Sodium Tripolyphosphate Market Outlook:

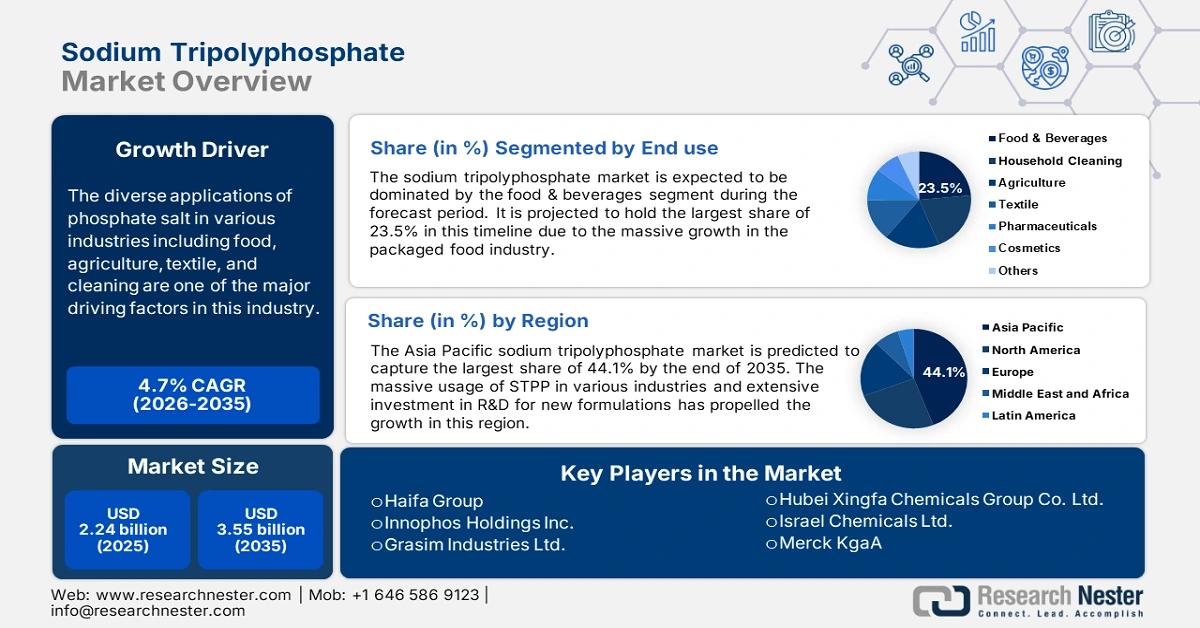

Sodium Tripolyphosphate Market size was over USD 2.24 billion in 2025 and is poised to exceed USD 3.55 billion by 2035, witnessing over 4.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of sodium tripolyphosphate is estimated at USD 2.33 billion.

The diverse applications of phosphate salt in various industries including food, agriculture, textile, and cleaning are one of the major driving factors in this industry. The continuous growth in these industries is subsequently propelling the demand for such inorganic compounds, inspiring companies to increase their production.

The sodium tripolyphosphate market significantly contributes to maintaining the quality of dyeing and finishing processes. It is used as a dispersing agent in the textile industry to prevent dye particles from clumping, ensuring even color distribution. The surging demand for lasting and attractive clothes with vibrant colors is inflating the need for more efficient STPP chemicals. According to a report published by UNEP, in May 2024, the global textile industry secured USD 1.5 trillion in revenue in the same year. The growth in textile production and changing fashion trends are further enlarging the industry size.

Key Sodium Tripolyphosphate Market Insights Summary:

Regional Highlights:

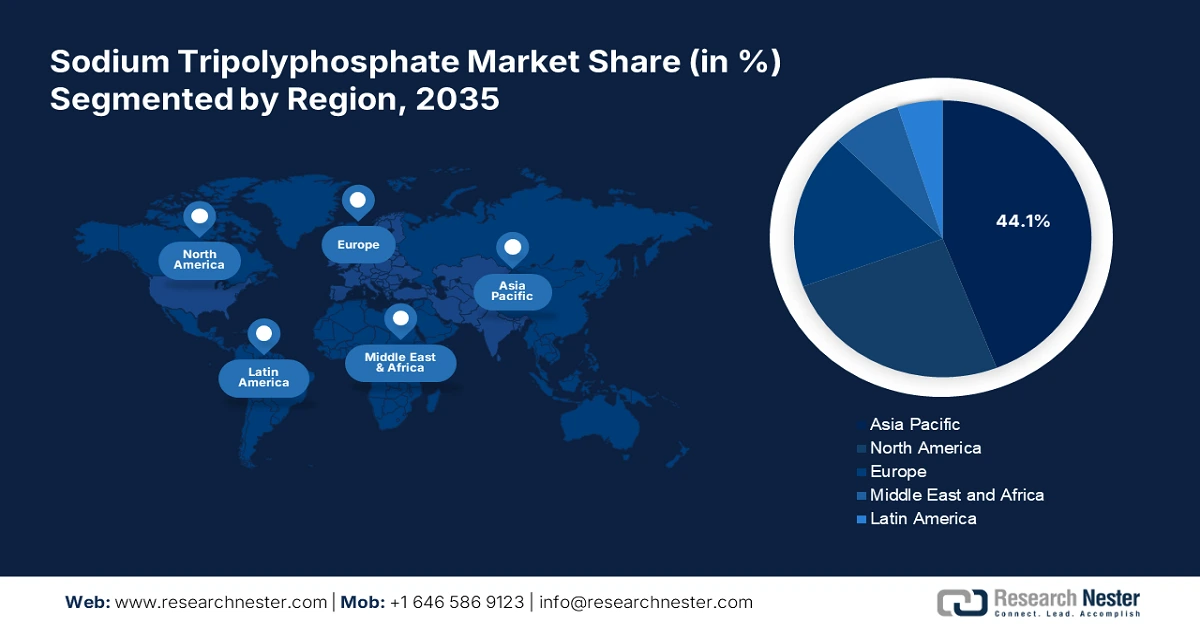

- Asia Pacific’s 44.1% share in the sodium tripolyphosphate market is driven by massive usage of STPP in various industries, ensuring dominance through 2026–2035.

- North America's Sodium Tripolyphosphate Market is expected to see the fastest growth by 2035, attributed to the surge in demand for water treatment chemicals and packaged food.

Segment Insights:

- The Food & Beverages segment is anticipated to achieve a 23.5% share by 2035, fueled by massive growth in the packaged food industry.

Key Growth Trends:

- Efficacy as a cleaning reagent

- Increasing R&D activities in this sector

Major Challenges:

- Concern about environmental impact

- Volatility in supply and pricing

- Key Players: Haifa Group, Grasim Industries Ltd., Hubei Xingfa Chemicals Group Co. Ltd., Innophos Holdings Inc., Israel Chemicals Ltd., Merck KgaA, PhosAgro, Tata Chemicals Ltd., Thermo Fisher Scientific Inc.

Global Sodium Tripolyphosphate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.24 billion

- 2026 Market Size: USD 2.33 billion

- Projected Market Size: USD 3.55 billion by 2035

- Growth Forecasts: 4.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (44.1% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, India, Japan, United States, Germany

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 14 August, 2025

Sodium Tripolyphosphate Market Growth Drivers and Challenges:

Growth Drivers

- Efficacy as a cleaning reagent: The heavy usage of STPP in producing cleaning materials such as detergents, dishwashing liquids, and industrial cleaners is propelling the demand in the sodium tripolyphosphate market. The reagent’s ability to enhance the efficiency of these products by binding with calcium and magnesium ions in hard water. The widespread range and application of STPP in domestic and industrial cleaning extend to water softening and filtration. The binding properties help the material to be required as a crucial component in municipal and industrial water treatment plants. Such large-scale usage of this component has greatly impelled demand in this sector.

- Increasing R&D activities in this sector: The ongoing developments to increase the effectiveness of products in the sodium tripolyphosphate market are playing a pivotal role in securing its future growth. Companies are heavily investing in improvising the manufacturing process and methods to enhance the quality of STPPs. This further ignites the R&D to develop more sustainable production technologies. For instance, in 2022, the Polish Journal of Chemical Technology published a study report, classifying a cleaner way of producing STPP. It stated that the comparison showed the effectiveness of the DSM method due to the progress in technology, design, and apparatus solutions.

Challenges

- Concern about environmental impact: Consumer preference is shifting, and they are now seeking more sustainable options. This may restrict the growth of the sodium tripolyphosphate market due to the rising questions about the impact of STPP usage. Being a key ingredient in cleaning products such as detergents, it contributes to eutrophication, leading to nutrient pollution in the water bodies. Further, it is pushing consumers to switch to other alternative options available in the market.

- Volatility in supply and pricing: Unpredicted disruptions in the supply chain of raw materials may hinder timely production and profit margin in the sodium tripolyphosphate market. Challenges in global distribution, such as transportation delays, trade restrictions, and material shortages, can also affect product availability and pricing strategies. This can further create hurdles for companies desiring to expand their business worldwide.

Sodium Tripolyphosphate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.7% |

|

Base Year Market Size (2025) |

USD 2.24 billion |

|

Forecast Year Market Size (2035) |

USD 3.55 billion |

|

Regional Scope |

|

Sodium Tripolyphosphate Market Segmentation:

End use (Household Cleaning, Food & Beverages, Agriculture, Textile, Pharmaceuticals, Cosmetics)

In terms of end use, the sodium tripolyphosphate market is expected to be dominated by the food & beverages segment during the forecast period, 2025-2035. It is projected to hold the largest share of 23.5% in this timeline due to the massive growth in the packaged food industry. The segment is expanding with the growing investment in R&D to produce safer preservatives for these packaged and processed consumer goods. In May 2024, the packaged food sector in India is estimated to hold more than USD 3 billion by the end of 2027. The ready-t0-eat industry is poised to obtain over USD 290 million in 2025, raising the demand for STPP.

