- An Outline of the Global Smart Water Metering Market

- Market Definition

- Market Segmentation

- Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

- Opportunities

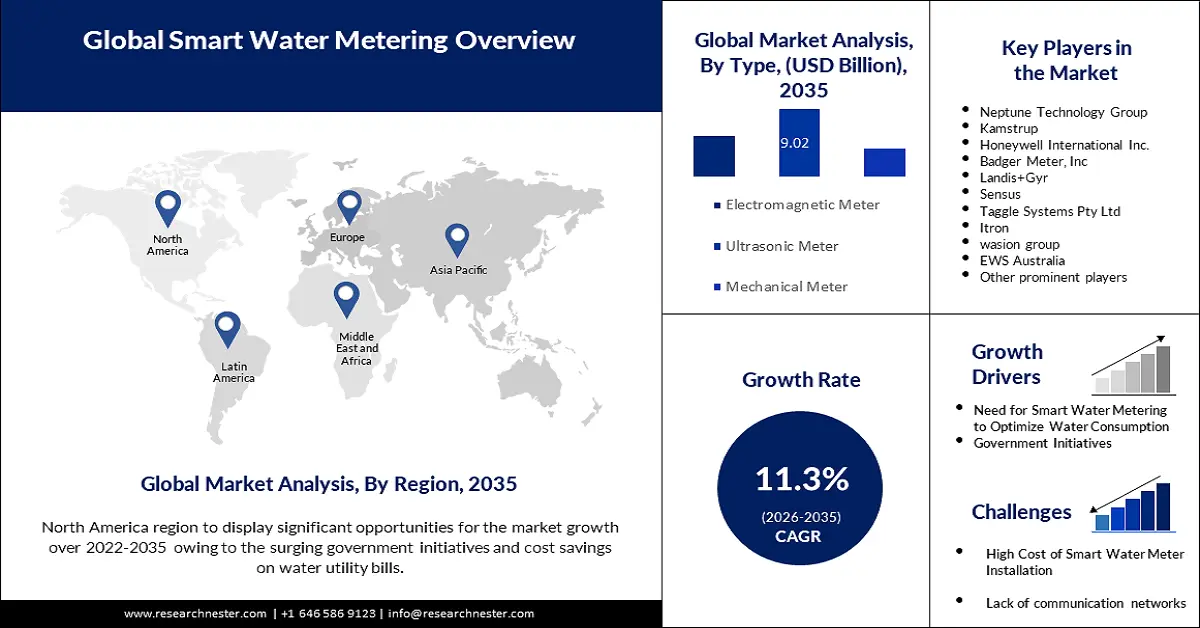

- Growth Drivers

- Major Roadblocks

- Prevalent Trends

- Government Regulations

- Analysis of the Current Technologies

- Growth Outlook

- Analysis on Government Initiatives

- Risk Analysis

- SWOT

- Supply Chain

- End-User Analysis

- Regional Demand

- Recent News

- Type Analysis

- Price Benchmarking

- Technology Analysis

- Survey Analysis

- Market Trend Analysis

- Factors affecting the market

- Technical Specification Analysis

- Operational Cost Analysis

- Application Analysis

- Supply Chain

- Technology Analysis

- Analysis of Revenue Rate Improvement Before and After Installation of Smart Water Metering

- Technological Advancements in Smart Water Metering

- Analysis of Smart Water Metering Installation Area

- Comparative Positioning

- Competitive Landscape

- Competitive Model

- Market Share of Major Companies Profiled, 2023

- Business Profile of Key Enterprise

- Neptune Technology Group Inc.

- Kamstrup

- Honeywell International Inc.

- Badger Meter, Inc.

- Landis+Gyr

- Xylem

- Arad Group

- Itron Inc.

- Diehl Stiftung & Co. KG

- Wasion Holdings Limited

- ZENNER International GmbH & Co. KG

- OSAKI ELECTRIC CO., LTD.

