Smart Robots Market Outlook:

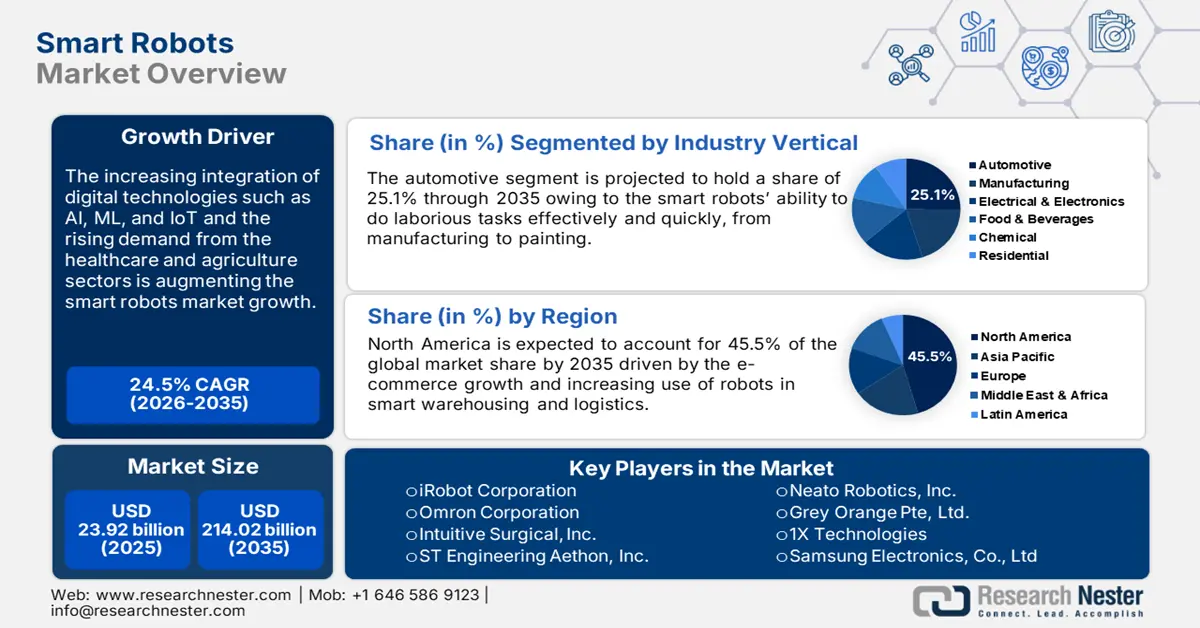

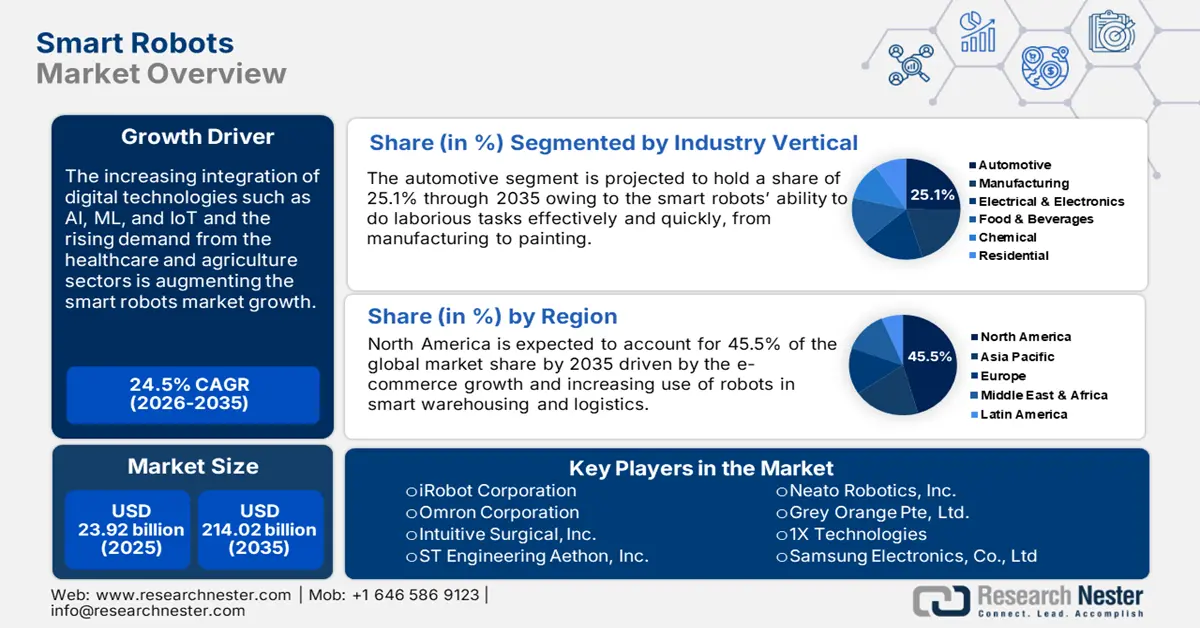

Smart Robots Market size was over USD 23.92 billion in 2025 and is anticipated to cross USD 214.02 billion by 2035, witnessing more than 24.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of smart robots is assessed at USD 29.19 billion.

