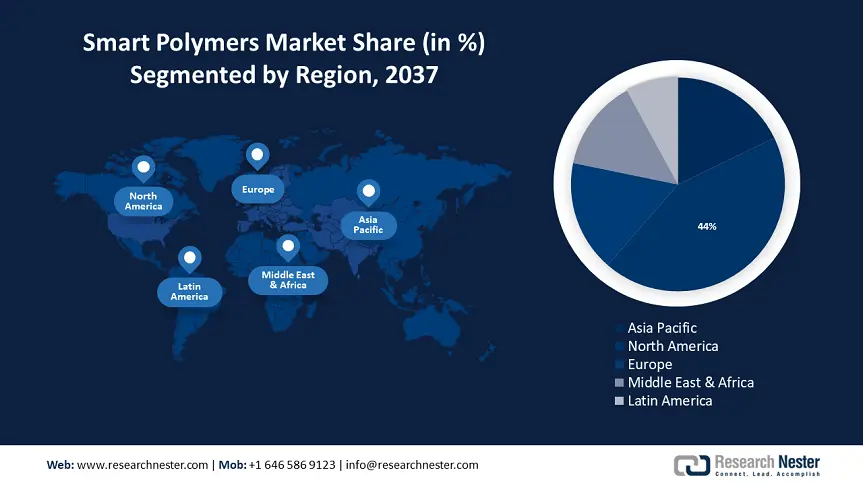

Smart Polymers Market Regional Analysis:

North America Market Insights

North America industry is predicted to dominate majority revenue share of 44% by 2035. The growing healthcare industry in conjunction with growing military and defense applications will significantly fuel demand in North America for processing light–sensitive fabrics and camouflage.

Major automakers in the United States manufacture and export automobiles to economies in the Americas, Europe, and Asia–Pacific. The automotive and automobile manufacturing market in the United States was valued at USD 82.6 billion in 2021, according to the National Automobile Dealers Association (NADA). According to the association, sales of new light vehicles should reach 15.4 million units in the US by 2022, a 3.4% rise.

Canada is one of the leading automakers in the world, producing a sizable share of the global vehicle output. Canada produced 1.12 million cars and light vehicles in 2021, a 19% drop from 2020. Canada produces about two million cars and light trucks annually, which makes up a sizeable amount of the global automobile production.

European Market Insights

The European region will also encounter huge growth for the smart polymers market during the forecast period owing to cutting–edge techniques & usage in various applications. The market is expected to grow exponentially in Europe, particularly in Germany and France, due to strict government regulations regarding the environment and the use of traditional polymers, as well as an increase in R&D initiatives in the field of nanomedicines.

Germany’s robust automotive industry is a significant consumer s are used in various of smart polymers. These materials are used in various components such as composite tires, fluid shock systems, and airbag sensors, contributing to enhanced performance and safety. The industry’s continuous investments in new technologies and materials is expected to drive further demand. As an instance, BMW declared in March 2023 that carbon fiber composites would be used in the manufacturing of its new iX electric vehicle. This is a big step because it's the first mass–produced vehicle that BMW has employed carbon fiber composites in.

The steady demand for newer and quicker electrical and electronic products is being driven by the electrical and electronics industry's rapid rate of technical innovation, which is increasing the manufacturing of these products in France. With 8.1% of the European market in 2022, France ranked as the second–largest producer of electrical and electronic goods.

In 2020, the United Kingdom's polymer production amounted to 1.67 million tonnes, which is approximately half of its consumption of 3.3 million tonnes. As a result, the UK depends significantly on imported raw materials for its polymer production.