- Mitsubishi Electric Corporation

- Global Smart Water Metering Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) Volume (Thousand Units) and Compound Annual Growth Rate (CAGR)

29.3 Global Smart Water Metering Market Segmentation Analysis (2024-2037)

29.3.1 By Type

- Electromagnetic Meter, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Ultrasonic Meter, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Mechanical Meter, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- By Component

- IT Solutions, Market Value (USD Million), and CAGR, 2024-2037F

- Communications, Market Value (USD Million), and CAGR, 2024-2037F

- Meters & Accessories, Market Value (USD Million), and CAGR, 2024-2037F

29.3.3 By Technology

- Advanced Meter Infrastructure, Market Value (USD Million), and CAGR, 2024-2037F

- Automatic Meter Reading, Market Value (USD Million), and CAGR, 2024-2037F

- Applications

- Commercial, Market Value (USD Million), and CAGR, 2024-2037F

- Industrial, Market Value (USD Million), and CAGR, 2024-2037F

- Residential, Market Value (USD Million), and CAGR, 2024-2037F

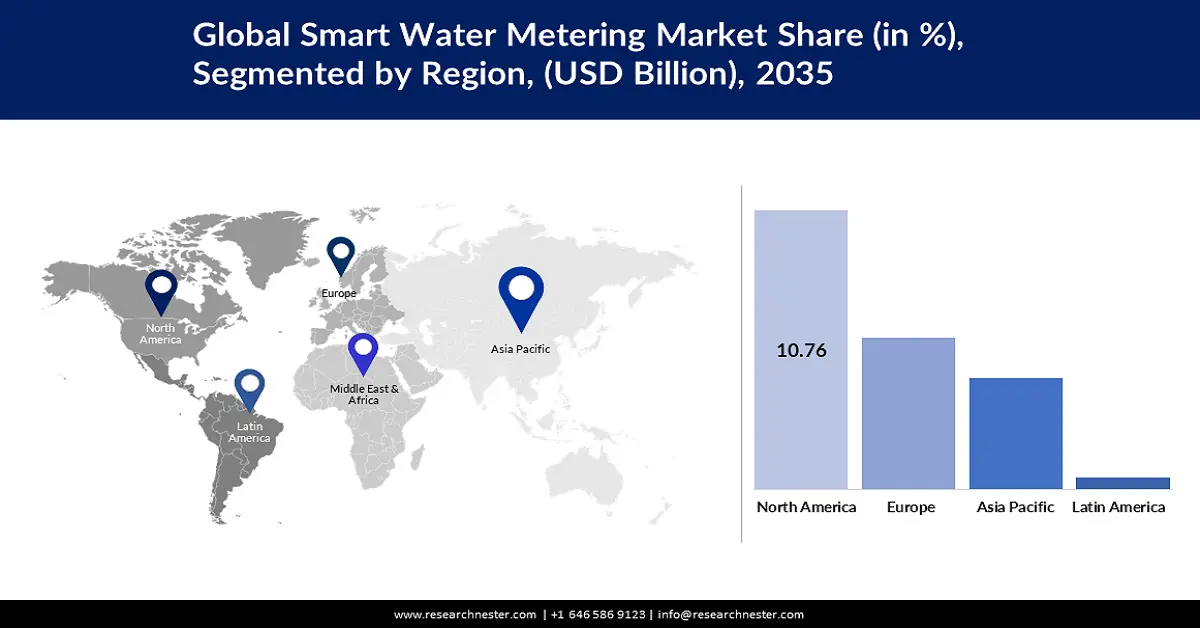

29.3.5 By Region

- North America, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Europe Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Asia Pacific Excluding Japan Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Japan Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Latin America Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Middle East and Africa Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

29.4 Cross Analysis of Type W.R.T. Application (USD Million), 2024-2037

30. North America Smart Water Metering Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) Volume (Thousand Units) and Compound Annual Growth Rate (CAGR)

30.3 North America Smart Water Metering Market Segmentation Analysis (2024-2037)

30.3.1 By Type

- Electromagnetic Meter, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Ultrasonic Meter, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Mechanical Meter, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

30.3.2 Component

- IT Solutions, Market Value (USD Million), and CAGR, 2024-2037F

- Communications, Market Value (USD Million), and CAGR, 2024-2037F

- Meters & Accessories, Market Value (USD Million), and CAGR, 2024-2037F

- By Technology

- Advanced Meter Infrastructure, Market Value (USD Million), and CAGR, 2024-2037F

