Soft Ferrite Market Outlook:

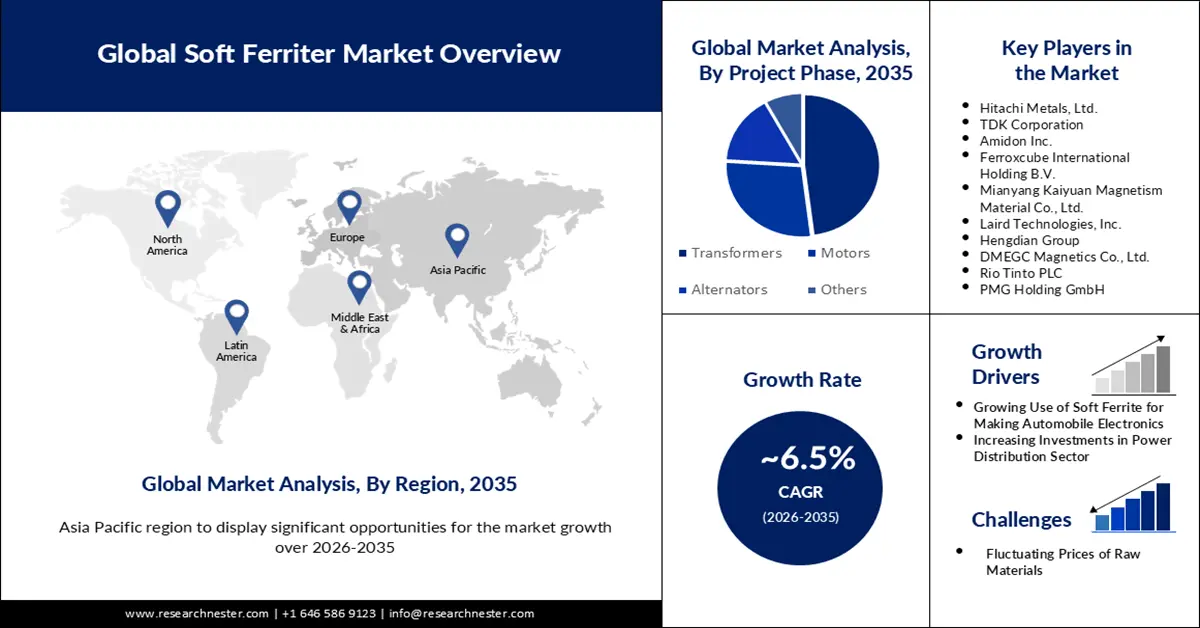

Soft Ferrite Market size was valued at USD 2.51 billion in 2025 and is expected to reach USD 4.71 billion by 2035, registering around 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of soft ferrite is assessed at USD 2.66 billion.

The growth of the market can be attributed to the widespread adoption of soft ferrite across multiple fields the primary factors impacting the development of the soft ferrite market throughout the forecast period. Transmission transformers, portable transformers, distribution transformers, 1 HP-100 HP motors, 101 HP-200 HP motors, 201 HP-500 HP motors, 501 HP-1000 HP motors, Inductors, and generators are some of the primary sectors where the soft ferrite industry is frequently employed.

Soft ferrite is a ceramic substance with moderate coercive strength. This characteristic aids in the modification of their magnetization, allowing them to function as magnetic field conductors. This attribute allows soft ferrite to spread smoothly for usage in a variety of applications throughout the electronics industry. Also, With the growing demand from the chemical sector, the market is expected to grow in the future. According to the U.S. Bureau of Economic Analysis, in 2020, for the U.S., the value added by chemical products as a percentage of GDP was around 1.9%. Additionally, according to the World Bank, the Chemical industry in the U.S. accounted for 16.43% of manufacturing value-added in 2018.

Key Soft Ferrite Market Insights Summary:

Regional Highlights:

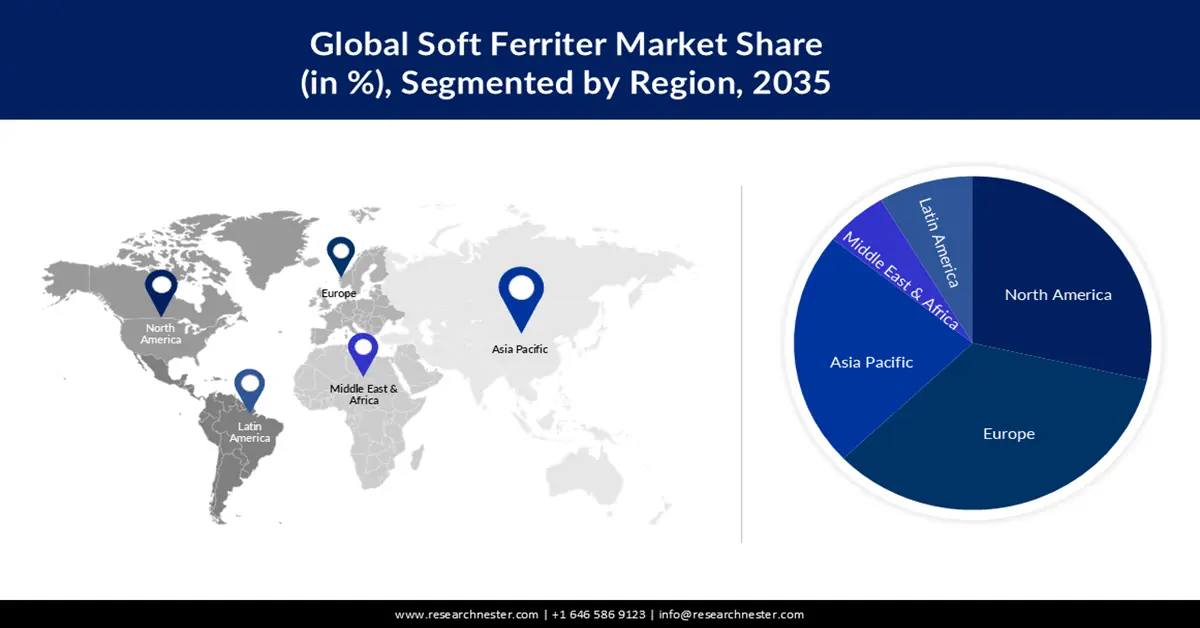

- The Asia Pacific region is projected to secure a 41% share by 2035 in the soft ferrite market, propelled by escalating electricity demand and rapid industrialization.

- North America is anticipated to record robust growth through 2035, supported by expanding electrical component production and surging electric vehicle adoption.

Segment Insights:

- The transformers segment in the soft ferrite market is forecast to command a 48% share by 2035, bolstered by intensifying requirements for energy-efficient power distribution systems.

- The Mn-Zn ferrite segment is set to account for about 65% share by 2035, sustained by its broad adoption across electrical components owing to superior saturation and conductivity characteristics.

Key Growth Trends:

- Major Growth in Electronic Sector

- Increase in the Automotive Electronics field

Major Challenges:

- Fluctuating Prices of Raw Materials

- Complexities in The Structure of Soft Ferrite

Key Players: Toshiba Materials Co., Ltd., Hitachi Metals, Ltd., TDK Corporation, Amidon Inc., Ferroxcube International Holding B.V., Mianyang Kaiyuan Magnetism Material Co., Ltd., Laird Technologies, Inc., Hengdian Group, DMEGC Magnetics Co., Ltd., Rio Tinto PLC, PMG Holding GmbH.

Global Soft Ferrite Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.51 billion

- 2026 Market Size: USD 2.66 billion

- Projected Market Size: USD 4.71 billion by 2035

- Growth Forecasts: 6.5%

Key Regional Dynamics:

- Largest Region: Asia Pacific (41% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Vietnam, Mexico, Indonesia, Brazil

Last updated on : 19 November, 2025

Soft Ferrite Market - Growth Drivers and Challenges

Growth Drivers

-

Major Growth in Electronic Sector- The soft ferrite market is projected to rely heavily on the attributes of elevated electrical resistance and excellent magnetic properties. With large-scale utilization of numerous equipment, the consumer electronics sector retains the worldwide industry thriving. From 1.3% in 2012, India's revenue share in the worldwide electronics manufacturing sector climbed to 3.6% in 2020.

- Increase in the Automotive Electronics field- The utilization of soft ferrite in automotive electronics is propelling the soft ferrite industry to the next level. There are around 306 automobile and engine production centers in Europe that build passenger vehicles, light commercial vehicles, heavy-duty cars, buses, and engines.

- Increasing Investments in the Power Distribution Industry- Annual global power distribution investment was expected to reach USD 1.9 trillion in 2021, up roughly 10% from 2020 and adding overall investment back to its pre-crisis state.

- Rising Applications in Aerospace & Defense Sectors- According to the Boeing Commercial Outlook 2022-2041, total new jet deliveries globally are estimated to exceed 41,170 by 2041. For the first time, global defense spending reached over USD 2 trillion in 2021. Global investment in 2021 was 0.7% greater than in 2020.

- Growing Demand for Telecommunication Services- Total telecom investment in 2020 was expected to be over USD 1500 billion globally.

Challenges

-

Fluctuating Prices of Raw Materials

-

Complexities in The Structure of Soft Ferrite- The complexity of minimizing eddy current losses is the key difficulty faced by most producers in the marketplace, leading to declining market share during the projection period.

