Soap Noodles Market Outlook:

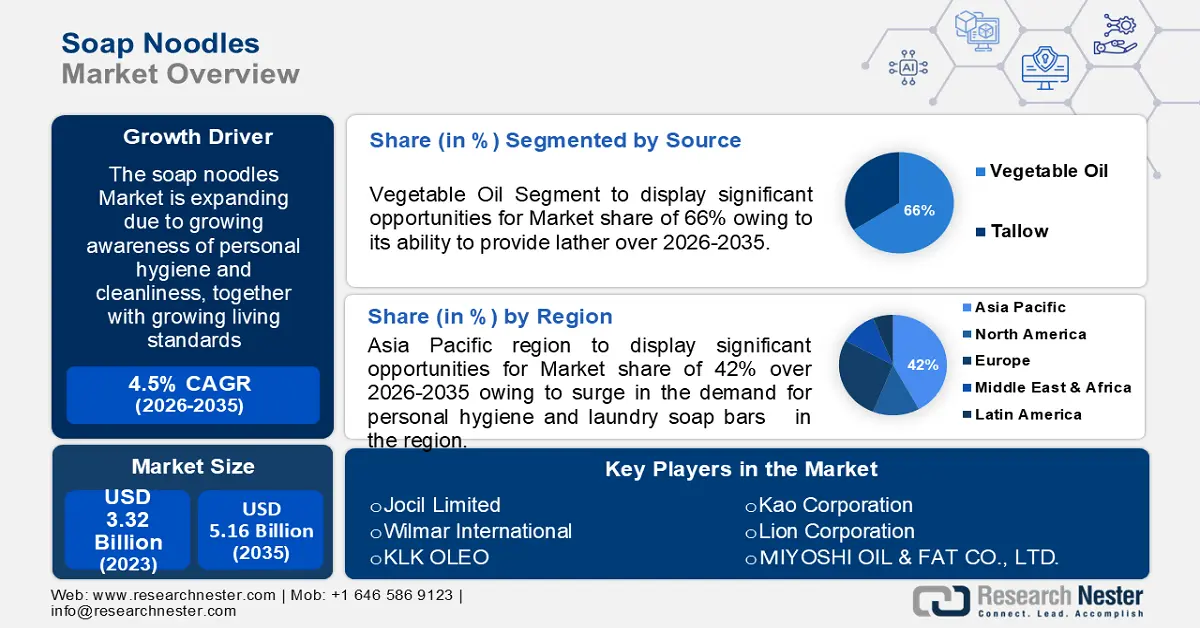

Soap Noodles Market size was over USD 3.32 billion in 2025 and is anticipated to cross USD 5.16 billion by 2035, witnessing more than 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of soap noodles is assessed at USD 3.45 billion.

Growing awareness of personal hygiene and cleanliness, together with growing living standards, are the main factors driving the market's expansion. Superior soaps are in more demand as people's lifestyles get better. The growing awareness among consumers regarding the role hygiene plays in halting the spread of diseases is fueling the soap noodles market for products made of soap.

Moreover, to meet this demand, soap noodles—a key ingredient in the manufacturing of soap—are crucial. The market is also profiting from consumers' increasing inclination for soaps with natural and organic ingredients. Customized soap noodle compositions make it possible for producers to further satisfy certain customer preferences, which accelerates soap noodles market expansion. As reported by National Library of Medicine, at a compound annual growth rate of 3.9%, global soap production is predicted to increase from USD 180.99 billion in 2020 to USD 188.09 billion by the end of 2021; from 2020 to 2030, it is predicted to reach 6.7%.

