Sodium Sulfide Market Outlook:

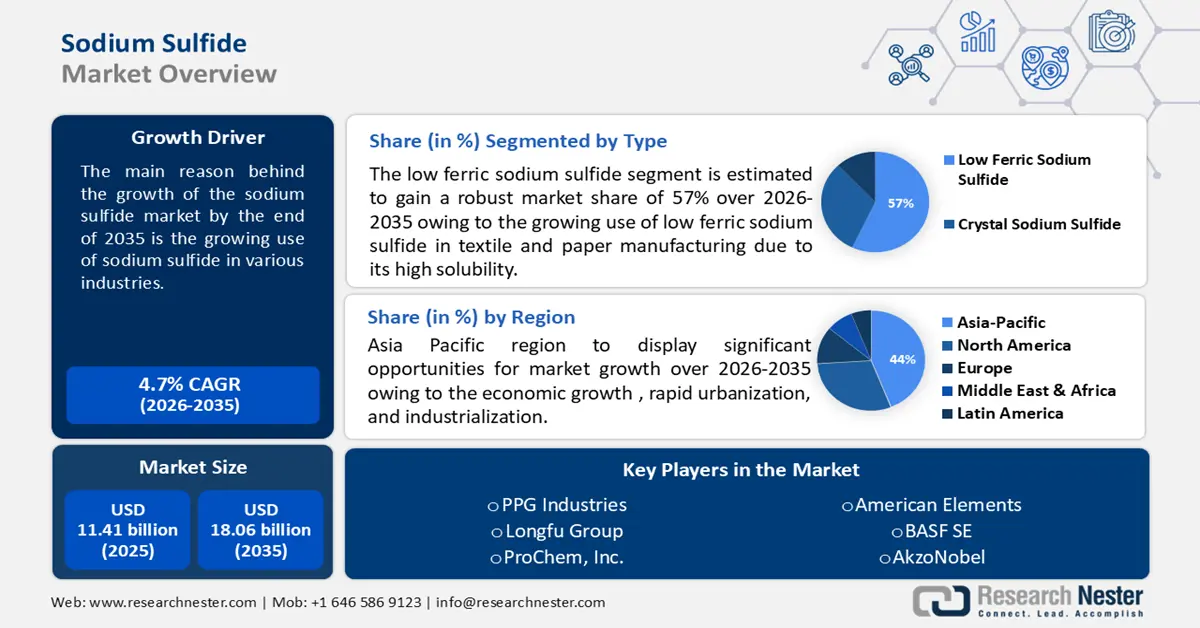

Sodium Sulfide Market size was valued at USD 11.41 billion in 2025 and is expected to reach USD 18.06 billion by 2035, registering around 4.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of sodium sulfide is evaluated at USD 11.89 billion.

The sodium sulfide market growth is attributed to the growing population, which has increased the demand for leather products. The use of sodium sulfide in the manufacturing of leather products is huge because it acts as a dehairing agent. According to Research Nester analysis, the global leather industry produces over 23 billion square feet of leather annually.

Key Sodium Sulfide Market Insights Summary:

Regional Highlights:

