Smart Watch and Smart Ring LED Market Outlook:

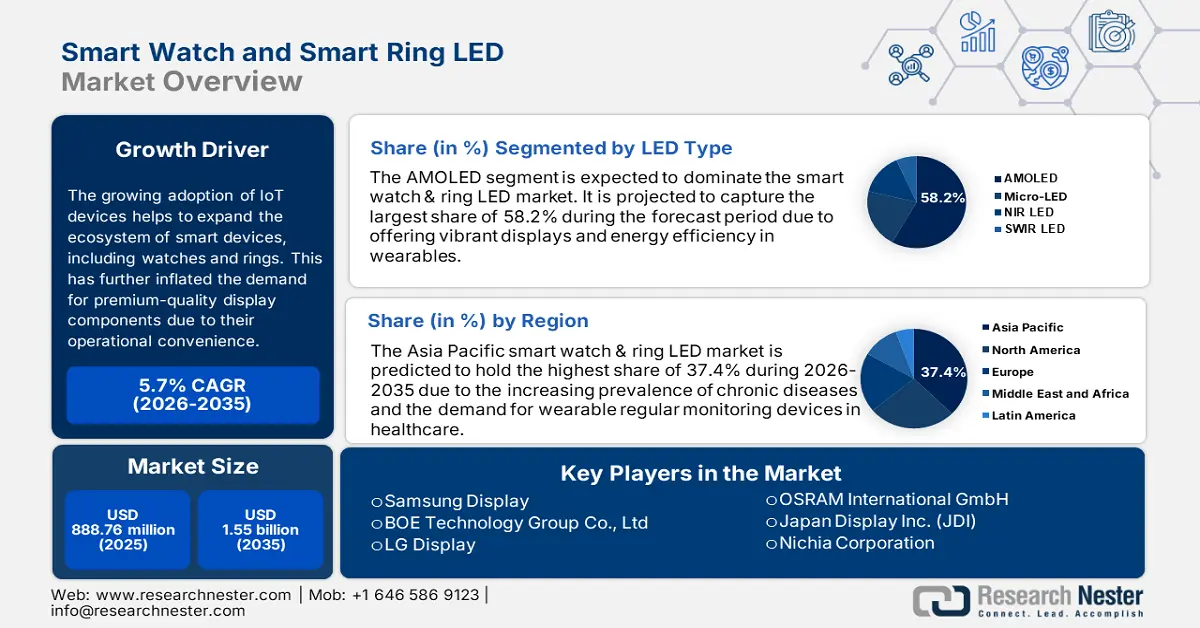

Smart Watch and Smart Ring LED Market size was valued at USD 888.76 million in 2025 and is expected to reach USD 1.55 billion by 2035, registering around 5.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of smart watch and smart ring LED is assessed at USD 934.35 million.

The growing adoption of IoT devices helps to expand the ecosystem of smart devices, including watches and rings. Thus, the demand for wearable systems with personalized features and multi-functionality has increased. This has further inflated the demand for premium-quality display components due to their operational convenience while using them.

The integration of IoT has also resulted in the easy availability through online platforms made to retail for the smart watch and smart ring LED market. Besides the health monitoring features, global leaders are now also focusing on making these devices suitable for fashion trends. This has further led to an increment in demand for more stylish and personalized displays. Wearables are now being customized to appeal to a broader range of customers by incorporating stylish designs, interchangeable bands, and advanced features. For instance, in February 2023, Noise launched NoiseFit Halo Smart Watch with an AMOLED display of 1.43 inches and a 466*466-pixel screen resolution. The watch offers an immersive viewing experience with an attractive design and palm control features.

Key Smart Watch and Smart Ring LED Market Insights Summary:

Regional Highlights:

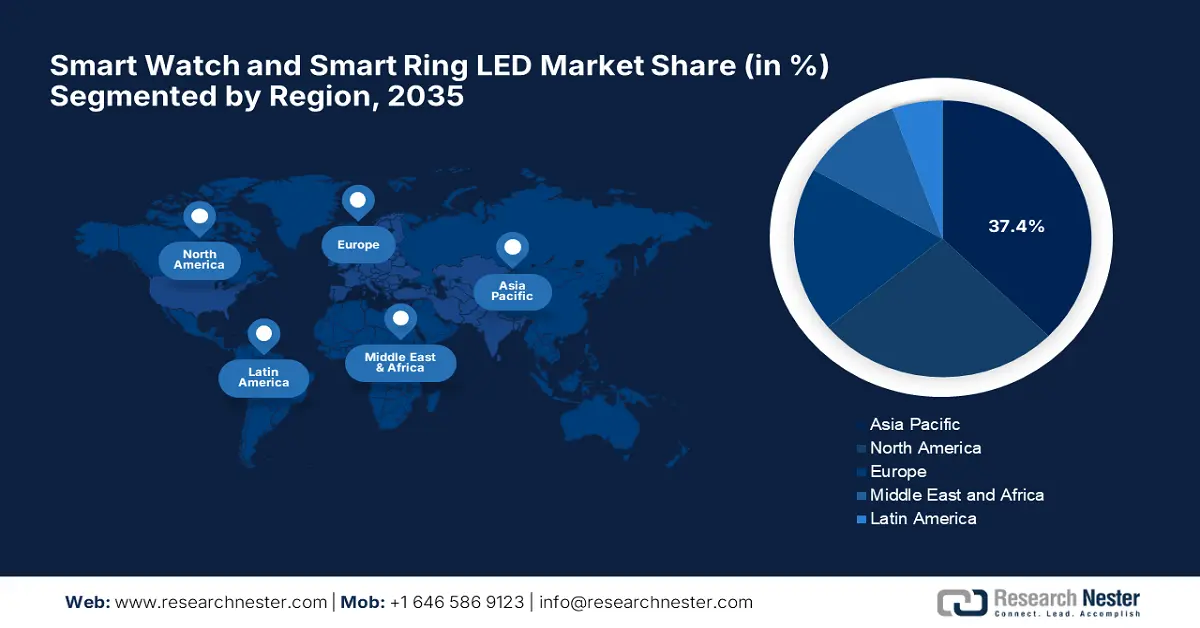

- Asia Pacific commands a 37.4% share in the Smart Watch and Smart Ring LED Market, bolstered by positive response towards advancements in healthcare and wearable technology, driving significant growth through 2026–2035.

- The North America Smart Watch and Smart Ring LED Market is anticipated to achieve significant growth by 2035, driven by the extensive use of smart wearables inflating demand for high-tech LED displays.

Segment Insights:

- The Smart Watch segment is expected to see significant growth by 2035, driven by smart features like connectivity, health tracking, and mobile payment capabilities.

- The AMOLED segment is anticipated to hold a 58.2% share by 2035, fueled by vibrant displays and energy efficiency in wearable devices.

Key Growth Trends:

- Technological advancements

- Health benefits and convenience

Major Challenges:

- Concerns about consumer privacy

- Increased competition and changing preferences

- Key Players: Samsung Display, BOE Technology Group Co., Ltd, LG Display, OSRAM International GmbH, Japan Display Inc. (JDI), Nichia Corporation, DOWA Electronics Materials Co..

Global Smart Watch and Smart Ring LED Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 888.76 million

- 2026 Market Size: USD 934.35 million

- Projected Market Size: USD 1.55 billion by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, South Korea, Japan, Germany

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 14 August, 2025

Smart Watch and Smart Ring LED Market Growth Drivers and Challenges:

Growth Drivers

-

Technological advancements: The ongoing developments greatly contribute to the progress of the smart watch and smart ring LED market. The innovative solutions have helped the sector to introduce devices with improved sensors and tracking capabilities. The upgrade can optimize energy consumption to offer longer battery life, enhancing user experience. Elevated Bluetooth, 5G, and Wi-Fi connectivity between wearables and other devices creates a connected ecosystem, availing unmatched convenience. Such advancements are further accelerating the purchase of these smart watches and rings, subsequently inflating the need for reliable LED manufacturers for sufficient supply.

- Health benefits and convenience: Increased focus on self-health management has driven significant growth in the smart watch and smart ring LED market. People are now seeking solutions for continuous health monitoring, due to growing emphasis on personal well-being. Many governing bodies and research institutions are also considering these devices to be effective for maintaining public health. For instance, in June 2024, Tampere University conducted a study, revealing a method of preventing sudden cardiac deaths by using smart wearables. The newly developed computational method can predict the risk by a one-minute heart rate measurement at rest using smartwatch analytics.

Challenges

-

Concerns about consumer privacy: The smartwatches and rings are made to collect sensitive health-related data, raising questions about data security. This may further hinder maximum adoption in the smart watch and smart ring LED market. The risk of cyber threats can lead to reduced consumer trust in the effectiveness of these devices. The strict regulations including GDPR and HIPPA can become difficult for companies to comply with while developing new technologies.

- Increased competition and changing preferences: The market of smartwatches and rings is filled with technology giants such as Apple, Samsung, and Garmin, making it difficult to maintain growth for newcomers. Tech companies often lock their vendor for supplying LED and other display components. This may further hinder the expansion of the smart watch and smart ring LED market due to the non-participation of other electronic leaders.

Smart Watch and Smart Ring LED Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 888.76 million |

|

Forecast Year Market Size (2035) |

USD 1.55 billion |

|

Regional Scope |

|

Smart Watch and Smart Ring LED Market Segmentation:

LED Type (Micro-LED, AMOLED, NIR LED, SWIR LED)

In smart watch and smart ring LED market, AMOLED segment is poised to capture over 58.2% revenue share by 2035. These solutions offer vibrant displays and energy efficiency in wearable devices, featuring heart rate monitoring and step counting. Such advantages have further led consumers to invest in wearables that track calorie burning, heart rate, sleep quality, and blood oxygen levels. For instance, in September 2024, Amazfit launched the Amazfit T-Rex 3 smartwatch at the IFA Berlin trade event. The new design features a 16% larger and 100% brighter AMOLED display, featuring military-grade durability, cutting-edge outdoor navigation, and unparalleled battery life.

