- An Introduction to the Research Study

- Market Definition

- Market Segmentation

- Assumptions and Assumptions

- The Research Procedure

- Research Objective

- Sources of Data

- Secondary

- Primary

- Manufacturer/service provider front

- End user front

- An Abstract of the Report

- Evaluation of Market Fluctuations and Outlook

- Market Growth Drivers

- Market Growth Deflation

- Market Trends

- Application-based

- Technology based

- Fundamental Market Prospects

- Strategic Competitive Opportunities

- Geographic Opportunities

- Application Centric Opportunities

- Regulatory & Standards Landscape

- Economic Outlook

- Industry Risk Analysis

- Use Case Analysis

- Analysis of Ongoing Trends

- Industry Value Chain Analysis

- Technological Shift and Implementation Analysis

- Startup Analysis

- Analysis of Controlled Environment Agriculture (CEA)

- Differences between Traditional and Smart Farming

- Regional Analysis

- Industry Growth Outlook

- Decarbonization Strategy and Carbon Credit Benefits for Market Players

- Global Government Decarbonization Plans/Goals by Each Country under 2015

- Measures taken by Countries to Reduce Carbon Footprints

- Carbon Credits and Subsidy Plans/Benefits Rolled out by the Government for Market Players

- Effective Ways to Harness Carbon Credits and Impact on Profit Margins

- Demand Impact on the Companies Opting for Carbon Credits

- Competitive Model: A Detailed Inside View for Investors

- Market share of key competitors in the market, (%) 2022

- Benchmarking of the competitors

- Profile of the major vendors

- Ag Leader Technology

- AGCO Corporation

- AgJunction LLC

- Autonomous Solutions, Inc.

- Argus Embedded Systems Pvt. Ltd

- CropMetrics LLC

- John Deere

- DeLaval

- Trimble Inc.

- Topcon

- Global Smart Farms Market, Outlook & Projections, Opportunity Assessment, 2023 to 2036

- Market Overview

- Market Revenue by Value (USD million) and Compound Annual Growth Rate (CAGR)

- Global Smart Farms Market, Segmentation Analysis, 2022-2035

- By Technology

- Indoor Vertical Farming, Market Value (USD Million), CAGR, 2023-2036F

- Automated Farming, Market Value (USD Million), CAGR, 2023-2036F

- Livestock Farming, Market Value (USD Million), CAGR, 2023-2036F

- Modern Greenhouses, Market Value (USD Million), CAGR, 2023-2036F

- Precision Farming, Market Value (USD Million), CAGR, 2023-2036F

- Others, Market Value (USD Million), CAGR, 2023-2036F

- By Application

- Livestock Monitoring and Management, Market Value (USD Million), CAGR, 2023-2036F

- Indoor Farming, Market Value (USD Million), CAGR, 2023-2036F

- Aquaculture, Market Value (USD Million), CAGR, 2023-2036F

- Others, Market Value (USD Million), CAGR, 2023-2036F

- By Geography

- Market Overview

- Market Revenue by Value (USD million) and Compound Annual Growth Rate (CAGR)

- North America, Market Value (USD million), and CAGR, 2023-2036F

- Europe, Market Value (USD Million), and CAGR, 2023-2036F

- Asia Pacific, Market Value (USD Million), and CAGR, 2023-2036F

- Latin America, Market Value (USD Million), and CAGR, 2023-2036F

- Middle East and Africa, Market Value (USD Million), and CAGR, 2023-2036F

- By Technology

- North America Smart Farms Demand Outlook & Projections, 2023 to 2036: A Comprehensive Study for Stakeholders

- Market Overview

- Market Revenue by Value (USD million) and Compound Annual Growth Rate (CAGR)

- North America Smart Farms Market Valuation, Business Viewpoint and Forecast by Segment, 2022-2035

- By Technology

- Indoor Vertical Farming, Market Value (USD Million), CAGR, 2023-2036F

- Automated Farming, Market Value (USD Million), CAGR, 2023-2036F

- Livestock Farming, Market Value (USD Million), CAGR, 2023-2036F

- Modern Greenhouses, Market Value (USD Million), CAGR, 2023-2036F

- Precision Farming, Market Value (USD Million), CAGR, 2023-2036F

- Others, Market Value (USD Million), CAGR, 2023-2036F

- By Application

- Livestock Monitoring and Management, Market Value (USD Million), CAGR, 2023-2036F