- Automatic Meter Reading, Market Value (USD Million), and CAGR, 2024-2037F

30.3.4 By Applications

- Commercial, Market Value (USD Million), and CAGR, 2024-2037F

- Industrial, Market Value (USD Million), and CAGR, 2024-2037F

- Residential, Market Value (USD Million), and CAGR, 2024-2037F

30.3.5 By Country

- US, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Canada, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

30.4 Cross Analysis of Type W.R.T. Application (USD Million), 2024-2037

31. Europe Smart Water Metering Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) Volume (Thousand Units) and Compound Annual Growth Rate (CAGR)

31.3 Europe Smart Water Metering Market Segmentation Analysis (2024-2037)

31.3.1 By Type

- Electromagnetic Meter, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Ultrasonic Meter, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Mechanical Meter, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- By Component

- IT Solutions, Market Value (USD Million), and CAGR, 2024-2037F

- Communications, Market Value (USD Million), and CAGR, 2024-2037F

- Meters & Accessories, Market Value (USD Million), and CAGR, 2024-2037F

31.3.3 By Technology

- Advanced Meter Infrastructure, Market Value (USD Million), and CAGR, 2024-2037F

- Automatic Meter Reading, Market Value (USD Million), and CAGR, 2024-2037F

31.3.4 By Applications

- Commercial, Market Value (USD Million), and CAGR, 2024-2037F

- Industrial, Market Value (USD Million), and CAGR, 2024-2037F

- Residential, Market Value (USD Million), and CAGR, 2024-2037F

- By Country

- UK, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Germany, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- France, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Italy, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Spain, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- BENELUX, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Poland, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Russia, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Rest of Europe, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

31.4 Cross Analysis of Type W.R.T. Application (USD Million), 2024-2037

32. Asia Pacific Excluding Japan Smart Water Metering Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) Volume (Thousand Units) and Compound Annual Growth Rate (CAGR)

32.3 Asia Pacific excluding Japan Smart Water Metering Market Segmentation Analysis (2024-2037)

- By Type

- Electromagnetic Meter, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Ultrasonic Meter, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Mechanical Meter, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- By Component

- IT Solutions, Market Value (USD Million), and CAGR, 2024-2037F

- Communications, Market Value (USD Million), and CAGR, 2024-2037F

- Meters & Accessories, Market Value (USD Million), and CAGR, 2024-2037F

32.3.3 By Technology

- Advanced Meter Infrastructure, Market Value (USD Million), and CAGR, 2024-2037F

- Automatic Meter Reading, Market Value (USD Million), and CAGR, 2024-2037F

32.3.4 By Applications

- Commercial, Market Value (USD Million), and CAGR, 2024-2037F

- Industrial, Market Value (USD Million), and CAGR, 2024-2037F

- Residential, Market Value (USD Million), and CAGR, 2024-2037F

- By Country

- China, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- India, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Indonesia, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- South Korea, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Malaysia, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Australia, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Singapore, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Vietnam, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Thailand, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- New Zealand, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Rest of Asia Pacific excluding Japan, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

32.4 Cross Analysis of Type W.R.T. Application (USD Million), 2024-2037

33. Japan Smart Water Metering Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), & Volume (Thousand Units) and Compound Annual Growth Rate (CAGR)

33.3 Japan Smart Water Metering Market Segmentation Analysis (2024-2037)

33.3.1 By Type

- Electromagnetic Meter, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Ultrasonic Meter, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Mechanical Meter, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- By Component

- IT Solutions, Market Value (USD Million), and CAGR, 2024-2037F

- Communications, Market Value (USD Million), and CAGR, 2024-2037F

- Meters & Accessories, Market Value (USD Million), and CAGR, 2024-2037F

33.3.3 By Technology

- Advanced Meter Infrastructure, Market Value (USD Million), and CAGR, 2024-2037F

- Automatic Meter Reading, Market Value (USD Million), and CAGR, 2024-2037F

33.3.4 By Applications

- Commercial, Market Value (USD Million), and CAGR, 2024-2037F

- Industrial, Market Value (USD Million), and CAGR, 2024-2037F

- Residential, Market Value (USD Million), and CAGR, 2024-2037F

33.4 Cross Analysis of Type W.R.T. Application (USD Million), 2024-2037

34. Latin America Smart Water Metering Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) Volume (Thousand Units) and Compound Annual Growth Rate (CAGR)

