Smart Packaging Market Outlook:

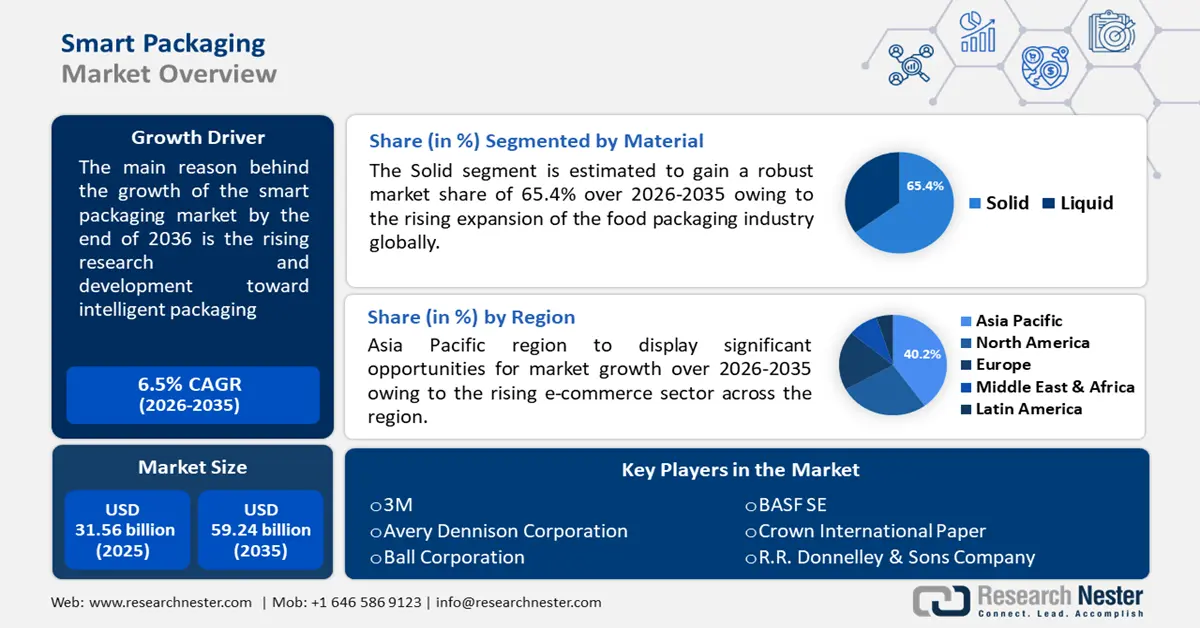

Smart Packaging Market size was over USD 31.56 billion in 2025 and is projected to reach USD 59.24 billion by 2035, growing at around 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of smart packaging is evaluated at USD 33.41 billion.

Smart packaging enables end-to-end tracking of products in a complex global supply chain. The surging need to improve the safety of pharmaceutical and food products is anticipated to boost the smart packaging market. Active packaging with ethanol emitters and modified atmosphere packaging (MAP) are being employed to increase the product's shelf life. Therefore, companies protect product quality throughout transit by incorporating advanced technology in packaging. As per Research Nester’s survey in 2024, nearly 10-20 % of e-commerce products are returned due to customers receiving damaged items.

Key Smart Packaging Market Insights Summary:

Regional Highlights:

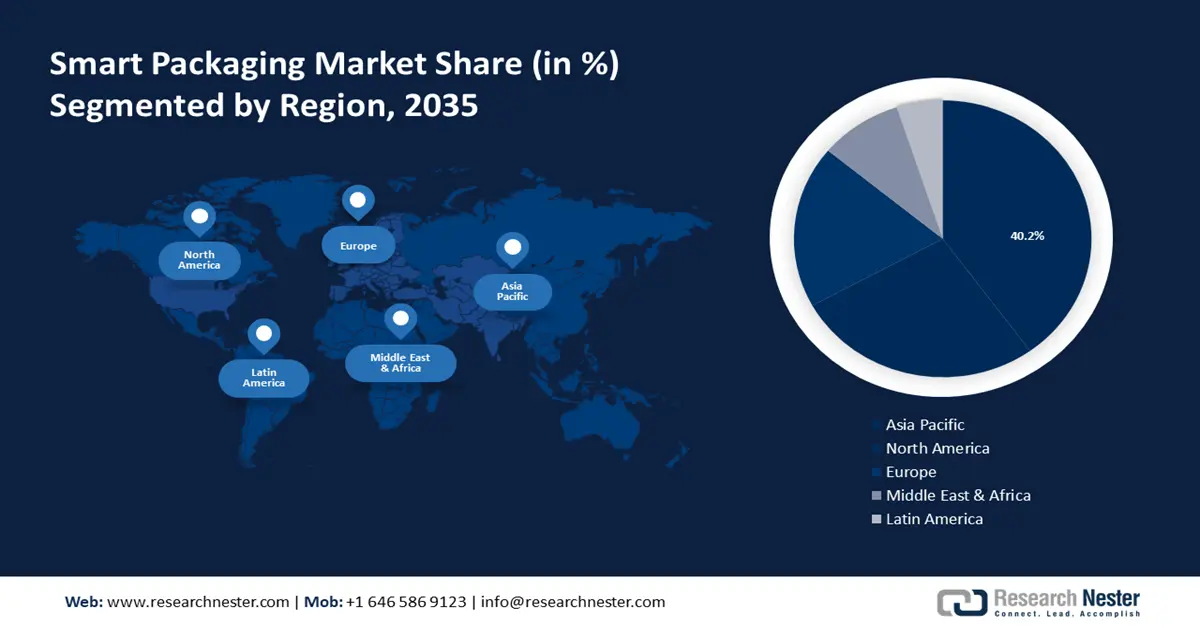

- The Asia Pacific smart packaging market achieves a 40% share by 2035, driven by the rising e-commerce sector supporting smart packaging adoption.

Segment Insights:

- The active packaging segment in the smart packaging market is projected to achieve significant growth till 2035, fueled by the rising demand for ready-to-eat and takeaway meals, which benefit from the longer shelf life enabled by active packaging.

- The healthcare segment in the smart packaging market is expected to capture the largest share by 2035, driven by the increasing integration of smart packaging technologies, such as RFID tags and temperature monitoring, in the healthcare sector.

Key Growth Trends:

- Increasing demand for smart biogenic packaging

- Multiplying consumption of organic packaged food

Major Challenges:

- Excessive cost and complications of technologies

- Lack of knowledge among customers

Key Players: 3M, Avery Dennison Corporation, Ball Corporation, BASF SE, Crown International Paper, R.R. Donnelley & Sons Company, Stora Enso, Sysco Corporation, Zebra Technologies Corp., BeFC, Asahi Kasei Corporation, Rengo Co., Ltd., Smart Packaging Hub, RICOH NAKAMOTO SMART PACKAGING Co., Ltd.

Global Smart Packaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 31.56 billion

- 2026 Market Size: USD 33.41 billion

- Projected Market Size: USD 59.24 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 17 September, 2025

Smart Packaging Market Growth Drivers and Challenges:

Growth Drivers

- Increasing demand for smart biogenic packaging - Smart biogenic packaging is an emerging concept, where intelligent and active packaging technologies are coupled together to give consumers more trustworthy information about the state of food products.

According to the Multidisciplinary Digital Publishing Institute Journal released in 2022, biosensors are essential in food packaging to assess the quality of the food by detecting chemical substances containing biological components such as antibodies, enzymes, and microorganisms. These sensors consist of a transducer that converts the biochemical signal detected by the bioreceptor into a quantitative response. Hence, the rising demand for smart biogenic packaging is predicted to elevate smart packaging market growth. - Multiplying consumption of organic packaged food - More & more people are looking for healthy food & beverage options, such as organic, and vegan products that meet their nutritional requirements. For instance, as per a 2023 survey by the Organic Trade Association, the sales of organic products reached nearly USD 70 billion in the U.S. Moreover, organic food is a premium product, and the target audience must be able to observe the difference through the packaging. Therefore, companies are switching to organic packaging to improve their brand image. For instance, in June 2023, Avery Dennison Corporation introduced four labeling papers made from recycled pulp, and alternative fibers intended for the premium packaging sector, including gourmet food, craft beverages, wine & spirits, and others.

Challenges

- Excessive cost and complications of technologies - The expense and complexity of the technologies are two major obstacles that are expected to restrict smart packaging market growth. Advanced materials, sensors, and software are needed for smart packaging, which raises the cost of installation and production. In addition, the incorporation of sensors and electrical devices inside the packaging may raise additional complexity and dependability concerns.