Key Soap Noodles Market Insights Summary:

Regional Highlights:

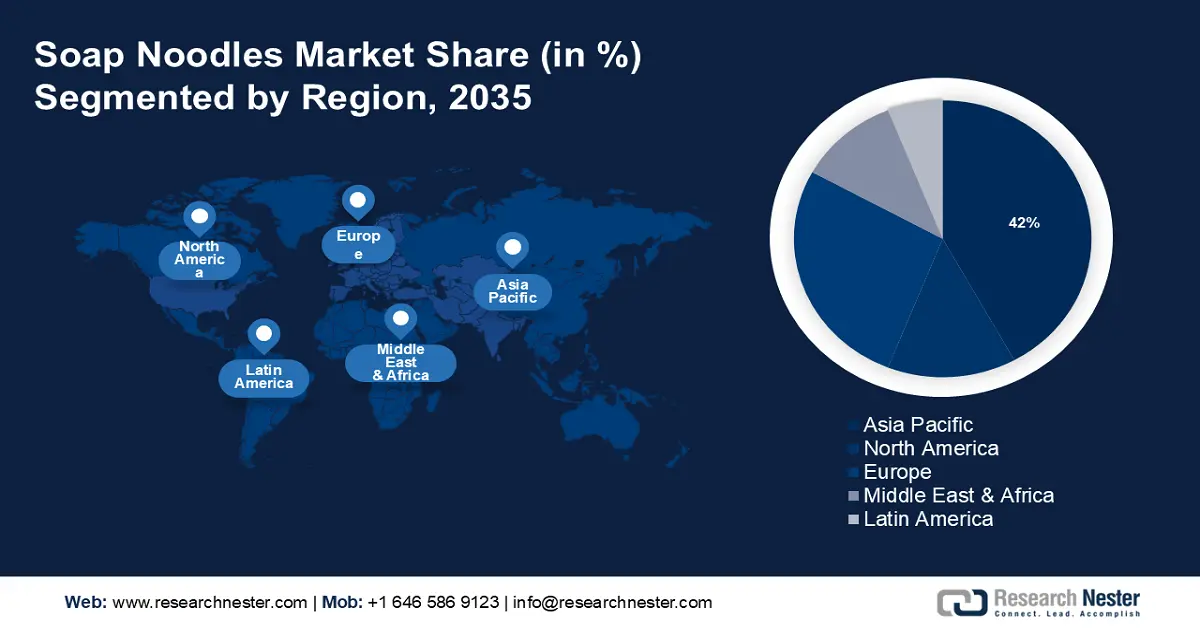

- The Asia Pacific soap noodles market will dominate around 42% share by 2035, driven by the growing population and increased demand for personal hygiene and laundry soap bars.

- The Europe market demonstrates substantial growth during the forecast timeline, driven by increased focus on hygiene and technological improvements in soap noodle production.

Segment Insights:

- The vegetable oil segment in the soap noodles market is projected to hold a 66% share by 2035, driven by its ability to provide lather and sustainable properties.

- The saponification segment in the soap noodles market is expected to maintain a 52% share by 2035, driven by its economical and easy-to-operate process.

Key Growth Trends:

- Rising demand for natural and eco

- Innovation in soap manufacturing

Major Challenges:

- Increasing competition from new product innovation

- Fluctuating price and availability of palm oil

Key Players: Jocil Limited, Wilmar International, KLK OLEO, Olivia Impex Pvt Ltd, Timur Network Sdn Bhd, Rubia Industries Limited, 3F Industries LTD, Prakash Chemicals International Pvt. Ltd, John Drury & Co Ltd and M Bedforth & Sons, Kao Corporation.

Global Soap Noodles Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.32 billion

- 2026 Market Size: USD 3.45 billion

- Projected Market Size: USD 5.16 billion by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Indonesia, Malaysia, Thailand

Last updated on : 17 September, 2025

Soap Noodles Market Growth Drivers and Challenges:

Growth Drivers

-

Rising demand for natural and eco–friendly soap to propel the market – The global demand for natural and eco–friendly products has driven growth in the soap noodles market, which are essential ingredients for making soap. Consumers are increasingly conscious of the harmful effects of synthetic and personal care ingredients, leading to a shift towards natural and environmentally friendly soap noodles.

This is due to a growing awareness of health issues associated with artificial chemicals in traditional soaps, resulting in a higher demand for natural soap noodles. Moreover, the sales of organic soaps have tremendously increased and is projected to be around USD 3.5 billion in 2030. - Innovation in soap manufacturing – Advances in soap manufacturing technology and the development of new product variants, such as anti–bacterial and aromatic soaps, drive the demand for specialized soap noodles. Manufacturers are innovating to meet diverse consumer preferences.