- Indoor Farming, Market Value (USD Million), CAGR, 2023-2036F

- Aquaculture, Market Value (USD Million), CAGR, 2023-2036F

- Others, Market Value (USD Million), CAGR, 2023-2036F

- By Country

- US, Market Value (USD million), and CAGR, 2023-2036F

- Canada, Market Value (USD million), and CAGR, 2023-2036F

- By Technology

- Europe Smart Farms Demand Outlook & Projections, 2023 to 2036: A Comprehensive Study for Stakeholders

- Market Overview

- Market Revenue by Value (USD million) and Compound Annual Growth Rate (CAGR)

- By Technology

- By Application

- By Country

- Germany, Market Value (USD million), and CAGR, 2023-2036F

- France, Market Value (USD million), and CAGR, 2023-2036F

- UK, Market Value (USD million), and CAGR, 2023-2036F

- Italy, Market Value (USD million), and CAGR, 2023-2036F

- Spain, Market Value (USD million), and CAGR, 2023-2036F

- Russia, Market Value (USD million), and CAGR, 2023-2036F

- Netherlands, Market Value (USD million), and CAGR, 2023-2036F

- Rest of Europe, Market Value (USD million), and CAGR, 2023-2036F

- Asia Pacific Smart Farms Demand Outlook & Projections, 2023 to 2036: A Comprehensive Study for Stakeholders

- Market Overview

- Market Revenue by Value (USD million) and Compound Annual Growth Rate (CAGR)

- Asia Pacific Smart Farms Market Valuation, Business Viewpoint and Forecast by Segment, 2022-2035

- By Technology

- By Application

- By Country

- China, Market Value (USD million), and CAGR, 2023-2036F

- India, Market Value (USD million), and CAGR, 2023-2036F

- Japan, Market Value (USD million), and CAGR, 2023-2036F

- South Korea, Market Value (USD million), and CAGR, 2023-2036F

- Australia, Market Value (USD million), and CAGR, 2023-2036F

- Singapore, Market Value (USD million), and CAGR, 2023-2036F

- Rest of Asia Pacific, Market Value (USD million), and CAGR, 2023-2036F

- Japan Smart Farms Demand Outlook & Projections, 2023 to 2036: A Comprehensive Study for Stakeholders

- Market Overview

- Market Revenue by Value (USD million) and Compound Annual Growth Rate (CAGR)

- Japan Smart Farms Market Outlook & Projections, Opportunity Assessment by Segment

- By Technology

- Indoor Vertical Farming, Market Value (USD million) CAGR, 2022-2035F

- Automated Farming, Market Value (USD million) CAGR, 2022-2035F

- Livestock Farming, Market Value (USD million) CAGR, 2022-2035F

- Modern Greenhouses, Market Value (USD million) CAGR, 2022-2035F

- Precision Farming, Market Value (USD million) CAGR, 2022-2035F

- Others, Market Value (USD million) CAGR, 2022-2035F

- By Application

- Livestock Monitoring and Management, Market Value (USD million) CAGR, 2022-2035F

- Indoor Farming, Market Value (USD million) CAGR, 2022-2035F

- Aquaculture, Market Value (USD million) CAGR, 2022-2035F

- Others, Market Value (USD million) CAGR, 2022-2035F

- By Technology

- Latin America Smart Farms Demand Outlook & Projections, 2023 to 2036: A Comprehensive Study for Stakeholders

- Market Overview

- Market Revenue by Value (USD million) and Compound Annual Growth Rate (CAGR)

- Latin America Smart Farms Market Valuation, Business Viewpoint and Forecast by Segment, 2022-2035

- By Technology

- By Application

- By Country

- Brazil, Market Value (USD million), and CAGR, 2023-2036F

- Mexico, Market Value (USD million), and CAGR, 2023-2036F

- Argentina, Market Value (USD million), and CAGR, 2023-2036F

- Rest of Latin America, Market Value (USD million), and CAGR, 2023-2036F

- Middle East and Africa Smart Farms Demand Outlook & Projections, 2023 to 2036: A Comprehensive Study for Stakeholders

- Market Overview

- Market Revenue by Value (USD million) and Compound Annual Growth Rate (CAGR)

- Middle East and Africa Pacific Smart Farms Market Valuation, Business Viewpoint and Forecast by Segment, 2022-2035