-

Some Characteristics such as Minimal saturation magnetic flux density, reduced Curie point, and poor mechanical qualities

Soft Ferrite Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 2.51 billion |

|

Forecast Year Market Size (2035) |

USD 4.71 billion |

|

Regional Scope |

|

Soft Ferrite Market Segmentation:

End-user Segment Analysis

The soft ferrite market is segmented and analyzed for demand and supply by end users into transformers, motors, alternators, and others. Out of these, the transformers segment is estimated to gain the largest market share of about 48% in the year 2035. The growing demand for energy-efficient power distribution systems, as well as severe regulatory requirements to reduce power waste, are boosting the segment's growth prospects. The growing demand for energy-efficient power distribution networks, as well as severe federal regulations to reduce power waste, are boosting the market's growth opportunities. Increased innovation for the building of a centralized power distribution network, continuing use of sophisticated monitoring solutions, and the advancement of power distribution infrastructure are expected to open up new potential opportunities for the transformers segment. Baoding Tianwei Baobian Electric Co. Ltd revealed the manufacturing of its 110KV natural ester oil transformer in September 2022.

Product Segment Analysis

The global soft ferrite market is also segmented and analyzed for demand and supply by product into Mn-Zn ferrite, and Ni-Zn ferrite. Amongst these three segments, the Mn-Zn ferrite segment is expected to garner a significant share of around 65% in the year 2035. Manganese-zinc ferrite (Mn-Zn Ferrite) is widely used in the electrical sector owing to its low cost and, more importantly, its favorable externalities, and numerous industries manufacture motors and transformers. These ferrites are also employed in magnetic liquids, sensors, and biosensors. Furthermore, it has superior saturation levels and conductivity than nickel zinc ferrite from a technical standpoint. Throughout the mid-term projection time frame, there is expected to be a surge in consumer demand for Mn-Zn Ferrite.

Our in-depth analysis of the global market includes the following segments:

|

By Product |

|

|

By Application |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Soft Ferrite Market - Regional Analysis

North American Market Insights

The market in North America is estimated to witness noteworthy growth over the forecast period on the back of the rising production of electrical components in the region. Apart from this, the growing use of electric motors for a variety of industrial applications such as refrigeration, pumping, compressed air, and material processing, is also expected to expand the market in the region in the coming years. As a result of an increase in electrical machinery production in the region. Key market companies in the region's electrical industry, including General Electric, demonstrate an increase in soft ferrite usage. One of the main influences fueling the expansion of the market in North America is the increasing demand for electric automobiles. In the motors and generators of electric cars, ferrite magnets are used. The region's primary markets are the United States and Canada.

APAC Market Insights

Asia Pacific industry is anticipated to account for largest revenue share of 41% by 2035, which can be credited to the increasing demand for electricity, rapid population growth, and growing industrialization in the region. For instance, the electricity consumption in China was more than 7500 terawatt hours in 2020, up from about 7225 terawatt hours in 2019. The total electricity consumption in this nation has only observed a hike since 2010. Over the historical era, Japan has shown potential for expansion in the soft ferrite industry. This is a consequence of increased soft ferrite usage in electrical components such as transformers, smart transformers and motors. Furthermore, an increase in power industry projects may increase the requirement for soft ferrite in the country. According to the National Investment Promotion and Facilitation Agency, India's contribution to global electronics production has increased from 1.3% in 2012 to 3.0% in 2018, with a target of $400 billion by 2025. Therefore, the rise in the electronics sector is also estimated to contribute to the regional market.

Europe Market Insights

Moreover, the market in Europe is anticipated to acquire a significant share during the forecast period. Higher permeation and saturation degrees of Mn-Zn ferrite are expected to boost consumption from motor manufacturers, increasing sales in Europe. As a result of its energy-saving properties, soft ferrite is increasingly being used in high-frequency transformers, which is expected to fuel the expansion of this market in Europe. Furthermore, Germany is known around the world for its pioneering microelectronics manufacturing and research facilities. Germany's electronics industry is also Europe's biggest manufacturing and distribution market. As a result, growth in the electronics sector is expected to add to the regional market over the upcoming decades.

Soft Ferrite Market Players:

- Toshiba Materials Co., Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hitachi Metals, Ltd.

- TDK Corporation

- Amidon Inc.

- Ferroxcube International Holding B.V.

- Mianyang Kaiyuan Magnetism Material Co., Ltd.

- Laird Technologies, Inc.

- Hengdian Group

- DMEGC Magnetics Co., Ltd.

- Rio Tinto PLC

- PMG Holding GmbH

Recent Developments

- Hitachi Metals, Ltd. announced its involvement in the development of ML27D, which is a soft ferrite core material with distinguished high frequency characteristics. The use of this material is projected to enable low core loss and high energy savings.

- Cosmo Ferrites, a popular soft ferrites manufacturer, achieved a new record of Rs 635, up 4% on the BSE. From a low of Rs 17.50, the stock has risen 3,529% in FY22.

- Report ID: 3350

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Soft Ferrite Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.