Sodium-Ion Battery Market Outlook:

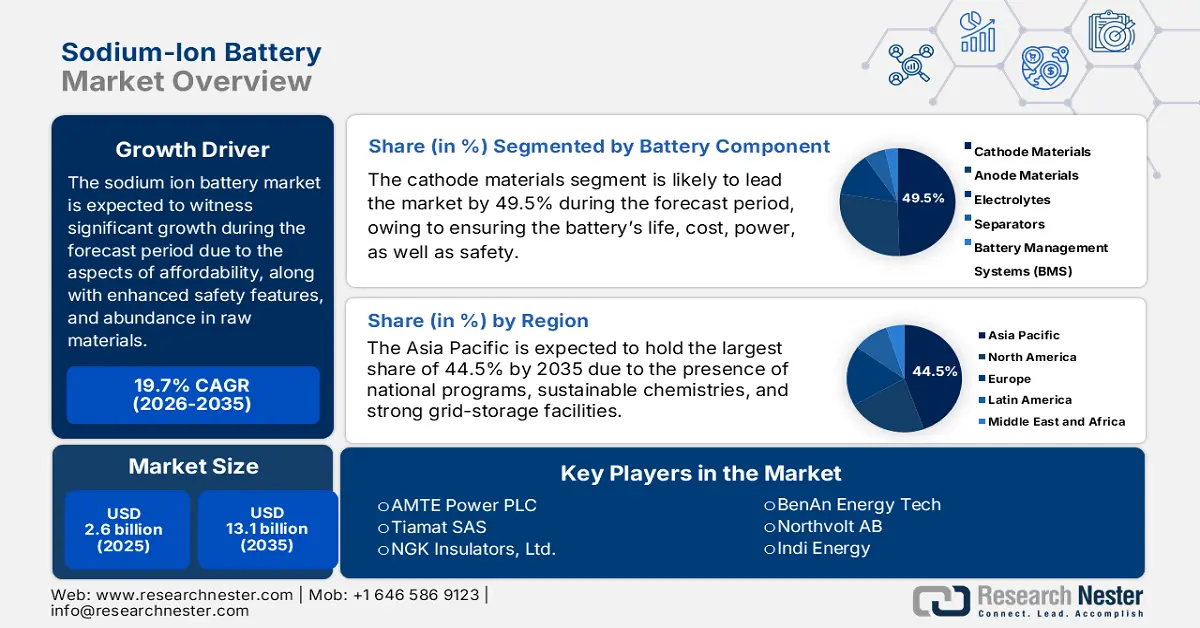

Sodium-Ion Battery Market size was over USD 2.6 billion in 2025 and is estimated to reach USD 13.1 billion by the end of 2035, expanding at a CAGR of 19.7% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of sodium-ion battery is assessed at USD 3.1 billion.

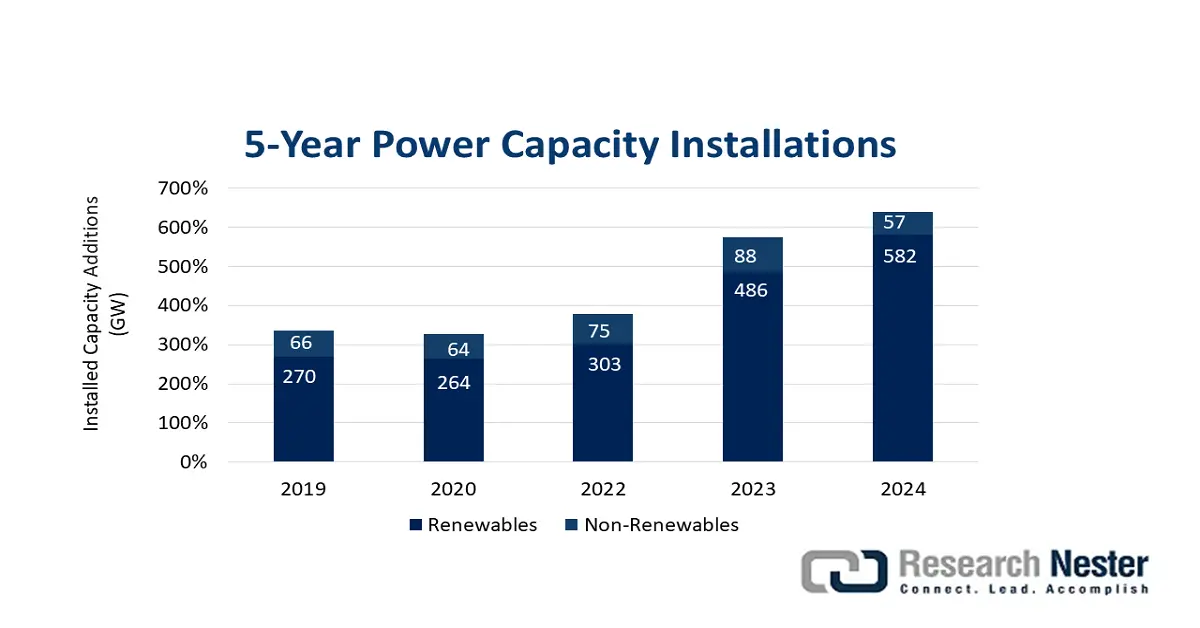

The international sodium-ion battery market is evolving as a robust alternative to lithium ion, which is fueled by cost efficiency, enhanced safety features, and abundant raw materials. With industries and governments globally investing in sustainable energy storage solutions, the sodium ion technology is readily gaining traction in industrial backup systems, electric mobility, and grid applications. According to a data report published by the IRENA Organization in 2025, the market is presently in its nascent stage and the production capacity can reach to GWh every year by the end of 2025, which is further projected to expand to 400 GWh per year by the end of 2030. Besides, the worldwide electric vehicle battery demand is also expected to reach almost 4,300 GWh every year by the end of the same year. Besides, progress in renewable power technology capacity installation is also driving the sodium-ion battery market globally.

Furthermore, the commercialization momentum, grid storage adoption, global partnerships, increased focus on sustainability and safety, as well as diversification of applications are other factors which are also fueling the sodium-ion battery market. As per a report published by the NREL Government in 2025, the overall grid economy caters to almost 20% of variable generation on a yearly basis without the demand for energy storage. In addition, this also constitutes nearly 35% of variable generation with the launch of low-cost flexibility options, including an increased utilization of demand response. Besides, NREL’s renewable electricity futures study has demonstrated more than a 50% increase in the demand for flexible options, such as energy storage. Moreover, the aspect of cost modeling across different regions is extremely competitive in the case of automotive lithium-ion battery manufacturing is also fueling the market’s development.

Regional Cost Modeling for Lithium-ion Battery Manufacturing (2025)

|

Region |

Cost (USD per kWh) |

|

Japan |

395 |

|

Korea |

363 |

|

China Tier 1 |

349 |

|

China Tier 2 |

378 |

|

Mexico Transplant (Japan) |

333 |

|

U.S. Future |

363 |

Source: NREL Government