Smart Home Market Outlook:

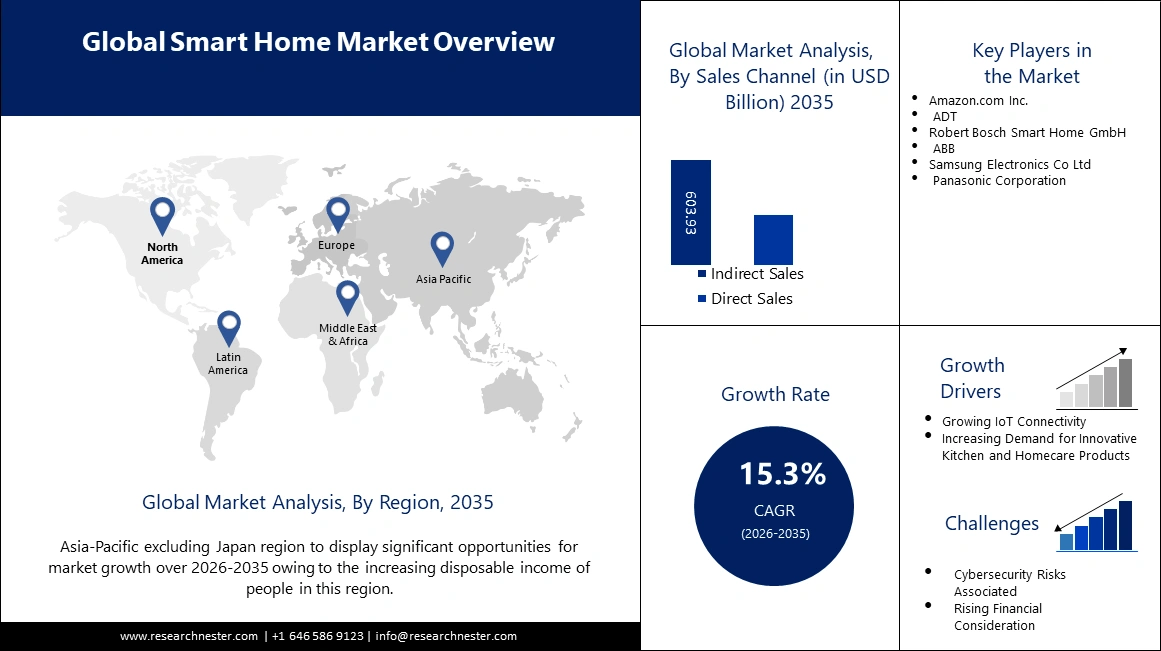

Smart Home Market size was over USD 123.46 billion in 2025 and is projected to reach USD 512.65 billion by 2035, witnessing around 15.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of smart home is evaluated at USD 140.46 billion.

The growing concern for home safety and security is one of the factors behind the smart home market's immense growth. To improve consumer security and safety, a growing number of government institutions and groups are investing in smart devices.As an illustration of its increased commitment to tackling safety risks in the smart home industry, the British government committed GBP 400,000 in May 2020 to improve the security of smart consumer gadgets.

Two major factors propelling the smart appliance industry are faster cooking times and better food quality. When it comes to multitasking, consumers give priority to time-saving features and look for appliances that improve cooking accuracy and efficiency. Furthermore, there is a huge possibility for development in incorporating food recognition technology into appliances like refrigerators and ovens, since this will satisfy customer demands for more sustainable and intelligent cooking.

To satisfy customer demands, smart kitchen appliances must always change, with functional improvements being crucial. This includes functions like energy-saving apps, helpful alerts, and Wi-Fi connectivity. Voice-activated stovetops, remote oven preheating, and smart microwaves with barcode readers and cooking instructions downloaded are a few examples of products now on the market.

Key Smart Home Market Insights Summary:

Regional Highlights:

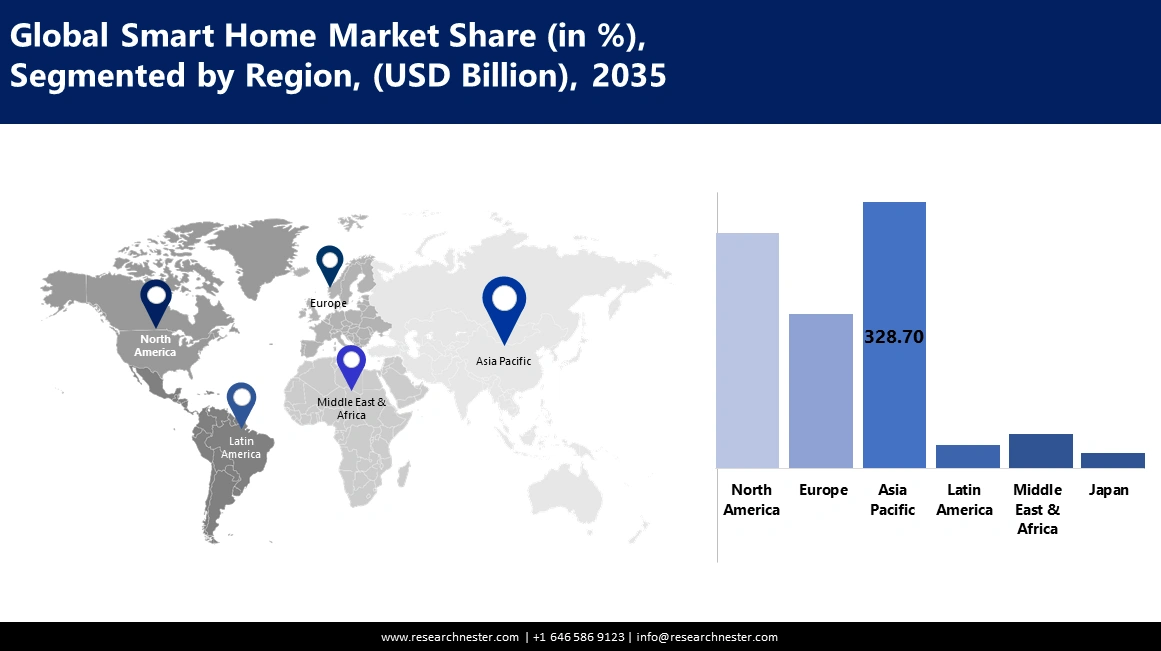

- Asia Pacific smart home market will secure over 38% share by 2035, driven by urbanization, rising disposable income, and a tech-savvy population.

- North America market will account for 32% share by 2035, driven by extensive internet access, technological advances, and an increasing preference for connected living.

Segment Insights:

- The indirect sales segment in the smart home market is projected to capture a 65% share by 2035, influenced by the extensive reach of indirect sales channels like big box stores.

- The security & access control segment in the smart home market is projected to witness significant expansion by 2035, fueled by the demand for advanced biometric security solutions.

Key Growth Trends:

- Escalating internet of things (IoT) connectivity

- Energy efficiency and sustainability is considered a key trend in the industry

Major Challenges:

- Growing cybersecurity threats

- Rising financial consideration to hamper the market in the upcoming period.

Key Players: Amazon.com Inc., ADT, Robert Bosch Smart Home GmbH, ABB, Samsung Electronics Co Ltd, Panasonic Corporation.

Global Smart Home Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 123.46 billion

- 2026 Market Size: USD 140.46 billion

- Projected Market Size: USD 512.65 billion by 2035

- Growth Forecasts: 15.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 17 September, 2025

Smart Home Market Growth Drivers and Challenges:

Growth Drivers

- Escalating internet of things (IoT) connectivity - The market for smart homes is expanding due to the widespread use of Internet of Things (IoT) devices. The way homes function has changed as a result of IoT's capacity to easily link and integrate diverse gadgets into daily life.

IoT makes it possible for homeowners to live in a more practical and effective environment by enabling centralized control and automation. In 2019, sales of Internet of Things smart home devices are expected to reach USD 13 billion, and by 2022 it is estimated that they will be worth over USD 53 billion.

- Energy efficiency and sustainability is considered a key trend in the industry - The worldwide trend in smart home adoption is driven by consumers' demand for energy savings and the responsibility to protect the environment. Innovative devices that not only reduce energy consumption but also contribute to a greener and more sustainable household are actively sought by consumers.

Smart home technology provides easy control and energy management at the touch of a button. Smart thermostats provide both comfort and significant energy savings, given that US households spend more than 900 dollars a year on heating and cooling. The global smart home market is growing significantly due to increasing consumer demand for energy savings and the responsibility of protecting the environment.

Challenges

- Growing cybersecurity threats - Cyber attacks pose a serious threat to the smart home market. The hijacking of smart devices enables hackers to control them, even if the user has no idea about it. Such a situation could lead to serious consequences, as attackers can use these devices to gain access to the entire smart home network in which sensitive information and security are at risk. In addition, the smart home ecosystem is very concerned with data leaks and identity theft.

