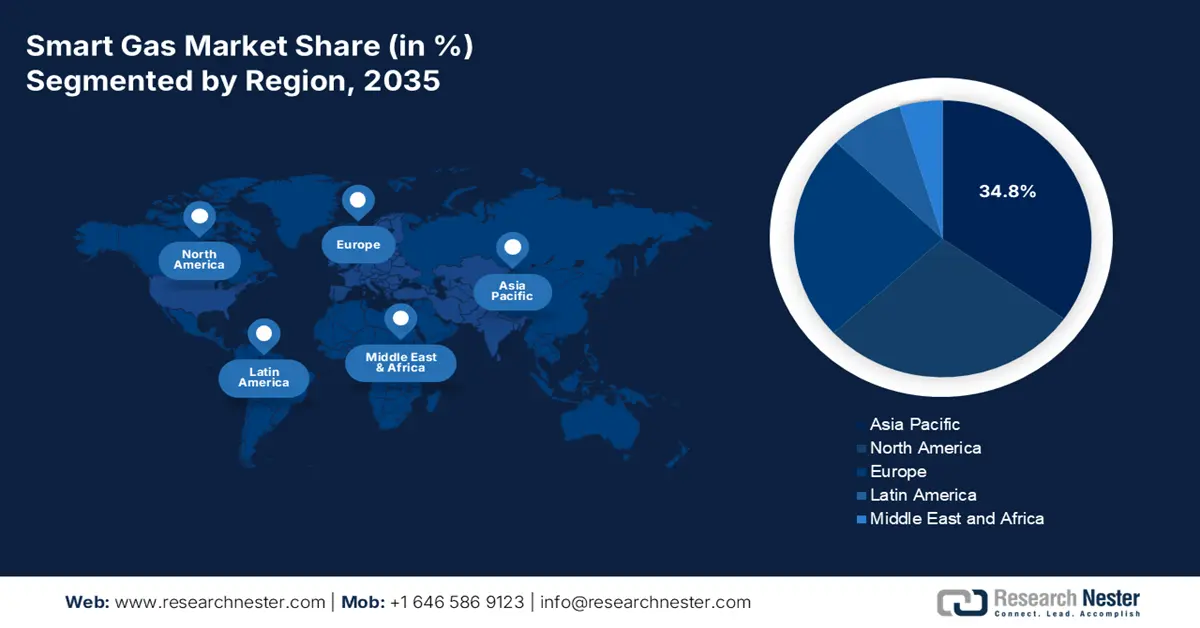

Smart Gas Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the smart gas market is anticipated to garner the largest share of 34.8% by the end of 2035. The market’s upliftment in the region is extremely driven by industrial digitalization at scale, methane abatement programs, and increased AMI rollouts. According to an article published by the Climate and Clean Air Coalition in 2025, the energy demand in the Association of Southeast Asia Nations (ASEAN) is expected to reach an estimated 1,282 Mtoe, with gas and oil catering to 47% of the mix. In addition, it has also been predicted that energy-based GHG emissions are expected to reach 4,503 Mt CO2-eq by the end of 2050. Likewise, within this particular emissions mix, methane accounts for 15.2%, thereby making it the second largest pollutant in ASEAN. Besides, of these, the oil and gas industry has been regarded as the largest contributor, accounting for 53.2%, thereby bolstering the market’s growth in the region.

China in the smart gas market is growing significantly, owing to the presence of dual-control and efficiency regimes, increased AMI deployments, and massive utility networks. As per an article published by the Journal of Power Sources in February 2025, the country’s solar and wind power generation readily accounted for 37% and 40% of the international total. Besides, the country is considered the world’s largest carbon emitter, accounting for an estimated 29% of the world’s total. For instance, China’s installed wind power capacity has reached 330 GW, along with the solar power capacity reaching 310 GW. In this regard, both these power generation across 30 provinces of the country increased from 02.8 billion kWh and 3.5 billion kWh to 655.8 billion kWh and 325.4 billion kWh, respectively. Therefore, with increased focus on energy efficiency, there is a huge growth opportunity for the market in the country.

India in the smart gas market is also growing due to green hydrogen investment, CCUS research and development upscaling, and industrial decarbonization. The Department of Science & Technology has also launched the national research and developmental program in 2025 for coordinating infrastructure, industrial pilots, and research that demand precision metering. As stated in an article published by the Ministry of New and Renewable Energy in December 2025, two crucial financial incentive mechanisms have been proposed with ₹ 17,490 crore by the end of 2030, with a focus on the intensive manufacturing of electrolysers and producing green hydrogen. Moreover, an outlay of ₹455 crore for low-carbon steel projects, along with ₹496 crore for mobility pilot projects, and ₹115 crore for shipping pilot projects, has been allocated, thus boosting the smart gas market in the country.