- Lack of knowledge among customers - Generally, the people of developing countries have limited knowledge about the technologies recently used in packaging. Therefore, most of the time, they remain incompetent to use the smart packaging tools.

Smart Packaging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 31.56 billion |

|

Forecast Year Market Size (2035) |

USD 59.24 billion |

|

Regional Scope |

|

Smart Packaging Market Segmentation:

Type

Active packaging segment is estimated to dominate over 55.7% smart packaging market share by 2035, owing to the growing popularity of ready-to-eat and takeaway meals among the urban population. The application of packaging has a direct effect on the shelf life of ready-to-eat meals. Hence, active packaging technologies absorb substances such as moisture, and oxygen from the product to protect against food spoilage.

According to the World Health Organization (WHO), nearly 1 in 10 people across the globe fall ill after eating contaminated food every year. Therefore, the demand for active packaging to secure food from deterioration for a long time is rising.

Application

The healthcare segment in smart packaging market is set to hold the largest share by 2035, due to the latest trends in smart packaging in the healthcare sector, including QR codes, RFID tags, temperature monitoring, and others. The smart packaging is designed to provide additional benefits beyond just protecting the product inside. For instance, in December 2020, to enhance patient safety and satisfaction, Avery Dennison collaborated with Schreiner MediPharm and PragmatIC Semiconductor to utilize NFC technology by bringing smart packaging for common pharmaceutical items up to the unit level.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

|

Material |

|

|

Level of Packaging |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Packaging Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is anticipated to dominate majority revenue share of 40% by 2035. The rising e-commerce sector across the region will massively support the expansion of the market. The majority of enterprises now use custom-made corrugated boxes instead of plain, uninteresting boxes. As a result, smart packaging is becoming a more viable choice.

China’s e-commerce sales have increased greatly in the past few years, resulting in the growth of the smart packaging industry in this country. Furthermore, as per the recent data from the International Trade Association (ITA) published in December 2023, over half of all e-commerce transactions are occurring in China

The quick advancement in the Internet of Things (IoT) will lead to the smart packaging market expansion in Japan. The experts of Research Nester predict in 2023 that Japan's Internet of Things (IoT) industry is growing quickly, with a current market value of JPY 1.53 trillion (USD 9.47 billion) and expected to rise to JPY 1.85 trillion (USD 11.45 billion) by 2024.

In South Korea, the smart packaging industry will grow because of the rising online population in this country. This directly increases the purchase from the online apps, which leads to excessive use of smart packaging. The Research Nester Survey performed in January 2024 stated that in 2023, almost 97% of the population in South Korea used the internet.

North America Market Insights

The North America region will account for a significant share of profit in the smart packaging market owing to the rising inclination towards sustainable packaging options. For instance, with the help of the UN Environment Programme and the Ellen MacArthur Foundation, over 500 organizations have joined together to create the Global Commitment, which aims to create a circular economy for plastics.

The rambling demand for secured medicine packaging in the U.S. will drive the market growth of smart packaging.

The rising consumption of alcohol is booming the smart packaging market in Canada. In the alcoholic beverage industry, smart packaging satisfies customer engagement and quality assurance requirements.

Smart Packaging Market Players:

- 3M

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Avery Dennison Corporation

- Ball Corporation

- BASF SE

- Crown International Paper

- R.R. Donnelley & Sons Company

- Stora Enso

- Sysco Corporation

- Zebra Technologies Corp.

- BeFC

Key tactics employed by participants in the smart packaging market include product/service launches, approvals, patents and events, acquisitions, partnerships, and collaborations. Below is a list of the leading businesses in this sector:

Recent Developments

- On March 12, 2024, Avery Dennison Information Technology conducted a virtual ceremony to present its first Supplier Excellence Awards, which honored three industry suppliers. The sourcing relationship, delivery and performance, and innovation scores of the winners were taken into consideration throughout the selection process.

- On October 11th, 2023, Silver Crystal Group, a well-known participant in sports clothing customization and application across in-venue, direct-to-business, and e-commerce platforms, entered into a formal agreement to be acquired by Avery Dennison Information Technology.

- Report ID: 6270

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Smart Packaging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.