- Rising financial consideration to hamper the market in the upcoming period.

- Compatibility issues between devices of different companies are set to hinder market growth in the forecast period

Smart Home Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

15.3% |

|

Base Year Market Size (2025) |

USD 123.46 billion |

|

Forecast Year Market Size (2035) |

USD 512.65 billion |

|

Regional Scope |

|

Smart Home Market Segmentation:

Product Type Segment Analysis

Security & access control segment share in the smart home market is estimated to cross 22% by the end of 2035. The key components of the market are still security and access control, which accounts for a large part of this market share. This section contains a full range of options for homeowners who wish to safeguard their assets and set up secure living spaces.

Secure access control, which will keep us safe from attackers and other possible dangers, is one of the core elements of a smart home. Traditional home security systems such as physical keys, passwords, and PINs are examples of systems that are expensive and do not meet the needs of the customer in terms of security and convenience.

In addition to protecting our homes from unauthorized entry, simple and safe access with a biometrics security system can be made available for authorized users. Smart home security can be greatly enhanced by biometric solutions that use fingerprints, gaits, facial expressions, palm prints, and a combination of multiple biometrics.

For example, in September 2022, Amazon.com Inc. introduced the Ring Spotlight Cam Plus, Ring Spotlight Cam Pro, and 2nd Gen alarm panic button which uses radar and 3D motion detection features for security and access control purposes.

Sales Channel Segment Analysis

In smart home market, indirect sales segment share is poised to exceed 65% by 2035. For many smart home products, indirect sales channels are the key to distribution. They offer manufacturers a more extensive reach and leverage the current retail infrastructure. Big box stores offer a broad range of smart home devices at competitive prices, reaching mass audiences and specialty electronic shops focus on high-end products with professional staff and the potential for bundling services.

A huge selection of smart home products from different brands is offered by giant online retailers such as Amazon and eBay, which are reaching a global audience. With a USD 1.7 billion offer for iRobot, the maker of smart Roomba vacuums, Amazon is making efforts to enter this new segment of intelligent homes.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

Sales Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Home Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific industry is estimated to hold largest revenue share of 38% by 2035. Urbanization, rising disposable income, and a tech-savvy population could be the reason for the growth of the market in the region. Examples include the widespread adoption of smart appliances, such as the Samsung Family Hub refrigerator and Xiaomi Smart Air Purifiers.

The demand for luxurious smart home products is driven by rising living standards in the region. In a sign of an increasing trend towards the adoption of modern home technology, 76% of Chinese consumers are willing to purchase devices that can be used for convenience and comfort.

Factors such as high Internet penetration, growing awareness of fitness, and healthy lifestyles among China's middle-class population that leads to a high disposable income are driving the Chinese market growth.

The growing adoption of voice-controlled products and smart speakers is one of the most important trends in the Indian market. The demand for an interconnected smart home ecosystem is increasing as more and more households are adopting intelligent assistants and voice recognition technology.

Growth in Japan can be attributed to growing demand for security applications, as well as increased energy efficiency and overall comfort.

North American Market Insights

Smart home market share for North America region is set to reach 32% by 2035. The market for smart homes in North America is growing on the back of factors such as extensive internet access, technological advances, and an increasing preference for connected living.

Internet of Things devices, e.g. intelligent thermostats, security systems, and voice assistants are part of the main components. Leading companies such as Ring, Nest, and ADT offer a full range of smart security solutions, including video doorbells and security cameras. Notably, 39.2% of households in the region have adopted smart home technology, making it the biggest global adoption rate.

Due to technological progress and increasing consumer adoption, the market in the United States is expanding.

The rapid growth of the market in Canada is driven by increasing demand for energy-efficient and connected devices in households nationwide.

Smart Home Market Players:

- Johnson Controls

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Honeywell International Inc.

- Siemens AG

- Schneider Electric SE

- Amazon.com Inc.

- ADT

- Robert Bosch Smart Home GmbH

- ABB

- Samsung Electronics Co Ltd

- Panasonic Corporation

Recent Developments

- To provide modern automation solutions for residential, commercial, and construction complexes, Schneider Electric has acquired AVEVA plc through the use of its advanced software capabilities. This acquisition is expected to increase Schneider Electric's ability to offer home automation.

- ABB Ltd., intending to expand its home automation portfolio, has entered into a collaboration with SAMSUNG ELECTRONICS CO., LTD. The collaboration will make it easier for new customers to reduce their costs and contribute positively towards the environment.

- Report ID: 6059

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Smart Home Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.