Application (Detergent, Cleaning Agent, Water Treatment, Food Preservation, Paints & Dying, Ceramic Tiles, Metal Treatment)

In terms of application, the detergent segment is poised to capture a significant share of the sodium tripolyphosphate market during 2025-2035. The wide usage of STPP in manufacturing cleaning substances has driven remarkable growth in this segment. Exceptional properties such as water softening, building, pH control, and stain removal have propelled the need for this component. The availability and application of powdered laundry detergent and dishwashing products have created a huge consumer base for this segment.

Our in-depth analysis of the global sodium tripolyphosphate market includes the following segments:

|

End use |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sodium Tripolyphosphate Market Regional Analysis:

APAC Market Statistics

Asia Pacific sodium tripolyphosphate market is projected to account for revenue share of more than 44.1% by the end of 2035. The massive usage of STPP in various industries has propelled the growth in this region. Countries such as China, India, and Japan are focusing on expanding their supply channels from both domestic and international reservoirs to secure uninterrupted resources. Moreover, the growing industrial income in these countries is notably influencing companies to invest in this sector. According to a report published by the Australian Bureau of Statistics, in May 2024, the earnings from selected industries in the country accounted for a growth of USD 93.4 billion.

India presents great scope for the sodium tripolyphosphate market due to the growing demand for its authentic food everywhere, particularly in foreign countries. According to a report published by APEDA in 2024, India exported USD 7.7 billion worth of processed goods during 2023-2024. The report further states, that direct foreign investment in the country’s food processing sector accounted to be USD 608 million during the same period. Such a developing trend of pre-cooked or packaged food is increasing the need for non-toxic preservatives for storing food for a long time while delivering the original taste.

China is expected to lead the regional sodium tripolyphosphate market in the upcoming years due to its well-established supply chain and large production facilities. The country is focused on outstretching its distribution network of STPP worldwide. It has already started contributing by supplying the components on a large scale in the neighboring countries. In a report published by the World Bank in 2023, it was stated that China was the largest sodium tripolyphosphate provider of Japan with an amount of 5,211,720 kg. This showcases the growth of this country in being a leader in the global landscape.

North America Market Analysis

North America is projected to become one of the fastest-growing consumers in the sodium tripolyphosphate market during the forecast period. It is expected to present lucrative opportunities for global competitors to generate profitable revenue. The surge in water treatment chemicals including sodium salts of polyphosphates has driven remarkable growth in this region. The well-established manufacturing infrastructure of this region is also contributing to the expansion of the domestic and international supply chain for STPP. In addition, its dependency on packaged or processed food has leveraged the need for the most effective and safe preservatives including sodium tripolyphosphate.

The U.S. is focused on accelerating its production of STPP domestically to supply the surging demand for clean and purified water. According to a report published by EPA in 2022, the country obtained the first rank in importing STPP, accounting for 54 million kg in 2021. Such massive consumption of sodium tripolyphosphate is encouraging the leading manufacturers in this country to invest in larger production to procure its dependence on external suppliers. In addition, it is creating scope for future developments in producing more efficient products.

Canada is also garnering its domestic supply source for the sodium tripolyphosphate market with its natural reservoirs. The country is contributing to coping with the surging demand for water-cleaning chemicals by being one of the major suppliers of STPP for the region. The country is also proactively participating in international trade by achieving a balanced import-export chain. According to the EPA report published in 2022, besides being the domestic supplier, Canada became an international trading partner by exporting 43 million kg STPP worldwide in 2021.

Key Sodium Tripolyphosphate Market Players:

- Haifa Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Grasim Industries Ltd.

- Hubei Xingfa Chemicals Group Co. Ltd.

- Innophos Holdings Inc.

- Israel Chemicals Ltd.

- Merck KgaA

- PhosAgro

- Tata Chemicals Ltd.

- Thermo Fisher Scientific Inc.

The global leaders in the sodium tripolyphosphate market are increasingly expanding their production to consolidate their position in the global trade. The enlarging business of STPP across the world is inspiring many manufacturers to invest in this sector. According to the 2022 OEC report, the global trade of sodium triphosphate accounted for USD 725 million in the same year. Additionally, it showed a growth of 31.7% in exports during 2021-2022, the top exporters being China, Belgium, Canada, Tunisia, and Thailand. The growing dynamics are further encouraging players to invest in R&D to introduce new and more effective formulations. This further brings and promotes innovation and sustainability in this sector.

These key players include:

Recent Developments

- In August 2024, PhosAgro hosted a tour for African journalists to its Volkhov production complex to enlighten their plans and contribution to the market. They unveiled their extensive range of products including sodium tripolyphosphate and global expansion ideas.

- Report ID: 6794

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sodium Tripolyphosphate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.