For instance, coconut oils and derivatives are used in the production of Opal CO 100% soap noodles, enabling the companies to produce soap bars that are luxurious, effective, and extremely foamy and that customers adore. - Rising environmental awareness – In reality, oil is broken up by soaps and detergents and sent lower into the water column, where it damages a greater variety of marine life. Furthermore, soaps and detergents by themselves are a potentially dangerous pollution when they end up in our rivers. Environmental concerns and the push for sustainable products are leading to increased demand for biodegradable and eco–friendly soap noodles. Companies are focusing on sustainable sourcing and production practices to cater to this soap noodles market segment.

When comparing bar soap and liquid soap, bar soap is typically seen as a more eco–friendly option. According to research, the carbon footprint of liquid soap is approximately 25% greater than that of bar soap per wash, involving five times more energy in its production and close to 20 times more energy in its packaging.

Challenges

-

Increasing competition from new product innovation – The soap noodles market is declining due to the increasing popularity of soap gels, bathing gels, and dishwashing gels. These gels are preferred for their ease of use and high level of cleaning power, giving them a significant share of the market in comparison to soap noodles. The growing demand for these gels is significantly affecting suppliers of soap noodles.

- Fluctuating price and availability of palm oil – Palm oil availability significantly influences the soap noodles market. Due to its variable output, the price of palm oil is constantly fluctuating, which in turn affects the price of soap noodles. Key industry players are striving to acquire and produce palm oil at lower costs in order to decrease the overall production expenses of soap noodles.

Soap Noodles Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 3.32 billion |

|

Forecast Year Market Size (2035) |

USD 5.16 billion |

|

Regional Scope |

|

Soap Noodles Market Segmentation:

Source Segment Analysis

Vegetable oil segment is expected to account for more than 66% soap noodles market share by the end of 2035. The segment growth can be attributed to its ability to provide lather. In the market, vegetable oil has various advantages, particularly in the chemical sector. First of all, soap noodles made from vegetable oil offer a sustainable and renewable substitute for components made from petroleum.

They contribute to a cleaner and more ecologically friendly production process and lessen reliance on fossil fuels. Second, compared to synthetic counterparts, soap noodles made from vegetable oil contain less potentially dangerous ingredients. Because of this, they are a safer and more appealing choice for customers who value natural and chemical–free products.

The Malaysia Palm Oil Board (MPOB) reported that in 2018, Malaysia's palm oil plantation area reached 5.85 million hectares, showing a 0.7% increase from the previous year. Additionally, Malaysia's export of oil palm products in 2018 accounted for over 24 million tons, a 3.8% rise from the previous year. This is expected to boost the soap noodles market share, as Malaysia is one of the major suppliers of soap noodle feedstock.

Application Segment Analysis

By 2035, household segment is set to hold more than 36% soap noodles market share. Also, in 2022, the segment accumulated a value of around USD 2 billion. The segment growth is due to its extensive use in household cleaning products. They are an essential component in many and personal care products for the home.

Bar soaps, liquid soaps, and even specialty soaps for particular uses like antibacterial or moisturizing soaps are made from soap noodles. In homes, these soaps are frequently used for laundry, dishwashing, bathing, and hand washing. Because they effectively clean, lather, and remove dirt from surfaces, soap noodles are vital for preserving household cleanliness and personal hygiene. Because of their adaptability, they may be made to match the tastes and requirements of individual customers by adding new scents, colors, and ingredients. In 2022, the median yearly price of soaps and detergents in the US was approximately USD 85.37 per unit of consumption.

Process Segment Analysis

In soap noodles market, saponification segment is projected to hold more than 52% revenue share by 2035. The process of saponification entails turning oil or fat into soap noodles while an aqueous alkali is present. As this procedure is economical and easy to operate, it is greatly preferred over the fatty acid approach.

At a temperature of 80 oC, saponification occurs with the use of 5 M KOH to separate the bonds of triglycerides in WCO, producing glycerol and potassium oleic, linoleic, palmitic, and stearic acid with a conversion rate of 78.3%. The method results in soap noodles, which are connected

with a superb oil combination and remarkable perfume retention. One of the main areas that went the oil–saponification road in 2018 was Asia Pacific, and it is expected that this trend will continue for forecast timeline.