34.3 Latin America Smart Water Metering Market Segmentation Analysis (2024-2037)

34.3.1 By Type

- Electromagnetic Meter, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Ultrasonic Meter, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Mechanical Meter, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- By Component

- IT Solutions, Market Value (USD Million), and CAGR, 2024-2037F

- Communications, Market Value (USD Million), and CAGR, 2024-2037F

- Meters & Accessories, Market Value (USD Million), and CAGR, 2024-2037F

34.3.3 By Technology

- Advanced Meter Infrastructure, Market Value (USD Million), and CAGR, 2024-2037F

- Automatic Meter Reading, Market Value (USD Million), and CAGR, 2024-2037F

34.3.4 By Applications

- Commercial, Market Value (USD Million), and CAGR, 2024-2037F

- Industrial, Market Value (USD Million), and CAGR, 2024-2037F

- Residential, Market Value (USD Million), and CAGR, 2024-2037F

- By Country

- Brazil, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Argentina, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Mexico, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Rest of Latin America, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

34.4 Cross Analysis of Type W.R.T. Application (USD Million), 2024-2037

35. Middle East & Africa Smart Water Metering Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) Volume (Thousand Units) and Compound Annual Growth Rate (CAGR)

35.3 Middle East & Africa Smart Water Metering Market Segmentation Analysis (2024-2037)

35.3.1 By Type

- Electromagnetic Meter, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Ultrasonic Meter, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Mechanical Meter, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- By Component

- IT Solutions, Market Value (USD Million), and CAGR, 2024-2037F

- Communications, Market Value (USD Million), and CAGR, 2024-2037F

- Meters & Accessories, Market Value (USD Million), and CAGR, 2024-2037F

35.3.3 By Technology

- Advanced Meter Infrastructure, Market Value (USD Million), and CAGR, 2024-2037F

- Automatic Meter Reading, Market Value (USD Million), and CAGR, 2024-2037F

35.3.4 By Applications

- Commercial, Market Value (USD Million), and CAGR, 2024-2037F

- Industrial, Market Value (USD Million), and CAGR, 2024-2037F

- Residential, Market Value (USD Million), and CAGR, 2024-2037F

- By Country

- GCC, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Israel, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- South Africa, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

- Rest of Middle East & Africa, Market Value (USD Million), Volume (Thousand Units) and CAGR, 2024-2037F

35.4 Cross Analysis of Type W.R.T. Application (USD Million), 2024-2037

36 Global Economic Scenario

37 About Research Nester

Smart Water Metering Market Outlook:

Smart Water Metering Market size was over USD 5.67 billion in 2025 and is projected to reach USD 16.54 billion by 2035, growing at around 11.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of smart water metering is evaluated at USD 6.25 billion.

A major driver for the growth of the smart water metering market is the rising global water scarcity and the urgent requirement for sustainable water resources management. The push to save water creates demand for advanced water-saving solutions. smart water metering effectively answer the challenge by offering precise measurement and monitoring capabilities. In June 2024, the Water Collaborative of Greater New Orleans highlighted the effort of the Sewerage and Water Board of New Orleans (SWBNO)’s efforts to install smart water metering across the city and estimates that it will lead to accurate billing for residents. The increasing adoption of smart water metering in residential homes is indicative of their effectiveness in water saving and accurate billing.

In February 2024, the United Nations Educational, Scientific, and Cultural Organization (UNESCO) stated that the water demand from the municipal sector has experienced a significant increase relative to the other sectors and is estimated to keep growing owing to surging urbanization. The trends are favorable for the adoption of smart water metering owing to their ability to optimize water use and mitigate waste, allowing municipalities to reduce water wastage. Additionally, the integration of data analytics is expected to improve the efficacy of the product by allowing utilities to identify patterns, predict demand, and improve water distribution. For instance, in January 2024, Badger Meter Inc. announced that it had acquired select remote water monitoring hardware and software from Trimble and TrimbleUnity Remote Monitoring Software. The acquisition will provide real-time monitoring hardware and software targeted at distributed data collections for applications in water, stormwater, wastewater, and environmental water monitoring indicating the potential of revenue growth in advanced data analytics solutions in smart water monitoring.