- By Technology

- By Application

- By Country

- GCC, Market Value (USD million), and CAGR, 2023-2036F

- Israel, Market Value (USD million), and CAGR, 2023-2036F

- South Africa, Market Value (USD million), and CAGR, 2023-2036F

- Rest of Middle East & Africa, Market Value (USD million), and CAGR, 2023-2036F

- Recommendation by Analyst for C-Level Executives

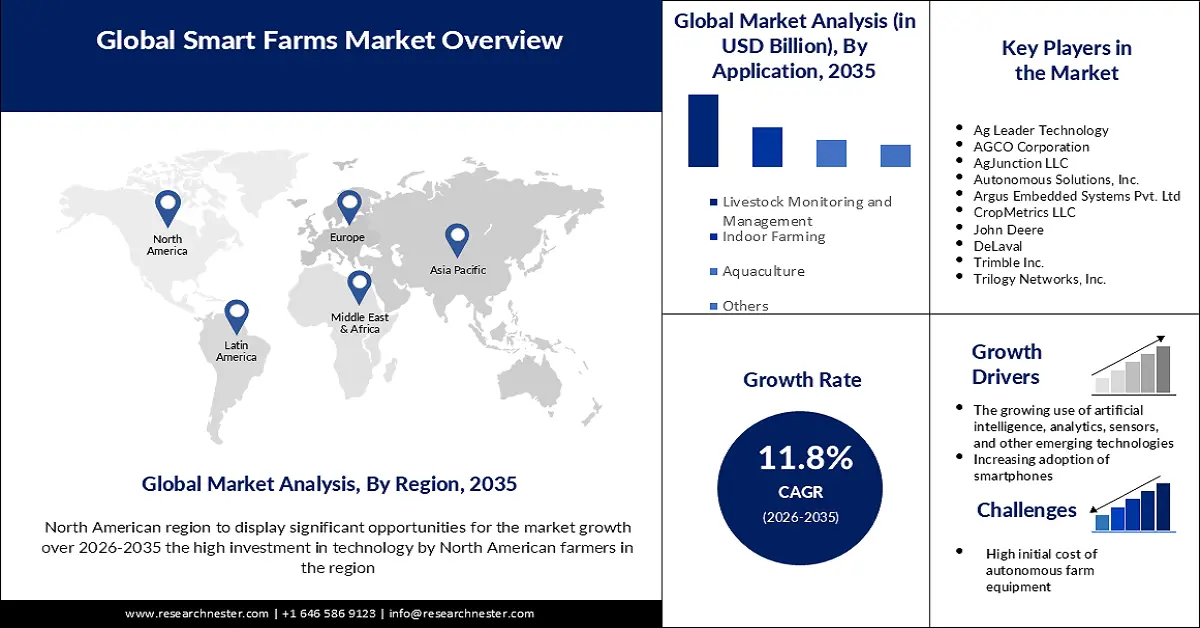

Smart Farms Market Outlook:

Smart Farms Market size was over USD 20.25 billion in 2025 and is anticipated to cross USD 61.78 billion by 2035, growing at more than 11.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of smart farms is assessed at USD 22.4 billion.

The demand for smart farms is attributed to the rising use of technologies in agriculture. For instance, in August 2023, Cornell University published a report stating that 32% of farms used the Internet to purchase agriculture inputs. Farmers include artificial intelligence, the Internet of Things, and automation for various purposes. The practice has emerged as a need of the hour for the global agriculture sector.

Also, farmers are taking initiatives to adopt sustainable agricultural practices to mitigate the consequences of resource-intensive farming. According to the National Institutes of Health in 2023, freshwater plays a pivotal role in daily life and agriculture is responsible for nearly 70% of withdrawal volume. Techniques such as smart irrigation systems reduce water use by ensuring the best application where it is needed. For example, soil moisture sensors can transmit signals to irrigation systems to work efficaciously only when the soil is dry.

Key Smart Farms Market Insights Summary:

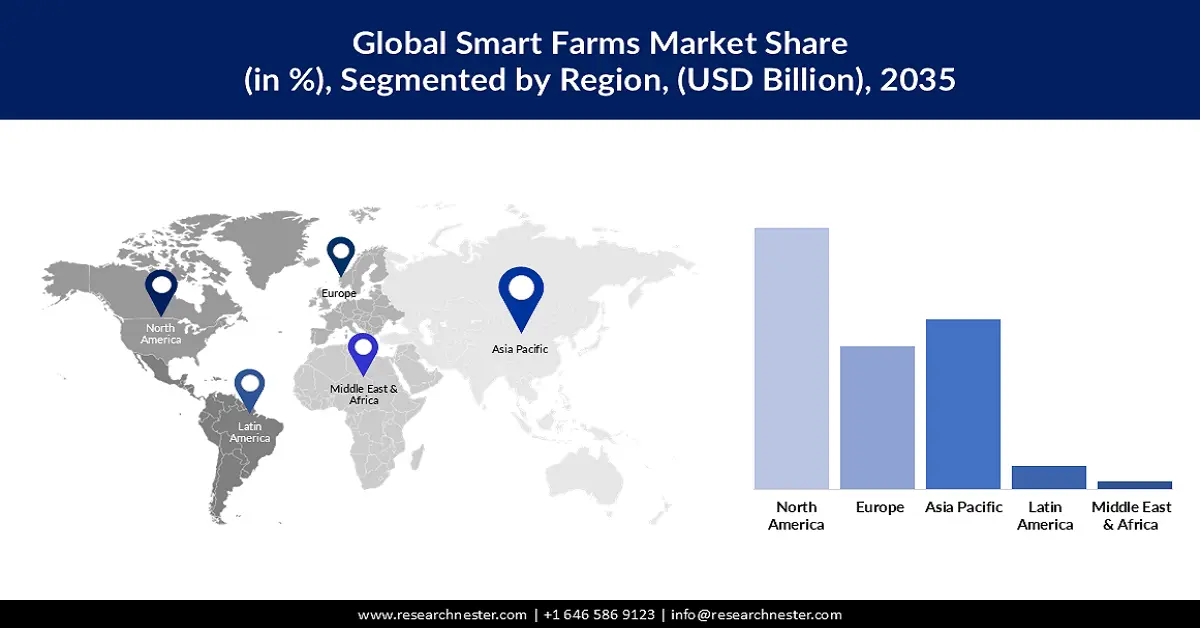

Regional Highlights:

- North America smart farms market will secure around 42% share by 2035, driven by the growing number of market vendors and high investment in technology.

Segment Insights:

- The precision farming segment in the smart farms market is expected to secure a remarkable share by 2035, fueled by improved productivity and effective resource utilization.

- The livestock monitoring & management segment in the smart farms market is projected to exhibit the fastest growth over 2026-2035, driven by the use of IoT technologies to improve efficiency, reduce costs, and optimize animal health.

Key Growth Trends:

- Rising government initiatives

- Increasing demand for food

Major Challenges:

- Technical Risks

- Low adoption in rural farms

Key Players: Ag Leader Technology, AGCO Corporation, AgJunction LLC, Autonomous Solutions, Inc., Argus Embedded Systems Pvt. Ltd, CropMetrics LLC, John Deere, DeLaval, Trimble Inc., Trilogy Networks, Inc.

Global Smart Farms Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 20.25 billion

- 2026 Market Size: USD 22.4 billion

- Projected Market Size: USD 61.78 billion by 2035

- Growth Forecasts: 11.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Netherlands, Japan, Germany

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 10 September, 2025

Smart Farms Market Growth Drivers and Challenges:

Growth Drivers

-

Rising government initiatives: According to the data published by the World Bank in December 2024, governments provide over USD 650 billion per year in public support to the agricultural sector. Many governments in developed as well as developing countries attempt to bolster agricultural innovation and development by setting up policies, funding, and organizing programs.

- Increasing demand for food: The demand for food is increasing, owing to the rapidly growing population. As the world’s population continues to rise, the area of land available for agriculture is on the decline. For instance, according to the United Nations, the population around the world is estimated to reach 9.8 billion by 2050. Thus, the demand for food is estimated to grow at a rate of 2% every year. In previous years, smart farming methods have helped to increase food production without compromising quality standards.

- Surge in adoption of smartphones: The use of smartphones in agriculture helps to provide real-time information about crops and machinery to the user, regardless of the farmer's physical presence. Today, the smartphone has a wide range of sensors that plays an essential role in real-time information gathering on weather, crop conditions, and soil health information. This contributes to additional revenue growth in the smart agriculture market. According to the World Economic Forum in April 2023, there are over 5.4 billion people globally who have at least 1 subscription.

- Surge in the integration of AI and Big data: AI holds the capability to revolutionize soil management by analyzing data to optimize nutrient levels. AI also automates repetitive tasks and allows farmers to focus on strategic activities. A survey conducted by Pew Research in February 2023, found that 27% of Americans say they interact with AI numerous times in a day.

