This acquisition aims to support the development of STLA Smart Cockpit, which will offer more flexible and faster mobility.

- Report ID: 6659

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Software-Defined Vehicle Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.