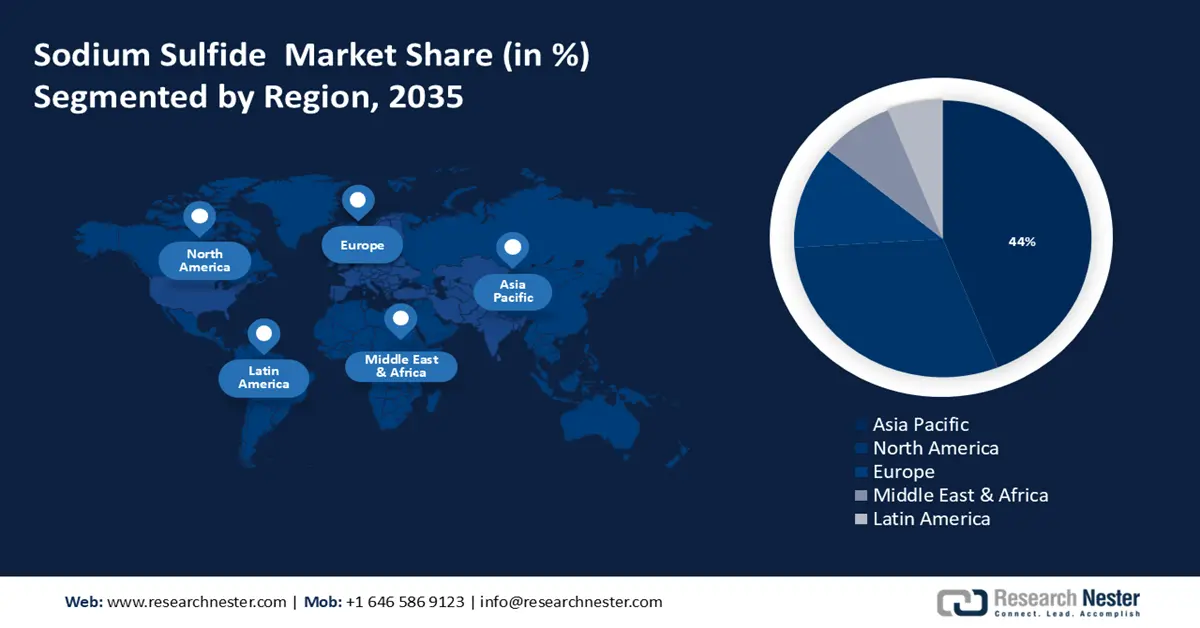

- Asia Pacific sodium sulfide market will hold more than 44% share by 2035, driven by economic development and industrialization.

- North America market will achieve huge CAGR during 2026-2035, driven by ore processing and technological infrastructure.

Segment Insights:

- The low ferric sodium sulfide segment in the sodium sulfide market is projected to hold a 57% share by 2035, fueled by its high solubility and widespread use in textile and paper industries.

- The paper & pulp segment in the sodium sulfide market is projected to hold a 54% share by 2035, influenced by growing demand for sodium sulfide in textile finishing and fashion industry growth.

Key Growth Trends:

- Growing use of sodium sulfide in various industries

- Increasing demand for eco-friendly products

Major Challenges:

- Harmful effect on health

- Rising competition among key players

Key Players: PPG Industries, Emco Dyestuff Pvt. Ltd., American Elements, Innova Priority Solutions, Chemical Products Corporation, ProChem, Inc., Longfu Group, BASF SE, AkzoNobel, Nilkanth Organics.

Global Sodium Sulfide Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.41 billion

- 2026 Market Size: USD 11.89 billion

- Projected Market Size: USD 18.06 billion by 2035

- Growth Forecasts: 4.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (44% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 17 September, 2025

Sodium Sulfide Market Growth Drivers and Challenges:

Growth Drivers

- Growing use of sodium sulfide in various industries - The use of sodium sulfide is growing in various industries, such as textiles, mining, and pulp & paper, among others. Moreover, mining activities are increasing due to the rising demand for construction and electricity generation. The high use of sodium sulfide in ore process flotation to assemble iron in the mining industry boosts the sodium sulfide market. According to a published report, the revenue of the top 40 global mining companies amounted to USD 943 billion worldwide in 2022.

Furthermore, sodium sulfide works as a reducing agent in the dyeing of textiles, which increases its adoption in the textile industry and has many uses that expand its market size. - Increasing demand for eco-friendly products - Due to rising environmental concerns, there is an increase in demand for eco-friendly and sustainable products. According to researchers at Research Nester, over the past five years, there has been a 71% rise in online searches for sustainable goods globally. Sodium sulfide is considered less harmful and hazardous as compared to other chemicals which increase its adoption in various sectors.

Additionally, the chemical industry is becoming more environment-oriented by encouraging the use of less hazardous chemicals for the production of goods and adopting sustainability practices. Furthermore, increasing awareness of sustainability and eco-friendliness among manufacturers boosts the . - Technological advancements in the production of sodium sulfide - The ongoing research and development activities and technological advancements in the production process of sodium sulfide to improve its quality are crucial steps in market growth. Moreover, the use of various advanced techniques in the manufacturing of sodium sulfide to remove all impurities increases its adoption.

The growing need in industries for high-quality sodium sulfide is addressed by technological advancements and the use of innovative techniques. Additionally, the higher use of technology in the production process of sodium sulfide reduces the cost and time of manufacturing units and meets the rising need for sodium sulfide.

Challenges

- Harmful effect on health - There are many health concerns associated with sodium sulfide as it causes eye and skin irritation, and respiratory diseases and is toxic to humans. Moreover, various health problems occur with the use and production of sodium sulfide which may limit its adoption in industries and hinder sodium sulfide market growth.

- Rising competition among key players - The growing number of alternative manufacturers and key players in the production of sodium sulfide poses a challenge to market growth. Furthermore, rising competition in the production of sodium sulfide causes price fluctuations and reduces profit margins.