Market players acknowledge a pivotal role in advanced manufacturing and logistics by replacing rudimentary tasks. As AI and robots converge, companies are adopting smart robots to streamline complex workflows and create more value for customers. According to the International Federation of Robotics in September 2024, 4,281,585 units were operating in factories globally. Also, in March 2024, NVIDIA and Teradyne Robotics collaborated to develop collaborative robots (cobot) and autonomous mobile robots using NVIDIA Jetson AGX Orin for edge AI applications, including NVIDIA’s cuMotion path, UR's PolyScope X software, and UR5e cobot platforms.

Other factors propelling the growth of the market are increasing efforts to boost productivity and reduce labor costs. Industries are leveraging smart robots for conducting tasks such as welding, assembly, packaging, quality control, etc. For instance, data published by the International Federation of Robotics in January 2024 stated that the inclusion of robotics leads to a 35% cost reduction while maintaining state-of-the-art output and efficient work safety.

Key Smart Robots Market Insights Summary:

Regional Highlights:

- North America smart robots market will dominate more than 45.50% share by 2035, driven by warehouse automation and strong robotics ecosystem.

- Asia Pacific market will achieve robust growth during the forecast timeline, attributed to industrial robot use and government subsidies.

Segment Insights:

- The automotive segment (smart robots market) segment in the smart robots market is projected to capture a 25.10% share by 2035, driven by the extensive use of robots in automobile manufacturing for precision and efficiency.

- The inspection & security segment in the smart robots market is forecasted to achieve significant growth during 2026-2035, attributed to rising investments in AI-integrated robots for inspection and security purposes.

Key Growth Trends:

- Increased usage in the healthcare industry

- Rising deployment of robots in agriculture

Major Challenges:

- Data privacy concerns

- Expensive smart robots

Key Players: Brain Corporation, Neato Robotics, Inc., Grey Orange Pte, Ltd., 1X Technologies, and Samsung Electronics, Co., Ltd.

Global Smart Robots Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 23.92 billion

- 2026 Market Size: USD 29.19 billion

- Projected Market Size: USD 214.02 billion by 2035

- Growth Forecasts: 24.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, United States, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 10 September, 2025

Smart Robots Market Growth Drivers and Challenges:

Growth Drivers

- Increased usage in the healthcare industry: Robots are widely used in medical science for surgery, diagnostic assistance, drug delivery, etc. According to the National Institutes of Health in 2023, over 10 million robotic surgeries have been performed. Other than this, the burgeoning trend of personalized medicine is positively influencing the smart robot market. The private sector and governments are investing in advanced healthcare technologies, including medical robots to enhance services and healthcare infrastructure.

- Rising deployment of robots in agriculture: The agriculture sector is estimated to offer lucrative opportunities for smart robot producers in the coming years. The shortage of laborers, coupled with the high costs of manpower is driving the attention of farmers to smart robots. A few examples of agricultural robots include green seeker sensors, flying robots, robotic drone tractors, robots for picking fruit, and automated milking. According to the American Society of Mechanical Engineers in May 2023, there are currently 220 Oz bots in 48 countries that have done 36,000 hours of work. This statistic highlights that the use of robotics in agriculture is set to boom in the coming years, benefiting manufacturers to maximize their revenues.

- Emergence of Artificial Intelligence: The amalgamation of AI with robotics has been in huge demand in the market across various fields. AI allows articulated robots to perform tasks accurately and at a faster speed. For instance, AI-enabled robotics in education is a growing field where robots educate students on subjects while engaging with them.

Challenges

- Data privacy concerns: Data ownership raises ethical concerns, particularly in light of the expansion of software services for robots. Private information about people is accessible on the cloud owing to the rise of domestic robots for entertainment, education, and housework. The privacy of individuals may be violated if third parties, including marketing firms, purchase this data frequently. Robotic technologies such as the humanoid Lynx and the Roomba, capable of voice activation and intelligent reaction, if attacked by cybercriminals, can infringe or abuse these gadgets' voices, hampering the product and manufacturer’s goodwill and profit shares.