Furthermore, the rapid growth of the smart cities initiative is poised to create profitable revenue streams for the smart water metering market. Key market players are positioned to leverage emerging opportunities in high-income and middle to low-income economies as smart infrastructure initiatives expand. For instance, in June 2024, Sigfox SA was selected as the network to support South Africa’s transition to smart water metering, and as per the agreement, existing meters will be replaced or adapted as smart meters and will run on the nationwide Sigfox IoT network. Such government contracts or tenders are lucrative opportunities for the major players providing smart water metering solutions. The trends are favorable for the robust growth of the market by the end of the forecast period.

Key Smart Water Metering Market Insights Summary:

Regional Highlights:

- The Europe smart water metering market is projected to capture a 47.10% share by 2035, fueled by sustainability policies and large-scale smart metering initiatives.

- The North America market is anticipated to experience the fastest growth from 2026 to 2035, attributed to rising government contracts and smart city infrastructure projects.

Segment Insights:

- The ami segment in the smart water metering market is projected to hold a 54.70% share by 2035, attributed to the ability of AMI to offer real-time data analytics and two-way communication.

- The amr (technology) segment in the smart water metering market is expected to expand its revenue share substantially by 2035, driven by its adaptability to existing water distribution networks and cost efficiency.

Key Growth Trends:

- Increasing focus on non-revenue water (NRW) reduction

- Increasing partnerships between the public and private sector

Major Challenges:

- Intermittent water supply system constraints

- Power dependency and maintenance challenges in harsh systems

Key Players: ITRON Inc., Sensus USA Inc., Badger Meter Inc., Honeywell, Avnet, Kamstrup, Landis+Gyr, Zenner International, Sigfox SA , Metron.

Global Smart Water Metering Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.67 billion

- 2026 Market Size: USD 6.25 billion

- Projected Market Size: USD 16.54 billion by 2035

- Growth Forecasts: 11.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (47.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 11 September, 2025

Smart Water Metering Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing focus on non-revenue water (NRW) reduction: The increasing focus on reducing non-revenue water globally is positioned to be a major driver of the market. Utilities across the world lose a significant amount of their water supply to NRW because of inaccurate billing or leaks. smart water metering are an essential solution to NRW reduction as they assist in helping utilities identify and resolve inefficiencies in the distribution network. For instance, in September 2024, Avnet was granted a contract to supply Huizhong’s SCL61H-100 smart ultrasonic water meters to South East Water’s Digital Meters program. The ultrasonic water meters are expected to curb NRW such as water lost to leaks or bursts in the distribution systems. Key market players are investing to expand their portfolio of smart water metering to leverage the rising opportunities to supply advanced solutions.

-

Increasing partnerships between the public and private sector: The World Bank has indicated that the private sector can help reduce NRW in emerging economies, indicating profitable opportunities for key market players to leverage government contracts to provide smart water metering solutions. Furthermore, public-private collaborations offer the financial and technical resources required for large-scale deployment in urban areas. The partnerships are beneficial to overcome budgetary constraints faced by utilities, boosting faster adoption of smart meters.

For instance, in December 2024, the Bangalore Water Supply and Sewerage Board (BWSSB) in India announced plans to introduce AI (Artificial Intelligence)-enabled smart water metering, and domestic companies are seeking to secure the lucrative contract highlighting potential in public-private sector collaborations. Additionally, the alignment of the private sector’s innovation with the needs of the public sector is poised to assist the growth of the smart water metering market. -

Integration of IoT and AI in smart water metering: Rising innovations in sensor technology have improved the accuracy of smart water metering. Advanced sensors can detect minute anomalies in water slowly, accounting for micro leaks, leading to smart water metering becoming high-value products in smart city ecosystems. Furthermore, energy-efficient designs stand to expand the lifespan of smart meters, leading to higher adoptability.