Sodium Sulfide Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.7% |

|

Base Year Market Size (2025) |

USD 11.41 billion |

|

Forecast Year Market Size (2035) |

USD 18.06 billion |

|

Regional Scope |

|

Sodium Sulfide Market Segmentation:

By Type Segment Analysis

Low ferric sodium sulfide segment is estimated to account for more than 57% sodium sulfide market share by the end of 2035. The segment growth can be attributed to the growing use of low ferric sodium sulfide in textile and paper manufacturing due to its high solubility.

Moreover, the increasing demand for iron and metals due to rapid urbanization has increased the use of low-ferric sodium sulfide in the mineral industry, which boosts segment growth. Additionally, low-sodium sulfide is considered a safe chemical as compared to others, which leads to its huge adoption.

By Application Segment Analysis

By the end of 2035, paper & pulp segment is poised to dominate around 54% sodium sulfide market share. The rising middle-class income and boom in the fashion industry are responsible for an increasing demand for textile manufacturing. As per Research Nester estimates, in 2020, the global middle class spent USD 42 trillion, or 63.2% of the world’s consumer spending.

Moreover, with the rising demand for textile manufacturing, the need for sodium sulfide in the textile industry is also increasing as it provides finishing to fabrics. In addition, the growing demand for sodium sulfide in the textile industry boosts the segment growth.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sodium Sulfide Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific industry is anticipated to dominate majority revenue share of 44% by 2035. The market growth in the region is expected on account of economic growth, rapid urbanization, and industrialization.

The growing population and rising disposable income in India have increased the demand for products like footwear, bags, and other industrial goods. This leads to an increase in the adoption of sodium sulfide in various industries including leather, mining, and textile, and stimulates its sodium sulfide market growth. According to a report published by the Ministry of Statistics and Program Implementation (MOSPI), the total population in India was estimated at 1373.8 million people in 2022.

In China, strict environmental regulations and environmental conservation practices stimulate the demand for eco-friendly products. Moreover, the rising demand for eco-friendly products encourages the use of sodium sulfide in the manufacturing and chemical industries. As per a report published on Consumer Awareness and Behavior Change in Sustainable Consumption by China Sustainable Consumption Research Program, about 70% of Chinese consumers are aware of sustainability with more than 70% willing to pay higher prices for sustainable products.

North America Market Insights

The North American region will also encounter huge growth in the sodium sulfide market during the forecast period and will hold the second position owing to the well-established industrial infrastructure and technological advancements.

In the US, the growing demand for ferrous and non-ferrous metals such as iron, copper, and steel has increased ore processing. There is an increasing use of sodium sulfide in ore processing in the mineral industry, which expands the sodium sulfide market. According to a report published by the United States Geological Survey (USGS), USD 105 billion worth of nonfuel mineral commodities were produced by US mines in 2023, including industrial minerals and natural aggregates.

The growing need for sodium sulfide in the water treatment industry in Canada is boosting market growth. Due to rising concerns about water contamination, the need for effective water treatment is increasing. Moreover, sodium sulfide is a crucial chemical that is used in water treatment processes, increasing its adoption in the water treatment industry. According to a report published by the Government of Canada, in 2021, releases from wastewater treatment facilities accounted for 57%, 53%, and 47% of total releases of mercury, lead, and calcium, respectively.

Sodium Sulfide Market Players:

- PPG Industries

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Emco Dyestuff Pvt. Ltd.

- American Elements

- Innova Priority Solutions

- Chemical Products Corporation

- ProChem, Inc.

- Longfu Group

- BASF SE

- AkzoNobel

- Nilkanth Organics

The sodium sulfide market consists of several significant key players and chemical manufacturing companies that cater to the needs of various industries. Some of the key players in the market include:

Recent Developments

- BASF SE - BASF SE announced that it will expand its biomass balance portfolio to include BDO, THF, PolyTHF, and DMAPA. Moreover, the BASF will offer its customers ISCC PLUS and REDcert-certified products which will help in reducing the product’s carbon footprint. These new certifications emphasize the company’s commitment to sustainability.

- PPG Industries - PPG launched the PPG NEXON 810 coating. It is a copper-free antifouling that helps in reducing emissions and provides sustainability. Furthermore, PPG NEXON 810 coating helps in lowering greenhouse gas emissions by up to 25% as compared to its traditional coatings. This coating provides environmental protection with improved vessel performance.

- Report ID: 6219

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sodium Sulfide Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.