Smart Labels Market Outlook:

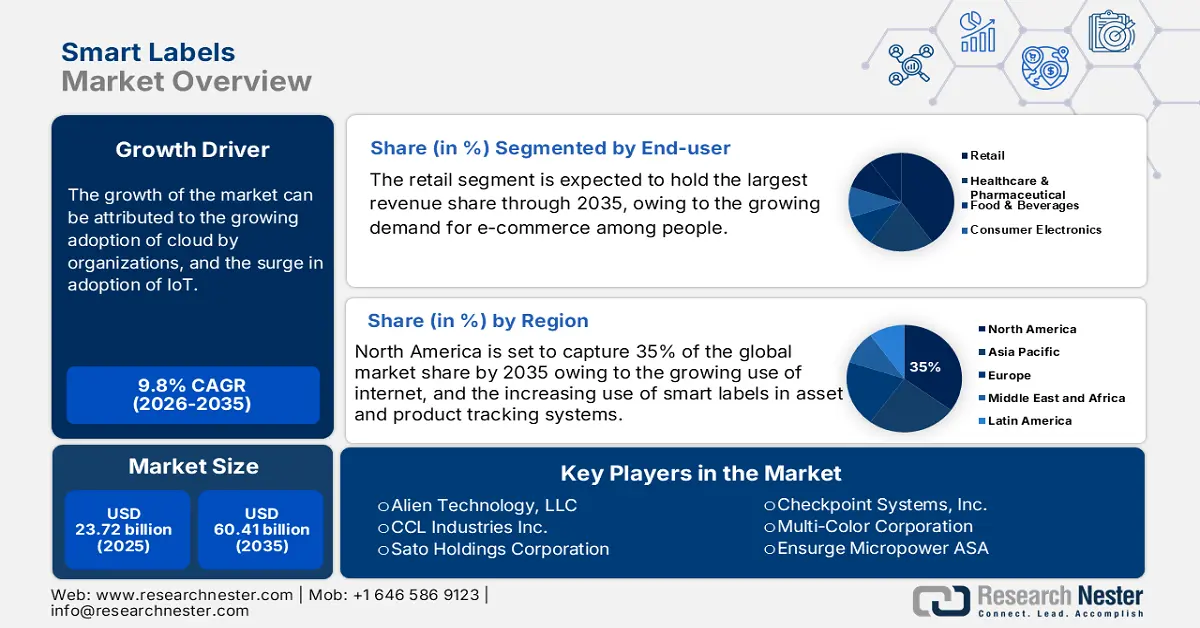

Smart Labels Market size was valued at USD 23.72 billion in 2025 and is expected to reach USD 60.41 billion by 2035, registering around 9.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of smart labels is evaluated at USD 25.81 billion.

The growth of the market can be attributed to growing adoption of cloud by organizations. About 93% of US businesses were employing cloud services in 2022. In contrast, approximately 66% of business infrastructure was hosted in the cloud. Hence, the demand for smart labels is estimated to increase with the growing adoption of cloud, since a smart label solution makes use of the cloud's capabilities to make the packaging and the content accessible online.

The QR code is one of the smart labels that is most frequently used. The number of smartphone users that scanned a QR code on their mobile devices increased by about 25% from 2020 to 2022 in the United States, where there were about 88 million smartphone users. By 2025, there are expected to be over 99 million Americans using mobile QR code scanners, with usage expected to continue to increase. One could quickly add this unobtrusive square to the product labels so that buyers may scan them with their mobile devices. The QR code could point someone in any direction after being scanned, including to a digital voucher, business website, or an invitation to download any app.

Key Smart Labels Market Insights Summary:

Regional Highlights:

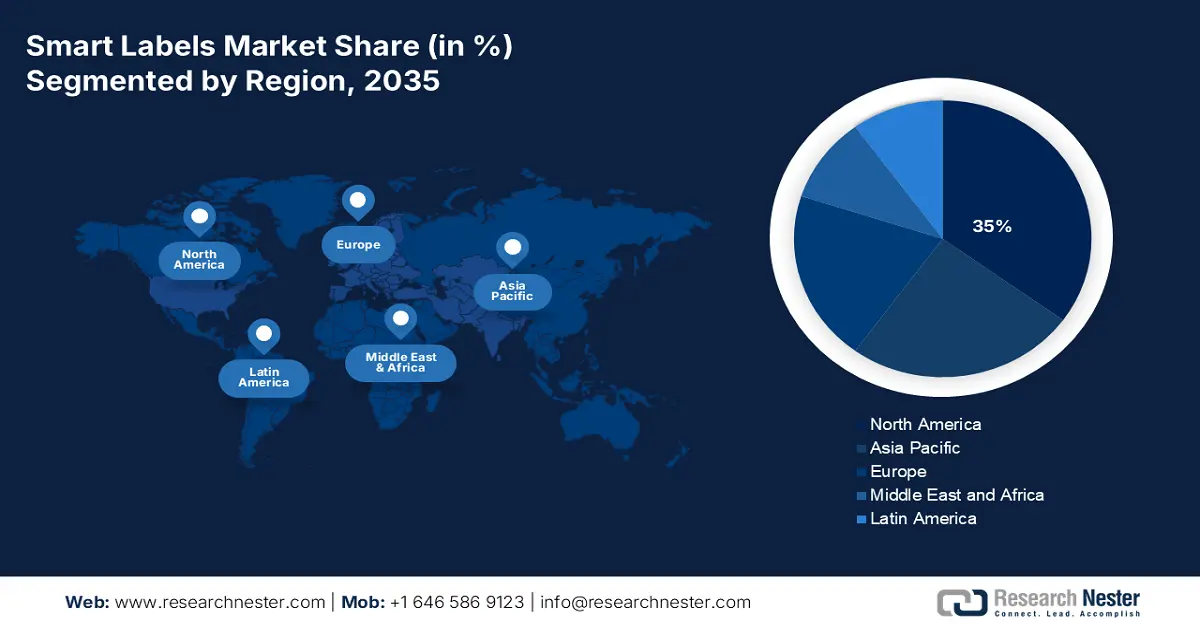

- North America smart labels market achieves a 35% share by 2035, driven by widespread smart label adoption in logistics and e-commerce.

- Asia Pacific market will capture the second largest share by 2035, driven by rising anti-theft tech demand and booming e-commerce.

Segment Insights:

- The retail segment in the smart labels market is anticipated to achieve the highest market share by 2035, driven by rising e-commerce demand and adoption of RFID for enhanced retail operations.

- The rfid segment in the smart labels market is expected to experience significant growth over 2026-2035, attributed to RFID's ability to track, authenticate, and manage objects efficiently.

Key Growth Trends:

- Growing Waste of Food & Beverages

- Protect Against Counterfeiters

Major Challenges:

- High Cost of Devices

- Growing Cyber Risk

Key Players: Avery Dennison Corporation, Advantech Co., Ltd., Checkpoint Systems, Inc., Alien Technology, LLC, CCL Industries Inc., Multi-Color Corporation, Invengo Technology, Co., Ltd., Mühlbauer Group, Ensurge Micropower ASA, Sato Holdings Corporation.

Global Smart Labels Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 23.72 billion

- 2026 Market Size: USD 25.81 billion

- Projected Market Size: USD 60.41 billion by 2035

- Growth Forecasts: 9.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 10 September, 2025

Smart Labels Market Growth Drivers and Challenges:

Growth Drivers

- Growing Waste of Food & Beverages - Each year, more than 29% of food is lost or squandered, globally. Food and beverage companies are able to communicate with their customers directly owing to QR codes. These could be used to provide facts about where food comes from, how it is transported, and even in-depth nutritional information that wouldn't fit on a typical label. Moreover, several businesses utilize other smart labels market in addition to QR codes. A further choice is the Time Temperature Indicator (TTI), which use color-changing technology to show how long a product has been in transit, whether it has been stored at the proper temperatures, and how much longer it has to go before expiring. Hence, this reduces the wastage of food & beverages.

- Protect Against Counterfeiters - Counterfeiters have an impact on almost every industry to some extent. The CDC believes that up to 41% of pharmaceuticals sold in low- and middle-income nations are fake drugs. Consumer goods are also at risk; every year, U.S. Immigration and Customs Enforcement intercepts counterfeit goods worth millions of dollars. These fake goods present a significant risk to public health and safety in both situations.

- Surge in Adoption of IoT - Almost 14 billion IoT devices are currently online worldwide. By 2030, the number of active IoT devices is anticipated to double.

- Growth in Adoption of Smartphones - By 2023, there are projected to be about 5 billion smartphone users worldwide, which would also mean that approximately 85 percent of people would be smartphone owners. With the help of smartphones, reading barcode has become very easy. Hence, large number of people are able to scan the barcode efficiently. Therefore, this factor is estimated to boost the growth of the smart labels market over the forecast period.

- Upsurge in Company Initiatives - In July 2022, Oli-Tec created a brand-new smart label technology for goods that mimics the packaged good's decomposition cycle and is appropriate for time- and temperature-sensitive goods with a shelf life of five to fifteen days. Any product that is impacted by temperature and time deterioration may utilize the label; this includes goods from the food, pharmaceutical, and cosmetics industries.

Challenges

- High Cost of Devices - Lack of investment by traditional label printing companies in digital printing services is one of the main barriers identified. Given the costly nature of sophisticated systems, traditional businesses in the smart labels market still don't invest in them.

