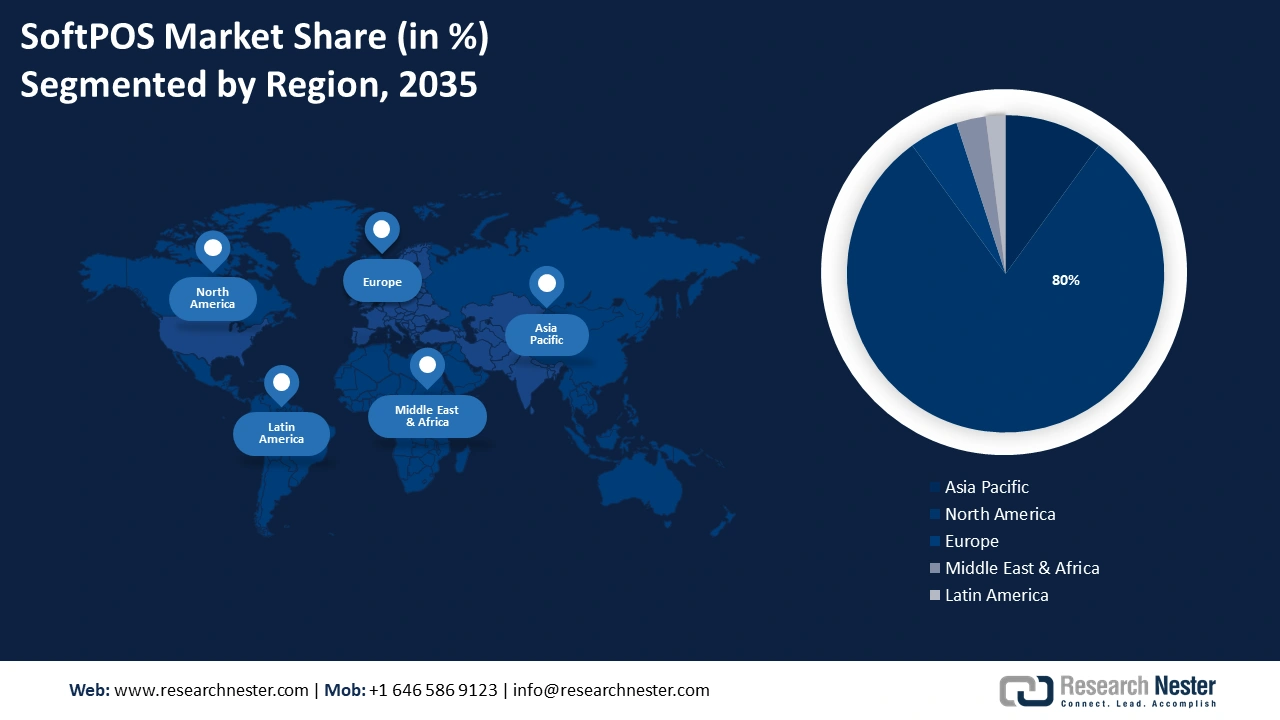

SoftPOS Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific region in softPOS market is projected to hold considerable revenue share by 2035. Growing smartphone usage, digital payment penetration, and the region’s drive towards financial inclusion are driving the growth. Governments and fintech firms are also adopting SoftPOS to facilitate economic digitization by expanding SoftPOS adoption across small and medium enterprises (SMEs). SoftPOS systems are further accelerated by the surge in e-commerce and mobile banking across Asia Pacific.

SoftPOS is a thriving market in India due to the rapid rise of fintech in the country, and government attempts to increase digital payments. In August 2024, Pine Labs, in collaboration with Visa, launched Pine Labs Mini at the Global Fintech Fest in Mumbai to address SMEs and local merchants. This device simplifies in-store digital payment, a traditional QR code with more sophisticated SoftPOS technologies. Driven by the growing SME sector in India and the demand for contactless payments, the SoftPOS segment is anticipated to witness higher growth in the country, and the country is expected to be a key player in the Asia Pacific market.

China SoftPOS market is anticipated to rise at a stable pace due to the advanced mobile payment ecosystem and wide adoption of contactless technology in the country. SoftPOS integration has been accelerated across retail, hospitality and transportation sectors as the government’s thrust on digital transformation and cashless transactions gained momentum. SoftPOS solutions are being picked up by major fintech firms that serve the country’s massive unbanked and underbanked populations. SoftPOS adoption is set to rise rapidly with super apps and mobile wallets, and China is set to lead Asia Pacific digital payment landscape.

North America Market Insights

By the end of 2035, North America region is likely to hold substantial softPOS market share, due to the growing demand for flexible and contactless payment options. Strong digital infrastructure, high smartphone penetration, and emphasis on financial inclusion make the SoftPOS systems an easy choice for new adoption in the region. As consumers increasingly move to cashless transactions, businesses are investing in technologies allowing mobile devices to act as payment terminals to make customers’ lives easier and cut costs for merchants.

The growth of the SoftPOS market in the U.S. is driven by partnerships between fintech companies and large acquirers. In November 2022, Phos partnered with Elavon to create a Tap to Pay solution that enabled ISOs and ISVs to use mobile devices to transform them into contactless payment terminals. This innovation addresses other sectors, such as retail and service industries, with a huge adoption of SoftPOS technology for small and mid-sized businesses. As U.S. consumers increasingly favor digital payments, the market is expected to thrive, with significant contributions from independent vendors and technology providers.

Canada SoftPOS market is anticipated to rise at a significant pace as the country strives to become a leading contactless, secure payment market. This has seen fintech firms ally with financial institutions, and small retailers and service providers have started to adopt. With the cashless payment rate on the rise, businesses are using SoftPOS technology to increase payment flexibility and accommodate changing consumer demand. These are part of the wider push of the government to digitize financial services and accelerate the pace of payment infrastructure innovation.