Challenges

-

Technical Risks: Compared to traditional farming, smart farming is a technology-driven farming. Hence, high reliance on technology comes with a potentially serious downside for the agrarian, if there is a breakdown in the unit/sensor failure. For instance, if the smart irrigation sensors are not working, the plants may either be under or overwatered. As a result, food safety is endangered in such cases, which can lead to high losses to the farmers.

- Low adoption in rural farms: The low literacy rate of farmers and lack of credit in rural areas are impeding growth. Installing AI, big data, etc. requires technical expertise that is difficult to understand initially.

Smart Farms Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.8% |

|

Base Year Market Size (2025) |

USD 20.25 billion |

|

Forecast Year Market Size (2035) |

USD 61.78 billion |

|

Regional Scope |

|

Smart Farms Market Segmentation:

Technology Segment Analysis

Precision farming segment is expected to account for remarkable smart farms market share by the end of 2035. Precision farming entails extremely precise, accurate, and optimum agricultural production. It enables improved productivity, effective resource utilization, and minimal environmental impact. According to data published by the Association of Equipment Manufacturers in March 2024, by adopting precision agriculture, farmers witnessed 4% in crop production, an increase of 7% in fertilizer placement efficiency, a reduction of 9% in herbicide and pesticide use, and a reduction of 6% in fossil fuel use. Focused pesticide application with AI-assisted analysis, targeting only areas that need attention instead of a blanket application, is the best illustration of a precision farming approach. These technologies allow farmers to collect and analyze data on a plethora of factors including weather, soil conditions, and crop growth to make more informed decisions about planting, irrigation, and fertilizer use.

Application Segment Analysis

The smart farms market from the livestock monitoring and management segment is expected to grow at the fastest CAGR during the upcoming years. Smart farming technologies can be used to monitor and manage livestock in a variety of ways. Technologies such as farm management software and digital farming are used to control and automate the delivery of feed, water, and veterinary care to animals. With the use of IoT technologies like geofencing, RFID, and sensors, farmers can collect and analyze a wide range of data that can be used to improve efficiency, reduce costs, and optimize animal health and welfare.

Our in-depth analysis of the global smart farms market includes the following segments:

|

Technology |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Farms Market Regional Analysis:

North America Marke Insights

North America industry is predicted to hold the largest revenue share of 42% by 2035. Factors such as the growing number of US-based market vendors and the high investment in technology by domestic farmers have contributed to this growth. In addition, key market players are establishing collaborations to support their market presence and consumer base. For instance, in February 2023, Public Investment Fund (PIF) and US-based Aero Farms signed a joint venture agreement to build and operate the largest indoor vertical farm in Saudi Arabia by utilizing the latest technologies with an annual production capacity of up to 1.1 million kgs of crops. The agreement will enable the growth of the agriculture sector by supporting Saudi Arabia’s positioning in vertical farming regionally. Other than this, the U.S. Department of Agriculture published data in October 2025 that almost 85% of the total farms in the country have adopted precision farming in some or the other form.

Asia Pacific Insights

The rising number of educated farmers in the Asia-Pacific is a significant factor propelling smart farms market expansion. There has been rising adoption of smart irrigation controllers, AI-based land analytics services, and rising agritech-startups in countries like China and India. For instance, according to the India Brand Equity Foundation, Indian agrotech companies are predicted to witness investments worth USD 30-35 billion by 2025.

Smart Farms Market Players:

- Ag Leader Technology

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AGCO Corporation

- AgJunction LLC

- Autonomous Solutions, Inc.

- Argus Embedded Systems Pvt. Ltd

- CropMetrics LLC

- John Deere

- DeLaval

- Trimble Inc.

- Trilogy Networks, Inc.

The competitive landscape of the smart farm market is rapidly evolving as established key players, tech giants and new entrants are investing in innovative technologies. Key players in the market are focused on developing new technologies and products catering to the stringent regulatory norms and consumer demand. These key players are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global market:

Recent Developments

- In February 2025, AGCO is set to launch new solutions at the World Ag Expo and National Farm Machinery Show. The company will team up with AgRevolution to provide visitors with efficient solutions.

- In January 2022, John Deere & Co. unveiled its line of autonomous tractors which have six pairs of stereo cameras enabling them 360-degree obstacle detection and the calculation of distance, at the Consumer Electronics Show to expand its impression in the precision agriculture segment.

- Report ID: 4690

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Smart Farms Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.