- Functional Abilities and Mechanical Susceptibility

- Growing Cyber Risk

Smart Labels Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.8% |

|

Base Year Market Size (2025) |

USD 23.72 billion |

|

Forecast Year Market Size (2035) |

USD 60.41 billion |

|

Regional Scope |

|

Smart Labels Market Segmentation:

End-user Segment Analysis

The global smart labels market is segmented and analyzed for demand and supply by end-user into retail, healthcare & pharmaceuticals, food & beverages, consumer electronics, supply chain & logistics, and transportation. Out of which, the retail segment is anticipated to garner the highest revenue by the end of 2035. The growth of the segment can be attributed to growing demand for e-commerce among people. Almost 3 billion people were anticipated to make online purchases in 2022. The world population is projected to be about 7 billion as of January 2023. That indicates that at least 27% of people worldwide make purchases online to meet their needs. The e-commerce and also m-commerce industries' breakthroughs and convergence are causing retailers to reevaluate their ideas and products, which is causing the global retail environment to change every day. Since a few years ago, the retail industry has changed to make use of RFID technology, which accounts for the majority of labels and tags produced to this day. Retailers could now better communicate with customers, apply anti-counterfeiting measures, and integrate customer experience into the Omni channel environment owing to this label technology. These elements fuel the retail sector's demand for intelligent labelling.

Technology Segment Analysis

The global smart labels market is also segmented and analyzed for demand and supply by technology into electronic article surveillance (EAS) security, RFID, sensing labels, near field communication tag, and QR code/2D barcode. Amongst which, the RFID segment is expected to have the significant growth over the forecast period. Radio frequency is used by RFID tags, a sort of tracking technology, to locate, recognize, follow, and communicate with objects and people. RFID tags could contain a variety of data, including serial numbers, a brief description, and even entire pages of information. Hence, owing to their advantages their preference is high among organizations. Cryptographic security elements are included in some RFID tags to provide a high level of verification and authentication. Low frequency (LF), high frequency (HF), and ultra-high frequency (UHF) radio frequencies are typically used to identify RFID tags (UHF).

Our in-depth analysis of the global smart labels market includes the following segments:

|

By Technology |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Labels Market Regional Analysis:

North American Market Insights

The share of smart labels market in North America is projected to cross 35% by 2035, backed by growing use of internet along with increasing use of smart labels in asset and product tracking systems. It was predicted that between 2023 and 2028, there would be an additional about 42 million internet users in North America. The total user base is estimated to grow to approximately 497 million users in 2028, marking the fifth year in a row that it has done so. Other reasons that manufacturers and merchants are being compelled to employ market for product labelling include rising labor costs and problems with price integrity. Also, a number of businesses from other sectors have launched initiatives in this region to boost the smart labels market. In addition, manufacturers and retailers are using smart labels, such as RFID, EAS, and NFC, extensively. They could track shipping goods owing to this, which opens up a number of options for market players in this region to flourish. In addition, the growing adoption of digital technology across numerous industries would support the market expansion for smart labels in the years to come.

APAC Market Insights

The Asia Pacific smart labels market is estimated to be the second largest, to have the highest growth. Since businesses are more concerned about security, there is an increase in demand for effective anti-theft technologies, which has had a big impact on the market for smart labels in this region. Throughout the projected period, characteristics including simultaneous identification, real-time location tracking, re-programmability, and detailed real-time information would considerably aid in the expansion of the market in Asia Pacific. Moreover, other factors which are estimated to boost the growth of smart labels market in this region are growing disposable income, and rise in use of e-commerce websites in order to purchase goods.

Europe Market Insights

Additionally, the smart labels market in Europe region is also estimated to have significant growth over the forecast period. The growth of the market can be attributed to growing technology advancement in this region. A variety of opportunities are presented by developments such as the Internet of Things, industrial data, advanced manufacturing, robots, and artificial intelligence that would allow European industry to strengthen its position as a leader in the developing smart labels market for future goods and services. Moreover, the penetration of mobile phones is also high in this region which has influenced people to purchase more goods online.

Smart Labels Market Players:

- Avery Dennison Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Advantech Co., Ltd.

- Checkpoint Systems, Inc.

- Alien Technology, LLC

- CCL Industries Inc.

- Multi-Color Corporation

- Invengo Technology, Co., Ltd.

- Mühlbauer Group

- Ensurge Micropower ASA

- Sato Holdings Corporation

Recent Developments

-

A pioneer in specialty label, security, and packaging solutions for large enterprises, governmental organisations, small businesses, and consumers, CCL Industries Inc. ("CCL") recently announced the acquisition of eAgile Inc. ("eAgile") and the intellectual property of Alert Systems ApS.

-

Portable Technology Solutions, LLC (PTS), a developer of mobile data gathering software and solutions, has revealed that Alien Technology, LLC’s ALR-H460 portable, rugged RFID reader is supported by its TracerPlus mobile software. TracerPlus is enterprise-class mobile and RFID software that works with a variety of home and office gear. With no programming necessary, TracerPlus may be customised to meet the exact demands of any user.

- Report ID: 4836

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Smart Labels Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.