Product Type (Smart Watch, Smart Ring)

Based on product type, the smart watch segment captured a significant share of the smart watch and smart ring LED market by the end of 2035. The growth is driven by smart features such as connectivity with other devices, health & fitness tracking, notifications, and mobile payment capabilities. These watches are increasingly being used by public authorities to prevent chronic conditions by monitoring with real-time data, inflating the demand for specific LEDs. For instance, in August 2023, the FDA approved Samsung’s Irregular Heart Rhythm Notification (IHRN) feature to reduce the risk of stroke, heart failure, and other cardiovascular complications. The new watch analyzes heart rhythms suggestive of atrial fibrillation (AFib) monitored from the wrist in the Health Monitor app.

Our in-depth analysis of the global smart watch and smart ring LED market includes the following segments:

|

LED Type |

|

|

Product Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Watch and Smart Ring LED Market Regional Analysis:

APAC Market Statistics

Asia Pacific in smart watch and smart ring LED market is projected to hold more than 37.4% revenue share by 2035 due to the positive response towards advancements in healthcare. Developing countries including Japan, China, India, and South Korea are focusing on introducing and implementing new technologies to reduce the increasing prevalence of health issues. The wearables are specially designed to obtain data directly from the user’s wrist or finger, which is crucial for maintaining good health. This has further influenced companies to create innovative displays and LED signaling systems to integrate these devices. The growing emphasis on delivering improved performance is encouraging leaders to introduce energy-efficient LEDs for long battery life.

India is showing great opportunities for domestic tech leaders to generate great revenue from the smart watch and smart ring LED market. The growing adoption of these wearables has created opportunities for companies to integrate fashionable displays and LED panels, solidifying their position in the global landscape. For instance, in March 2023, boAt launched Lunar Connect Pro and Lunar Call Pro to enter the premium segment of wearables. The new series features large AMOLED displays with chipsets that perform faster and offer futuristic appeal.

China has created a large consumer base for the smart watch and smart ring LED market by holding some of the largest electronics manufacturers including Xiaomi, Oppo, and Honor. These companies offer a wide range of affordable wearable tech, encouraging leaders to increase production. For instance, in September 2024, BOE announced an investment of USD 14.0 billion to double its production of new-generation semiconductor displays. The company aims to expand its presence in the OLED display sector for electronics including smartwatches.

North America Market Analysis

North America shows great opportunity for portfolio expansion for global leaders in the smart watch and smart ring LED market. The extensive use of smart wearables has inflated the need for cost-effective and high-tech displays and LED components to cope with the increasing demand. According to a Research Nester report, North America is expected to hold the largest share in the global smartwatch industry by the end of 2035. Such an enlarged marketplace for smart wearables is further inflating the demand in the LED display sector. Many domestic tech leaders including Apple are now investing more in integrating premium and energy-efficient displays such as AMOLED and OLED.

The U.S. is fostering great potential for growth in the global smart watch and smart ring LED market by utilizing the country’s increasing usage of wearables for health monitoring devices. According to a study conducted by NLM in December 2020, 43% of wearable users tend to utilize heart rate monitoring, calories burned, and step-counting features. Thus, the tech leaders are now proactively investing to import high-quality display components including LED panels to offer its large consumer base premium models.

Canada is also paving the way for garnering great profit margins for the global leaders in the smart watch and smart ring LED market due to increasing demand for smart wearables. This creates an opportunity for LED manufacturers to intervene in such a growing marketplace by introducing their advanced display panels. In addition, the country is fostering scope for premium smartwatch and ring suppliers around the world to expand their luxury portfolio in this segment. This is further influencing LED makers to outstretch their reach overseas.

Key Smart Watch and Smart Ring LED Market Players:

- Samsung Display

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BOE Technology Group Co., Ltd

- LG Display

- OSRAM International GmbH

The current dynamics in the market are evolving by incorporating advanced technologies such as biosensors in the wearables. Tech leaders are increasingly implementing precisely engineered LED panels to make their displays stand out in the global competition. This has further led to innovation in this sector. Governments are also taking part in promoting the health benefits of these devices to consumers. For instance, in October 2024, NHS released a 10-year plan to distribute health-monitoring smartwatches to millions of people having risk of chronic diseases such as diabetes and cancer. This further inspires global leaders to expand their supply chain across the world. Such key players include:

Recent Developments

- In September 2024, Apple launched the watch series 10, having the most advanced display with features including fast charging, water depth, and temperature sensing. The new wide-angle OLED display offers optimized pixels and a brighter view for easy reading.

- In August 2023, OPPO launched Watch 4 Pro, which is equipped with BOE’s flexible OLED cover display and main display. The high-end displays can offer premium image quality and smooth touch operations.

- Report ID: 6754

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.