The integration of IoT and AI in smart water metering is expected to significantly boost sales as industrial, commercial, and residential spaces are increasingly prioritizing data-driven solutions. For instance, in April 2024, SUEZ and Vodafone signed a global partnership to accelerate the next generation of smart water metering capable of remote reading via Narrowband IoT communication (NB-IoT) networks, and the partnership plans to bring over 2 million NB-IoT meters into service by 2030. Ambitious partnerships as such augur well for the future of the market, with the advent of the next generation of smart water metering positioned to drive more adoption.

Challenges

-

Intermittent water supply system constraints: The smart water metering market can face challenges in developing countries where water is supplied intermittently rather than continuously. The smart water metering are designed for continuous water flow monitoring and adaption to intermittent systems may require additional configuration. Such mismatches can minimize effectiveness.

-

Power dependency and maintenance challenges in harsh systems: The smart water metering sector can face constraints owing to dependency on batteries or external power sources, which can be a challenge in remote or harsh environments. High temperatures and humidity can reduce battery life. The advent of remote water monitoring systems is poised to navigate this challenge.

Smart Water Metering Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.3% |

|

Base Year Market Size (2025) |

USD 5.67 billion |

|

Forecast Year Market Size (2035) |

USD 16.54 billion |

|

Regional Scope |

|

Smart Water Metering Market Segmentation:

Technology Segment Analysis

AMI segment is likely to account for more than 54.7% smart water metering market share by the end of 2035. The advanced metering infrastructure systems allow utilities to monitor water usage remotely, driving its adoption. Furthermore, the ability of AMI to offer real-time data analytics and two-way communication capabilities bolsters adoption.

A major driver of the segment’s growth is the rising public and private collaborations, providing opportunities for businesses to offer robust water monitoring solutions. For instance, in June 2022, San Jose Water announced that the California Public Utilities Commission (CPUC) approved a request to deploy advanced metering infrastructure, and San Jose Water will be investing USD 100 million over the next four years. The deployment of smart water metering by the company is expected to improve customer experience and provide control to users over water bills and usage.

The automatic meter reading (AMR) segment of the smart water metering market is projected to expand its revenue share substantially by the end of the forecast period. AMR provides one-way communication and is gaining traction in areas where utilities seek to cut down operational costs associated with manual reading. A major driver of the segment is its adaptability to existing water distribution networks, boosting utilities to upgrade legacy systems without incurring major installation costs. For instance, in September 2021, the Second Sight Systems utility metering division was awarded an additional project through a partnership with Ferguson Waterworks, and the company replaced approximately 750 existing residential water meters with AMR water meters. The increasing advent of such projects indicates profitable opportunities within the segment for utilities to leverage AMR and address NRW losses.

Application Segment Analysis

The residential segment of the smart water metering market is projected to be the largest application during the forecast period. The profitable opportunities within the segment are attributed to the large volume of smart water metering installations required to cater to an ever-increasing urban population. The advent of smart homes is expected to drive continued demand, with utilities and governments prioritizing smart water metering solutions to address water scarcity concerns and mitigate NRW losses.

For instance, in September 2024, Metron launched the Ultrasonic Smart Water Metering dedicated utility app that is positioned to make water intelligence accessible to industry stakeholders and benefit consumers in residential spaces. Furthermore, the rising consumer awareness of sustainable water management is an emerging driver of the segment where businesses can continue to find profitable opportunities.

Our in-depth analysis of the global market includes the following segments:

|

Technology |

|

|

Application |

|

|

Product |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Water Metering Market Regional Analysis:

Europe Market Insights

Europe in smart water metering market is anticipated to capture around 47.1% revenue share by the end of 2035. Europe’s expansion is attributed to rising investments in water conservation efforts and policy-driven sustainable goals to support urban and rural housing communities with smart water solutions. Additionally, the European Union emphasizes building a robust circular economy in the region which necessitates mitigating NRW waste.

For instance, the EU Water Framework promotes sustainable water use, and businesses in the region are leveraging increasing opportunities to supply smart water metering solutions. For instance, in September 2024, Arqiva, from the UK, announced the connecting of two million smart water metering to its network and is poised to support per capita water consumption reduction targets for the next Asset Management Plan (AMP) in the country. With Germany, France, the UK, Netherlands leading the revenue share in the region, service providers are expected to find continuous opportunities via public and private contracts.