- Expensive smart robots: The production of smart robots requires high capital investment owing to the involvement of complex technologies. Many small companies running on tight budgets often hesitate to invest in smart robots due to their high costs, which limits their adoption rates and hinders the revenue growth of Smart robot market players.

Smart Robots Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

24.5% |

|

Base Year Market Size (2025) |

USD 23.92 billion |

|

Forecast Year Market Size (2035) |

USD 214.02 billion |

|

Regional Scope |

|

Smart Robots Market Segmentation:

Industry Vertical Segment Analysis

The automotive segment is likely to capture smart robots market share of around 25.1% by the end of 2035. The growth of the segment is primarily attributed to the growing use of robots in manufacturing automobiles. The automobile industry has the maximum number of robots working in factories all across the globe. According to data published by the International Federation of Robotics in March 2023, 1 million robots are working in the car industry. Smart robots make the work sophisticated enough to perform tasks with precision and efficiency, including stamping metal plates, trimming plastics, etc. Also, Automotive robotics seamlessly carries out the priming and painting of the vehicle body with zero to no errors.

Application Segment Analysis

The inspection & security segment is anticipated to exhibit significant growth over the forecast period. The smart robots integrated with artificial intelligence, machine learning, cameras, and sensors can detect and analyze the behavior of the object, offering real-time information to the operator on whether the object is dangerous or not. There has been a rising investment in research and development for developing state-of-the-art robots. For instance, according to The American Society of Mechanical Engineers in January 2023, Japan spent USD 930 million for robotics research and development.

Our in-depth analysis of the global smart robots market includes the following segments:

|

Component |

|

|

Application |

|

|

Industry Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Robots Market Regional Analysis:

North America Market Insights

North America smart robots market is anticipated to hold a revenue share of over 45.5% by the end of 2035, backed by a growing e-commerce business and a rise in the number of warehouses. The establishment of smart warehouses across the region is instilling the demand for robots. These advanced warehouses make widespread use of smart robots to minimize human errors and increase work efficiency. The region also has a presence of market giants like Tesla, which is known for advancements in humanoid and industrial robots including the Tesla Optimus.

The U.S. Department of Agriculture also revealed that in 2022, around 20% of individuals in the country bought groceries online. In the coming years, the number of online buyers in the U.S. is anticipated to increase substantially, creating a burden on warehouse and logistics. Thus, to combat this work pressure, warehousing companies are making considerable investments in adding network-linked devices including smart robots to their warehouses to make them more connected. These modifications make smart robot adoption more feasible since they depend on a fast network and digital data.

In Canada, to encourage the development of cutting-edge technologies in the robotics sector, the local government is offering supportive policies in the form of funds, subsidies, and tax benefits. According to a report published by the International Federation of Robotics in April 2024, robot installation in Canada reached 4,616 units. The government aims to put Canada at the forefront of the commercialization of artificial intelligence with this investment.

Asia Pacific Market Insights

The Asia Pacific smart robots market is estimated to increase at a robust CAGR. Smart industrial robots are largely used in the region’s automotive sector to manage welding, painting, and assembly processes on manufacturing lines. For instance, according to the International Federation of Robotics in September 2024, 1.7 million robots working in factories in China. Also, the government in the country has made robotics manufacturing a top priority by giving huge subsidies.

In India, the rapid digital shift across several industries such as automotive, textile, healthcare, chemical, residential, and manufacturing is augmenting the sales of smart robots. According to the International Federation of Robotics in September 2024, the country ranks 7th globally in terms of annual installation.

Smart Robots Market Players:

- iRobot Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Omron Corporation

- Intuitive Surgical, Inc.

- ST Engineering Aethon, Inc.

- Gecko Systems International Corporation

- Delaval Group

- Brain Corporation

- Neato Robotics, Inc.

- Grey Orange Pte, Ltd.

- 1X Technologies

- Samsung Electronics, Co., Ltd

The competitive landscape of the smart robots’ market is rapidly evolving as established key players, automotive giants, and new entrants are investing in novel technologies. Key players in the market are focused on developing new technologies and products catering to the stringent regulatory norms and consumer demand. These key players are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global smart robots market:

Recent Developments

- In August 2024, 1X Technologies revealed the launch of Neo Beta a humanoid robot for home use. Neo beta is beyond conventional, stiff robots, its bio-inspired design makes it safe to work among people.

- In January 2024, Samsung Electronics, Co., Ltd introduced a smart robot Ballie to perform household tasks. This AI home companion robot acts as a personal home assistant and autonomously drives around the home to perform various tasks effectively.

- Report ID: 4788

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Smart Robots Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.