Smart Government Market Outlook:

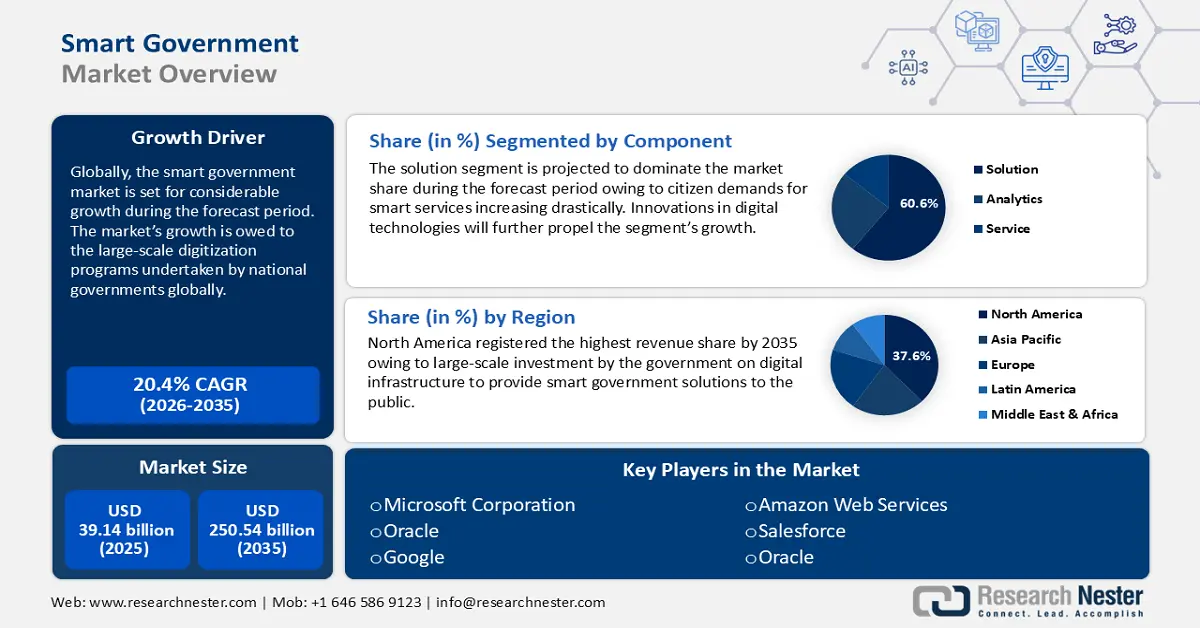

Smart Government Market size was valued at USD 39.14 billion in 2025 and is set to exceed USD 250.54 billion by 2035, registering over 20.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of smart government is estimated at USD 46.33 billion.

The burgeoning market for smart government solutions is attributed to a rapid rate of digitization. Innovations in internet of things (IoT), artificial intelligence (AI), and cloud computing have facilitated streamlining government operations, propelling the growth of the market.

The United Nations has an E-Government Development Index (EGDI) for all its member states. The E-Government Index assesses the incorporation of infrastructure technology for better service to people. In 2024, the 13th edition of the UN E-Government survey was released showing an upward trend in the development of digital government globally and improvement in the global average value of the EGDI, with population lagging in digital government reducing from 45% in 2022 to 22.4% in the current year. The trends indicate for the robust growth of smart government market.

The shift towards data-centric government is encouraging substantial investments in smart government solutions from both government and service providers accelerating the market’s growth. Smart government solutions can foster a responsive and citizen-centric approach to governance. For instance, the government in India launched the Aarogya Setu app in 2020 during the COVID-19 pandemic for self-assessment and contact tracing digital service. The government application became the fastest growing app globally after its release. As the penetration of 5G services continue to improve, the smart government services are poised to be disseminated to larger section of people.

