Software-Defined Networking Market Outlook:

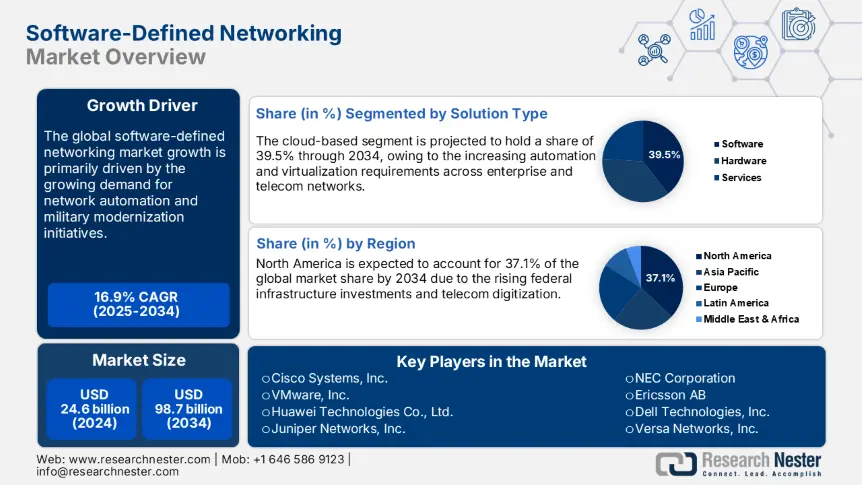

Software-Defined Networking Market size was valued at USD 24.6 billion in 2024 and is projected to reach USD 98.7 billion by the end of 2034, rising at a CAGR of 16.9% during the forecast period, from, 2025 to 2034. In 2025, the industry size of software-defined networking is estimated at USD 28.7 billion.

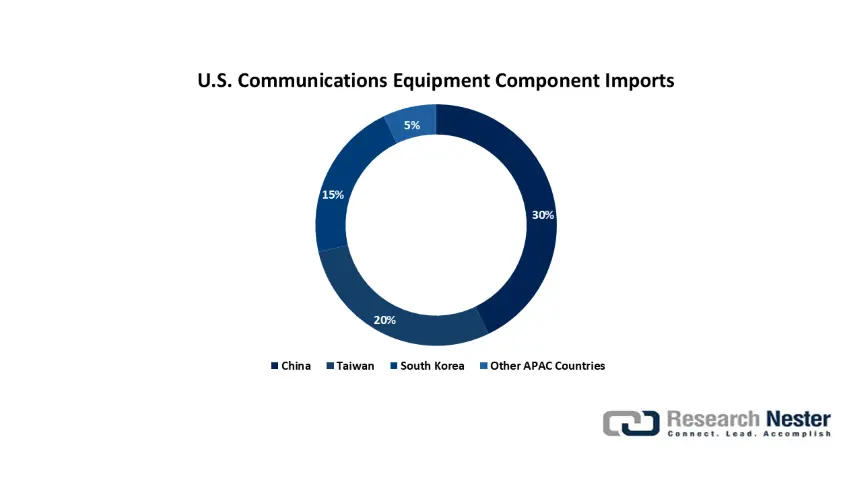

The software-defined networking trade is characterized by the multifaceted supply chain of semiconductor components and telecom hardware integration. The production of efficient software-defined networking solutions is dependent on advanced network processors, application-specific integrated circuits, and programmable switches. The supply of specialized raw materials and components is led by East Asian economies, owing to the strong presence of manufacturing hubs. The SDN market reports the import trade of raw materials from east to west, and the final product sales vice versa.

Source: International Trade Commission (ITC)

According to the International Trade Commission (ITC), the U.S. imports around 70% of its communications equipment components from Asia, with China, Taiwan, and South Korea. In 2023, U.S. communications equipment component imports grew by 6.3% YoY, reflecting high demand for programmable networking infrastructure. Domestic integration centers and OEMs are vital for incorporating SDN controllers into cloud and enterprise network systems. The Department of Commerce states that global semiconductor lead times fell to an average of 15 weeks in the fourth quarter of 2024, from over 22 weeks in 2022, enhancing hardware availability across SDN value chains. Such recommendations are poised to fuel the adoption of software-defined networking in the years ahead.