Germany holds a major revenue share in the Europe smart water metering market owing to sustainability initiatives and the proliferation of IoT technologies. Smart water metering are increasingly being adopted in the residential sector of Germany, offering effective leak detection and benefiting customers. A major driver of the market is the mandate by the government to roll out smart meters nationally to commercial and residential customers from 2025. Companies operating in the smart water metering sector are positioned to leverage the mandate by acquiring companies operating in Germany for their smart metering portfolios. For instance, in June 2024, Ancala announced the acquisition of Solandeo which was a full-scale smart metering solutions provider.

Furthermore, domestic companies have leveraged the rising demands by expanding smart water metering installation across Europe. For instance, Frasers group reported that in the financial year 2023, 90% of their properties had Smartvatten devices installed.

France is an emerging market in the Europe smart water metering industry. A supportive regulatory ecosystem prompting the installation of smart metering assists the sector’s growth. For instance, the Building Automation and Control Systems (BACS) decree of France boosts the adoption of smart water metering solutions. Furthermore, domestic companies of France are expanding to emerging markets in APAC such as India the Advanced Metering Infrastructure for 5 million Smart Meters project led by the EDF Group.

Key players in France are executing partnerships and agreements to improve smart remote reading infrastructure solutions. For instance, in November 2024, SUEZ and GRDF subsidiary IOWIZMI signed a 10-year contract to pool their remote reading infrastructures in the country, which stands to benefit from advancements in smart water metering technologies.

North America Market Insights

North America is projected to exhibit the fastest revenue growth in the North America smart water metering market after Europe. The rising government contracts at various levels are poised to provide profitable opportunities for businesses to install smart water metering solutions. For instance, in September 2023, the city of Sweetwater in the U.S. announced plans to install Ultrasonic Smart Water Metering in every business and home in partnership with Secure Vision of America as a part of a USD 15 million infrastructure project. Businesses with a strong presence in the region are set to benefit from an increasing number of infrastructure projects with secure funding streams.

The U.S. holds the largest revenue share in the North America smart water metering market. The demand for AMI has gained significant momentum owing to its ability to provide real-time data and remote monitoring capabilities. Federal initiatives supporting smart city projects are playing a pivotal role in the sector’s growth. For instance, in October 2024, the city of Fort Lauderdale announced plans to conduct a comprehensive audit and survey of all active water meters across the city. The initiative offers promise for major players to find opportunities to upgrade aging smart water infrastructure.

Canada is a rapidly growing market in the smart water metering industry of North America and is expected to increase its revenue share by the end of the forecast period. The rise of smart meter installation in Canada creates a profitable domestic market. Furthermore, all property owners must have a smart water metering installed in the city of Toronto, creating favorable opportunities for businesses to provide repair and upgrade solutions.

Additionally, domestic companies are expanding their smart metering services which augurs well for the future of the sector. For instance, in September 2022, Trilliant announced the successful implementation of a wireless water metering solution in Canada and specialization in the multi-residential sector.

Smart Water Metering Market Players:

- ITRON Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sensus USA Inc.

- Badger Meter Inc.

- Honeywell

- Avnet

- Kamstrup

- Landis+Gyr

- Zenner International

- Sigfox SA

- Metron

The global smart water metering market is poised to register robust growth during the forecast period. Key players in the market are leveraging the growing push to mitigate water waste and offer smart solutions in residential and commercial water management. Furthermore, businesses are investing in expanding their smart water metering solutions and improving the sensor technologies to provide data analytics for remote monitoring. Investments to improve supply, installation, and customer support by businesses in established and emerging markets to improve market share are beneficial for the competitive market.

Here are some key players in the market:

Recent Developments

- In December 2024, the New York City Department of Environmental Protection (DEP) announced plans to start a program to upgrade more than 600 thousand automatic meter reading (AMR) devices across New York City over the next three years, creating burgeoning opportunities to upgrade and install smart water metering.

- In October 2024, Diehl Metering announced the production of Hydrus smart meters in the U.S. market. The HYDRUS 2.0 will be a static ultrasonic water meter that will combine precision and connectivity and will be used as a home water meter, and for industrial water measurement.

- Report ID: 5090

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Smart Water Metering Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.