Key Smart Government Market Insights Summary:

Regional Highlights:

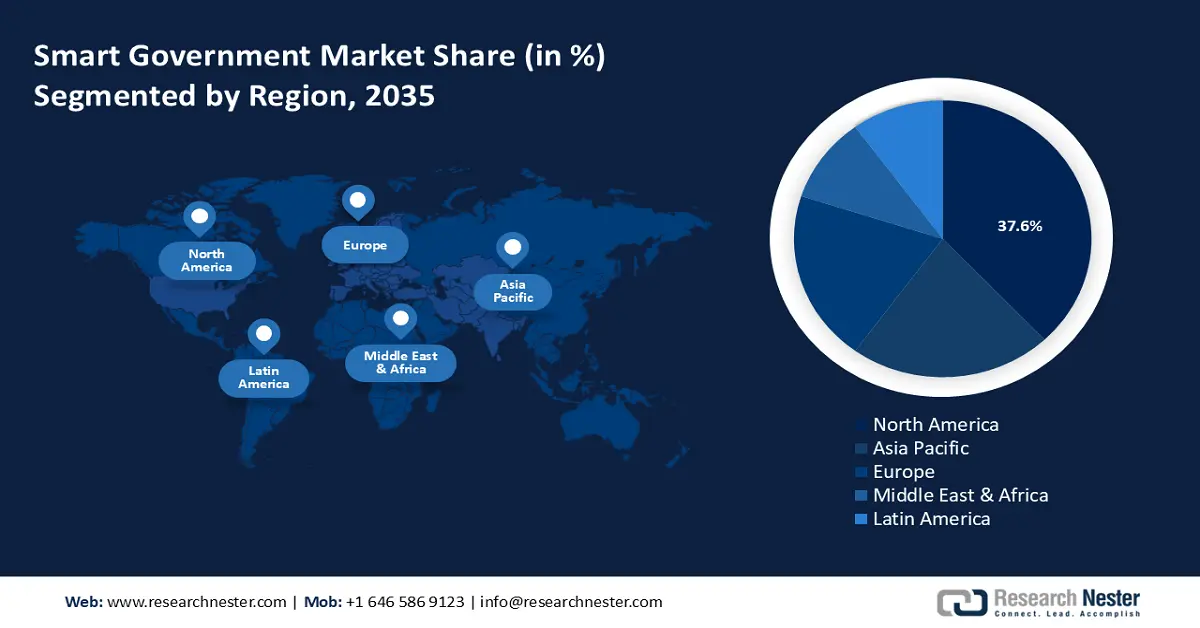

- North America smart government market will account for 37.60% share by 2035, driven by major government investments in digital infrastructure.

Segment Insights:

- The solution segment in the smart government market is anticipated to achieve a 60.60% share by 2035, fueled by rapid improvements in AI, IoT, and 5G technologies.

- The cloud segment in the smart government market is expected to capture a significant share by 2035, influenced by the adoption of cloud-based solutions for improved service delivery.

Key Growth Trends:

- Growing demands for data-driven decisions

- Advancements in digital infrastructure

Major Challenges:

- Data privacy and security concerns

- Digital divide and integration with legacy systems

Key Players: IBM Corporation, Cisco Systems, Inc., Microsoft Corporation, Oracle Corporation, SAP SE, Huawei Technologies Co., Ltd., Siemens AG, Capgemini SE, Accenture plc, OpenGov, Inc.

Global Smart Government Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 39.14 billion

- 2026 Market Size: USD 46.33 billion

- Projected Market Size: USD 250.54 billion by 2035

- Growth Forecasts: 20.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 18 September, 2025

Smart Government Market Growth Drivers and Challenges:

Growth Drivers

- Growing demands for data-driven decisions: The ability to collect and analyze vast amounts of data is a key driver for growth. Governments leverage data analytics in smart government solutions to make informed, data-driven decisions (DDD) that are more impactful. For instance, the Efficiency Unit of Hong Kong acts as a single point of contact for multiple government departments in handling citizen complaints and handles around 2.65 million calls and over 98 thousand emails every year. The unit partners with text mining firms to build a system to process the data and generate reports so that concerned departments are intimated with one click. The cost-effectiveness and efficiency of DDD are pushing for more governments to integrate smart government solutions.

- Advancements in digital infrastructure: The rapid expansion of IoT networks devices, and cloud computing is enabling governments around the world to build robust infrastructure and implement smart solutions. A strong infrastructure leads to seamless data exchange between systems improving the efficiency of transportation, traffic management, waste management, and e-governance.