Our in–depth analysis of the global soap noodles market includes the following segments:

|

Source |

|

|

Application |

|

|

Process |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Soap Noodles Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is likely to dominate majority revenue share of 42% by 2035. The growing population in the region has seen a surge in the demand for personal hygiene and laundry soap bars thereby positively contributing to the market growth.

Furthermore, the easy availability of vegetable oil in the region coupled with the increasing palm production is projected to add to the market growth. In 2021, there was a 7.3% increase in the volume of the Asia Pacific market, reaching 6,201.7 million units. This item is becoming more popular due to its lower chemical content and less harmful effects on the skin compared to other hygiene products.

The soap noodles market in China held a share of over 28% in 2018 and is projected to grow at a CAGR of over 3.5% during the assessment period. Additionally, the growing investment in the retail sector development has made the availability of consumer goods easier in recent years which shall further boost the soap noodles market revenue during the forecast period. In April 2023, according to the National Bureau of Statistics, there was a 2.3% increase in retail sales.

The amount of soap exported from Korea is predicted to increase by 0.8% a year, to about 4.6 million kg in 2026. The product's annual supply has increased by 0.5% since 1993. By 2026, 5.9 million kg of Korean soap are expected to be imported, up 0.4% year over year from 2021.

The personal care products sector in Japan is a multifaceted environment marked by stringent regulations and intense competition to retain consumers. Additionally, influenced by the reputation of leading manufacturers in the broader chemical consumer goods sector, Japanese personal care items frequently encompass household cleaning products such as laundry detergents and air fresheners. The estimated shipment value of the personal care market is 2.1 trillion JPY.

European Market Insights

Europe region is projected to register substantial growth through 2035. With continuing R&D efforts to provide high–quality soap noodle products and technological improvements, the market is anticipated to present new prospects. During the anticipated period, this is anticipated to offer a sufficient number of new growth possibilities in the market. Over the course of the forecast period, it is expected that the European soap noodles market will experience growth due to the growing demand for these noodles in the soap sector.

In the years 2017 to 2021, the European imports of soap increased from €1.7 billion to €2.1 billion, experiencing an average annual growth rate of 4.9%. The highest point of these imports was in 2020, driven by the increased focus on hygiene during the COVID–19 pandemic. Similarly, global soap imports reached €6.7 billion at their peak and then decreased to €5.2 billion in 2021. Europe's share of the total global imports stands at approximately 40%.

Germany was the second largest importer of Soap in the world in 2022, with imports totaling $489M. In the same year, Soap was the 432nd most imported item in Germany.

The United Kingdom witnessed an overall gain in sales value between 2010 and 2022. In 2022, the sales value stood at 117.15 million British pounds. Soap and organic surface–active products are chemicals that reduce the surface tension of a liquid or the interfacial tension between two liquids. They are used for many functions, such as cleaning, personal hygiene, cosmetics, detergents, and more.

Soap Noodles Market Players:

- IOI Oleochemical

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Jocil Limited

- Wilmar International

- KLK OLEO

- Olivia Impex Pvt Ltd

- Timur Network Sdn Bhd

- Rubia Industries Limited

- 3F Industries LTD

- Prakash Chemicals International Pvt. Ltd

- John Drury & Co Ltd and M Bedforth & Sons

The soap noodles market is very diverse, with several small– and large–scale producers located all over the world. To get a stronger grasp on the market, these significant companies in the soap noodle business are using a variety of organic and inorganic techniques.

Recent Developments

- KLK OLEO Kuala Lumpur Kepong Berhad, and Temix Oleo SpA went into a definitive agreement to purchase a majority stake in Temix Oleo through its resource–based manufacturing business. Temix Oleo now has the chance to expand its product line and reach new markets while emphasizing innovation and sustainability due to this acquisition.

- 3F Industries LTD, an Indian company situated in Arunachal Pradesh, has expanded its palm oil factory. In addition, the business bought 120 acres of land for the project, which would be utilized as a raw material to make soap noodles.

- Report ID: 6238

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Soap Noodles Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.