Europe Market Insights

Europe in the smart gas market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly fueled by interoperable data platforms across industrial and utilities sites, leak detection, digitalized mandates driving AMI deployment, chemical sustainability, and the regional climate-neutral 2050 objective. According to an article published by Fraunhofer ICT in 2025, the PLANETS project in the region received EUR 14.5 million for demonstrating the applicability of the SSbD Draft Framework. The ultimate purpose is to develop technical alternatives for 3 essential molecule classes in the chemical industry, including surfactants, flame retardants, and plasticizers. Moreover, as per the May 2022 NLM article, public inventories estimated approximately 355,000 chemicals that have been registered for utilization and production, with an estimated 69,000 chemicals in commerce, thereby making it suitable for uplifting the market in the region.

Germany in the smart gas market is gaining increased traction due to sustained digitalization, the energy-intensive chemical and pharma industry, and a massive industrial base under the regional market and climate frameworks. As per an article published by ITA in August 2025, the country has a target for 80% of its overall electricity supply to originate from renewables by the end of 2030, and also gained 59% as of 2024. In addition, the country has planned to lower its greenhouse gas emissions by 65% within the same year, with its ultimate objective to achieve carbon neutrality by 2045. Besides, the country’s government has revealed plans to set aside USD 11.3 billion by 2030 to readily subsidize electricity prices for energy-based sectors to shield businesses from increased electricity prices, particularly for energy-based organizations, thus catering to the market’s growth.

Poland in the smart gas market is also developing, owing to the policy clarity on energy transition, grid modernization, and substantial gas system throughput. Additionally, national energy transformation approaches have set a long-lasting path for facility investment, offering support for AMI analytics, interoperability, and rollouts across industrial and transmission facilities. As per an article published by the Energy Transition Organization in April 2023, the installed photovoltaic capacity has reached 11 GW by the end of August 2022 in the country, denoting an over 84% enhancement from the previous year. Moreover, the solar production in the country is projected to increase by almost 20 GW by the end of 2030, especially in the newest solar sources, along with the production potential of 21 TWh every year, and more than 14 GW in the latest onshore wind farms, with a 37 TWh production potential per year.

North America Market Insights

North America's smart gas market is projected to witness considerable growth by the end of the stipulated period. The market’s growth in the region is highly propelled by the chemical value chain, safety modernization across utilities, digitalized metering rollouts, and the presence of methane reduction mandates. According to an article published by the EPA Government in December 2024, the U.S. Environmental Protection Agency and the U.S. Department of Energy declared an estimated USD 850 million for 43 selected projects to assist small oil and gas operators, tribes, and other entities across the nation to monitor, measure, diminish, and quantify methane emissions from the oil and gas industry. Moreover, there has been the allocation of USD 350 million in grant funding by the EPA and DOE to support industrial efforts for reducing emissions at low-producing wells, conduct environmental restoration, and ensure monitor emissions, and conduct environmental restoration.

The smart gas market in the U.S. is gaining increased exposure, owing to methane abatement, programmatic support, industrial alignment, federal budget provision, and the presence of governmental programs. As per a report published by the U.S. Department of Energy in March 2023, the DOE has readily proposed USD 51.9 billion in budget authority as of 2024, denoting USD 6.2 billion or a 13.6% increase from the 2023 Enacted Level. Besides, the Budget has provided a generous investment of USD 8.8 billion for the Office of Science for making advancements towards the authorized level in the CHIPS and Science Act for supporting next-generation research. Furthermore, with the funding for Science, the Budget offers more than USD 1 billion to support the objective of gaining fusion on the decadal timescale. Besides, the Budget also invested nearly USD 2 billion to support the clean energy workforce as well as infrastructure projects across the country, thus suitable for boosting the market.

DOE Budget Provision by Program in the U.S. (2024)

|

Program Type |

Funding Amount and Rate |

|

Fossil Energy and Carbon Management |

USD 0.9 billion and 2% |

|

Nuclear Energy |

USD 1.5 billion and 3% |

|

Energy Efficiency and Renewable Energy |

USD 3.8 billion and 7% |

|

Environmental Management |

USD 8.7 billion and 17% |

|

Office of Science |

USD 8.8 billion and 17% |

|

National Nuclear Security Administration |

USD 23.8 billion and 46% |

|

Cybersecurity, Energy Security, and Emergency Response |

USD 0.5 billion and 1% |

|

All other programs |

USD 3.2 billion and 6% |

Source: U.S. DOE

The smart gas market in Canada is also growing due to the presence of emissions reduction and federal clean energy programs, utility modernization and smart city strategies, industrial and chemical demand, along with safety and environmental regulations. As stated in an article published by the Government of Canada in March 2023, the country’s government declared suitable support, comprising almost USD 100 million, to reduce the carbon footprint and optimize worker safety at BHP’s USD 7.5 billion. Additionally, in Ontario, Umicore notified its plan to invest USD 1.5 billion in a net-zero infrastructure for producing crucial electric vehicle battery components. Besides, in Quebec, Rio Tinto Fer et Titane declared its plans to bolster the production of critical minerals, reduce emissions, and assist in building clean technology supply chains through USD 222 million in federal funding.