Additionally, governments globally are digitizing their services to drastically cut down on long queues and wait times. In most government portals, citizens can now apply for documents virtually without the need to physically visit offices. Smart digital infrastructure can prevent the percentage of mishaps. For instance, in August 2024, the Ministry of Road Transport and Highways in India announced the Advanced Traffic Management System (ATMS) to be installed in high traffic density expressways and highways for effective monitoring. - Government mandates on digital transformation: Governments around the world are enacting policies and regulations that encourage digitization and adoption of smart government solutions. For instance, the United Nations Conference on Trade and Development (UNCTAD) reported in 2018 on the success of South Korea’s e-Government initiatives leading to greater convenience and a hyper-connected society. Additionally, the push for digital transformations in a bid to intensify the smart government initiatives allows vendors providing infrastructure as a service (IaaS), IoT sensors, etc., to provide their services to the government in long-term contracts which boosts the smart government market growth. Government policies as such enable the growth of the market as revenue streams open for service providers to integrate their smart services to government projects.

Challenges

- Data privacy and security concerns: Data security is a major concern in smart government solutions. The digital initiative requires citizens to store their data with the government such as the National Registration Identity Card (NRIC) of Singapore. Due to rising cases of data theft, the onus falls on the governments to provide robust security to citizen’s data. Any leak of sensitive data such as healthcare details can prove to be disastrous to smart government market growth.

- Digital divide and integration with legacy systems: Digital divide is a significant constraint of the market. The challenge of digital divide is larger in emerging economies where large section of population may not have access or awareness of digital services. This creates a gap in the beneficiaries in smart government solutions. Additionally, vendors can face impediments in integrating smart technologies in outdated legacy systems.

Smart Government Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

20.4% |

|

Base Year Market Size (2025) |

USD 39.14 billion |

|

Forecast Year Market Size (2035) |

USD 250.54 billion |

|

Regional Scope |

|

Smart Government Market Segmentation:

Component Segment Analysis

Solution segment is projected to dominate smart government market share of around 60.6% by the end of 2035, owing to rapid improvement in AI, IoT, and 5G technologies. The segment is characterized by diverse set of offerings that enable governments to provide efficient and citizen-centric services. The rising demand for citizen engagement platform boosts the growth of the component segment.

Citizen engagement platforms such as e-government services, digital voting platforms, feedback tools, apps, etc., witness a high rate of participation enabling the growth of the segment. For instance, the Christchurch Council in New Zealand has a Snap Send Solve app where users reported over 48000 local issues in 2019. The diverse offerings in the segment open new revenue streams for the service providers.

The analytics segment is poised to increase its revenue share during the forecast period due to greater demand for data-driven decisions (DDD) and formulating citizen-friendly policies. Due to the growing number of public sector organizations processing large amounts of data for better service delivery, smart service providers for advanced AI-driven analytics tools are witnessing a steady boost in revenue. For instance, in 2024, NITI Aayog in India launched the National Data & Analytics Platform (NDAP) that allows merger of datasets and make cross-sectoral analysis easier to provide data-driven solutions to the public.

Deployment Segment Analysis

The cloud segment in smart government market is estimated to significantly increase its revenue share by the end if 2035. The segment’s growth is attributed to increasing adoption of cloud-based solutions by the public sector to improve service delivery and optimize operations. Governments require secure cloud-based solutions to store large amounts of data.

The increase in investments to modernize IT infrastructures by governments is attributed to the rapid growth of the segment. For instance, in 2021, Amazon Web Services became the official cloud platform of the Digital Agency of Japan for regional and public government. In 2022, the Digital Agency of Japan subscribed to cloud services from Microsoft and Oracle Corporation. Major cloud services platform like Oracle, Amazon Web Services, and Google Cloud offer dedicated government cloud infrastructure to maintain robust security.

Our in-depth analysis of the global market includes the following segments

|

Component |

|

|

Deployment |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Government Market Regional Analysis:

North America Market Insights

North America in smart government market is anticipated to dominate over 37.6% revenue share by 2035. The rapid rise of the market in the region is attributed to government investments in digital infrastructure to provide smart government services to the public. In Canada and U.S., there has been greater investments in AI, data analytics, and cloud services to improve ease of service delivery. In 2024, the United Nations released the E-Government Developmental Index (EGDI) report where U.S. ranked at 19 in EGDI and Canada ranked at 47.

U.S. is the leading market for smart government solutions in North America. In 2024, U.S. was ranked at 11th out of 193 countries in the E-Participation index by UN. The high-rate of citizen participation bodes well for the market growth in U.S. In March 2023, the Department of Defense (DOD) awarded contracts to four service providers i.e., Amazon Web Services Inc., Google Support Services LLC, Oracle, and Microsoft Corporation, in support of its Joint Warfighting Cloud Capability.

Additionally, the government invests heavily on smart government systems to improve citizen convenience opening up opportunities for smart service providers to partner with the public sector. For instance, in 2023, the U.S. Department of Transportation (USDOT) announced that USD 500 million will be granted via SMART Grants Program to invest in smart systems improving transportation efficiency.

Canada holds a major share in the smart government market in North America. In 2024, Canada was ranked at 15 out of 193 countries in the E-Participation index by the UN. Federal and provincial governments in Canada are rapidly integrating smart government solutions to improve service efficiency to the public. In 2023, the government of Canada organized smart cities challenge for all municipalities, local or regional governments, and indigenous communities to encourage smart government solutions at grassroot levels. Additionally, large-scale government investments in projects such as Smart Grid enables the rapid growth of the market in Canada.

APAC Market Insights

Asia Pacific is poised to increase its revenue share by a significant amount during the forecast period. The rapid growth of the smart government market is due to large scale digitization drives in emerging economies such as China and India. The large-scale population in many APAC countries also boosts the drive to inculcate smart government solutions. India, Singapore, Japan, and China have national smart portals for citizen registry. Key market players are poised to find greater revenue streams in the region as public sectors in various levels of the government collaborate with private sectors to deliver smart government solutions to the public.

In India, the market is estimated to have major growth spurt during the forecast period owing to large-scale digitization drive by the government. For instance, in 2024, Invest India announced the Digital India initiative, which was extended to 2025-2026, and the budget allocated was USD 178.6 million. Government backed applications such as the Indian Railway Catering and Tourism Corporation provide smart ticketing, catering, and touring solutions to citizens, and vendors such as Haldiram, Dominos, Relfood deliver food via the IRCTC application. As 5G services penetrate more in India, the access of smart government solutions will improve. Additionally, government drive of creating smart cities ensures smart government solutions to reach local governments enabling the robust market growth.

China is poised to rapidly increase its market share during the forecast period and become a leading player in the smart government market. The Digital China strategy of the government is reaping dividends as the government is able to deploy AI, big data, and cloud computing services rapidly to improve public administration. Local market players in China are leveraging the push for smart government solutions. For instance, the Alibaba Group designed the City Brain software system that utilizes AI for efficient urban management. In 2019, Alibaba announced that City Brain system is now used in 22 Chinese cities in an effort to make cities smarter. As the 14th 5-year plan of China drives public sectors to accommodate smart government solutions, the market is set for a considerable boost by the end of 2035.

Smart Government Market Players:

- Microsoft Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Oracle

- Amazon Web Services

- Salesforce

- IBM

- Cisco

- Huawei

- Alibaba

- Capgemini Government Solutions

- HashiCorp

The smart government market is projected to have a strong growth curve during the forecast period. The sector has global and local players vying to attain government contracts and provide smart government solutions to leverage the rising push for digitization globally. Key market players are investing in providing secure cloud solutions amongst other services to the public sector to increase their market share.

Some of the key players in the market are:

Recent Developments

- In September 2024, Amazon Web Services announced that National Health Authority (NHA), Government e-Marketplace (GeM), and Public Sector Bank Alliance (PSBA) have adopted AWS technology to accelerate digital services in India.

- In August 2023, Huawei announced an in-house innovative technical foundation for digital twins in China that can aggregate water conservation data and provide physical mappings.

- In June 2020, Salesforce launched a dedicated cloud for U.S. government clients called Government Cloud Plus to cater to local, federal, and state customers.

- Report ID: 6475

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Smart Government Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.